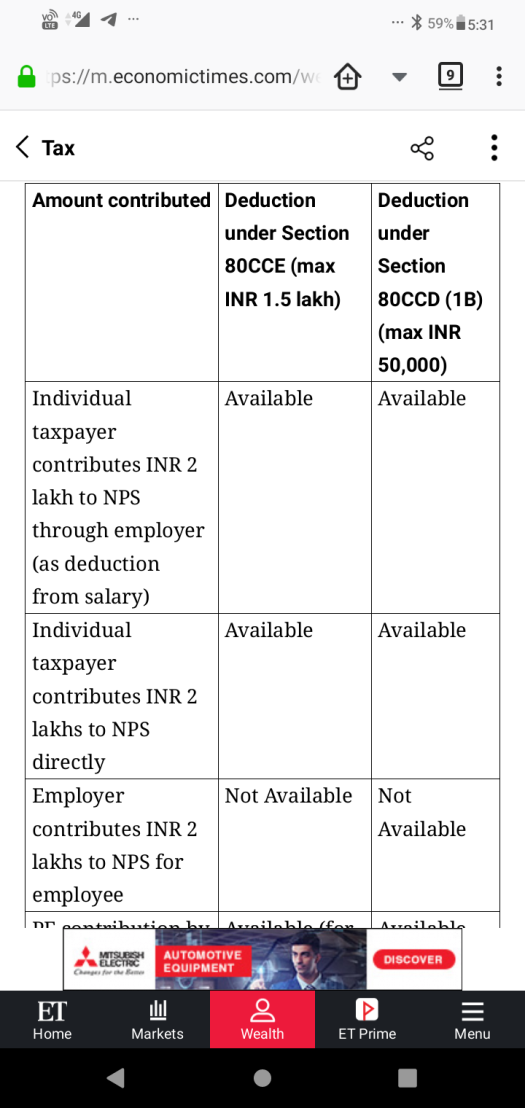

Nps Additional Tax Rebate Web 8 f 233 vr 2019 nbsp 0183 32 Section 80 CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA made by employees However the total amount of

