How To Pay Car Taxes In South Carolina In this state you must pay your personal vehicle property taxes before a license plate can be renewed and a new decal issued You can pay both the vehicle property taxes and renewal fees at the county treasurer s office

When you buy the vehicle to get a license plate for it you ll do all of the following Contact your county office to have a property tax bill generated Pay your tax bill to the county and provide the SCDMV with the paid property tax receipt in your name In South Carolina taxes on your vehicle are paid a year ahead Before you can register your vehicle with the SC Department of Motor Vehicles DMV you must first pay the property taxes that are required in the county in which you reside

How To Pay Car Taxes In South Carolina

How To Pay Car Taxes In South Carolina

https://i.ytimg.com/vi/CNPzpDbx3Cg/maxresdefault.jpg

How To Mekha News

https://media.mekhanews.com/2022/01/rod.jpg

Ways To Save Money On Your Taxes In South Carolina Coastal Tax And

https://coastaltaxandaccounting.com/wp-content/uploads/2023/05/Ways-to-Save-Money-on-Your-Taxes-in-South-Carolina.jpg

Vehicle taxes must be paid prior to registering the vehicle with the S C Department of Motor Vehicles Vehicle taxes are paid in advance covering a period of one year Always review tax notices and make address corrections before paying If you pay your vehicle taxes by mail at any NBSC branch via the Internet or phone the sticker comes from SCDMV That sticker is sent to your mailing address within 7 business days Please make sure that your address is correct and that your insurance certification is provided when required

Payments made via mail may take up to 3 weeks to process Online payments may take up to 4 days to reflect payment Your payment is considered received as of the Post Mark date Internet payments received after closing time How to Calculate Sales Tax on a Car in South Carolina Calculating your state sales tax on your new car in South Carolina is easy Just follow this simple formula to find how much you will need to pay in sales tax and how much you ll need to pay in

