Illinois Real Estate Tax Rebate 2024 1 What is the Illinois Property Tax Credit 2 Am I eligible for a property tax credit 3 What may not be included when I figure a property tax credit 4 How do I claim the Property Tax Credit 5 If you received a letter regarding your property tax credit 6 Why did I receive a letter asking me to verify my property tax credit

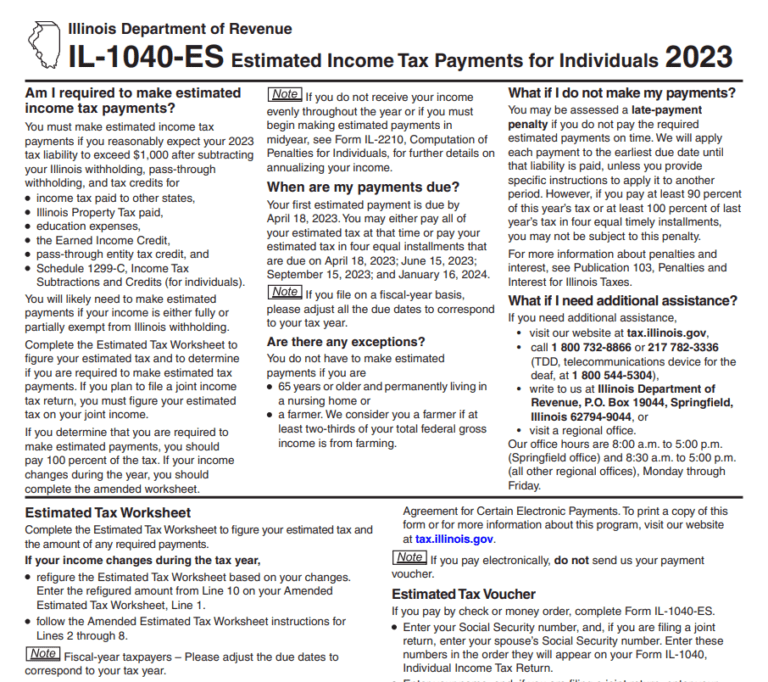

The Illinois Department of Revenue s IDOR taxpayer assistance number is available for tax related inquiries and includes automated menus allowing taxpayers to check the status of a refund identify a PIN or receive estimated payment information without having to wait for an agent Tips for preparing for tax season FOX consumer reporter Steve Noviello breaks down what you need to know ahead of filing your taxes this year CHICAGO The Illinois Department of Revenue has

Illinois Real Estate Tax Rebate 2024

Illinois Real Estate Tax Rebate 2024

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Illinois-Income-Tax-Rebate-2023.jpg

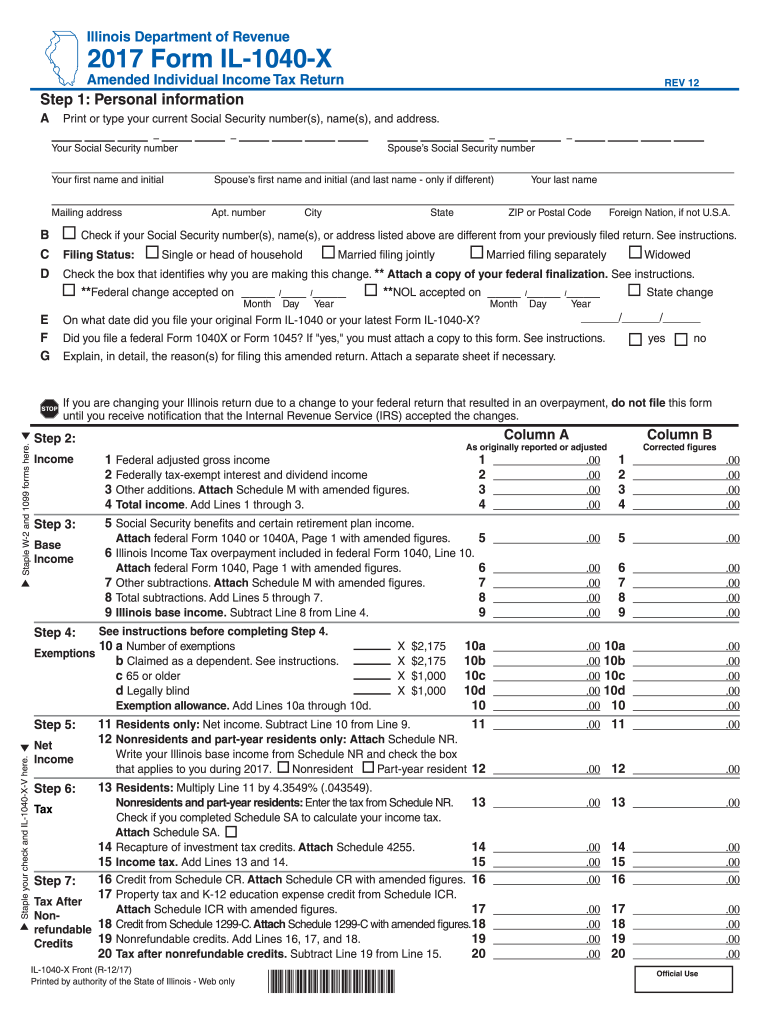

Il 1040 Instructions Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/453/14/453014487/large.png