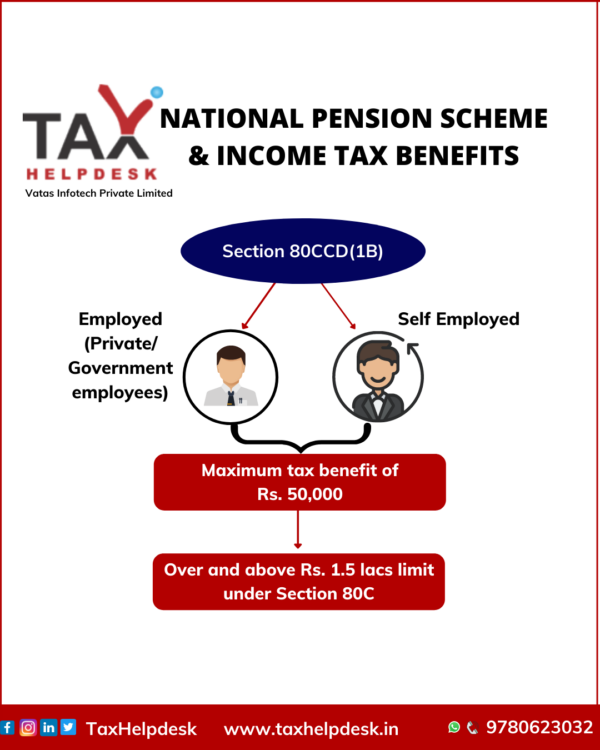

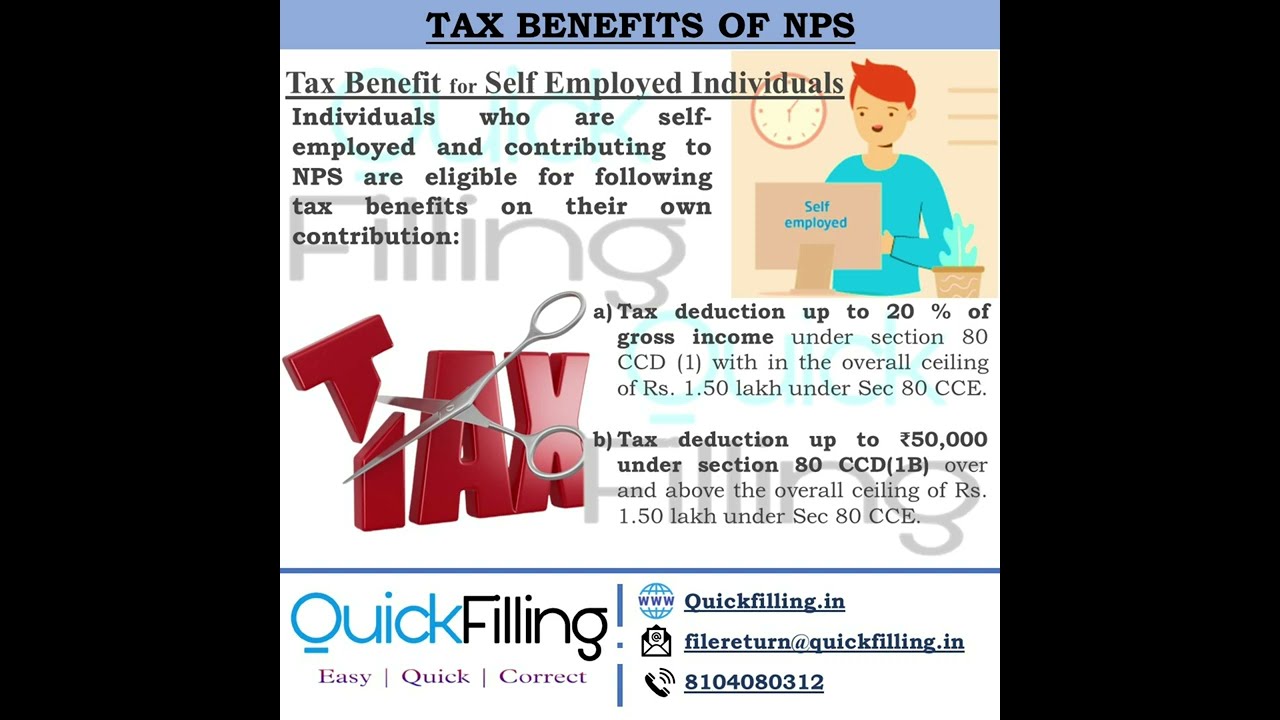

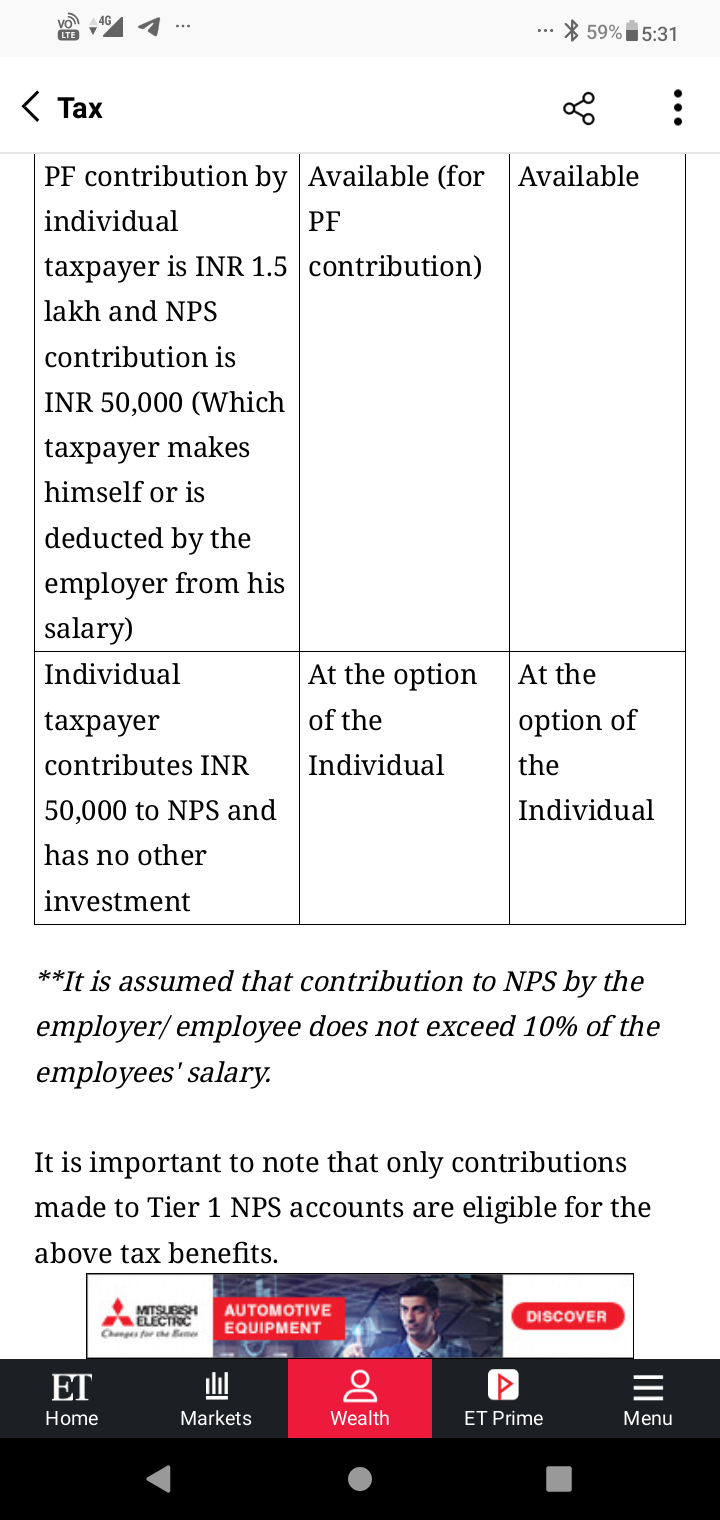

Web 26 f 233 vr 2021 nbsp 0183 32 Synopsis If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C Web 30 janv 2023 nbsp 0183 32 Additional Contribution NPS subscribers also have an option to claim further tax benefits on investments up to INR 50 000 which is over and above the limit of INR 1 5 lakh under section

