Income Criteria For Pa Property Tax Rebate Form Web 2022 Property Tax Rent Rebate applications must be postmarked by December 31 2023 to be considered myPATH allows claimants of the Property Tax Rent Rebate Program to file their applications online Learn more about the online filing features for the Property

Web Property Tax Rent Rebate Program The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older The income limit is 35 000 a year for homeowners and 15 000 annually Web as eligibility income by Property Tax or Rent Rebate claimants The country code field has been changed from a three character field to a two character field See the instructions for Country Code on Page 10 for additional information PURPOSE The Property Tax Rent

Income Criteria For Pa Property Tax Rebate Form

Income Criteria For Pa Property Tax Rebate Form

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

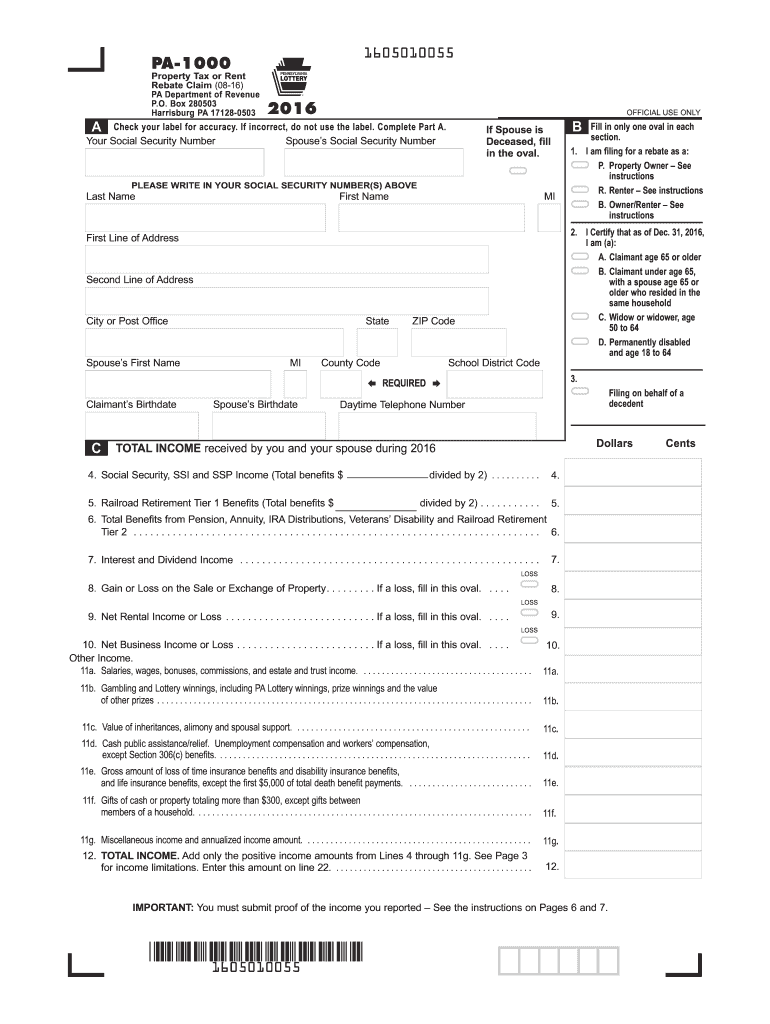

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pennsylvania-property-tax-rent-rebate-5-free-templates-in-pdf-word-4.png

Web Eligibility Criteria Applicants of the Property Tax Rent Rebate program must still fall under one of the previous four categories to qualify That means the program will continue to benefit eligible Pennsylvanians age 65 and older widows and widowers age 50 and Web PENNSYLVANIA DEPARTMENT OF REVENUE PROPERTY TAX RENT REBATE PROGRAM The Property Tax Rent Rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18

Web INCOME LEVEL Maximum Rebate 0 to 8 000 650 8 001 to 15 000 500 Enter the amount from Line 13 of the claim form on this line and circle the corresponding Maximum Rebate amount for your income level Owners use Table A and Renters use Table B 23 Web 19 janv 2023 nbsp 0183 32 The income limit is 35 000 a year for homeowners and 15 000 annually for renters and half of Social Security income is excluded The maximum standard rebate is 650 but supplemental rebates for certain qualifying homeowners can boost rebates to