Tax Rebate 2023 Illinois Qualification Criteria Claim Process And Strategies To Maximize Your

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Tax-Rebate-2023-Illinois.jpg?resize=978%2C781&ssl=1

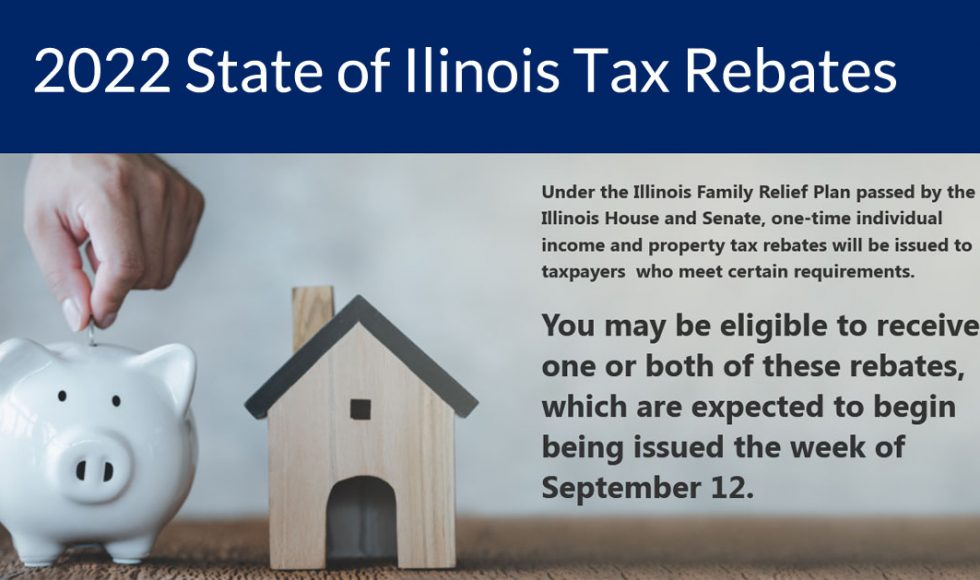

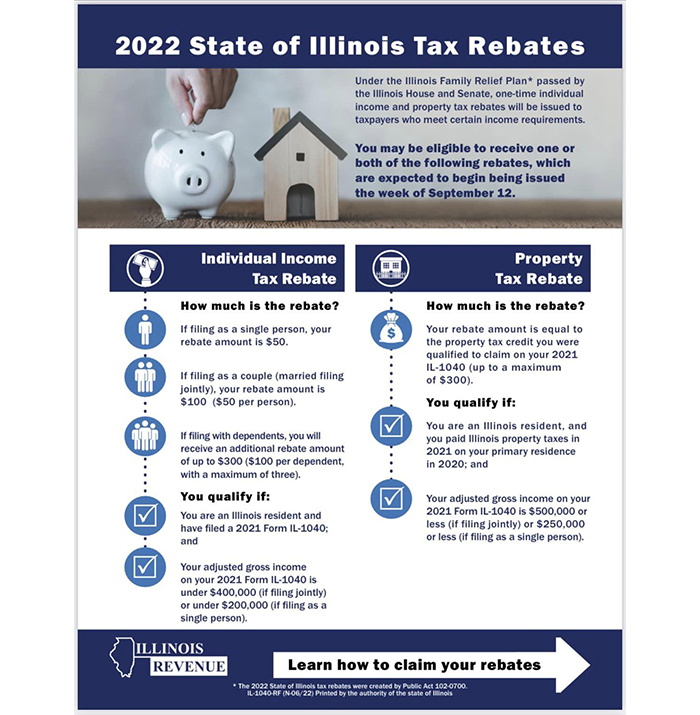

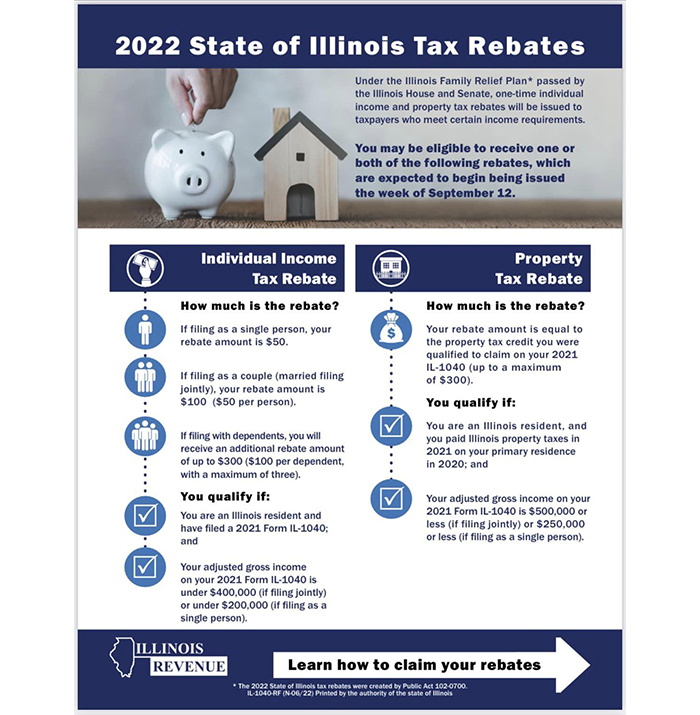

2024 This bulletin is written to inform you of recent changes it does not replace statutes rules and regulations or court decisions For information or forms Visit our website at tax illinois gov Register and file your return online at mytax illinois gov For registration questions call or email us at 217 785 3707 REV CentReg illinois gov The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300

The Senior Citizens Real Estate Tax Deferral program allows qualifying seniors to defer up to 7 500 per year in property taxes The state of Illinois pays the taxes that are deferred by program participants The 3 interest rate charged for 2023 taxes due in 2024 is half the rate charged in previous years when the state charged 6 interest If filing jointly 500 000 is the maximum income permitted to receive the property tax rebate while 400 000 is the limit for income tax rebates Single filers can have adjusted gross incomes of

Download Illinois Real Estate Tax Rebate 2024

More picture related to Illinois Real Estate Tax Rebate 2024

Illinois Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Illinois-Tax-Rebate-2023-768x682.png

Tax Rebate FAQs Rep Thaddeus Jones

https://www.repthaddeusjones.com/wp-content/uploads/2022/09/illinois_tax_rebates_2022-980x580.jpg

Real Estate Money Illinois Illinois Real Estate 2022 Amazing YouTube

https://i.ytimg.com/vi/obcyHaNMU5Y/maxresdefault_live.jpg

Sales tax holiday From August 5 14 Illinois will have a sales tax holiday in which sales tax rates on school related items no cap and eligible clothing and footwear items cannot exceed 125 each will be reduced Applicable items will have a state sales tax of 1 25 instead of the existing 6 25 rate View taxing district debt attributed to your property Search 84 million in available property tax refunds Search 34 million in missing exemptions going back four years Change your name and mailing address Pay Online for Free Use your bank account to pay your property taxes with no fee More Ways to Pay Chase

