Hsa Contributions Taxable In Wisconsin Turbotax As of October of 2023 it appears that WI ACT 35 has corrected the difference between the IRS rule and WI law with regard to HSA contributions taxable in WI as it relates to

Effective for taxable years beginning in 2011 and thereafter Wisconsin follows the provisions of Public Law 108 173 relating to health savings accounts Eligible individuals may claim a If you made contributions to an HSA prior to 2011 Wisconsin did not permit the deduction of such contributions However subsequent to 2010 Wisconsin passed a law that

Hsa Contributions Taxable In Wisconsin Turbotax

Hsa Contributions Taxable In Wisconsin Turbotax

https://images.squarespace-cdn.com/content/v1/5c1b1a77e17ba3747352f631/21101b42-0f2b-4335-876b-e60f9b4c8803/HSA+after+65.jpg

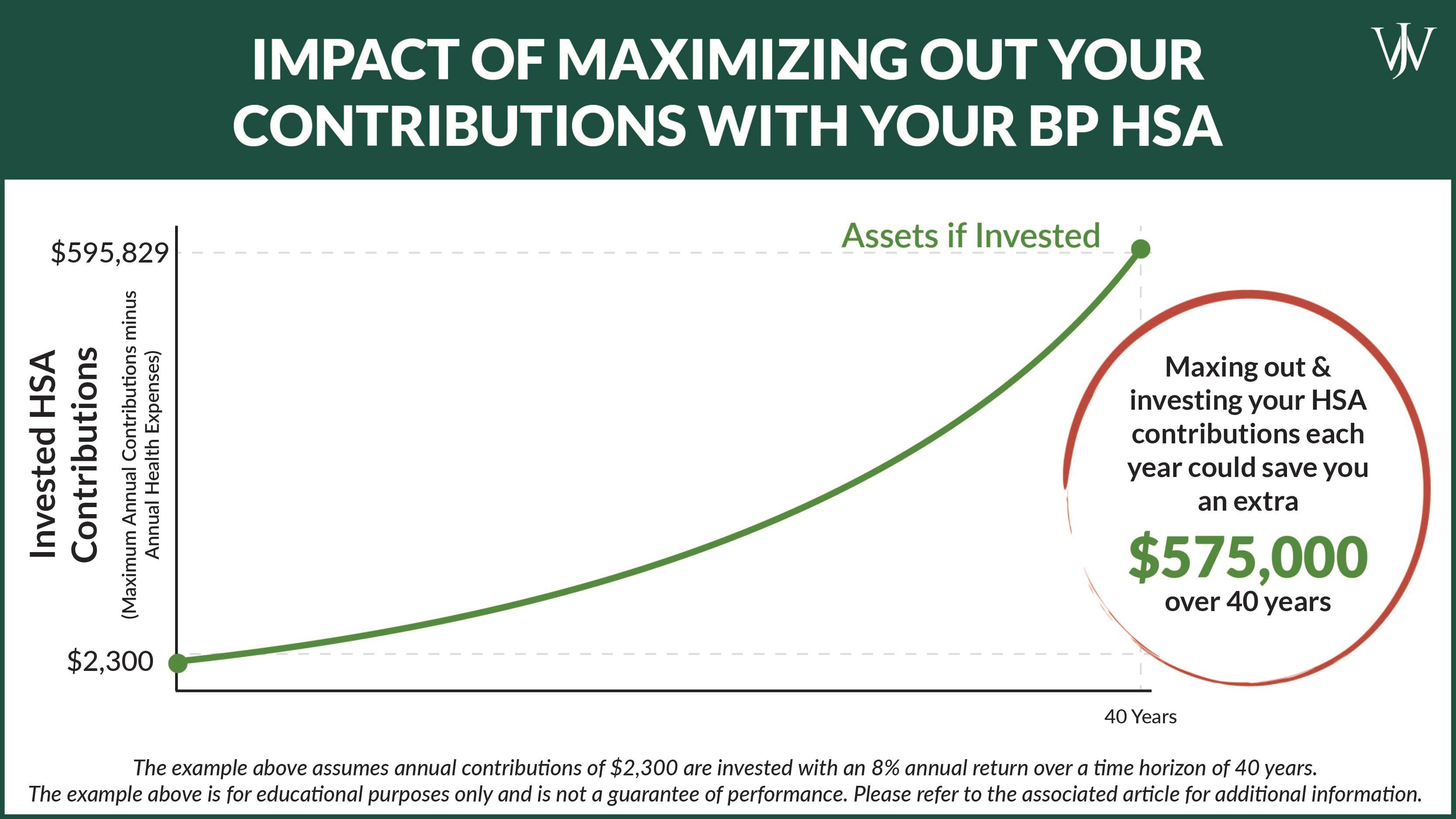

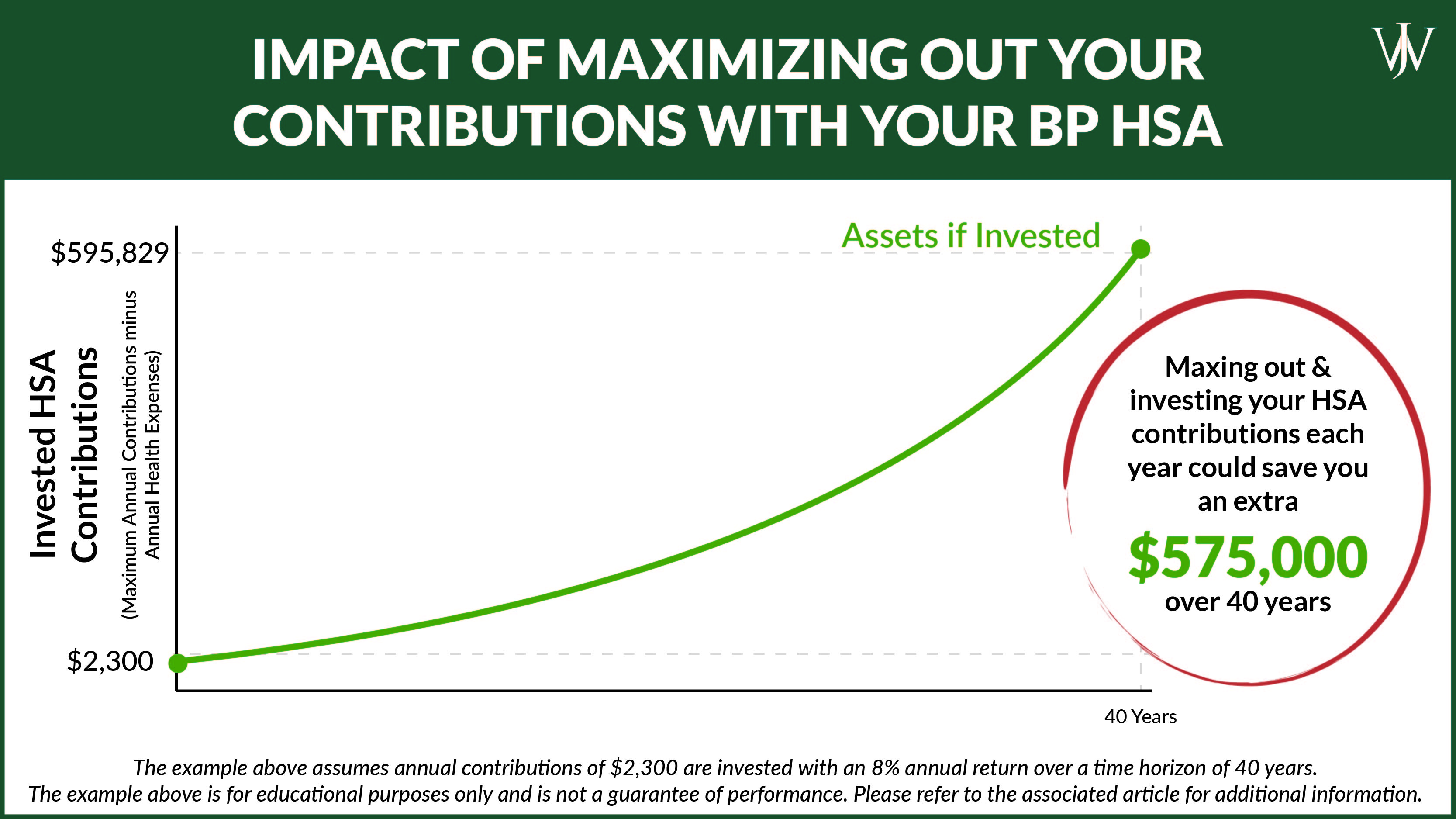

BP HSA Tax Benefits Investment Strategies To Consider In Open Enrollment

https://insights.wjohnsonassociates.com/hubfs/Blog Graphic_ BP HSA_1600x900_impact of maxing out bp hsa contributions annually-jpg.jpeg

IRS Announces 2023 HSA Contribution Limits

