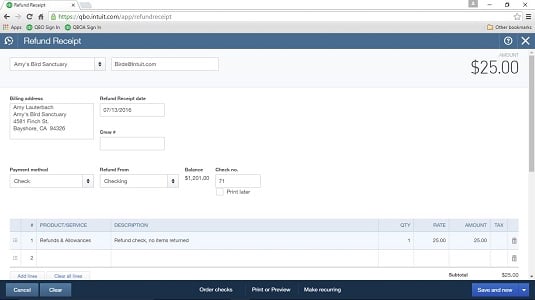

How To Record Income Tax Refund In Quickbooks Desktop The steps below will guide you through the process From the Employees menu select Payroll Taxes and Liabilities then Deposit Refund Liabilities Select the name of the vendor who submitted the refund check In the Refund Date field enter the deposit date

How to Record a Tax Refund in the Desktop Version of QuickBooks Open QuickBooks Desktop and navigate to the Banking menu Click on Make Deposits to record the tax refund received into your bank account within QuickBooks Desktop Select I can share a few insights to help you record the refund from your vendor If you received a refund and you want it to apply to a bill invoice you can create a bank deposit and use Accounts Payable as the account

How To Record Income Tax Refund In Quickbooks Desktop

How To Record Income Tax Refund In Quickbooks Desktop

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

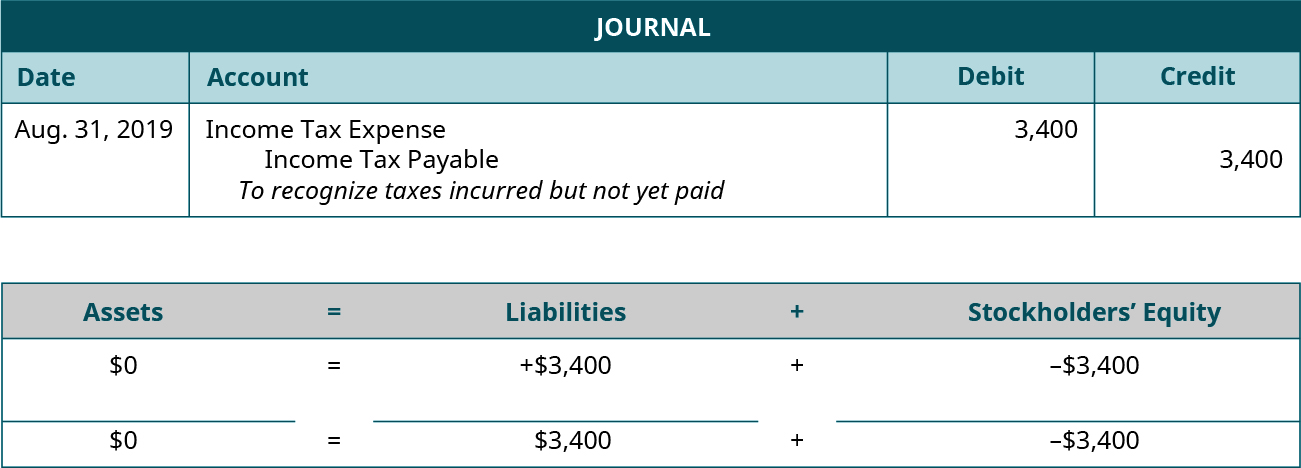

Entr e De Journal Pour L imp t Sur Le Revenu StackLima

https://media.geeksforgeeks.org/wp-content/uploads/20220513152536/IncomeTaxSol.PNG