Download How To Pay Car Taxes In South Carolina

More picture related to How To Pay Car Taxes In South Carolina

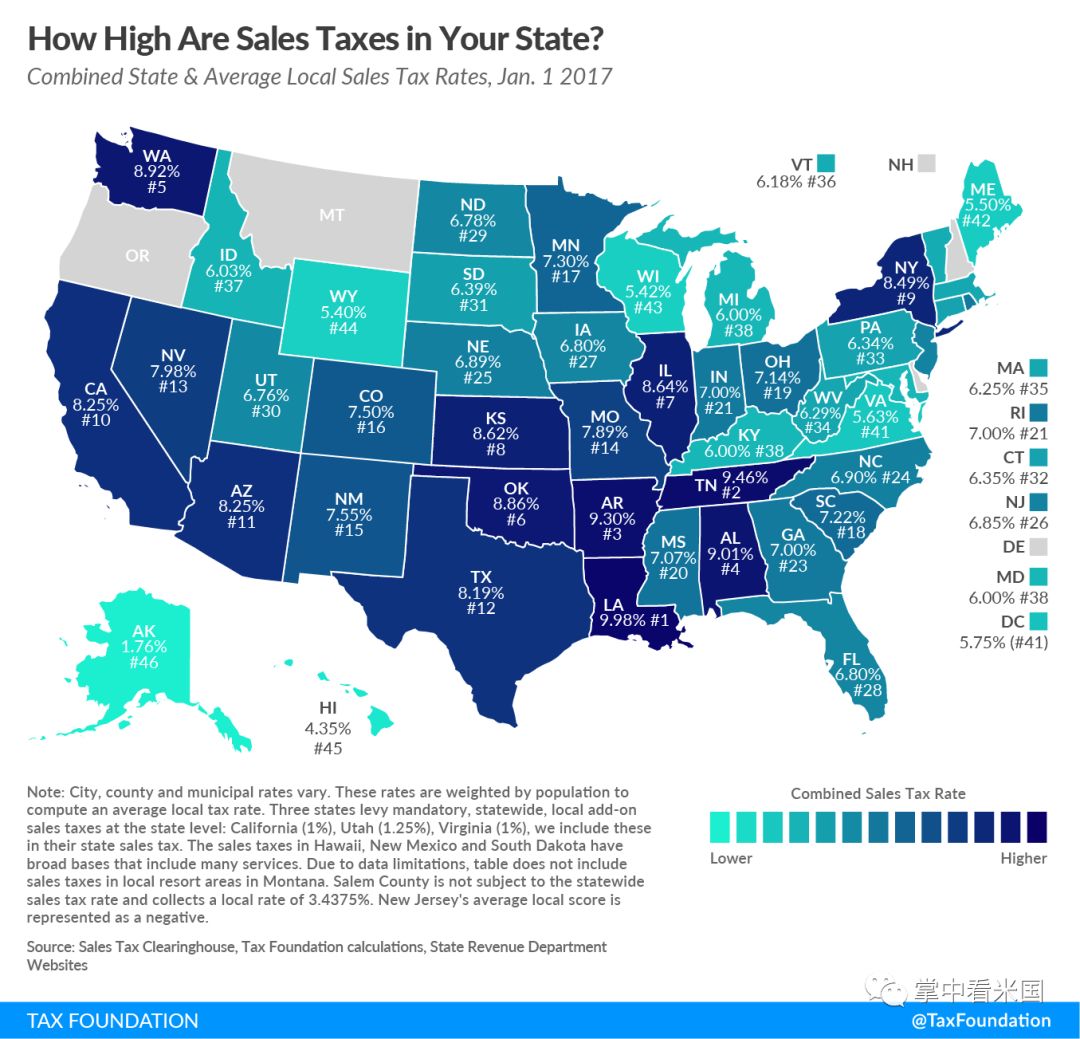

Which States Pay The Most Federal Taxes A Look At The Numbers

https://dyernews.com/wp-content/uploads/taxmap-1.png

Taxes To Pay In Florida

https://www.bocaratonnation.com/img/5f67e8b35101adc80d80ccf7331d31d9.jpg?17

How To Pay Car Token Tax Online Across Pakistan A Step by Step Guide

http://lcci.pk/wp-content/uploads/2023/07/How-to-Pay-Car-Token-Tax-Online-Across-Pakistan.png

Purchases of vehicles are among the biggest sales made in South Carolina which means that they can often lead to a pricey sales tax bill The state collects a 6 percent sales tax on all Richland County Personal Vehicle Tax Estimator Enter the first 3 fields to calculate your estimated vehicle tax Please note that DMV and other vehicle fees are not included in the estimated tax amount

In order to register your vehicle in any circumstance you must first pay property taxes your county and have the paid property tax receipt for the SCDMV License Plates You may hear a license plate referred to as a tag Regular passenger vehicles receive a license plate with a registration card and a decal or sticker for the license plate For questions regarding the online form and tax bill please contact the Auditor s Office at 843 832 0118 For payment related questions please contact the Dorchester County Treasurer s Office at 843 832 0165

How To Pay Your Taxes YouTube

https://i.ytimg.com/vi/bZjTIHPyY94/maxresdefault.jpg

How To Pay Less Taxes In 2024 ADHD Friendly YouTube

https://i.ytimg.com/vi/4xHpuTC3XJE/maxresdefault.jpg

https://www.scdmvonline.com/Vehicle-Owners/...

In this state you must pay your personal vehicle property taxes before a license plate can be renewed and a new decal issued You can pay both the vehicle property taxes and renewal fees at the county treasurer s office

https://scdmvonline.com/Vehicle-Owners/Buying-Or-Selling-A-Car

When you buy the vehicle to get a license plate for it you ll do all of the following Contact your county office to have a property tax bill generated Pay your tax bill to the county and provide the SCDMV with the paid property tax receipt in your name

How To Pay Your Taxes YouTube

What Is US Taxation

Here s How To Pay Car Taxes Online From Your Smartphone

How To Pay Car Loan Off Early MoneyLion

How To Pay Your Income Taxes With A Credit Card Loans Canada

How To Pay Your Income Taxes With A Credit Card Loans Canada

Morning Notes Reston Now

What Are The Consequences Of Not Paying Road Tax

Issues Stephanie Beaut For Secretary Of State Of Rhode Island

How To Pay Car Taxes In South Carolina - Personal property taxes on motor vehicles and recreational vehicles must be paid before your license plates can be renewed Taxes are due throughout the year on a staggered monthly schedule You have 45 days after moving to