Download Income Criteria For Pa Property Tax Rebate Form

More picture related to Income Criteria For Pa Property Tax Rebate Form

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-11.png?w=526&h=743&ssl=1

PA 1000 2014 Property Tax Or Rent Rebate Claim Free Download

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-l2.png

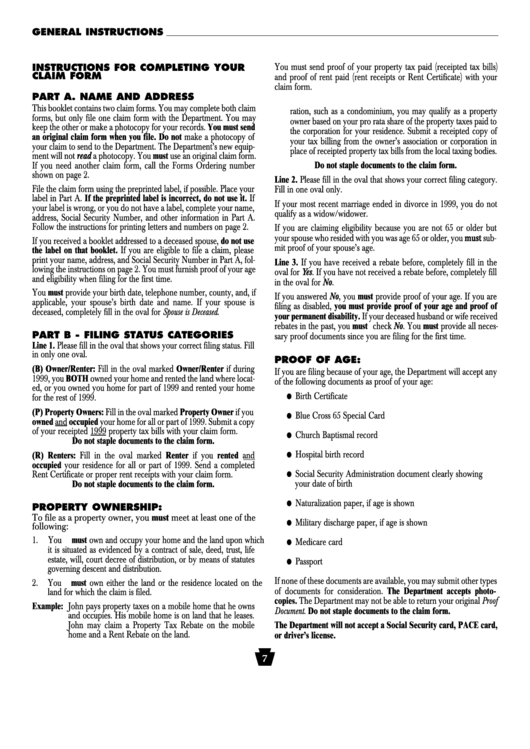

Form Pa 1000 Instructions For Completing Your Claim Form Property

https://data.formsbank.com/pdf_docs_html/338/3380/338028/page_1_thumb_big.png

Web 16 sept 2007 nbsp 0183 32 Do not include Black Lung benefits Submit photocopies of pension annuity benefits statements along with other forms 1099 showing the income However rollovers from Individual Retirement Accounts and employer pensions are not includable in Web 4 ao 251 t 2023 nbsp 0183 32 The lowest income households will be eligible for rebates of 1 000 up from 650 the previous maximum The law also resolves the mismatch between state and federal law that fueled the program s waning usage The federal government adjusts

Web 28 sept 2022 nbsp 0183 32 The income limit is 35 000 per household for homeowners and 15 000 per household for renters If you receive Social Security benefits the state only counts half of that towards the income cap Some veterans benefits aren t counted at all Web The income limit for the rebate is 35 000 a year for homeowners and 15 000 annually for renters As well half of Social Security income is excluded If you are a spouse personal representative or estate you may file rebate claims on behalf of any claimant that lived

