Illinois State Tax Rebate Status Web 27 sept 2022 nbsp 0183 32 For additional information or to check on the status of a rebate visit tax illinois gov rebates Those needing can also call 1 800 732 8866 or 217 782 3336

Web 27 oct 2022 nbsp 0183 32 state tax Illinois Tax Rebates a k a Illinois Stimulus Checks Are Still Being Sent If you haven t received your Illinois tax rebate you can track the status of Web You may use our refund inquiry application to check the status of your current year refund I have lost or misplaced my refund check how do I go about getting a new one For a

Illinois State Tax Rebate Status

Illinois State Tax Rebate Status

https://npr.brightspotcdn.com/dims4/default/759130d/2147483647/strip/true/crop/758x413+0+0/resize/880x479!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

Il 1040 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/453/14/453014487/large.png

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Web 4 oct 2022 nbsp 0183 32 The 2022 State of Illinois Tax Rebates are one time payments to qualified Illinois residents approved under the Illinois Family Relief Plan The checks consist of two different rebates Web 12 f 233 vr 2023 nbsp 0183 32 The IRS said in a press release that in the interest of sound tax administration residents in most states including Illinois will not be required to report

Web Property Tax Rebate How much is the rebate Your rebate amount is equal to the property tax credit you were qualified to claim on your 2021 IL 1040 up to a maximum of 300 Web 7 sept 2023 nbsp 0183 32 IRS weighs in on state rebate payments In most cases according to the IRS taxpayers who receive special state payments one time refunds rebates or other

Download Illinois State Tax Rebate Status

More picture related to Illinois State Tax Rebate Status

Tax Rebate 2023 Illinois Qualification Criteria Claim Process And

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Tax-Rebate-2023-Illinois.jpg?resize=978%2C781&ssl=1

