Illinois Rebate Redemption Sales Tax Web Yes Any agreement in which a local government shares a portion of the sales tax allocations with another business local government or taxing district needs to be

Web You must log in to MyLocalTax using the first seven digits of the location code for the business from which the rebated sales taxes are generated Send a message through Web 30 juin 2022 nbsp 0183 32 The Family Relief Plan includes several tax holidays meaning a temporary cut in taxes including but not limited to a year long suspension of the state s 1 sales tax on groceries a

Illinois Rebate Redemption Sales Tax

Illinois Rebate Redemption Sales Tax

https://npr.brightspotcdn.com/dims4/default/42b0372/2147483647/strip/true/crop/758x413+0+0/resize/1760x958!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

2021 Illinois Property Tax Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

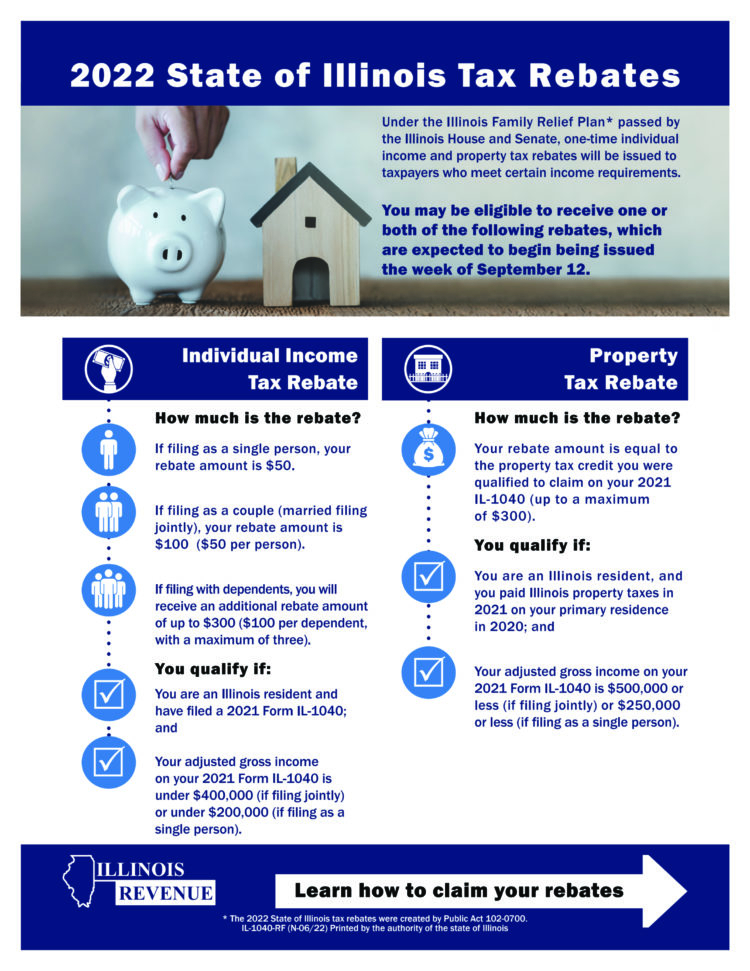

Web 8 juin 2009 nbsp 0183 32 Illinois Clarifies Auto Rebates and Dealer Incentives The Illinois Department of Revenue has amended an Illinois retailers tax regulation to clarify the sales tax Web 8 d 233 c 2022 nbsp 0183 32 The 2022 Illinois property tax rebate is equal to the property tax credit claimed on your 2021 Illinois tax return up to a maximum of 300 To qualify for the

Web 30 juin 2022 nbsp 0183 32 An income tax rebate of 50 per individual with income below 200 000 a year or 100 for couples filing jointly with income below 400 000 a year plus 100 per Web Sales Taxes Sales amp Use Taxes Resources pertaining to these temporary tax reductions are available at Retailer Resources Groceries Back to School Holiday Motor Fuel

Download Illinois Rebate Redemption Sales Tax

More picture related to Illinois Rebate Redemption Sales Tax

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

https://content.govdelivery.com/attachments/fancy_images/ILDOR/2022/08/6364888/tax-rebates-082922-facebook_original.jpg

Sales Tax Certificate Illinois

https://i2.wp.com/data.formsbank.com/pdf_docs_html/139/1398/139825/page_1_thumb_big.png

Redemption Beware Salyer Law Offices

https://www.salyer.law/wp-content/uploads/2020/03/Tax-Two.png

Web 12 f 233 vr 2023 nbsp 0183 32 Those rebates passed as part of the state s fiscal year 2023 budget were given to individuals who made less than 200 000 or couples who made less than Web 1 juil 2022 nbsp 0183 32 Public Act 102 0700 suspended the state one percent 1 low rate of sales and use tax on retail sales of groceries normally taxed at this rate from July 1 2022

Web 30 sept 2022 nbsp 0183 32 A maximum of a 300 property tax rebate or the equivalent of a 2021 qualified property tax credit can go to those reporting a gross income of 500 000 or Web Illinois State Statute provides that a municipality may enter into an agreement to share or rebate sales tax over a finite period of time The City of Geneva has made economic

Illinois Electric Vehicle Rebate Program LLC To Get Credit Funny

https://funnyinterestingcool.com/download/file.php?id=418

Loughran Cappel backed Measure Sends Tax Rebates To Illinois Families

https://www.senatorloughrancappel.com/images/taxrebategrpahic.jpg

https://tax.illinois.gov/questionsandanswers/rebatesharing.html

Web Yes Any agreement in which a local government shares a portion of the sales tax allocations with another business local government or taxing district needs to be

https://tax.illinois.gov/content/dam/soi/en/web/tax/questions…

Web You must log in to MyLocalTax using the first seven digits of the location code for the business from which the rebated sales taxes are generated Send a message through

Deadline To Fill Out Form For Illinois Income And Property Tax Rebates

Illinois Electric Vehicle Rebate Program LLC To Get Credit Funny

Did You Get Your 2022 Illinois Tax Rebates Less Than A Month Left To

Illinois Rebate For Property Taxes PropertyRebate PropertyRebate

Today Is The Final Day To Qualify For Illinois Income And Property Tax

Up To 700 For IL Residents How To Get Your Tax Rebate Check WIBQ

Up To 700 For IL Residents How To Get Your Tax Rebate Check WIBQ

Which States Have Property Tax Rebates PropertyRebate

King Von Net Worth Who Was His Girlfriend Before His Death What Were

Illinois Income And Property Tax Rebates On The Way South Central

Illinois Rebate Redemption Sales Tax - Web 21 sept 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be