The informational bulletin lists all of the additional tax and fee acts that are impacted by the payment equals agreement changes made to Section 4 of the Retailers Occupation Tax Act Informational Bulletin FY 2024 15 Illinois Department of Revenue January 2024 Michigan Sales and use tax Guidance on refund procedures provided In fact his 4 500 SALT 3 500 property tax 1 000 sales tax would have been reduced to 4 200 4 500 300 probably reducing his federal tax bill by 66 if he were in the 22 tax bracket Thus Bernard should include his 300 tax rebate in his gross income if he lives in a state that did not condition the rebate on general welfare

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

https://repsnessil66.com/wp-content/uploads/2022/09/2022-State-Tax-Rebate-Info_1-post.jpg

IL Tax Rebates Set To Go Out Next Week See If You Qualify Across Illinois IL Patch

https://patch.com/img/cdn20/shutterstock/920517/20220907/124246/styles/patch_image/public/shutterstock-2064344777___07003833551.jpg

https://tax.illinois.gov/individuals/credits/propertytaxcredit.html

1 What is the Illinois Property Tax Credit 2 Am I eligible for a property tax credit 3 What may not be included when I figure a property tax credit 4 How do I claim the Property Tax Credit 5 If you received a letter regarding your property tax credit 6 Why did I receive a letter asking me to verify my property tax credit

https://tax.illinois.gov/research/publications/bulletins/fy-2024-18.html

The Illinois Department of Revenue s IDOR taxpayer assistance number is available for tax related inquiries and includes automated menus allowing taxpayers to check the status of a refund identify a PIN or receive estimated payment information without having to wait for an agent

