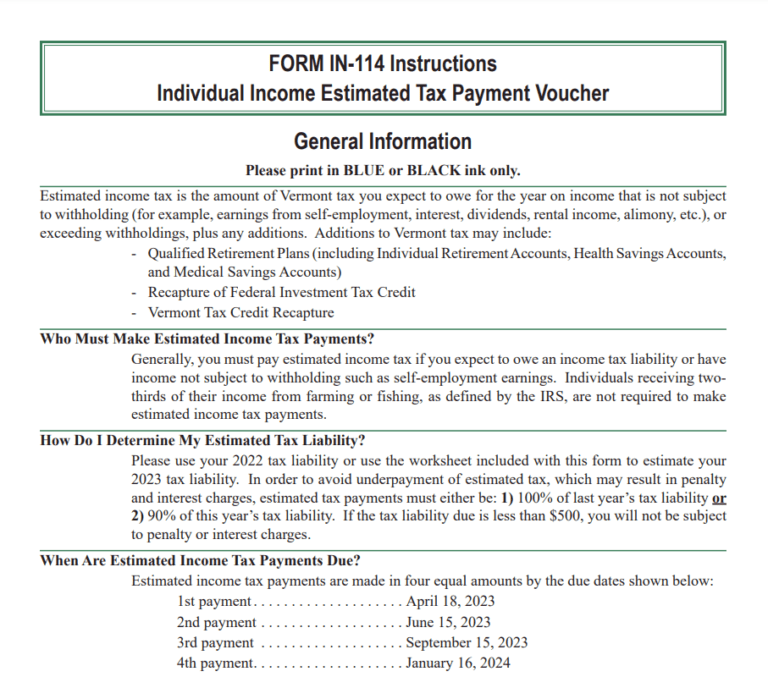

Laundry Tax Rebate Calculator Web If your laundry expenses washing drying and ironing but not dry cleaning expenses are 150 or less you can claim the amount you incur on laundry without providing written

Web How much you can claim You can either claim the actual amount you ve spent you ll need to keep receipts an agreed fixed amount a flat rate expense or flat rate deduction Web 28 mars 2023 nbsp 0183 32 In the 2023 24 tax year the flat rate expense for uniform is 163 60 so If you earn up to 163 50 270 you can claim 20 of that 163 60 back If you earn over 163 50 270 you

Laundry Tax Rebate Calculator

Laundry Tax Rebate Calculator

https://lh3.googleusercontent.com/blogger_img_proxy/AByxGDTAhJPiIS5F3rlVAHETFSXrT8G2u5rfxpNGmJRtuftwBZWHVMRYKKLGQgRIG3sdaKJMGU6zHg-UShhgFMjhUChukul6yFOKd18sIVQwetgTKZqFYmBrNGuhyxcC7s8VgWr65a5HUcGYwD-gW8eHlnd5DsMOSf-kgQ=w1200-h630-p-k-no-nu

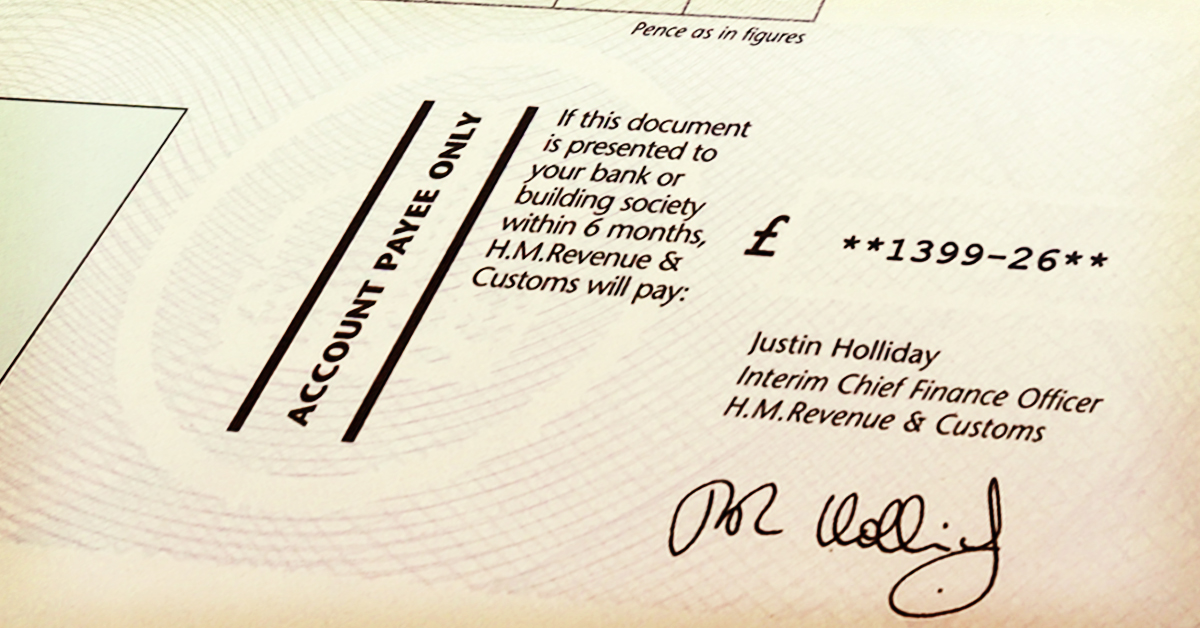

Cis Tax Rebate Calculator CALCULATORSD

https://i2.wp.com/easyaccountancy.co.uk/wp-content/uploads/2018/11/Screen-Shot-2018-11-13-at-21.14.32-1024x588.png

Tax Rebate Calculator

https://getyourtaxreturned.co.uk/mobile/wp-content/uploads/2017/01/TaxReturnedCheque.jpg