Casual Journal Entry For Income Tax Payable Financial Statement

https://psu.pb.unizin.org/app/uploads/sites/236/2020/07/1.18.20.jpeg

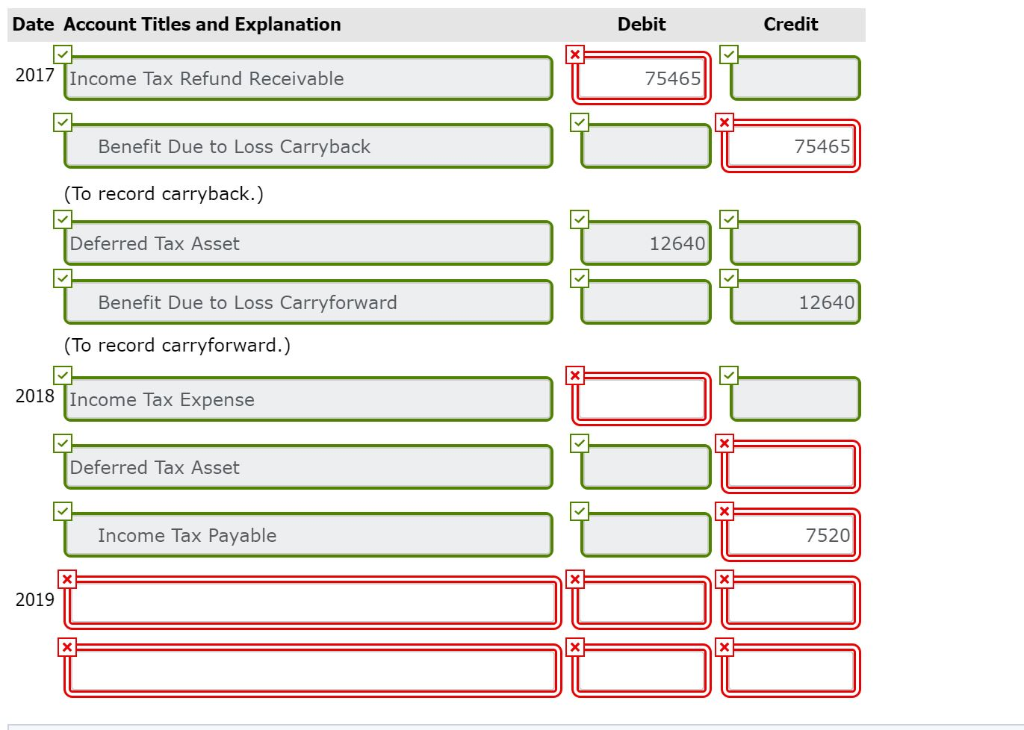

To record tax refunds in QuickBooks businesses need to follow specific steps to ensure accurate representation of income expenses and tax liabilities Proper recording involves creating a new bank account recording the refund as a deposit categorizing the How to record tax refund in accounting Again record taxes as liabilities in your books before paying them Mark a refund as a receivable aka an asset when you receive the refund When using double entry bookkeeping there are two steps for recording an income tax refund Step 1 Record the original tax payment

This learn QuickBooks for home finance video lesson will show you how to record your income tax refund The refund you receive indicates that your income tax Recording payroll tax payments in QuickBooks Desktop involves accurately entering the payment details and ensuring proper categorization within the accounting system This process includes recording payments for federal and state taxes as well as local taxes if applicable

Download How To Record Income Tax Refund In Quickbooks Desktop

More picture related to How To Record Income Tax Refund In Quickbooks Desktop

Journal Entry For Income Tax GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/uploads/20220513152449/IncomeTaxEx1.PNG

Casual Journal Entry For Income Tax Payable Financial Statement

https://media.cheggcdn.com/media/3e2/3e2a3bd8-a537-40a7-b910-4a36b8ceff06/phpD5KuDz.png

Income Tax Expense Unityqust

https://i.ytimg.com/vi/ItRa5S_WVIo/maxresdefault.jpg

Learn how to record refunds in QuickBooks Desktop for different scenarios such as returned items overpayments and prepayments This guide will help you maintain accurate records and customer satisfaction How to record refunds in QuickBooks Online Get personalized help categorizing transactions with Full Service Bookkeeping

In this article we will explore the step by step process of recording refunds in QuickBooks covering essential topics such as categorizing refunds issuing refunds to customers and recording vendor refunds Learn how to record and categorize refunds in QuickBooks Desktop with this comprehensive guide Improve your financial management with step by step instructions and frequent queries answered

FTB Tax Return FTB Refund Status KB CPA Services P A

https://kbcpagroup.com/wp-content/uploads/2021/10/2.png

How To Record Refunds In QuickBooks Online Dummies

https://www.dummies.com/wp-content/uploads/quickbooks-online-3e-refund-check.jpg

https://quickbooks.intuit.com/learn-support/en-us/...

The steps below will guide you through the process From the Employees menu select Payroll Taxes and Liabilities then Deposit Refund Liabilities Select the name of the vendor who submitted the refund check In the Refund Date field enter the deposit date

https://blueswanbookkeeping.com/tax-refund-in-quickbooks

How to Record a Tax Refund in the Desktop Version of QuickBooks Open QuickBooks Desktop and navigate to the Banking menu Click on Make Deposits to record the tax refund received into your bank account within QuickBooks Desktop Select

