Laundry Tax Deduction Calculator Reasonable basis method This includes the costs of washing drying and ironing Select the allowable type of work related clothing that is applicable Protective Clothing

The way you calculate your laundry expenses will depend on your how you clean your uniform We ve created the following table which lists some of the possible methods for laundering your work clothes as well as how If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self Assessment

Laundry Tax Deduction Calculator

Laundry Tax Deduction Calculator

https://simple-accounting.org/wp-content/uploads/2021/09/603e8923-3ad2-46a9-932d-fa75cdb7e2e3.jpg

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1080xN.5462529921_cvyy.jpg

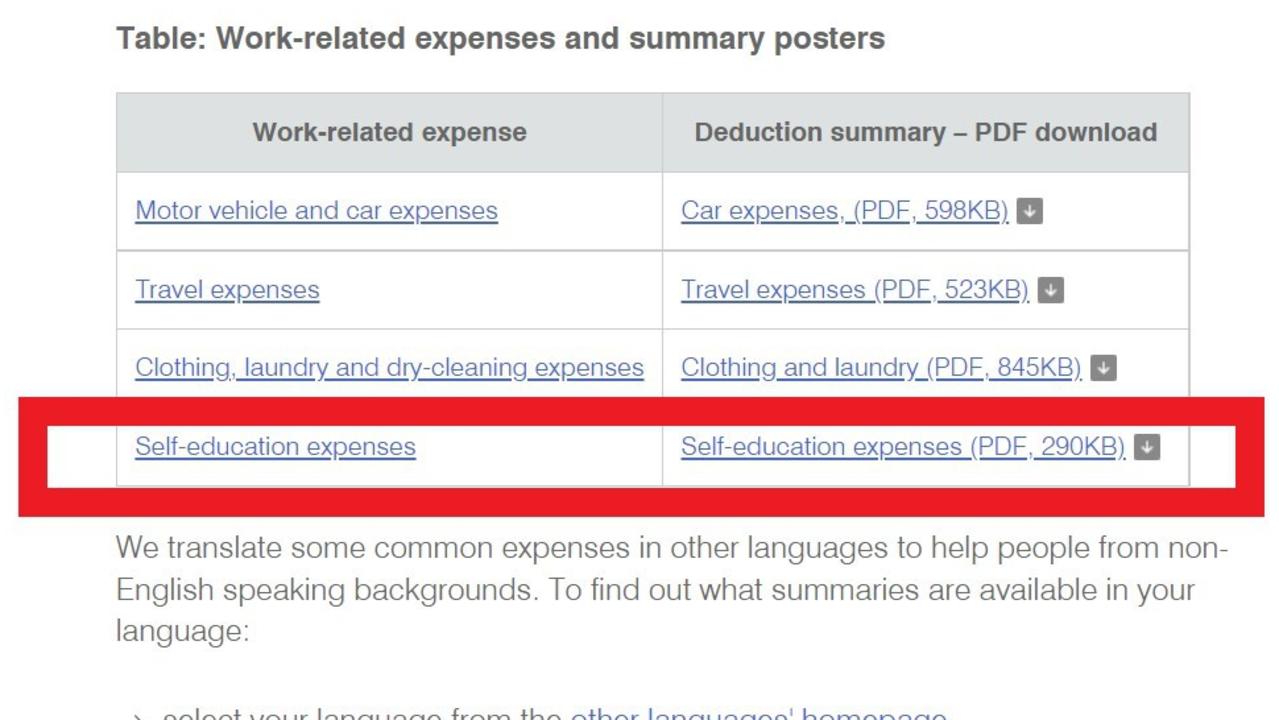

If the clothing qualifies as deductible required or essential distinctive or protective and not suitable for everyday wear outside work then the laundry or dry How to complete the work related clothing laundry and dry cleaning expenses section of your return using myTax

If you did washing drying or ironing yourself you can use a reasonable basis to calculate the amount such as 1 per load for work related clothing or 50 cents You can claim a deduction for the actual costs you incur to dry clean and repair work clothing in these categories If your laundry claim is 150 or less not including dry

Download Laundry Tax Deduction Calculator

More picture related to Laundry Tax Deduction Calculator

Tax Deduction For Clothing Laundry TAX TIPS CTAS4TAX Small

https://static.wixstatic.com/media/763bf2_779304b4d32b4dbfb2065d130e20027a~mv2.png/v1/fill/w_1000,h_563,al_c,q_90,usm_0.66_1.00_0.01/763bf2_779304b4d32b4dbfb2065d130e20027a~mv2.png

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

Top 4 Tax Deduction Tips For Teachers

https://s.yimg.com/ny/api/res/1.2/xk_8yJULvqW3EVp.3GA7Xw--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://s.yimg.com/os/creatr-uploaded-images/2021-08/7100e510-f31c-11eb-bfd7-f4e697936c7c