https://blog.threadhcm.com/hs-fs/hubfs/HSA Contribution Limits Table.png?width=1024&name=HSA Contribution Limits Table.png

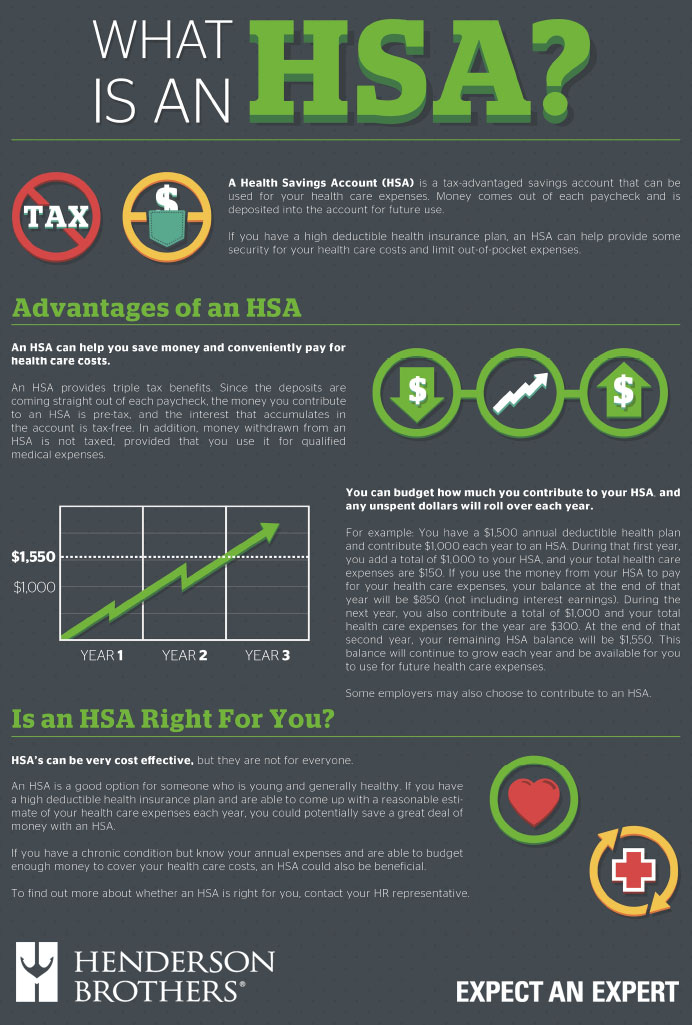

Post tax contributions are tax deductible You can make changes to your contribution at any time Distributions for eligible medical expenses are tax free HSA funds carry over year to year Eligible individuals may claim a deduction on their federal income tax returns for contributions to the HSA If the contribution is made by an employer or pre tax through an employer s