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

FTB Tax Return FTB Refund Status KB CPA Services P A

Income Statement Guide Definitions Examples Uses More QuickBooks

How To Claim Income Tax Refund And Steps To Check Status Online

Online Income Tax Refunds FBR

How To Check Your Income Tax Refund Status In Few Easy Steps YouTube

How To Check Your Income Tax Refund Status In Few Easy Steps YouTube

Average Tax Refund In Every U S State Vivid Maps

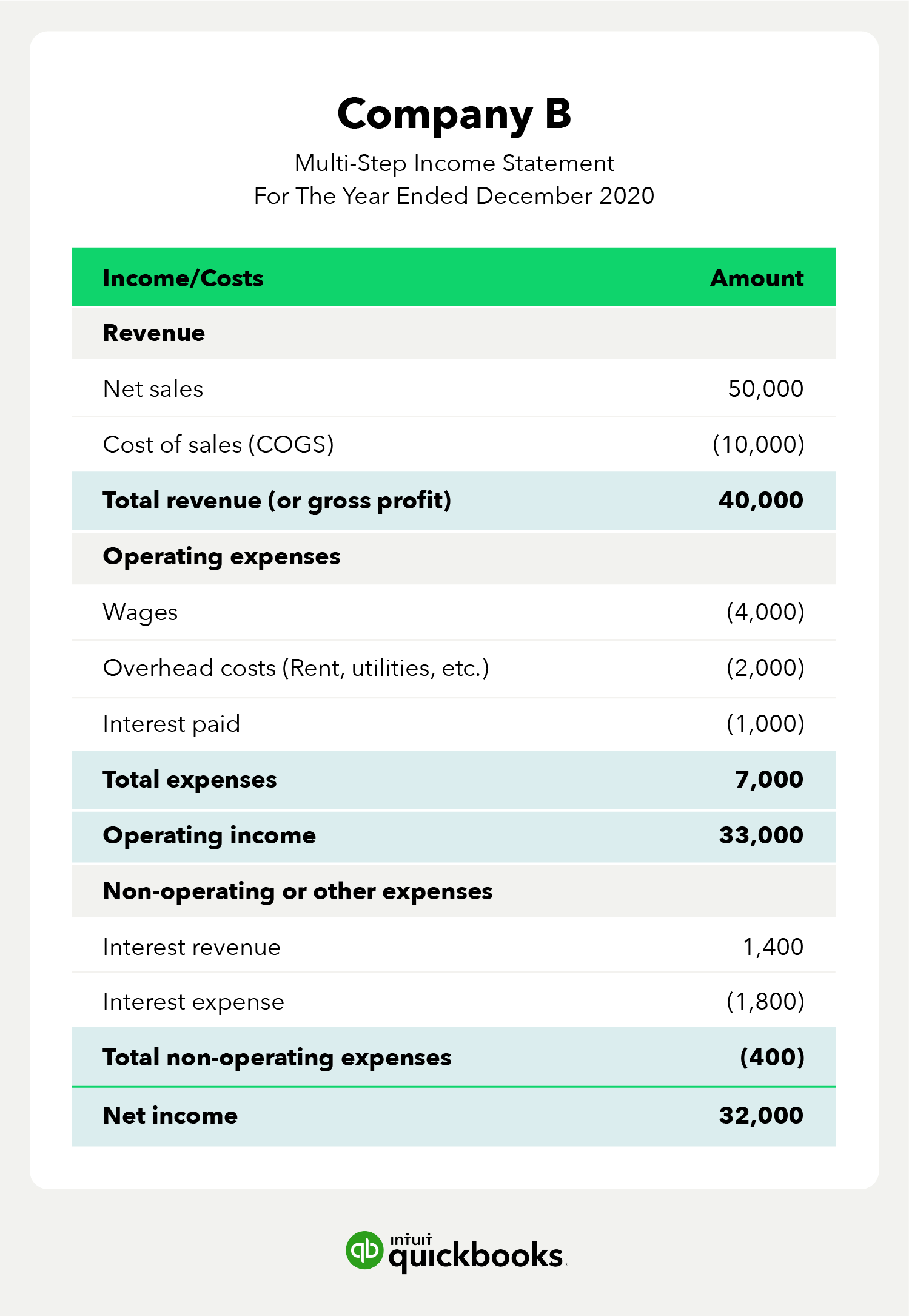

Multi Step Income Statement

Journal Entry For Income Tax Refund How To Record

How To Record Income Tax Refund In Quickbooks Desktop - I m here to help you record a refund in your QuickBooks Online QBO annette23 Once you got the refund Simply follow these steps Select New and click Bank Deposit In the Account drop down menu select the account where you got the refund Under the RECEIVED FROM column choose the vendor who gave you a refund