How To Take Rebate On Hra HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

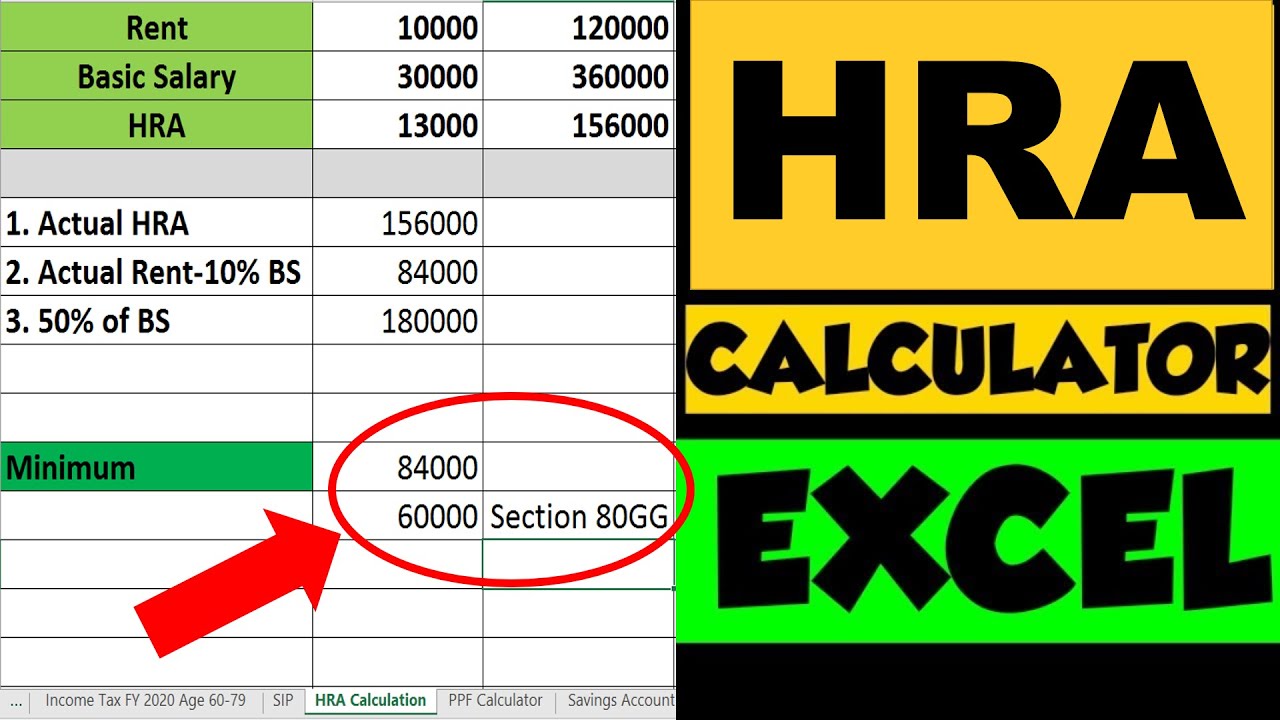

How to Use the HRA Calculator It is easy to use our HRA calculator when you know the steps Step 1 Enter your basic salary and HRA you get as per your salary slip Step 2 Enter the actual rent paid and specify whether you live in a metro city or not from the drop down The HRA calculation for income tax makes it easy for the employees to One can claim the lowest amount among HRA received rent paid minus 10 of salary or a fixed percentage based on your city This article gives complete information regarding the HRA exemption eligibility criteria documents required how to

How To Take Rebate On Hra

How To Take Rebate On Hra

https://i.ndtvimg.com/i/2017-10/iit-bombay-students-house-generate-energy_650x400_61507288403.jpg

How To Calculate Tax Rebate On Hra PRORFETY

https://lh3.googleusercontent.com/proxy/utWsw7C9_5dtyqCp5GpaM_rTqldfFpJN0LZmAIXcJzaX8byO8a3fJobn_2FHplENVQjNJddePNW_E4BzGnbnH55Gt6STvxc5zVFsiraSJ0_1PIN1dRirG0df-CUGg-RU=w1200-h630-p-k-no-nu