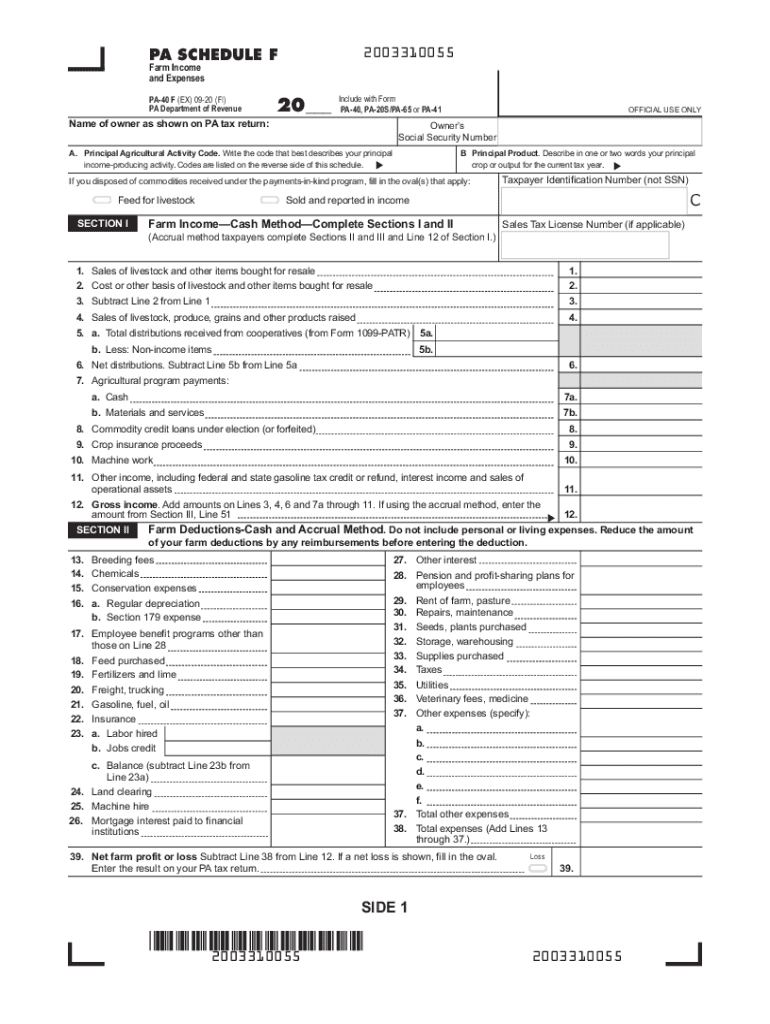

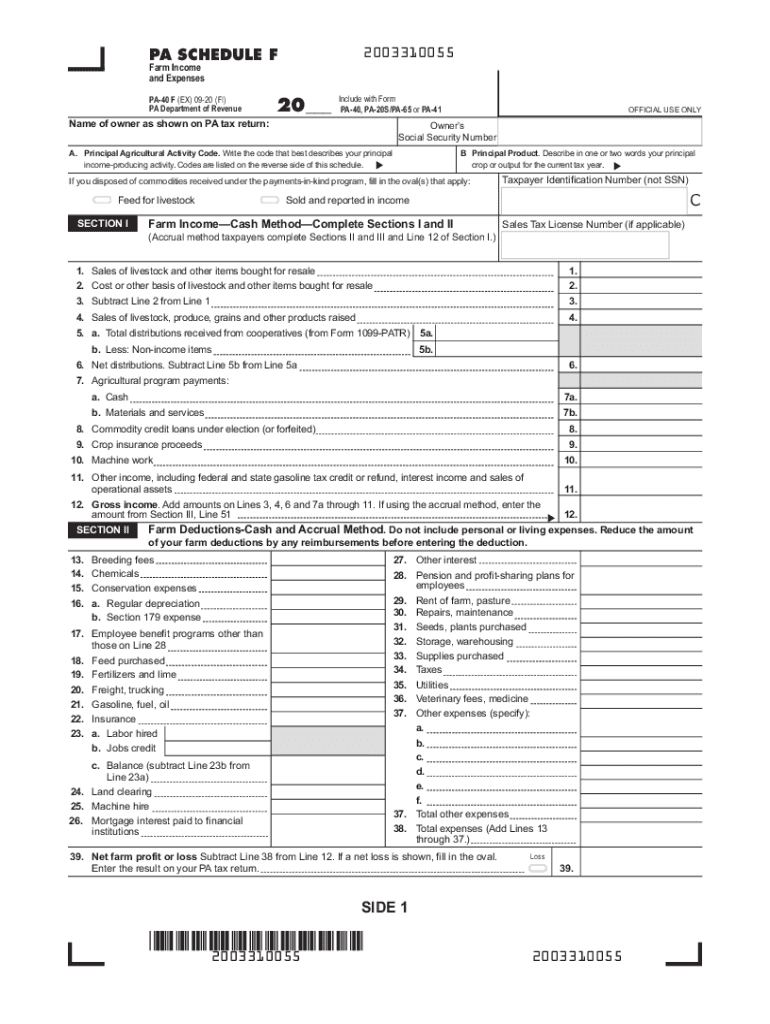

Pa 40 F Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/563/641/563641337/large.png

