Hsa Spending Rules Spouse Can you and your spouse share an HSA What if you re both on individual plans We dive into common scenarios to review what changes with an HSA when you get married

If your spouse is the designated beneficiary of your HSA it will be treated as your spouse s HSA after your death The Internal Revenue Service IRS has special rules regarding Health Savings Accounts HSA and how they should be managed Those rules can be confusing especially for married spouses who have more than

Hsa Spending Rules Spouse

Hsa Spending Rules Spouse

https://up.com.au/static/7ce061aff1fb2f43d3b0bff7fea59cce/zap-impulse-spending.png

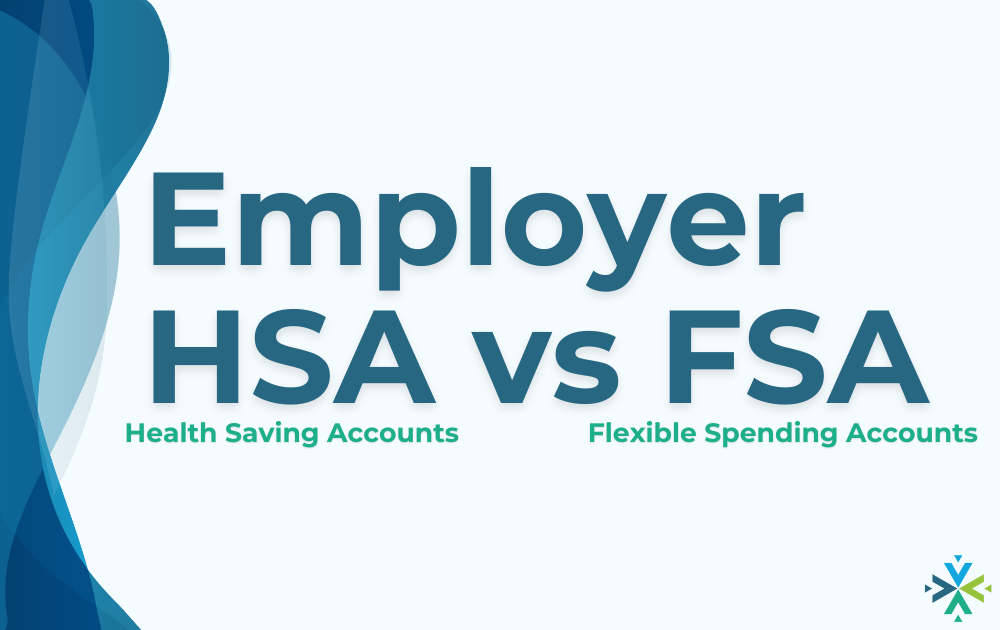

Employer Health Saving Accounts HSA Vs Flexible Spending Accounts FSA

https://healthcarepathfinder.com/wp-content/uploads/2022/11/17.png

HSA Contribution Limits Cray Kaiser

https://craykaiser.com/wp-content/uploads/2023/06/HSA-Contribution-Limit.png

When you your spouse or your dependents have qualified medical expenses that aren t covered by your health care plan you can pay for them tax free 1 with your HSA There How Can I Use HSA Money The money in your HSA can be used to pay for qualified medical expenses incurred by you your spouse and your dependents

You your spouse and your eligible dependents can all use your HSA money to pay for qualified medical expenses as long as everyone meets eligibility requirements and you Whether you are married to a spouse or have a domestic partner there are IRS rules in place for how you can open contribute and spend from your HSAs This

Download Hsa Spending Rules Spouse

More picture related to Hsa Spending Rules Spouse

HSA Investment Strategies MyHealthMath

https://myhealthmath.com/wp-content/uploads/2022/08/HSA-Investments-Blog.png

HSA Spending Rules Financial Benefit Services FBSBenefits

https://fbsbenefits.com/wp-content/uploads/2023/10/iStock-1182211221-scaled.jpg

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

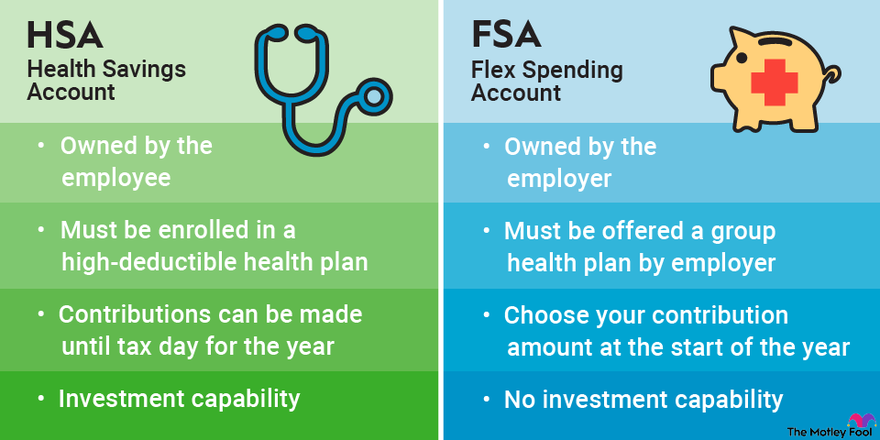

Health Savings Vs Flexible Spending Account What s The Difference

https://www.investopedia.com/thmb/PE1dbX0Tuo1ohlHmjw_RcTUcvNw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg

If a spouse is designated as your beneficiary they become the owner of your HSA after you pass away That means the benefits of the account including tax free withdrawals for qualified healthcare In this article we ll go over the rules regarding HSA contributions specifically focusing on rules in a scenario where two spouses each have an HSA We ll

Unlike an HSA an employee does not have to be enrolled in an HDHP to use an FSA According to IRS rules Sarah cannot contribute to her HSA because her If your spouse is 65 but you re aged 64 or under and you are the owner of the HSA you can still only use your savings to pay for qualified medical expenses If you

LINKA Spending Becomes Income For Android Download

https://images.sftcdn.net/images/t_app-cover-l,f_auto/p/f403ed2a-1af3-46b1-bc99-67ac80495313/4270153568/linka-spending-becomes-income-screenshot.png

HSA Vs FSA Accounts Side by Side Healthcare Comparison The Motley Fool

https://m.foolcdn.com/media/dubs/images/HSA-vs-FSA-plans-infographic.width-880.png

https://www.firstdollar.com/resources/hsas-and-spouses

Can you and your spouse share an HSA What if you re both on individual plans We dive into common scenarios to review what changes with an HSA when you get married

https://www.irs.gov/publications/p969

If your spouse is the designated beneficiary of your HSA it will be treated as your spouse s HSA after your death

IRS Announces 2023 HSA Contribution Limits

LINKA Spending Becomes Income For Android Download

File Rules And Regulations Threshing Committee Of The U S Food

Can I Use My HSA For My Spouse

Image Representing Permissive Hacking Rules

Our Family Spending Rules Modern Family Finance

Our Family Spending Rules Modern Family Finance

HSA Notability Gallery

UK NEW RULES SPOUSE WITH MASTER CAN GO STUDY VISA UPDATES 2023

Pcs Checklist Pcs Military Military Move

Hsa Spending Rules Spouse - You your spouse and your eligible dependents can all use your HSA money to pay for qualified medical expenses as long as everyone meets eligibility requirements and you