Earnings on the health savings account are taxable to the individual Amounts distributed from the health savings account are not taxable to Wisconsin regardless of whether or not the amount Yes the contributions made by your employer are not taxable income This money is yours tax free as long as you spend it on qualified medical expenses You can also make pre tax

Download Hsa Contributions Taxable In Wisconsin Turbotax

More picture related to Hsa Contributions Taxable In Wisconsin Turbotax

Do You Qualify For TurboTax Settlement In Minnesota Wisconsin

https://townsquare.media/site/164/files/2022/05/attachment-GettyImages-940325272.jpg?w=980&q=75

How Much Can You Contribute To An Hsa In 2022 2022 CGR

https://i2.wp.com/hrworkplaceservices.com/wp-content/uploads/2021/05/HRWS.2022-Limits-for-HSAs.Chart-A3.jpg

W2 Form Employer

https://imageio.forbes.com/blogs-images/kellyphillipserb/files/2014/02/W2.png?format=png&width=1200

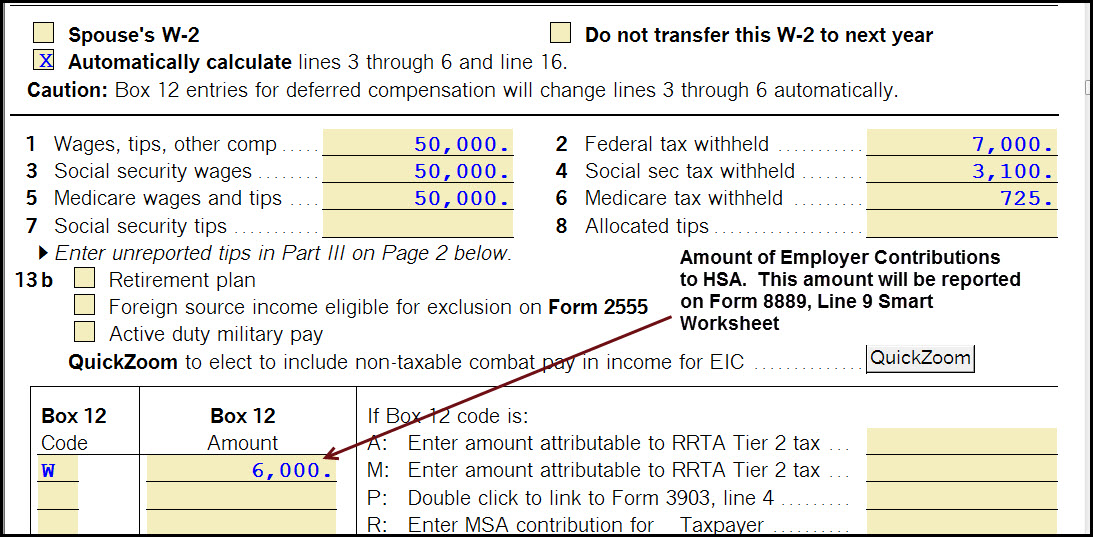

Until you complete the HSA portion of the TurboTax interview to establish your eligibility for an HSA contribution TurboTax will treat the amount entered on the W 2 form as Are HSA contributions tax deductible Yes you ll receive a tax deduction on Schedule 1 Part II Line 13 which then flows into Form 1040 line 10 as an adjustment to your income As you need the funds to pay medical

As healthcare expenses rise understanding the tax implications of HSAs is essential for maximizing their benefits This article examines the taxation aspects of HSAs focusing on Contributions are taxed and earnings and withdrawals are not exempt from state taxes Wisconsin Wisconsin aligns with federal rules providing state tax deductions for

WISCONSIN 1NPR Form DELAYED R TurboTax

https://preview.redd.it/wisconsin-1npr-form-delayed-v0-7fh8v2ifwjja1.png?width=785&format=png&auto=webp&s=2c13af9173c72090783c795584c48cef0c4ea792

HSAs Health Savings Accounts Henderson Brothers

https://www.hendersonbrothers.com/wp-content/uploads/2017/09/HSA-inforgraphic.jpg

https://ttlc.intuit.com › community › state-taxes › ...