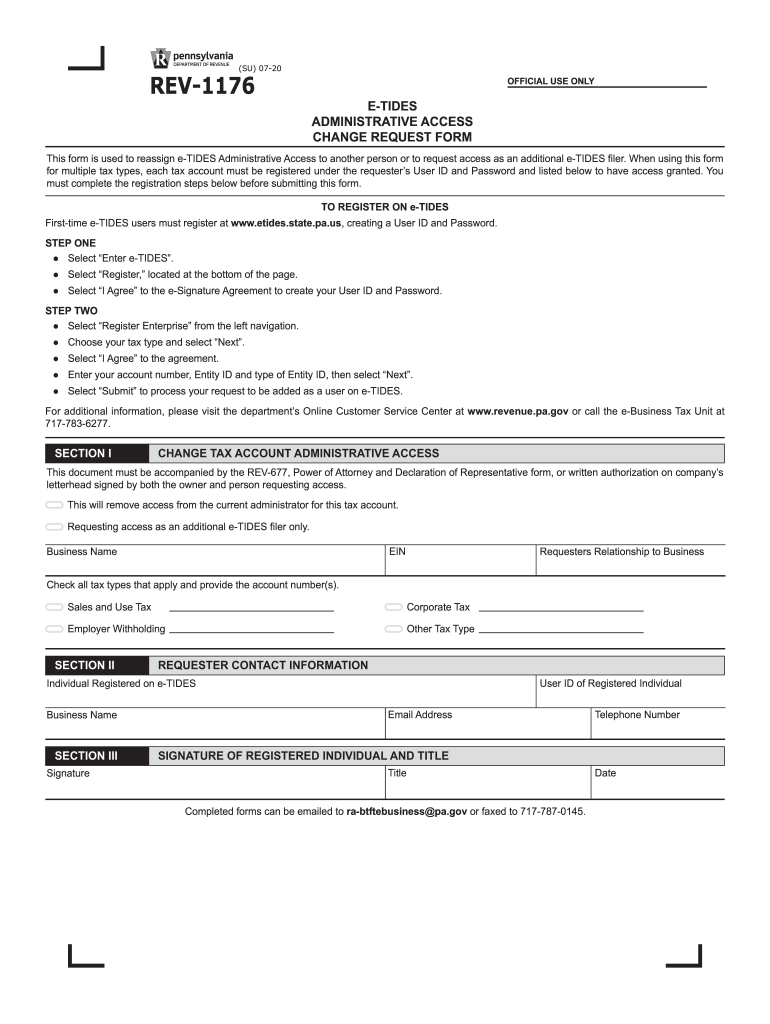

2020 2023 Form PA REV 1176 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/519/940/519940927/large.png

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/P…

Web 2022 Property Tax Rent Rebate applications must be postmarked by December 31 2023 to be considered myPATH allows claimants of the Property Tax Rent Rebate Program to file their applications online Learn more about the online filing features for the Property

https://www.revenue.pa.gov/IncentivesCreditsPrograms...

Web Property Tax Rent Rebate Program The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older The income limit is 35 000 a year for homeowners and 15 000 annually

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Pa 40 F Fill Online Printable Fillable Blank PdfFiller