Tax Exempt Status Illinois Template 2016 Lasopaherbal

https://www.pdffiller.com/preview/15/177/15177593/large.png

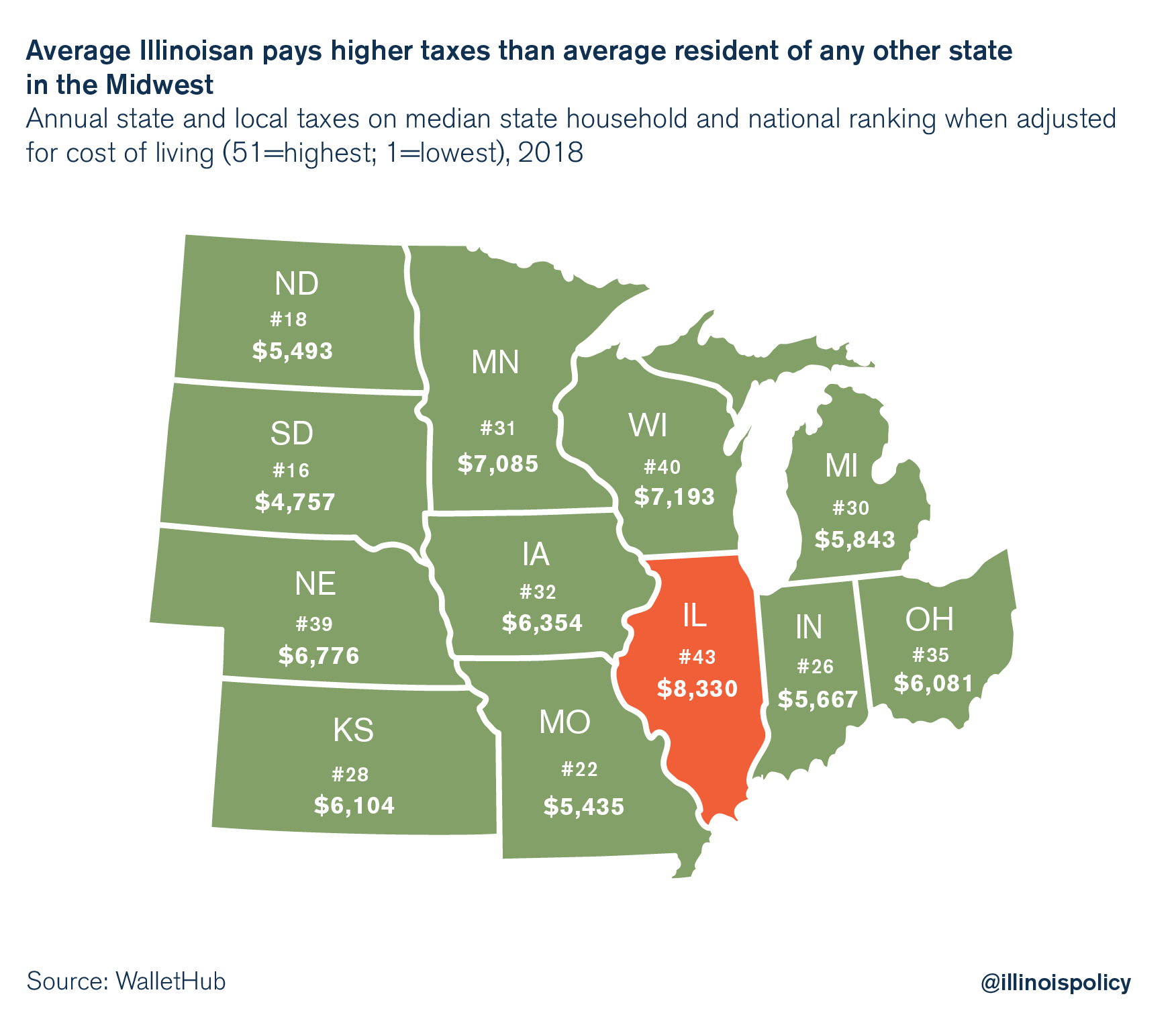

Illinois Suburbs With Low Property Taxes Property Walls

https://files.illinoispolicy.org/wp-content/uploads/2018/03/Wallethub_Graphic-2-1.png

Web Want to check on the status of your individual Illinois income tax refund Just provide us with your Social Security number first and last name We ll look through our records and let you know if we ve received your Web 2022 State of Illinois Tax Rebates Under the Illinois Family Relief Plan passed by the Illinois House and Senate one time individual income and property tax rebates will be

Web The state of Illinois is providing a property tax rebate in an amount equal to the property tax credit you qualified for on your 2021 return up to a maximum of 300 00 The Web Filing Help for Requesting Individual Income Tax Rebate and Property Tax Rebate By law Monday October 17 2022 was the last day to submit information to receive the Illinois

Did You Get Your Illinois Tax Rebate Check In The Mail Yet Here s

https://img.particlenews.com/image.php?type=thumbnail_580x000&url=1bj6p9_0iuVxhI000

Illinois Used To Have One Competitive Advantage Over Its Neighbors Its

https://jnswire.s3.amazonaws.com/jns-media/a9/1d/11699532/3_11_22_graph2.jpg

https://www.nbcchicago.com/news/local/havent-received-your-2022...

Web 27 sept 2022 nbsp 0183 32 For additional information or to check on the status of a rebate visit tax illinois gov rebates Those needing can also call 1 800 732 8866 or 217 782 3336

https://www.kiplinger.com/taxes/illinois-tax-rebate-stimulus-checks

Web 27 oct 2022 nbsp 0183 32 state tax Illinois Tax Rebates a k a Illinois Stimulus Checks Are Still Being Sent If you haven t received your Illinois tax rebate you can track the status of

