If You Get A Car Allowance Can You Still Claim Mileage If your employer does not require you to submit receipts for your car expenses and the amount of the car allowance is less than your actual expenses you

If your employer provides a car allowance you can still receive Mileage Allowance Payments MAPs Although you are responsible for any car expenses as It will be added to your salary It s taxed as regular income A mileage allowance is money that you get from your employer after a business trip If you do a lot of car

If You Get A Car Allowance Can You Still Claim Mileage

If You Get A Car Allowance Can You Still Claim Mileage

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

Oprah s Podcasts With Eckhart Tolle Are So Beautiful If You Get A

https://i.pinimg.com/originals/83/d6/79/83d679a0e2a244a8d832be17f462ac02.jpg

Can You Get A Car Title Without License YouTube

https://i.ytimg.com/vi/ktQ0F2tHtio/maxresdefault.jpg

When you use your personal vehicle for business purposes many employers will reimburse you per mile with Mileage Allowance Payments MAP HMRC provides As opposed to tax free cents per mile reimbursement a car allowance is considered income and it s fully taxable Despite that it s still preferred by some

Generally mileage reimbursements aren t included in your taxable income if they re paid under an accountable plan established by your employer To qualify as Instead mileage can be claimed on line 9 for car and truck expenses Alternatively people can claim their actual vehicle expenses for maintenance repairs and fuel

Download If You Get A Car Allowance Can You Still Claim Mileage

More picture related to If You Get A Car Allowance Can You Still Claim Mileage

Can You Get A Car Loan With Bad Credit Car News

https://www.carztune.com/wp-content/uploads/2021/04/bad-or-no-credit.jpg

You Get A Car And You Get A Car R funny

https://preview.redd.it/ou4b0hpiyze51.jpg?auto=webp&s=47e5d41045b60b62e457703ac6a642010a2a8746

:max_bytes(150000):strip_icc()/carloan_v1_0711-3ce056bee0c04cb5b50858ef0fa6eafd.png)

Car Loans Things You Need To Know Before Getting One Ambrasenatore

https://www.investopedia.com/thmb/S0ZSu8umS3YSQvebWS3KcEyRgvE=/2200x1500/filters:no_upscale():max_bytes(150000):strip_icc()/carloan_v1_0711-3ce056bee0c04cb5b50858ef0fa6eafd.png

