Ppf Rebate In Income Tax Web 27 avr 2022 nbsp 0183 32 From PPF to NPS smart tax saving options for FY 2022 23 The Financial Express Stock Stats Top Gainers Top Losers Indices Nifty 50 Sensex Web Stories NSE

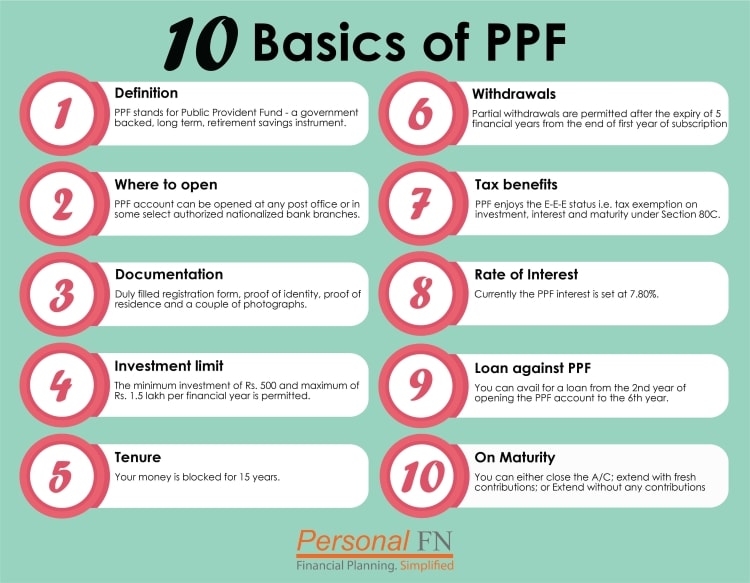

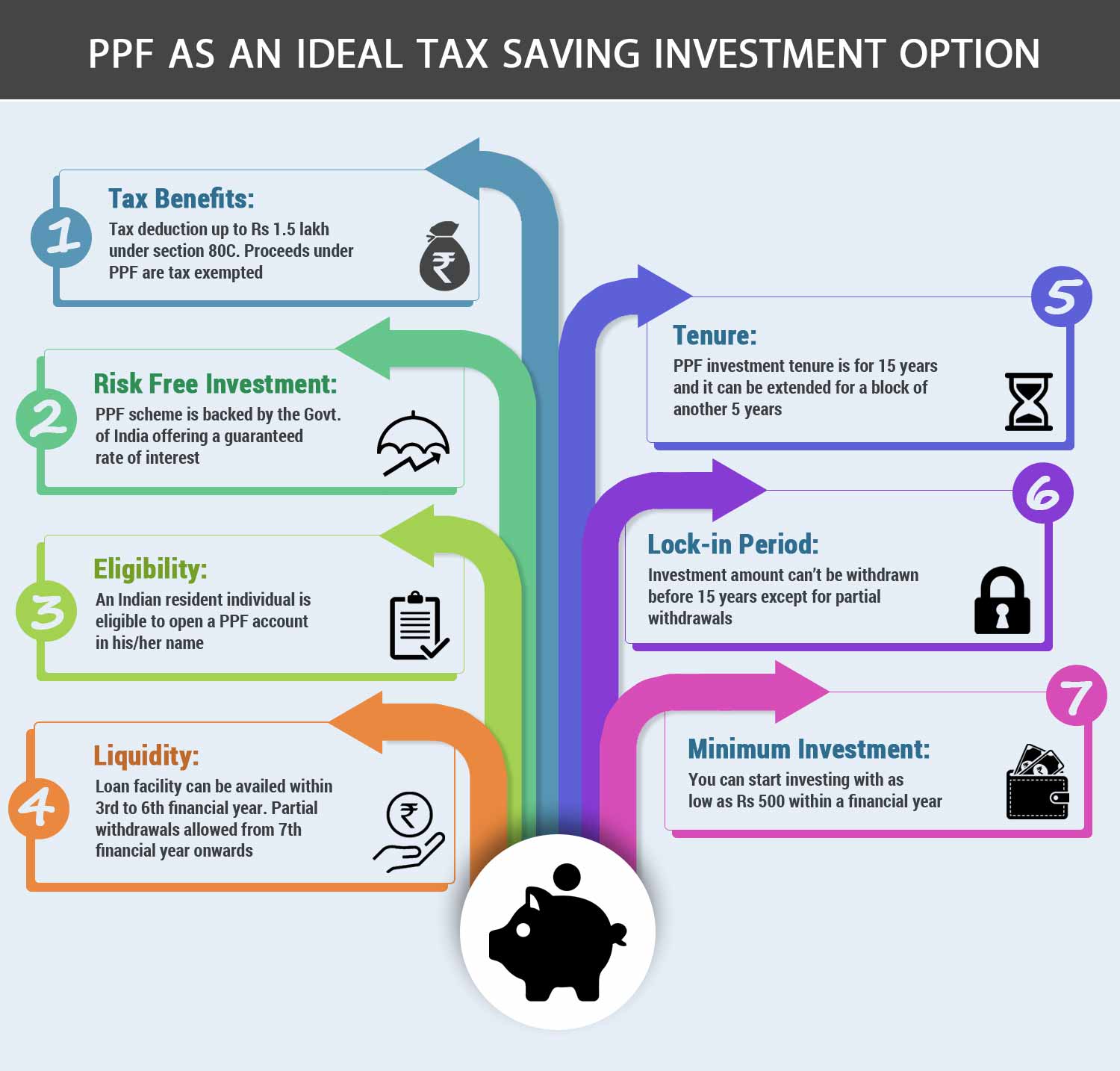

Web 16 f 233 vr 2022 nbsp 0183 32 The Public Provident Fund PPF gets triple exemption when it comes to income tax not many investments have this benefit You get tax exemption at the time Web 1 f 233 vr 2022 nbsp 0183 32 Income tax rebate to PPF top 5 budget 2022 announcements expected 2 min read 01 Feb 2022 08 45 AM IST Asit Manohar Budget 2022 expectations Income

Ppf Rebate In Income Tax

Ppf Rebate In Income Tax

https://i2.wp.com/www.insurancefunda.in/wp-content/uploads/2019/04/PPF-Account-Tax-Benefits.png?w=800&ssl=1

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

https://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

EPF PPF Or NPS Withdrawals Partial Full Latest Taxation Rules

https://www.relakhs.com/wp-content/uploads/2018/11/NPS-Withdrawals-Latest-Tax-rules-EPF-PPF-Partial-full-withdrawals-taxation-rules-NPS-Early-exit-Premature-withdrawals.jpg

Web 21 avr 2023 nbsp 0183 32 Interest amount and the maturity amount received from recognised provident fund are exempt from income tax under the new tax regime also by virtue of Section 10 11 and Section 10 12 read with Web 5 f 233 vr 2021 nbsp 0183 32 Talking on PPF contributions Gopal Bohra Partner NA Shah Associates said As per the budget proposal interest accrued to a taxpayer on contribution made on or after April 1 2021 to PF or

Web The deduction limit for PPF deposits was Rs 1 lakh which has been increased to Rs 1 5 lakhs from FY 2019 20 PPF accounts also have a maximum deposit limit of Rs 1 5 lakhs Web 19 juil 2018 nbsp 0183 32 1 Where You can open a PPF Account and How 2 Who can and who cannot not open PPF Account 3 You can have only one PPF account in your name 5 Minimum and maximum deposit limit for PPF 6

Download Ppf Rebate In Income Tax

More picture related to Ppf Rebate In Income Tax

PUBLIC PROVIDENT FUND PPF SCHEME INCOME TAX BENEFIT INVESTMENT LIMIT

https://1.bp.blogspot.com/-o016DqAIxCU/XsexiCnc3pI/AAAAAAAAdQo/ALxBcu7gUBg43xnqLbhGB99p9xeqjBUfgCLcBGAsYHQ/s1600/PPF%2BFeatures.jpg

PPF As A Tax Saving Instrument ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2017/12/tax-benefits-under-ppf.jpg