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

Did You Get Your Illinois Tax Rebate Check In The Mail Yet Here s

Illinois Unemployment 941x Fill Out Sign Online DocHub

Real Estate Tax Calculator Illinois QATAX

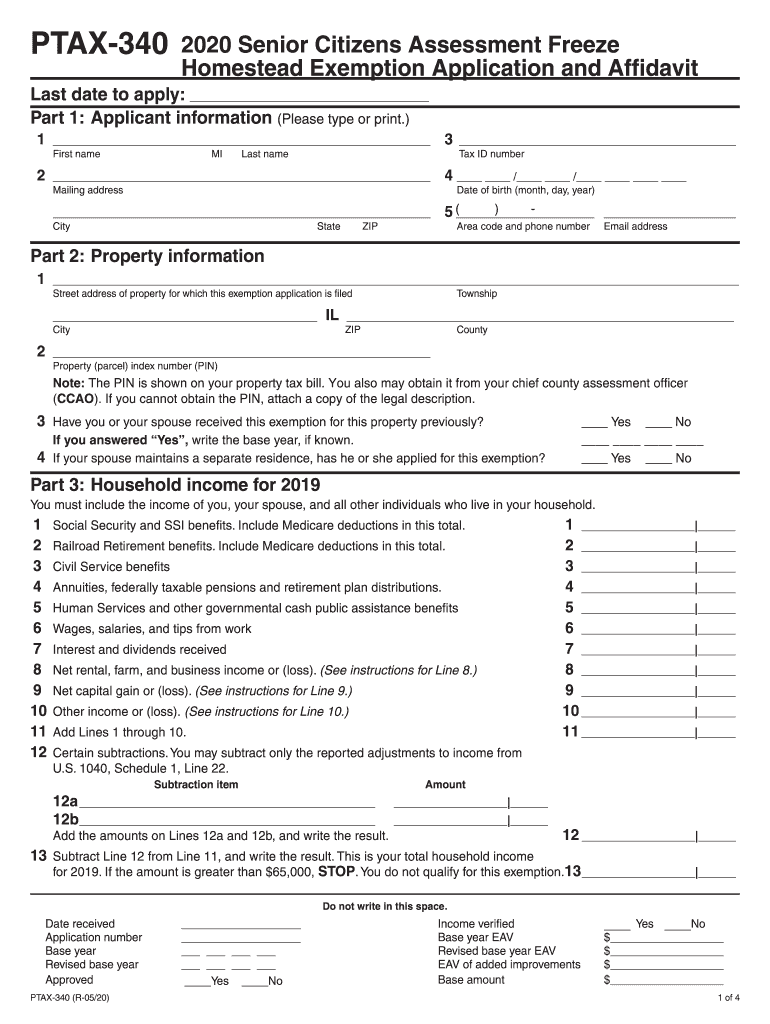

Ptax 340 Fill Out Sign Online DocHub

Illinois Tax Forms 2021 Printable State IL 1040 Form And IL 1040

Illinois Tax Forms 2021 Printable State IL 1040 Form And IL 1040

Unsure If You ll Receive Illinois Tax Rebate Checks Here s What Steps

Illinois 1040 Schedule Form Fill Out Sign Online DocHub

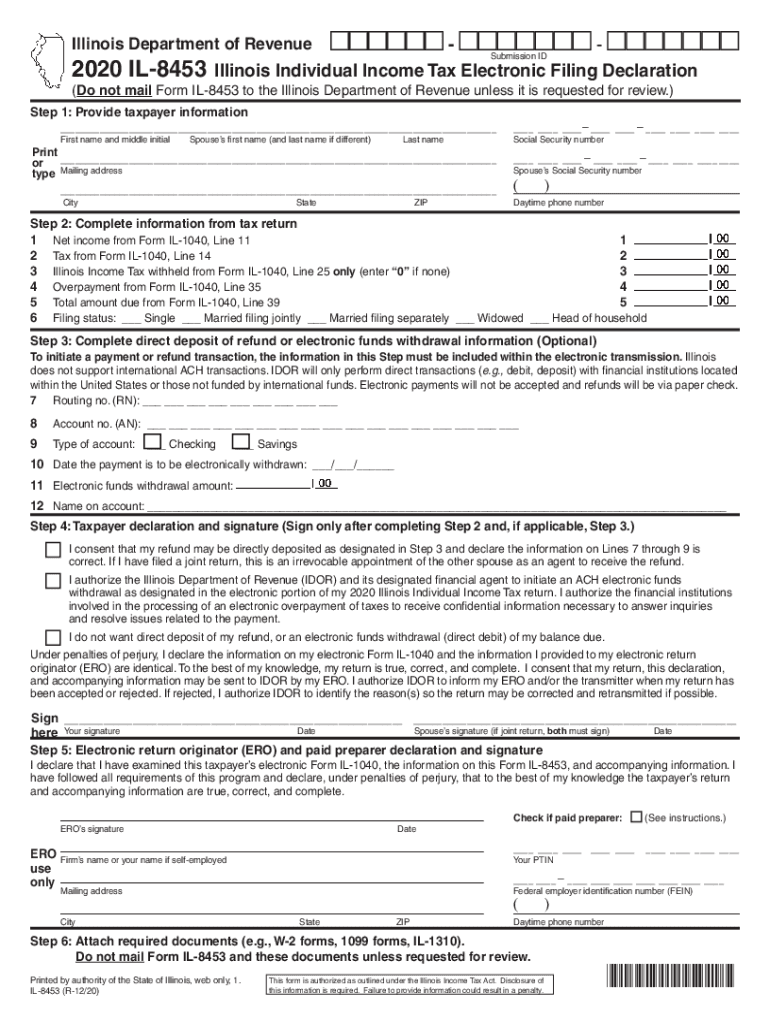

2020 Form IL DoR IL 8453 Fill Online Printable Fillable Blank

Illinois State Tax Rebate Status - Web 7 sept 2023 nbsp 0183 32 IRS weighs in on state rebate payments In most cases according to the IRS taxpayers who receive special state payments one time refunds rebates or other