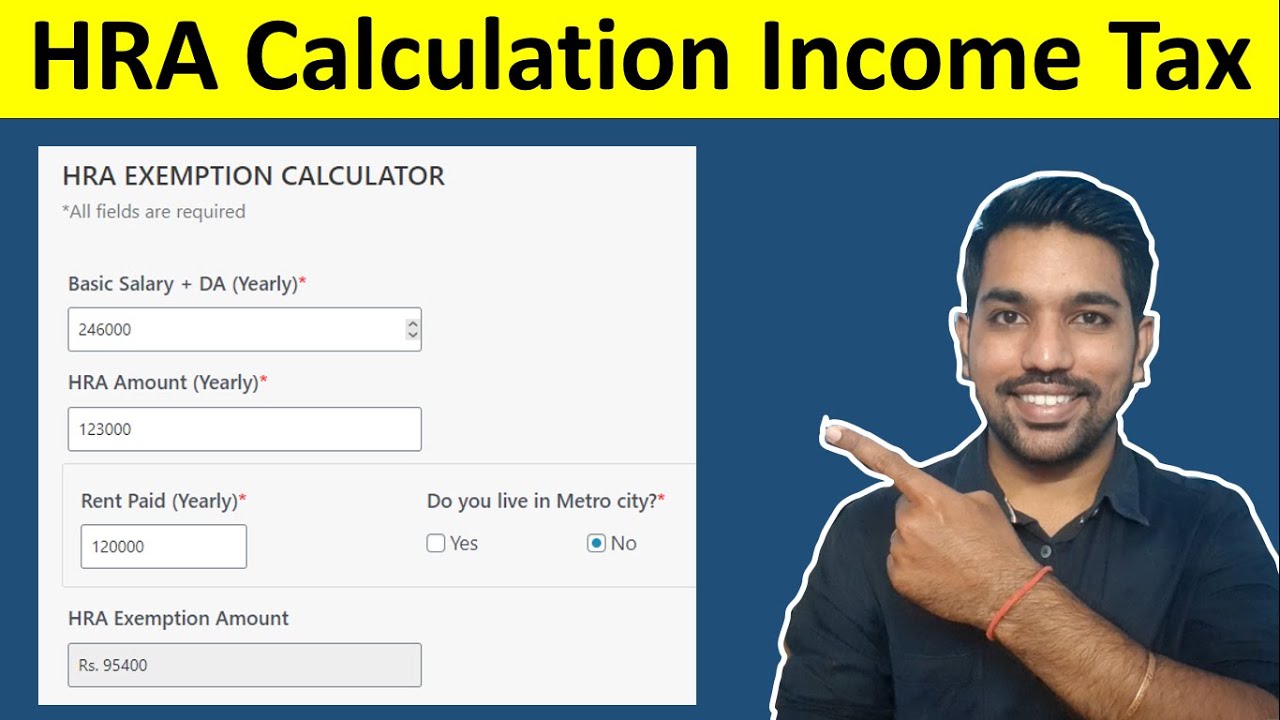

Hra Exemption In Income Tax E Filing Follow these basic steps to claim HRA exemption when filing ITR Calculate the amount eligible for HRA exemption as explained above you may also take the help of our free HRA calculator Calculate

