Illinois 2024 Tax Rebate Illinois Department of Revenue Announces Start to 2024 Income Tax Season Mission Vision and Value FY 2024 18 What s New for Illinois Income Taxes FY 2024 15 New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees Illinois Department of Revenue Announces Start to 2024 Income Tax Season

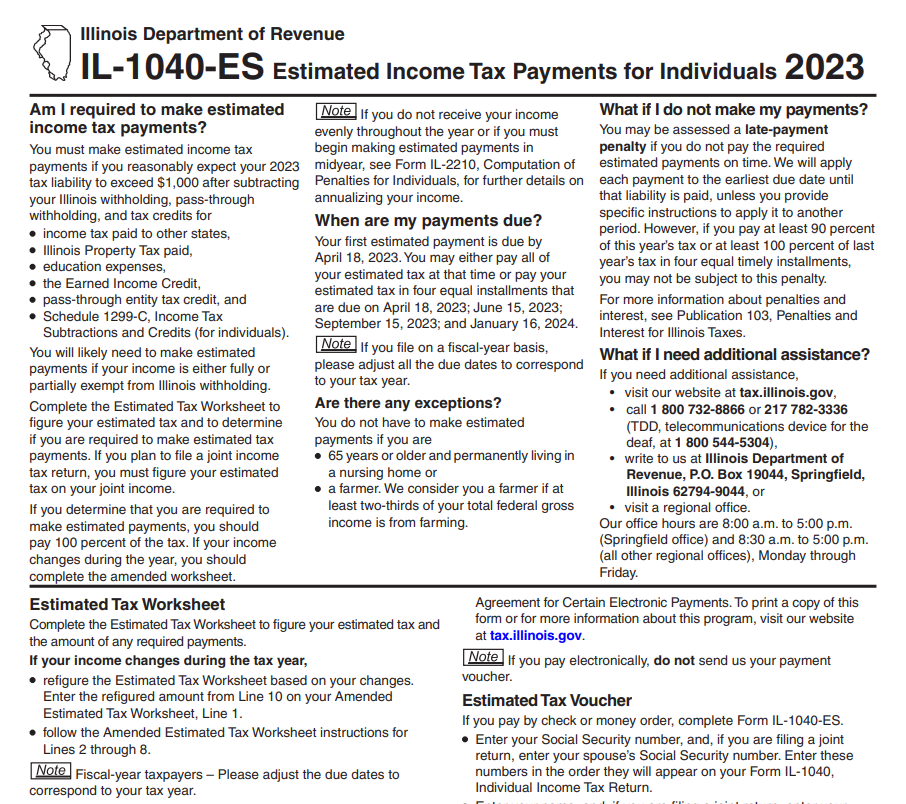

CHICAGO The Illinois Department of Revenue has announced the start of the 2024 tax season accepting 2023 tax returns beginning on January 29 That aligns with when the Internal Revenue IDOR s taxpayer assistance numbers are available for tax related inquiries and include automated menus allowing taxpayers to check the status of a refund identify an IL PIN or receive estimated payment information without having to wait for an agent To receive assistance taxpayers may call 1 800 732 8866 or 217 782 3336

Illinois 2024 Tax Rebate

Illinois 2024 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Illinois-Income-Tax-Rebate-2023.jpg

Illinois Tax Rebate 2022 Cray Kaiser

https://craykaiser.com/wp-content/uploads/2022/09/Illinois-Tax-Rebate.png

Illinois Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/03/Illinois-Tax-Rebate-2023.png

2024 This bulletin is written to inform you of recent changes it does not replace statutes rules and regulations or court decisions For information or forms Visit our website at tax illinois gov Register and file your return online at mytax illinois gov For registration questions call or email us at 217 785 3707 REV CentReg illinois gov The Illinois Department of Revenue IDOR announced on Thursday Jan 25 that it will begin accepting and processing 2023 tax returns on Monday Jan 29 the same date the Internal Revenue Service IRS begins accepting federal income tax returns We encourage taxpayers to file electronically as early as possible as this will speed processing

Individual Income Tax Rebate Anyone who filed taxes as a single person will receive 50 If you filed jointly you ll be given a 100 rebate 50 per person Those with dependents will Here s everything else you need to know about the rebates Income tax rebates Who qualifies You must have been an Illinois resident in 2021 with an adjusted gross income on your 2021 Form IL

Download Illinois 2024 Tax Rebate

More picture related to Illinois 2024 Tax Rebate

Tax Rebate 2023 Illinois Qualification Criteria Claim Process And Strategies To Maximize Your

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Tax-Rebate-2023-Illinois.jpg?resize=978%2C781&ssl=1

Illinois Ev Tax Rebate 2023 Tax Rebate

https://i0.wp.com/printablerebateform.net/wp-content/uploads/2023/03/Iowa-Tax-Rebate-2023-768x683.png

Tax Rebate FAQs Rep Thaddeus Jones

https://www.repthaddeusjones.com/wp-content/uploads/2022/09/illinois_tax_rebates_2022-980x580.jpg

If filing jointly 500 000 is the maximum income permitted to receive the property tax rebate while 400 000 is the limit for income tax rebates Single filers can have adjusted gross incomes of The property tax rebate is a maximum of 300 per household that is equal to the credit claimed for residential real estate property taxes on the 2021 Illinois income tax return The individual income tax rebate is 50 per individual 100 for couples who file married filing jointly provided their federal adjusted gross income is less than

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300

How Does Illinois s Property Tax Rebate Work

https://media.marketrealist.com/brand-img/SxFDcHPyG/1280x670/illinois-property-tax-rebate-1659496759243.jpg?position=top

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

https://tax.illinois.gov/research/news/illinois-department-of-revenue-announces-start-to-2024-income-ta.html

Illinois Department of Revenue Announces Start to 2024 Income Tax Season Mission Vision and Value FY 2024 18 What s New for Illinois Income Taxes FY 2024 15 New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees Illinois Department of Revenue Announces Start to 2024 Income Tax Season

https://news.yahoo.com/illinois-tax-season-2024-heres-210017466.html

CHICAGO The Illinois Department of Revenue has announced the start of the 2024 tax season accepting 2023 tax returns beginning on January 29 That aligns with when the Internal Revenue

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

How Does Illinois s Property Tax Rebate Work

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

Here Are The Federal Tax Brackets For 2023 Vs 2022 BitcoinEthereumNews

Nebraska Tax Rebate 2024 Eligibility Application Deadline Status PrintableRebateForm

IL Tax Rebates Set To Go Out Next Week See If You Qualify Across Illinois IL Patch

IL Tax Rebates Set To Go Out Next Week See If You Qualify Across Illinois IL Patch

Property Tax Rebate Pennsylvania LatestRebate

Tax Rates For The 2024 Year Of Assessment Just One Lap

Income Tax Rebate Under Section 87A

Illinois 2024 Tax Rebate - Generally state tax changes take effect either at the start of the calendar year January 1 or the fiscal year July 1 for most states with rate changes for major taxes typically implemented effective January 1 either prospectively as in these cases or retroactively as may happen under legislation enacted in the new year