Hybrid Car Federal Tax Credit For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use

Hybrid Car Federal Tax Credit

Hybrid Car Federal Tax Credit

https://i.pinimg.com/originals/4f/36/37/4f3637a1d452fad1c5cfa33165305fce.jpg

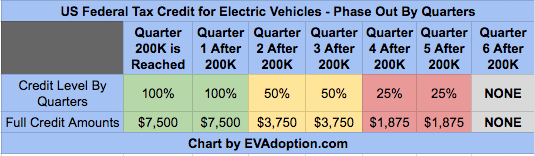

Electric Car Federal Tax Credit Phase Out Todrivein

https://todrivein.com/wp-content/uploads/2023/06/electric-car-federal-tax-credit-phase-out_featured_photo.jpeg

Federal Tax Credit Phase Out Quarters How It Works EVAdoption

https://evadoption.com/wp-content/uploads/2018/01/Federal-Tax-Credit-Phase-Out-Quarters-How-It-Works.png

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and

All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary The Inflation Reduction Act of 2022 changed which new fully electric and plug in hybrid vehicles were eligible for federal tax credits starting on April 18 2023

Download Hybrid Car Federal Tax Credit

More picture related to Hybrid Car Federal Tax Credit

Electric Vehicle Federal Tax Credit Explained Electric Driver

https://u4h6k2g9.rocketcdn.me/articles/wp-content/uploads/2021/07/Large-704-ElectrifyHomeAnnouncesAvailabilityofHomeStationElectricVehicleCharger-768x576.jpg

Sebastian Vettel Made Sure He Aborted His Final Qualifying Run At Qatar

https://carinmylife.com/wp-content/uploads/2021/11/1000-Horsepower-Audi-RS-Q8-Gets-Near-200-MPH-On-Autobahn-Night-Run-678x509.jpg

EV Incentives Electric Car Federal Tax Credit Explained Gearbrain

https://assets.rebelmouse.io/eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJpbWFnZSI6Imh0dHBzOi8vYXNzZXRzLnJibC5tcy8xOTU3ODM0Ni9vcmlnaW4uanBnIiwiZXhwaXJlc19hdCI6MTY2Nzk4OTI5Nn0.6Of2tp92894J4fbVo_FK1ew-C_wwTG_y1--qbP-S8Yg/img.jpg?width=1200&coordinates=0%2C158%2C0%2C5&height=600

The tax credit for EVs provides up to 7 500 toward a purchase of a qualifying Tesla Rivian or other plug in car Credits apply to plug in electric vehicles which include plug in hybrid EVs and battery electric vehicles BEVs Do used electric cars qualify for federal tax credits Yes

Plug in hybrid all electric and fuel cell electric vehicles purchased new in or after 2023 may be eligible for a federal income tax credit of up to 7 500 The amount and availability of the credit will depend on several factors Pricing for the hybrid model starts at 52 750 and it s the only PHEV on the list that s eligible for the full 7500 tax credit

Hybrid Car Federal Tax Credit

http://images.thecarconnection.com/med/sales-of-vehicles-qualifying-for-plug-in-electric-car-purchase-tax-credit-irs-nov-2014_100499338_m.jpg

Electric Car Rebates And Incentives Todrivein

https://todrivein.com/wp-content/uploads/2023/06/electric-car-rebates-and-incentives_featured_photo.jpeg

https://www.cars.com/articles/heres-wh…

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

https://www.irs.gov/newsroom/qualifying-clean...

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in

How To Calculate The Federal Tax Credit For Electric Cars GreenCars

Hybrid Car Federal Tax Credit

How To Calculate The Federal Tax Credit For Electric Cars GreenCars

An Even More Generous Electric Car Federal Tax Credit Reform Is Being

The Florida Hybrid Car Rebate Save Money And Help The Environment

Tesla Will Benefit From The EV Tax Credit Repeal Electric Car News

Tesla Will Benefit From The EV Tax Credit Repeal Electric Car News

Audi E Tron Tax Credit Dominic ferkovich

Tesla Lowers Prices On All Of Its Models

Official Toyota s 7 500 Federal Tax Credit Phaseout Is Underway

Hybrid Car Federal Tax Credit - A6 Beginning Jan 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is placed in service and