Property Tax Rebate Application Printable Pdf Download

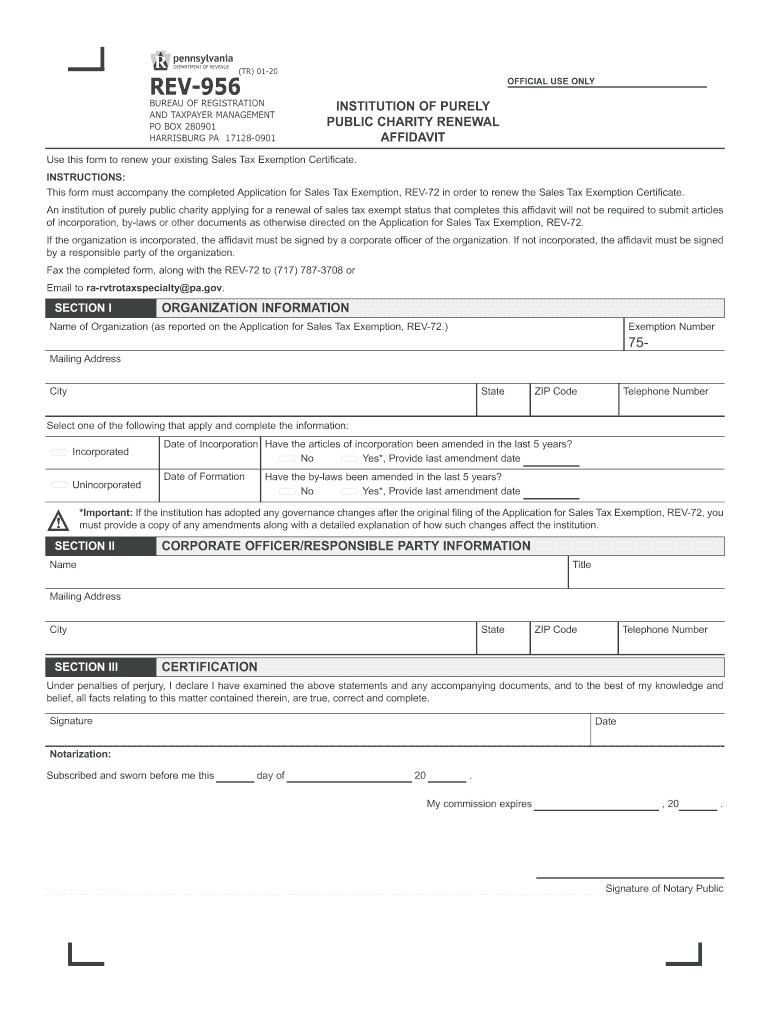

2020 2022 Form PA REV 956 Fill Online Printable Fillable Blank

Fillable Pa 40 Fill Out Sign Online DocHub

PA Rent Rebate Form Printable Rebate Form

PA Rent Rebate Form Printable Rebate Form

Pa Rent Rebate Form 2020 Fill Online Printable Fillable Blank

Form Et 1 Pa 2019 Fill Out Sign Online DocHub

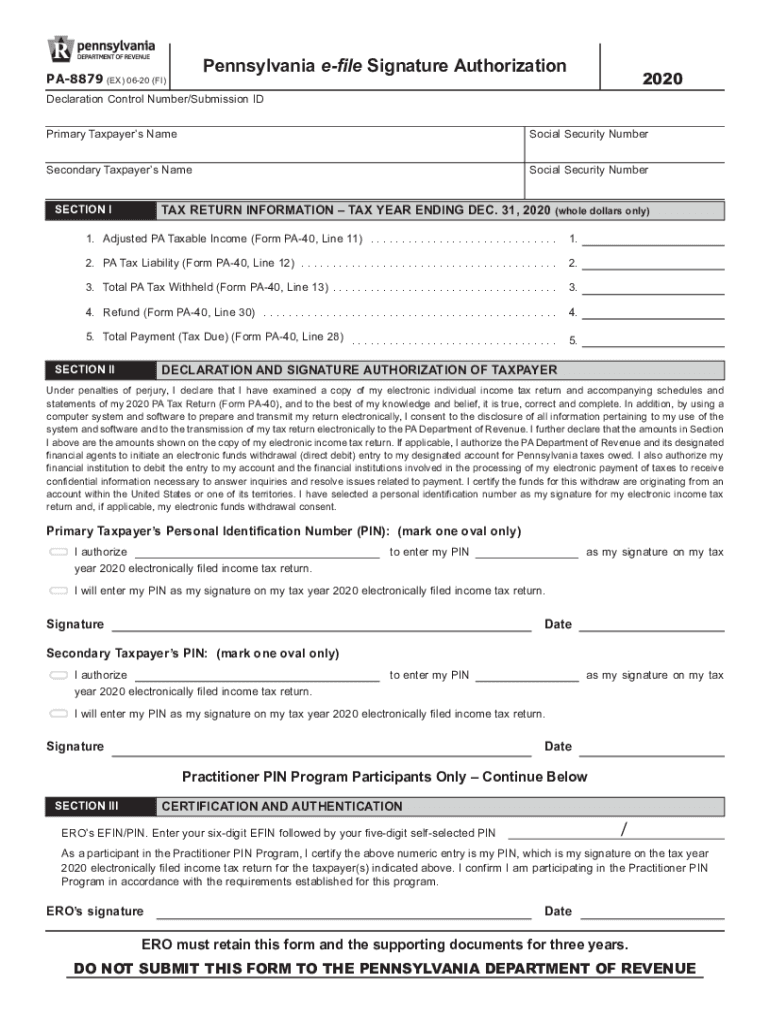

Pa Form 8879 Fill Out Sign Online DocHub

Income Criteria For Pa Property Tax Rebate Form - Web The PA Property Tax Rent Rebate Program benefits income eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older Form PA 1000 requires you to list multiple forms of income such