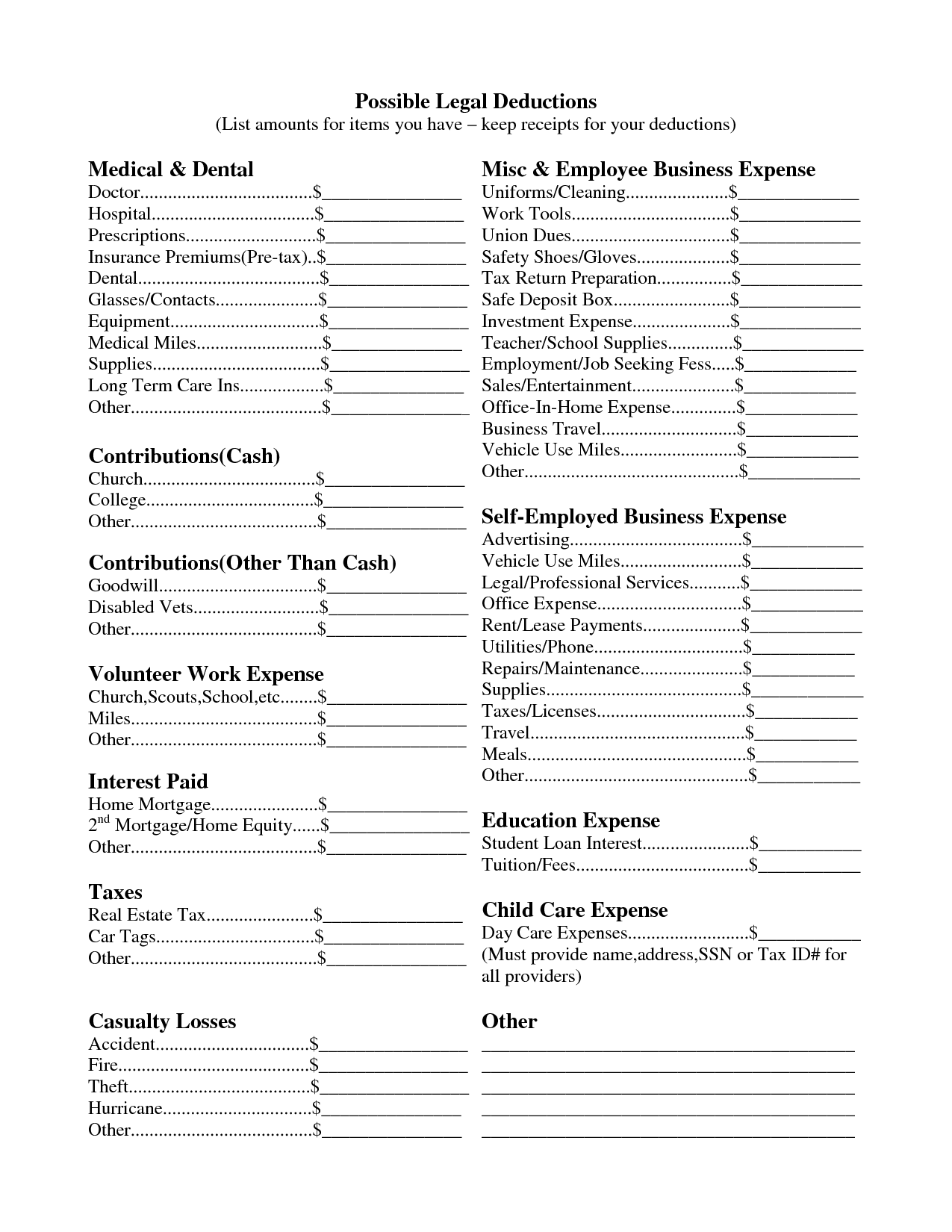

Key Takeaways Certain job related expenses such as theatrical costumes hard hats and other safety gear may be deductible Items that can be worn outside of Since you re likely spending extra money to have appropriate clothing to wear to work it makes sense that you can count it as a business expense In fact the IRS allows tax

Yes you can deduct the expenses of cleaning and laundering business use uniforms You would be able to expense detergent and appliances but be very careful Calculate the tax benefits on laundry expenses utilized for business purposes A simple AI tax service can help you know your laundry tax deductions

![]()

What Does In Another Life I Would Have Really Liked Just Doing

https://i.kym-cdn.com/editorials/icons/original/000/005/654/laundry_taxes_etc.jpg

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

https://cdn1.npcdn.net/image/16272778521a6ef50158b79f67207a9ee7fe2b2eb3.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

https://www.profitkit.com.au/laundry-deduction-calculator

Reasonable basis method This includes the costs of washing drying and ironing Select the allowable type of work related clothing that is applicable Protective Clothing

https://www.etax.com.au/laundry-expenses

The way you calculate your laundry expenses will depend on your how you clean your uniform We ve created the following table which lists some of the possible methods for laundering your work clothes as well as how

Example Tax Deduction System For A Single Gluten free GF Item And

What Does In Another Life I Would Have Really Liked Just Doing

Tax Deductions Guide Sunlight Tax

Grocery Tax Reduced To 1 Beginning Jan 1 2023 Virginia Tax

Tax Deduction Planner Graphic By Watercolortheme Creative Fabrica

What Will My Tax Deduction Savings Look Like The Motley Fool

What Will My Tax Deduction Savings Look Like The Motley Fool

Kurzstudie Tax Deduction Scheme Belgien EUKI

16 Budget Worksheet Self Employed Worksheeto

Tax Return How To Save Almost 2000 In Deductions News au

Laundry Tax Deduction Calculator - If you did washing drying or ironing yourself you can use a reasonable basis to calculate the amount such as 1 per load for work related clothing or 50 cents