As of October of 2023 it appears that WI ACT 35 has corrected the difference between the IRS rule and WI law with regard to HSA contributions taxable in WI as it relates to

https://www.revenue.wi.gov › DOR Publications

Effective for taxable years beginning in 2011 and thereafter Wisconsin follows the provisions of Public Law 108 173 relating to health savings accounts Eligible individuals may claim a

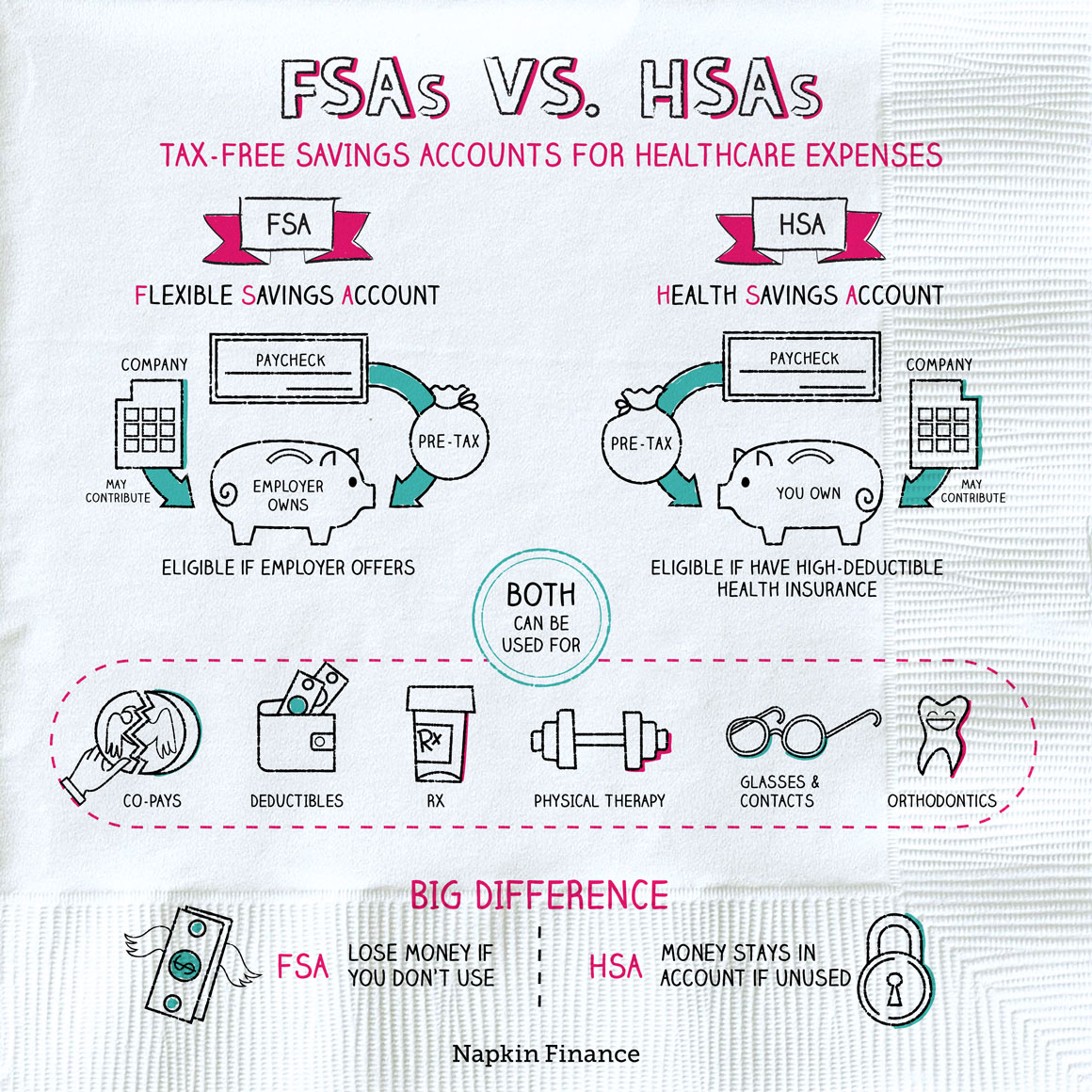

FSA Vs HSA Use It Or Lose It Napkin Finance

WISCONSIN 1NPR Form DELAYED R TurboTax

2023 HSA Contribution Limits Increase Considerably Due To Inflation

Why You Should Max Out Your HSA Contributions Smart Family Money