PPF Calculator What Is PPF Interest Rate How To Open PPF Account

https://policystar.com/wp-content/uploads/2020/07/ppf-form-d.png

Web 5 juin 2022 nbsp 0183 32 Investors who want to save tax while still earning risk free returns can consider investing in the Public Provident Fund PPF which is a mainstay among tax saving investors Web 31 mars 2023 nbsp 0183 32 Are there any tax implications for premature PPF withdrawal No according to Section 80C of the Income Tax Act whether you withdraw partially or prematurely

Web 16 juin 2021 nbsp 0183 32 PPF provides income tax deduction under section 80C for the amount invested subject to a limit of Rs 1 5 lakh a year Interest earned is exempt from tax and there is no tax on the amount received Web PPF amp Income Tax 2023 Different Moods 127K subscribers Subscribe 48K views 1 month ago RBI Bonds and other bonds ppf interestrates incometax The PPF balance will

Income Tax Return TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/Decoding-Section-87A-Rebate-Provision-under-Income-Tax-Act.png

2 In 1 Savings And Investment In PNB PPF Account Know Benefits

https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2022/01/05/171846-pnb-ppfpnb-twitter.jpg?itok=VlboCuBy&c=c5af8c0f92ccc8e249257bf0f1cb18e8

https://www.financialexpress.com/money/income-tax/from-ppf-to-nps...

Web 27 avr 2022 nbsp 0183 32 From PPF to NPS smart tax saving options for FY 2022 23 The Financial Express Stock Stats Top Gainers Top Losers Indices Nifty 50 Sensex Web Stories NSE

https://economictimes.indiatimes.com/wealth/invest/why-investors-love...

Web 16 f 233 vr 2022 nbsp 0183 32 The Public Provident Fund PPF gets triple exemption when it comes to income tax not many investments have this benefit You get tax exemption at the time

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Income Tax Return TaxHelpdesk

Section 87A Tax Rebate For Income Tax Payers In Budget 2019

PPF EEE Tax Benefits Complete Details 3 Tax Rebates In PPF Account

80C TO 80U DEDUCTIONS LIST PDF

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

Tax Rebate For Individual Deductions For Individuals reliefs

Ppf Rebate In Income Tax - Web The deduction limit for PPF deposits was Rs 1 lakh which has been increased to Rs 1 5 lakhs from FY 2019 20 PPF accounts also have a maximum deposit limit of Rs 1 5 lakhs