Nps Additional Tax Rebate

Nps Additional Tax Rebate

https://i.ytimg.com/vi/TqSSuNglkSg/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgALQBYoCDAgAEAEYZSBgKFUwDw==&rs=AOn4CLCBf5LDqx4ao2xyM9hyvx_JdhVGVQ

Get Additional Tax Benefit On NPS Contributionsu s 80CCD

https://media-exp1.licdn.com/dms/image/C5112AQHj8P9qw6GsUQ/article-cover_image-shrink_720_1280/0/1576844791541?e=2147483647&v=beta&t=IahHExoprpNvpUT_C_kldjv1SsTLjw5FkXx3HqakH7A

NPS Tax Benefit Sec 80C And Additional Tax Rebate Difference Between U

https://i.ytimg.com/vi/RYd7OpABVlU/maxresdefault.jpg

Web 5 f 233 vr 2016 nbsp 0183 32 Tax savings The Rs 50 000 extra deduction on NPS is useful for those in the highest tax bracket of 30 who can make an additional saving of Rs 16 000 in Web This rebate is over and above 80 CCE limit of Rs 1 50 lacs Voluntary Contribution Employee can voluntarily invest an additional amount of Rs 50 000 or more to the

Web 2 avr 2019 nbsp 0183 32 NPS Tax Benefit Sec 80C and Additional Tax Rebate Asset Yogi 3 7M subscribers Subscribe 9 3K Share 374K views 4 years ago Income Tax NPS tax benefits Web 30 mars 2023 nbsp 0183 32 Additional deduction of up to Rs 50 000 under Section 80CCD 1B of the Income Tax Act exclusively available through NPS investment The third deduction is in

Download Nps Additional Tax Rebate

More picture related to Nps Additional Tax Rebate

NPS Scheme National Pension Scheme NPS Tax Rebate In NPS YouTube

https://i.ytimg.com/vi/EmbzrLGi91k/maxresdefault.jpg

All About The National Pension Scheme In India TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2020/12/Section-80CCD1B-600x750.png

NPS Tax Benefit How To Claim Tax Benefit For Additional Rs 50 000

https://befinexpert.files.wordpress.com/2019/12/screenshot_20191216-1731459053301389216939998.png?w=525

Web 22 nov 2021 nbsp 0183 32 NPS gives additional income tax benefits if your employer offers it too These deductions are available for old and new income tax regimes Web 15 juil 2023 nbsp 0183 32 Taxpayers employed in government undertakings Central Government only upto 1 4 2020 and both central government amp state government from 1 4 2020 as amended by Union Budget 2022 can

Web 29 mai 2023 nbsp 0183 32 How much to invest in nps for tax benefit 2 How much is the tax benefit of NPS 3 How much should be invested in NPS 4 How can I save maximum tax in Web 24 f 233 vr 2020 nbsp 0183 32 If you are investing in NPS Scheme or planning to invest in NPS you need to be aware of all the latest NPS Income Tax benefits that are currently available under old

Additional Income Tax Exemption Under Section 80 CCD 1 For

http://4.bp.blogspot.com/-FQxJO2c4ong/VauMqUDT3MI/AAAAAAAAB4A/JBzf2yjxivI/s640/2.jpg

CSCeGov On Twitter Invest In NPS Today Gain Additional Tax Benefit

https://pbs.twimg.com/media/FoINKh5WQAIDmHf.jpg

https://cleartax.in/s/section-80-ccd-1b

Web 8 f 233 vr 2019 nbsp 0183 32 Section 80 CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA made by employees However the total amount of

https://economictimes.indiatimes.com/wealth/t…

Web 26 f 233 vr 2021 nbsp 0183 32 Synopsis If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C

AIPEU Gr C Phulbani Odisha 762 001 NPS Subscribers Can Now Claim Up

Additional Income Tax Exemption Under Section 80 CCD 1 For

NPS National Pension Scheme A Beginners Guide For Rules Benefits

NPS Tax Benefit Sec 80C And Additional Tax Rebate How To Use NPS

How To Invest In NPS Here Is Your Quick Guide To Save Additional Tax

NPS Tax Benefits Of NPS Hindi Additional Tax

NPS Tax Benefits Of NPS Hindi Additional Tax

NPS Tax Benefit How To Claim Tax Benefit For Additional Rs 50 000

NPS Tax Benefit Sec 80C And Additional Tax Rebate YouTube

Income Tax Deductions List FY 2018 19 List Of Important Income Tax

Nps Additional Tax Rebate - Web 24 juin 2020 nbsp 0183 32 NPS additional Rs 50 000 tax benefits Some additional tax benefits are also allowed under NPS rules Both salaried and self employed individuals can claim an