Web Convinced you are paying too much tax Never knew you could claim a uniform allowance Calculate your tax refund today Web If you did washing drying or ironing yourself you can use a reasonable basis to calculate the amount such as 1 per load for work related clothing or 50 cents per load if other

Web Our free uniform laundry tax calculator is here to help you work out how much your claim might be worth How long does it take for a uniform claim to complete The average Web The minimum allowance is 163 60 and the highest is 163 1170 per year remember you can back date for the last 4 years too For certain professions HMRC has agreed higher allowances Use our tax rebate

Download Laundry Tax Rebate Calculator

More picture related to Laundry Tax Rebate Calculator

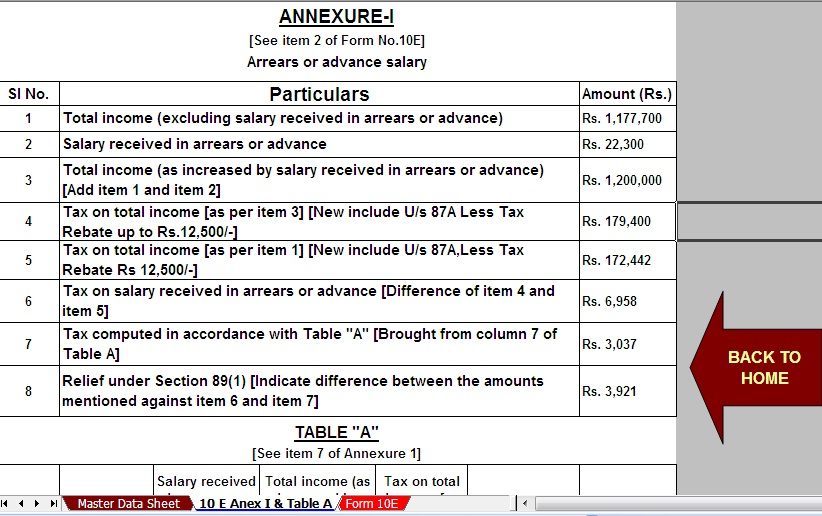

Health Care Tax Rebate Calculator 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/revised-tax-rebate-under-sec-87a-after-budget-2019-with-automated.jpg

Best Tax Rebate Calculator In UK 2022 Business Lug

https://businesslug.com/wp-content/uploads/2022/07/Tax-Rebate-Calculator-780x470.jpg

What Are The Best Ways To Manage Tax Rebates

https://bloggercreativa.com/wp-content/uploads/2022/08/Tax-Rebate-Calculator-2-1200x675.jpg

Web Method of calculating expenses At home washing eligible work clothes only 1 per load At home washing eligible work clothes and other laundry items 50 cents per load Laundromat washing eligible work Web Use our uniform tax calculator to work out how much you can reclaim Just enter your gross pay how much tax you ve paid and your job expenses The tax rebate calculator will

Web 3 mars 2016 nbsp 0183 32 complete Self Assessment tax returns except current year claims are claiming for expenses over 163 2 500 are claiming for more than 5 different jobs When you Web Completing your tax return Step 1 Add up all your deductible work related clothing laundry and dry cleaning expenses You can add up your claim and then go to step 2 Step 2

Claiming Tax Back When Working From Home Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/wfh.jpeg

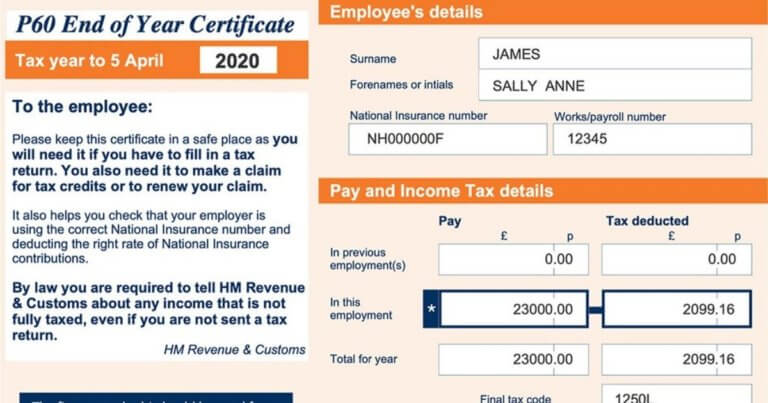

How To Get A Replacement P60 Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/p60-certificate-768x403.jpeg

https://www.ato.gov.au/.../Clothing-laundry-and-dry-cleaning-expenses

Web If your laundry expenses washing drying and ironing but not dry cleaning expenses are 150 or less you can claim the amount you incur on laundry without providing written

https://www.gov.uk/tax-relief-for-employees/uniforms-work-clothing-and...

Web How much you can claim You can either claim the actual amount you ve spent you ll need to keep receipts an agreed fixed amount a flat rate expense or flat rate deduction

Use Our Mechanics Tools Tax Rebate Calculator For 19 20 Rebate

Claiming Tax Back When Working From Home Tax Rebates

How Do I Claim The Recovery Rebate Credit On My Ta

H And R Block State Tax Calculator Printable Rebate Form

Tax Rebate Online Calculator CALCULATORSA

The Dark Side Of The Viral laundry And Taxes Meme Vogue India

The Dark Side Of The Viral laundry And Taxes Meme Vogue India

Va A Decidir Comedia Apellido How To Calculate Rebate Abierto Pl tano

Vermont Tax Rebate 2023 Printable Rebate Form

Tax Rebates For Healthcare Workers

Laundry Tax Rebate Calculator - Web In addition to the current year s allowance you can backdate your claim by up to four tax years too currently 2019 20 2020 21 2021 2022 and 2022 23 so five years in total If