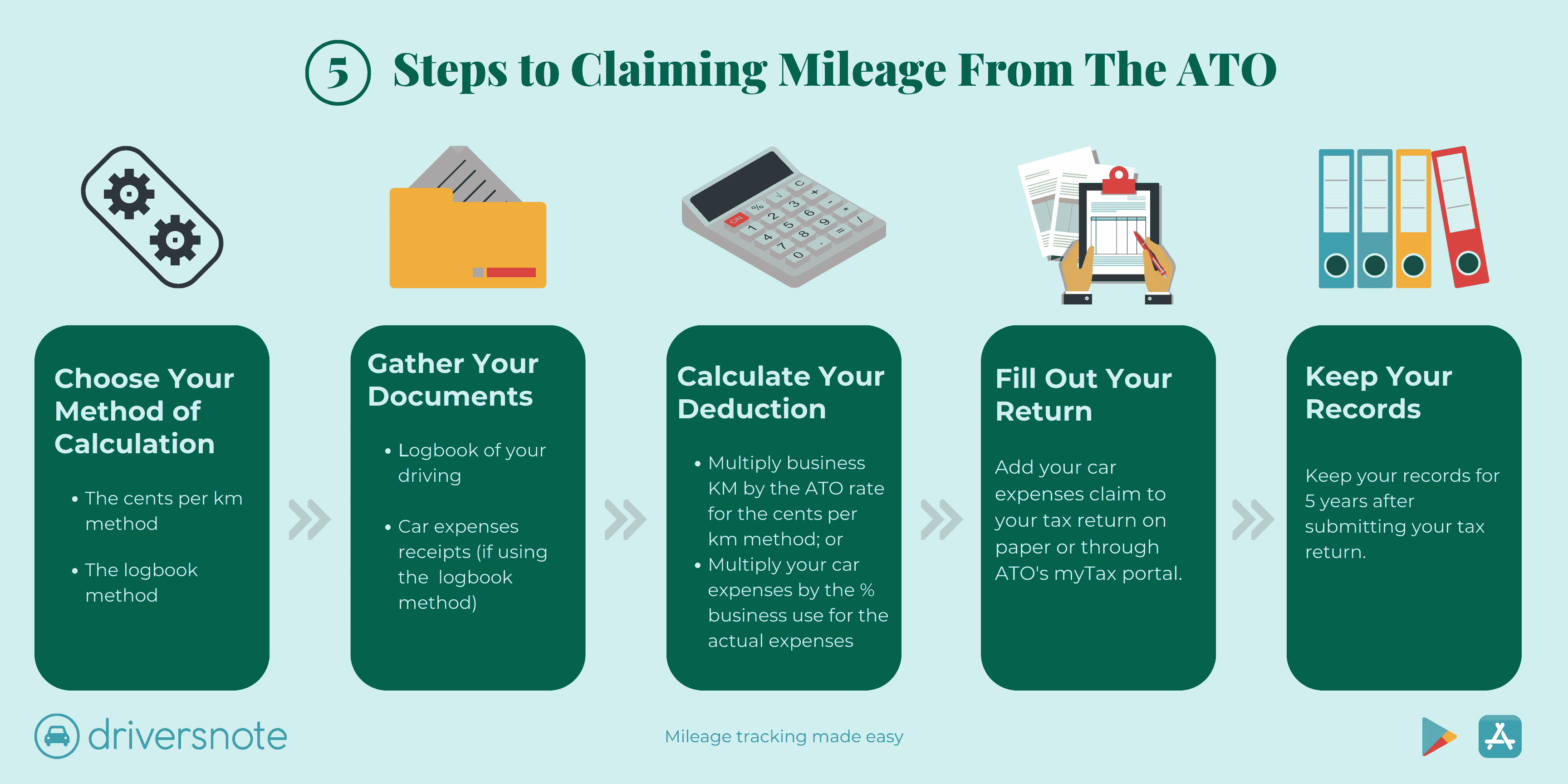

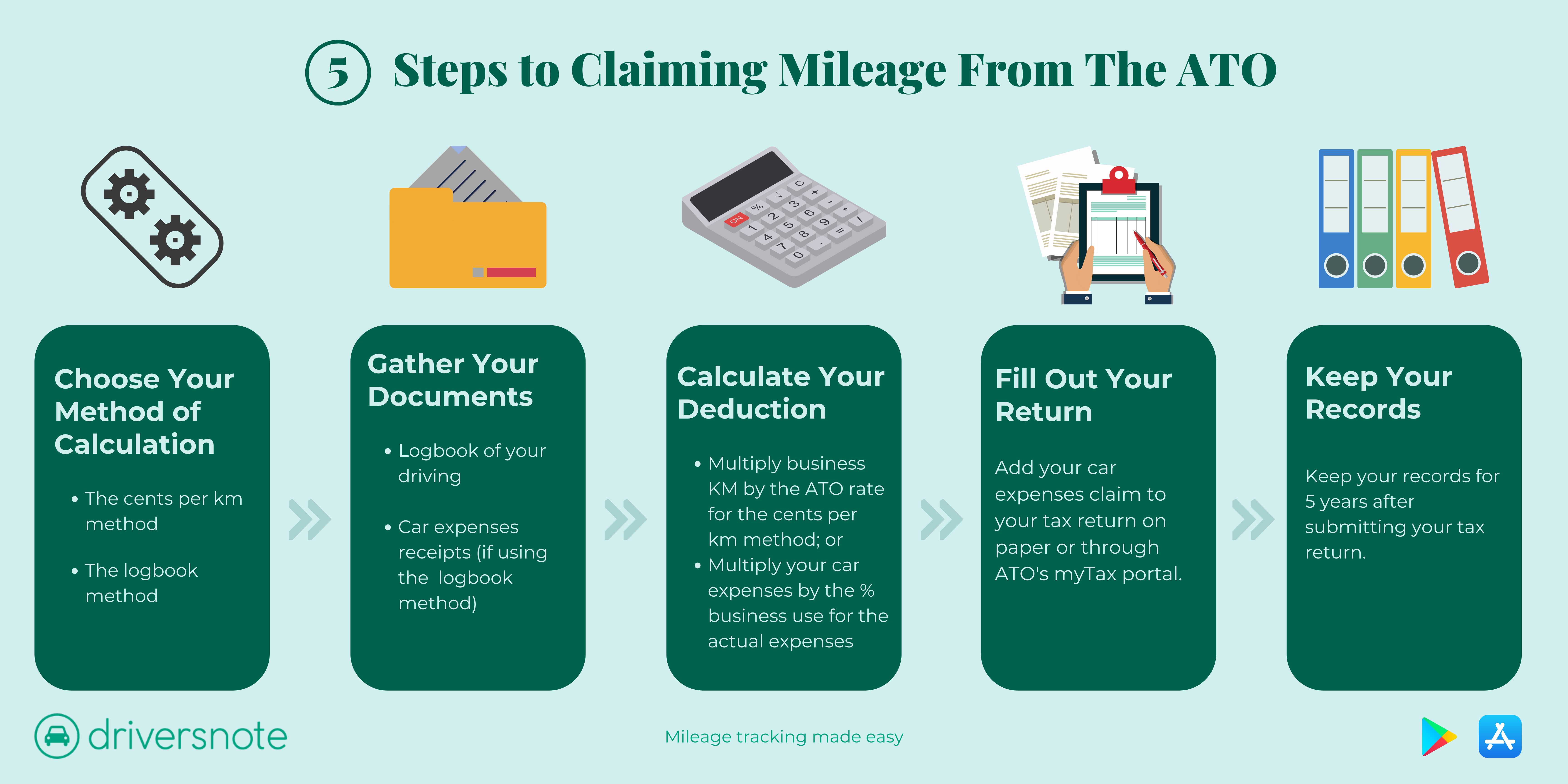

Driving your vehicle a lot of work can mean a lot of extra miles and added costs Luckily you can claim a tax write off for mileage in specific circumstances While not everyone You must not have claimed the special depreciation allowance on the car and You must not have claimed actual expenses after 1997 for a car you lease To use

For allowances based on mileage or tracking miscellaneous driving is still taxable because the non taxable mileage reimbursement can only be used for business purposes Rules for tax If you make payments to employees above a certain amount you ll have to report them to HM Revenue and Customs HMRC and deduct and pay tax Mileage

Can You Still Claim Sanctuary In A Church CHURCHGISTS COM

https://churchgists.com/wp-content/uploads/2022/06/can-you-still-claim-sanctuary-in-a-church-1024x914.jpg

5 Common Used Car Shopping Mistakes And How To Avoid Them Go Motors

https://gomotors.net/blog/wp-content/uploads/2021/10/79d726be7b1f797d8209882aac39df34.jpeg

https://ttlc.intuit.com/community/tax-credits...

If your employer does not require you to submit receipts for your car expenses and the amount of the car allowance is less than your actual expenses you

https://www.driversnote.co.uk/hmrc-mileage-guide/car-allowances-uk

If your employer provides a car allowance you can still receive Mileage Allowance Payments MAPs Although you are responsible for any car expenses as

Oprah Winfrey Pays Homage To THAT Iconic you Get A Car Meme As She

Can You Still Claim Sanctuary In A Church CHURCHGISTS COM

Mileage Claim Rate Everything You Need To Know Moss

Car Loan Financing Resources All You Need To Know Car Nation

You Get A Car You Get A Car Everyone Gets A Car R TheTPG

20 Bible Verses To Bless A New Car Everyday Bible Verses

20 Bible Verses To Bless A New Car Everyday Bible Verses

Calam o This Is What A Car Insurance Professional Will Advise You

How Do You Calculate Car Allowance For An Employee

You Get A Car Any You Get A Car Everybody Gets A Car R Warthunder

If You Get A Car Allowance Can You Still Claim Mileage - Car allowances are more simple to navigate than mileage reimbursements Employees are paid a set amount for car related expenses regardless of the actual distance they drive