How To File Cryptocurrency Taxes With TurboTax Step by Step CoinLedger

Understanding Tax Season Form W 2 Remote Financial Planner

Understanding Tax Season Form W 2 Remote Financial Planner

Entering HSA Health Savings Account Information Accountants Community

How Do Employer Contributions Affect My HSA Limit HSA Edge

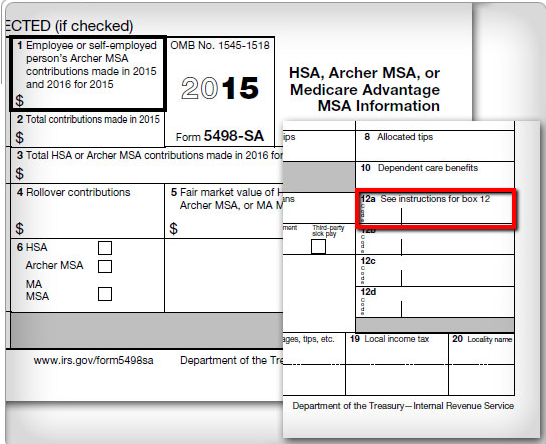

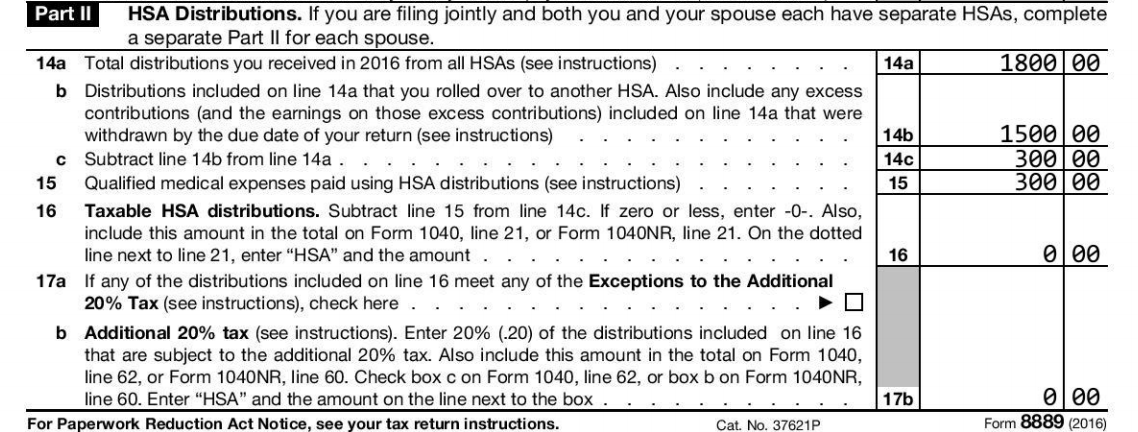

How To Handle Excess Contributions On HSA Tax Form 8889 HSA Edge

Hsa Contributions Taxable In Wisconsin Turbotax - Solved Turbotax puts an entry for Wisconsin 2022 HSA Smart Worksheet on Line 4 from the dialog distribution from years 2011 2021 and correctly subtracts