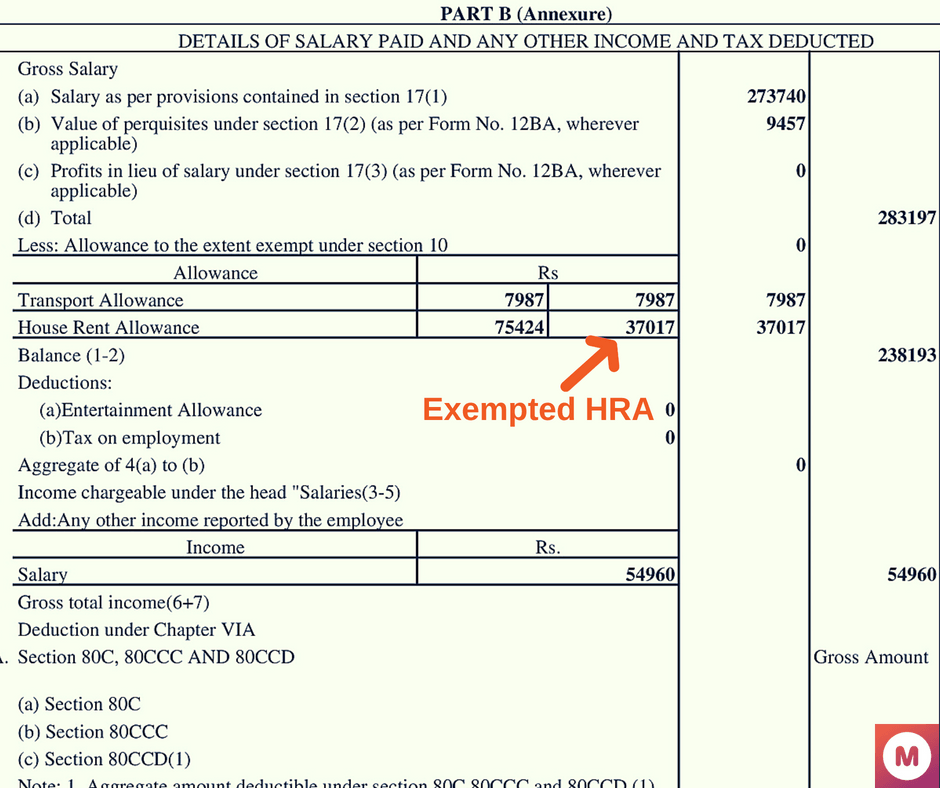

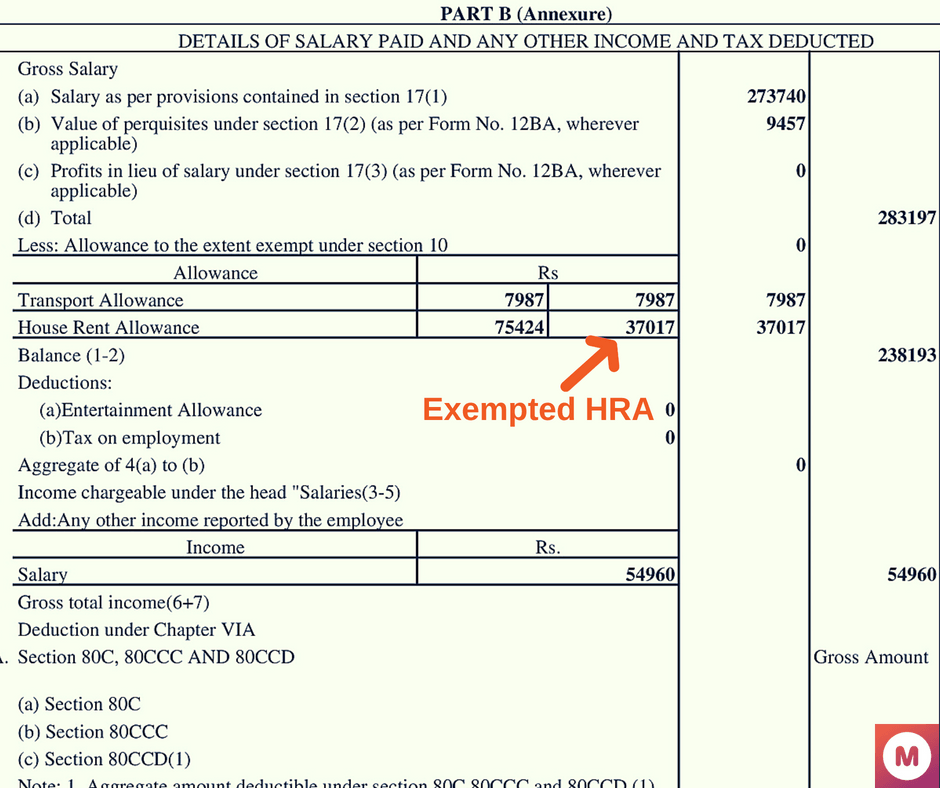

If you submit your rent documents receipts etc to your employer on time your Form 16 will show the HRA section as tax exempt Now depending on your Salaried individuals living in a rented house can claim HRA exemption under Section 10 13A of the Income Tax Act One can claim the lowest amount

Hra Exemption In Income Tax E Filing

Hra Exemption In Income Tax E Filing

https://i.ytimg.com/vi/O-wluM-mvG8/maxresdefault.jpg

HRA Calculation In Income Tax House Rent Allowance Calculator

https://i.ytimg.com/vi/J5KugtFfmJw/maxresdefault.jpg

What Is House Rent Allowance HRA Exemptions Calculation Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

If you are filing your tax return using ITR 1 on the e filing website the amount of HRA exempted from tax if any is likely to be pre filled It is advisable that individuals verify the pre filled information with HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or

By claiming HRA exemption the portion of your salary designated as HRA is deducted from your total taxable income thereby lowering your overall tax liability This can result in significant tax Income Tax Department has made PAN card mandatory for HRA Exemption Find out what to do in case your landlord doesn t have PAN

Download Hra Exemption In Income Tax E Filing

More picture related to Hra Exemption In Income Tax E Filing

HRA Exemption Calculator For Salaried Employees FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2021/12/how-to-calculate-hra-to-save-income-tax-1024x576.webp

Pin Auf NEWS You Can USE

https://i.pinimg.com/originals/4b/35/2c/4b352c55ac0959e4b980ff968f94f4f0.jpg

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

You can claim HRA exemption by submitting proof of rent receipts to your employer Alternatively you can claim the HRA exemption yourself while filing your income tax In this article we will walk you through the process of claiming HRA exemption in income tax Understanding the rules and guidelines for claiming House Rent Allowance Exemption can

Calculate your HRA Exemption with Tax2win s House Rent Allowance HRA Calculator easily and maximize your tax benefits Salaried employees who receive house rent allowance as a part of their salary and make payment towards rent can claim HRA exemption to reduce their

HRA Exemption In Income Tax 2023 Guide InstaFiling

https://instafiling.com/wp-content/uploads/2023/01/HRA-Exemption-In-Income-Tax-1080x675.png

How To Claim HRA Exemption In Income Tax House Rent Allowance

https://i.ytimg.com/vi/-3E6dCIbUCg/maxresdefault.jpg

https://tax2win.in/guide/hra-house-rent-allo…

Follow these basic steps to claim HRA exemption when filing ITR Calculate the amount eligible for HRA exemption as explained above you may also take the help of our free HRA calculator Calculate

https://blog.saginfotech.com/claim-hra-filing-income-tax-return

If you submit your rent documents receipts etc to your employer on time your Form 16 will show the HRA section as tax exempt Now depending on your

House Rent Allowance Calculation In Income Tax How To Calculate HRA

HRA Exemption In Income Tax 2023 Guide InstaFiling

House Rent Allowance How To Claim Exemption HRA Tax Benefit Illustration

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

How To Calculate HRA Tax Exemption In Income Tax Online Fi Money

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

HRA Exemption Calculator For Income Tax Benefits Calculation And

Income Tax Savings HRA

HRA House Rent Allowance Exemption Rules Tax Deductions

Hra Exemption In Income Tax E Filing - House Rent Allowance is an employer granted allowance for employee housing rent HRA is usually included in employee CTC Only rent paid amount can be