Tax Rebate Mortgage Interest Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

Web 20 juil 2016 nbsp 0183 32 In the tax year 2021 to 2022 Brian s salary is 163 36 000 and his rental income is 163 24 000 His mortgage interest is still 163 15 000 and he has other allowable expenses Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

Tax Rebate Mortgage Interest

Tax Rebate Mortgage Interest

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

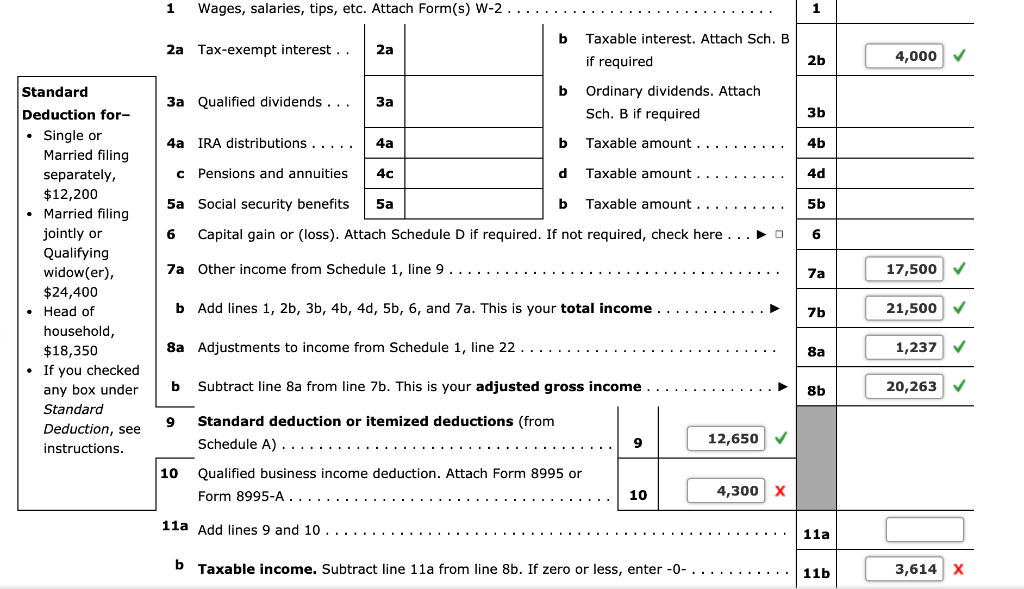

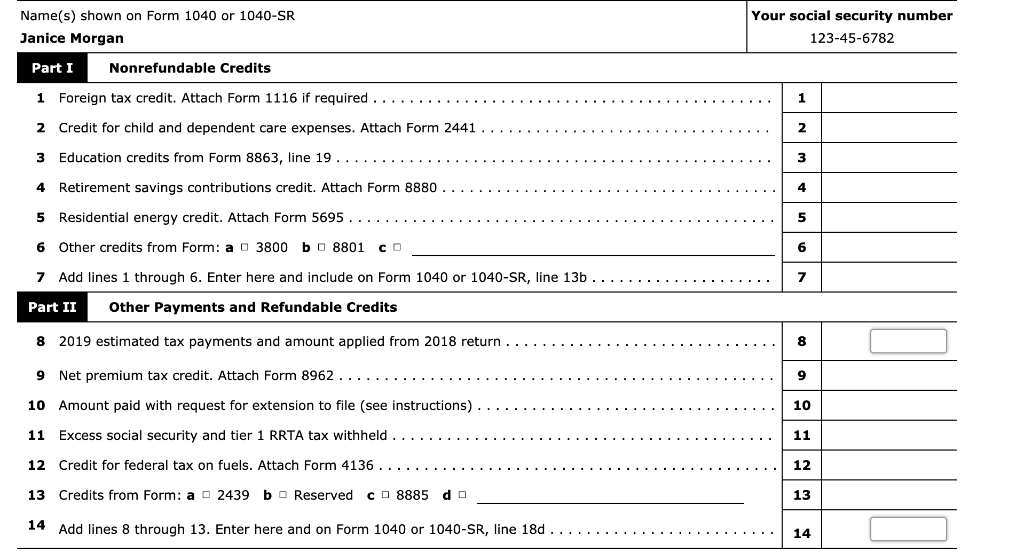

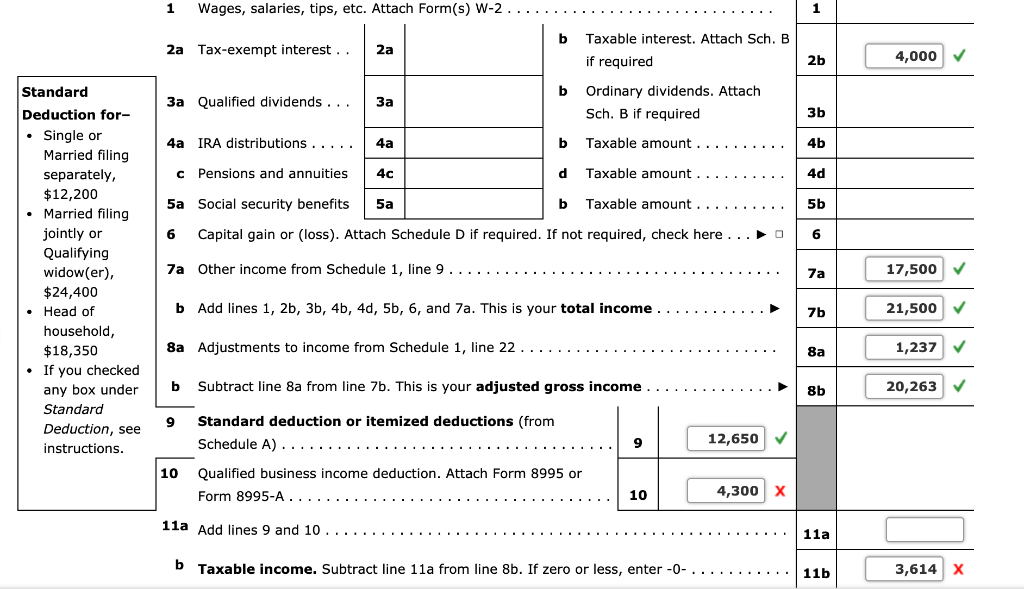