The Real Estate Professional Rules What Counts As A Rental Activity

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

Unsure If You ll Receive Illinois Tax Rebate Checks Here s What Steps To Take NBC Chicago

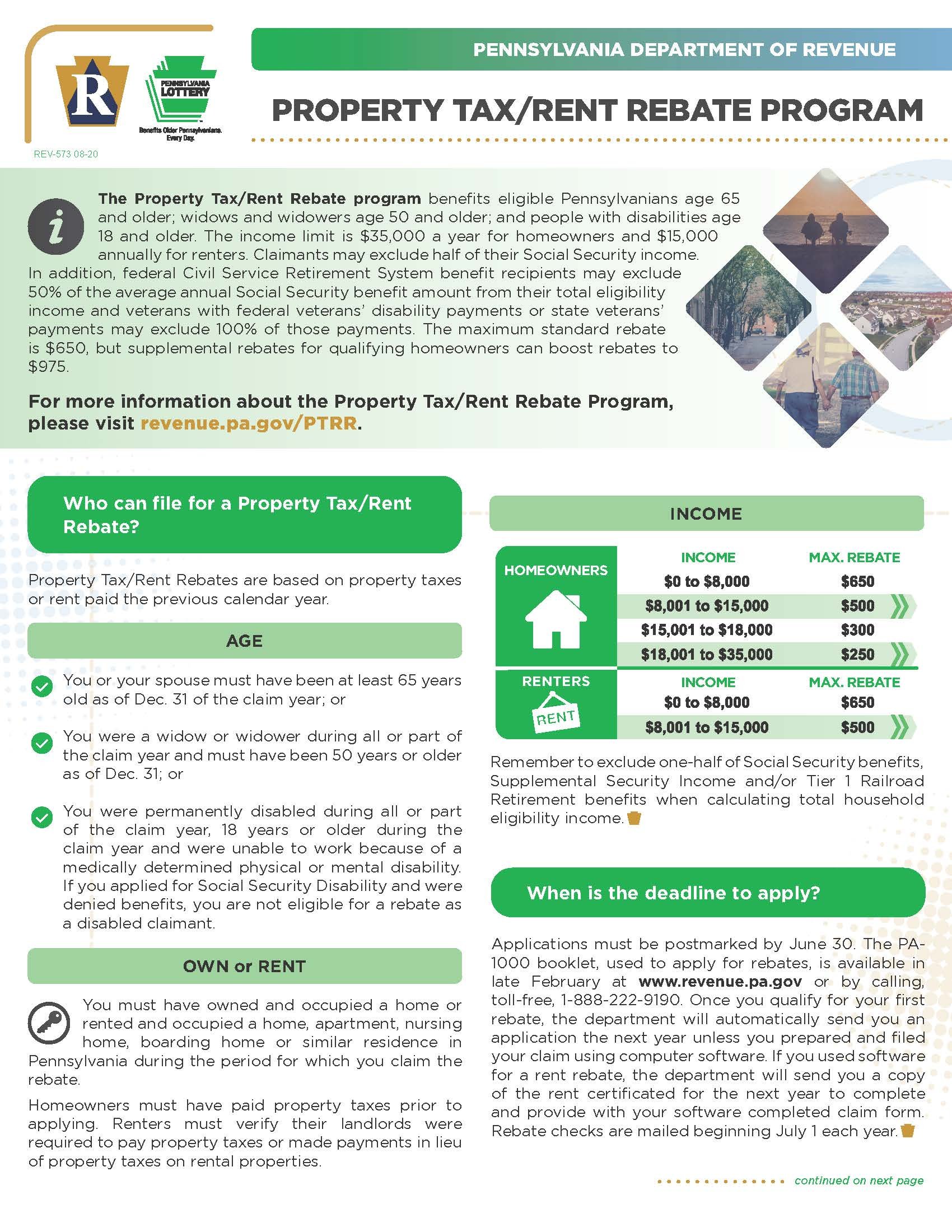

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

Real Estate Tax Notices And What To Do With Them YouTube

Real Estate Tax Disputes Lachman King PLC

Real Estate Tax Disputes Lachman King PLC

Real Estate Tax Tips For After The Sale YouTube

Real Estate Tax 101 Zoom Luma

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Illinois Real Estate Tax Rebate 2024 - Thirty four states will ring in the new year with notable taxA tax is a mandatory payment or charge collected by local state and national governments from individuals or businesses to cover the costs of general government services goods and activities changes including 17 states cutting individual or corporate income taxes and some cutting both