HRA Rebate Ll How To Take Hra Rebate Ll HRA Ll Income

https://i.ytimg.com/vi/H0CT76CU6c8/maxresdefault.jpg

To qualify for HRA tax exemption you need to provide your employer with your rent receipts and rental agreement Tax experts advise that having both the rental agreement and rent receipts from your landlord is necessary to claim the HRA tax exemption HRA Calculation Know how to Calculate HRA with examples calculate HRA from basic salary HRA Exemption Rules House Rent Allowance Calculation more

Learn about House Rent Allowance in detail including what is HRA Tax Exemptions and benefits of availing HRA Also know How to Calculate and Claim HRA House Rent Allowance HRA and home loan repayments both offer tax benefits to taxpayers If you receive HRA as a part of your salary and are also repaying a housing loan then this article should clear the air on the subject

Download How To Take Rebate On Hra

More picture related to How To Take Rebate On Hra

Rebating 3 How To Chisel Out A Rebate YouTube

https://i.ytimg.com/vi/jSe24kOOR_A/maxresdefault.jpg

HRA Calculation How To Calculate HRA In Salary Razorpay Payroll

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/09/hra_image.jpeg

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1068x830.png

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance the allowance will be fully taxable What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section

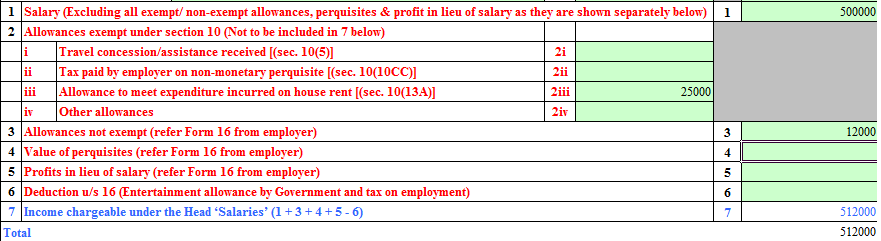

HRA Tax Exemptions How to save income tax on House Rent Allowance if you are living in rented house Find eligibility criteria to claim HRA Tax Exemption Even if you have forgotten to submit rental receipts you can claim an HRA rebate while filing your income tax returns All you have to do is manually calculate the HRA tax exemption using the formula mentioned above and then report this as an expense under Section 10 13A in ITR1

HRA Calculation Everything You Need To Know

https://www.canarahsbclife.com/content/dam/choice/tax-university/images/Picture1.png

How To Do A Concrete Garage Rebate YouTube

https://i.ytimg.com/vi/Pm3XItWzDbA/maxresdefault.jpg

https://taxguru.in › income-tax › house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

https://groww.in › calculators › hra-calculator

How to Use the HRA Calculator It is easy to use our HRA calculator when you know the steps Step 1 Enter your basic salary and HRA you get as per your salary slip Step 2 Enter the actual rent paid and specify whether you live in a metro city or not from the drop down The HRA calculation for income tax makes it easy for the employees to

HRA Exemption Excel Calculator For Salaried Employees House Rent

HRA Calculation Everything You Need To Know

What Is A Rebate Seconline

Income Tax HRA

How To Rebate Wood With A Router 2021 Beginners Guide

How To Rebate Wood With A Router 2021 Beginners Guide

How To Rebate Wood With A Router 2021 Beginners Guide

MENARDS 11 Rebate Offer How To Submit New Form NEW AND IMPROVED

Best Guide On HRA Exemption Section 10 13A TaxAdda

Claim Tax Benefit On HRA As Well As Tax Deduction On Home Loan

How To Take Rebate On Hra - When you are calculating HRA for tax exemption you take into consideration four aspects which includes salary HRA received the actual rent paid and where you reside i e if it is a metro or non metro