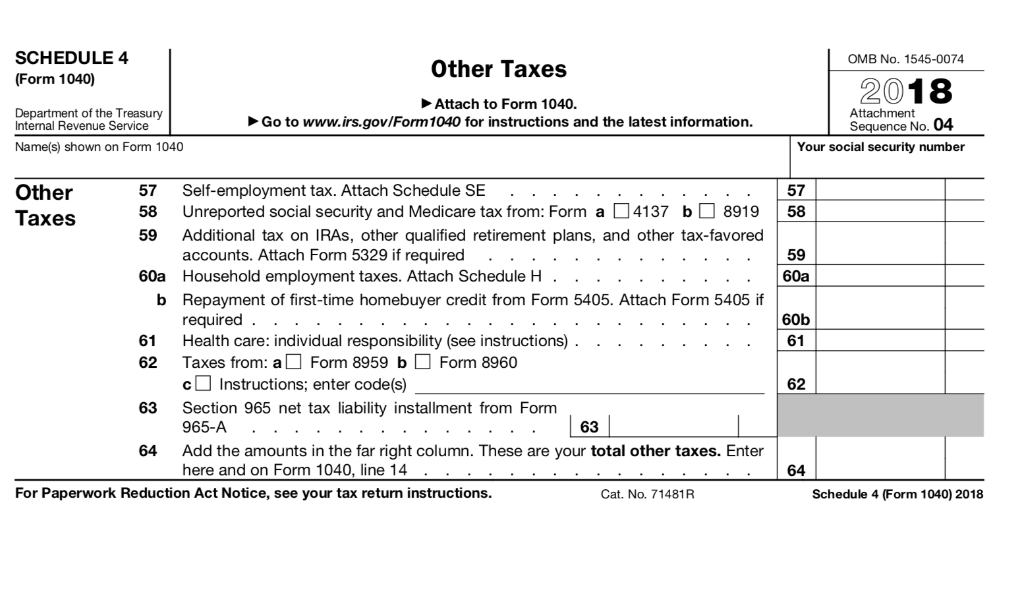

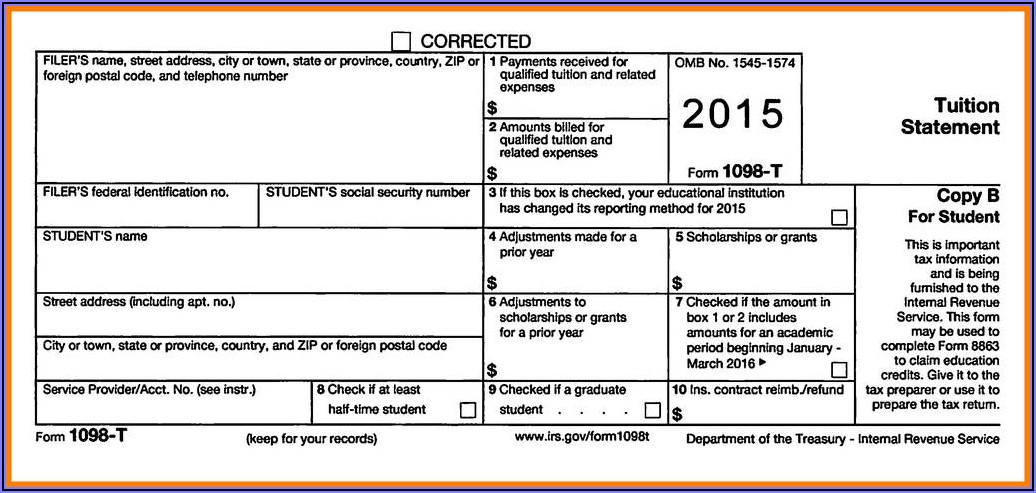

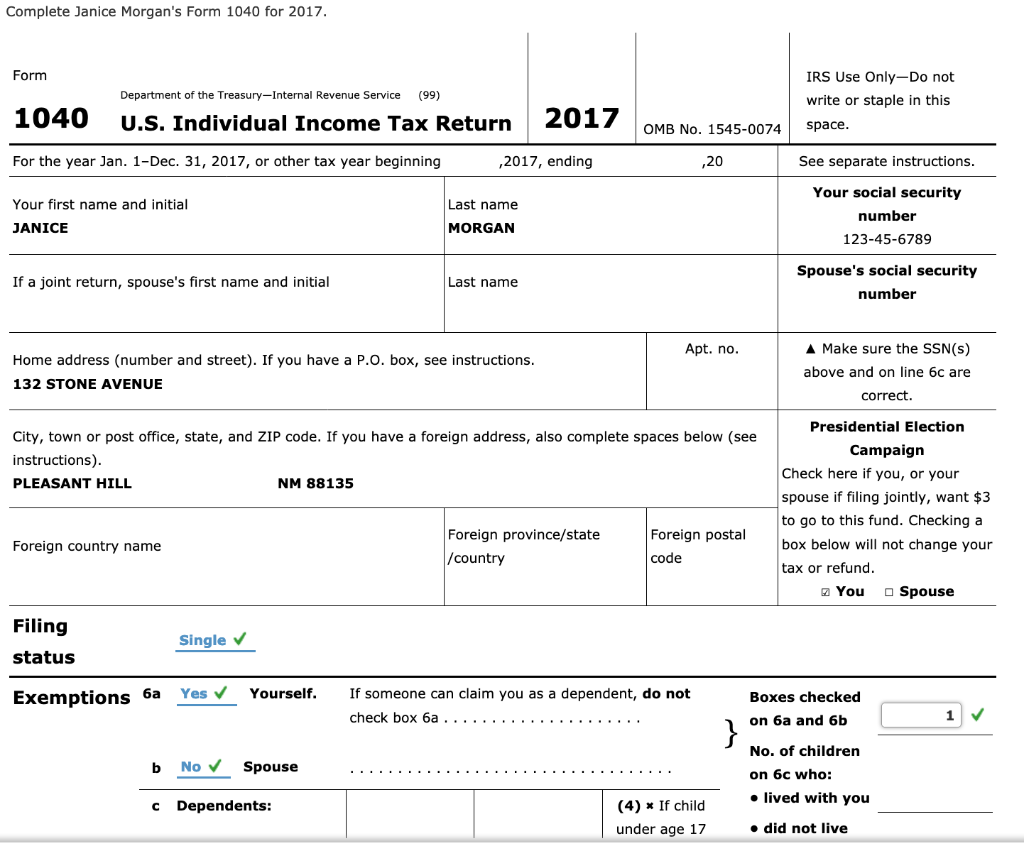

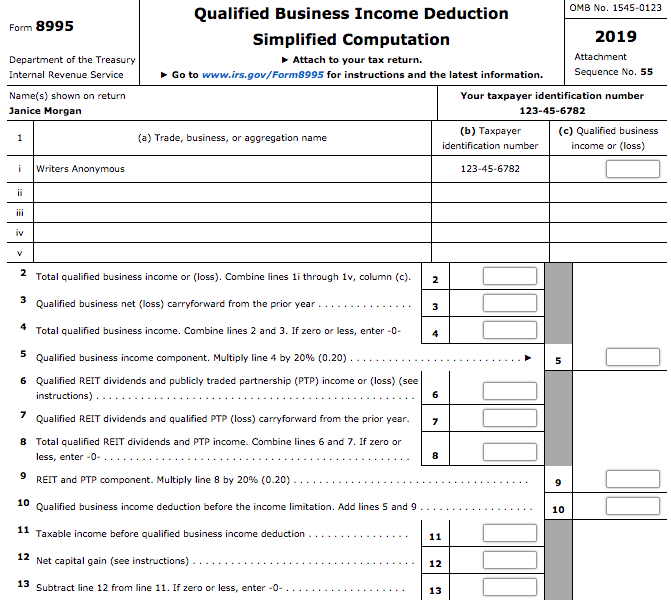

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/29e/29e60ea7-ac4f-41b4-b3e5-479b24bec3f3/phpYWR6IU

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

https://www.coursehero.com/qa/attachment/24027424/

Web 18 juil 2023 nbsp 0183 32 Deductible interest for new loans for your personal residence is limited to principal amounts 750 000 Mortgage interest deduction When you repay a mortgage Web One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income when filing their taxes This calculator estimates your tax savings after a house

Web 30 avr 2023 nbsp 0183 32 Using our 12 000 mortgage interest example a married couple in the 24 tax bracket would get a 27 700 standard deduction in 2023 25 900 in 2022 which is Web 1 sept 2023 nbsp 0183 32 Is mortgage interest tax deductible In a nutshell yes If you have a home loan the mortgage interest deduction allows you to reduce your taxable income by the amount of interest paid on the

Download Tax Rebate Mortgage Interest

More picture related to Tax Rebate Mortgage Interest

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/3b6/3b6e0b0f-5f0b-4b1a-993f-e6359e2d4ede/phpXXJUd2

34 Mortgage Interest Deduction Taxes NairnMykenzi

https://itep.sfo2.digitaloceanspaces.com/fig2_mid.png

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/e40/e40704e5-b559-4cc6-9813-0237a8a5e3d1/phpzsNBgK

Web You receive a mortgage credit certificate from State X This year your regular tax liability is 1 100 you owe no alternative minimum tax and your mortgage interest credit is Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers

Web According to IRS gov you can claim a mortgage interest tax deduction on a second home if it is not an investment property If you rent out the residence you must use it for more Web 22 juil 2021 nbsp 0183 32 Yes you can claim tax relief on mortgage interest However the changes over the past few years mean that you will be taxed on all your rental income and then

Form 11 Mortgage Interest Deduction Understand The Background Of Form

https://i.pinimg.com/736x/37/72/eb/3772ebf330c19d357fbb6e55732f99ca.jpg

Tax Law Flowchart Can You Deduct Your Mortgage Interest Mortgage

https://i.pinimg.com/originals/6f/6e/9a/6f6e9a1c4099b0715d0133dd3a576e04.png

https://www.abnamro.nl/.../mortgage-interest-deductions.html

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

https://www.gov.uk/guidance/changes-to-tax-relief-for-residential...

Web 20 juil 2016 nbsp 0183 32 In the tax year 2021 to 2022 Brian s salary is 163 36 000 and his rental income is 163 24 000 His mortgage interest is still 163 15 000 and he has other allowable expenses

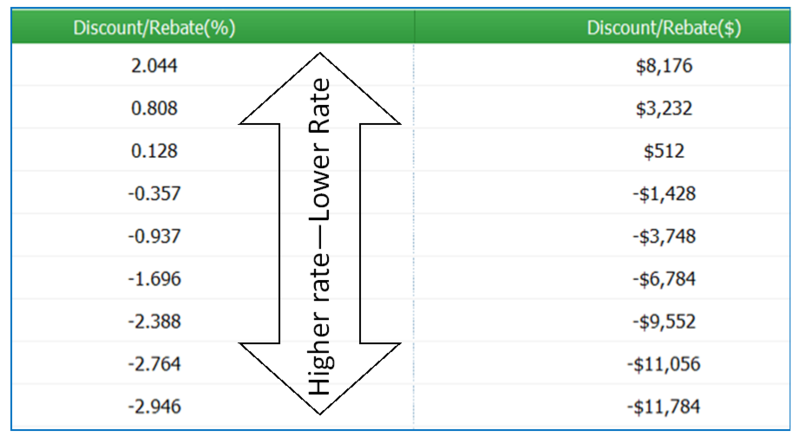

Using Rebate Pricing To Reduce Closing Cost On Your Refi Or Home Purchase

Form 11 Mortgage Interest Deduction Understand The Background Of Form

Deduct Mortgage Interest On Taxes Stock Image Image Of Federal

37 Standard Deduction Mortgage Interest EphraEmelyah

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Famous Greenline Loans Interest Rates References

Famous Greenline Loans Interest Rates References

1098 Mortgage Interest Tax Form Form Resume Examples GM9Oo5O39D

Military Journal Nm State Rebate 2022 According To The Department

Janice Morgan Age 24 Is Single And Has No Chegg

Tax Rebate Mortgage Interest - Web 18 juil 2023 nbsp 0183 32 Deductible interest for new loans for your personal residence is limited to principal amounts 750 000 Mortgage interest deduction When you repay a mortgage