Tax Deduction Mortgage Interest Second Home If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary home up to 750 000 if you are single or married

The short answer is yes Fortunately for taxpayers you can still deduct second mortgage interest but only under certain terms Factors affecting your ability to qualify can include the type and current amount of mortgage This part explains what you can deduct as home mortgage interest It includes discussions on points and how to report deductible interest on your tax return Generally home mortgage interest is any interest you pay on a loan

Tax Deduction Mortgage Interest Second Home

Tax Deduction Mortgage Interest Second Home

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

What Exactly Do I Need To Qualify For A Home Loan Blog Realty

https://www.realtyexecutives.com/blog/wp-content/uploads/2018/09/home-tax-deduction-mortgage-interest-picture-id903035430.jpg

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

You can deduct mortgage interest on a second home as long as it is a qualified home per IRS guidelines Learn if your second home is considered a qualified home and how this tax deduction Is the mortgage interest and real property tax I pay on a second residence deductible Answer Yes and maybe Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the

A mortgage interest deduction is a tax benefit that allows owners of one or two qualified homes to write off the interest they paid on their mortgage But remember that you can only claim the mortgage interest deduction for two You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the

Download Tax Deduction Mortgage Interest Second Home

More picture related to Tax Deduction Mortgage Interest Second Home

Cabinettreebydesign Deduct Second Home Plus Rv Taxes

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/shutterstock_1613352049-1280x720.jpg

Mortgage Interest Deduction YouTube

https://i.ytimg.com/vi/xyHdUVv36lg/maxresdefault.jpg

Is The Mortgage Interest Deduction In Play B Logics

https://i0.wp.com/blogics.loanlogics.com/wp-content/uploads/2016/10/mortgage-interest-deductions-in-jeopardy.jpg?fit=1238%2C856&ssl=1

You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest If you rent out your second Here s what you can usually deduct on your taxes when you have a second home Interest on the mortgage or a home equity loan Property taxes Losses and capital gains Mortgage interest deduction

Interest on your first and second home mortgages up to a combined value of 750 000 or 1 million if your mortgage started on or before December 15 2017 may be If you re planning to rent out your second home some or all of the time the tax picture changes You may be able to claim income tax deductions on mortgage interest property taxes

Understanding The Mortgage Interest Deduction The Official Blog Of

https://www.taxslayer.com/blog/wp-content/uploads/2022/05/Mortgage-Interest-Deduction-8-1594x2048.png

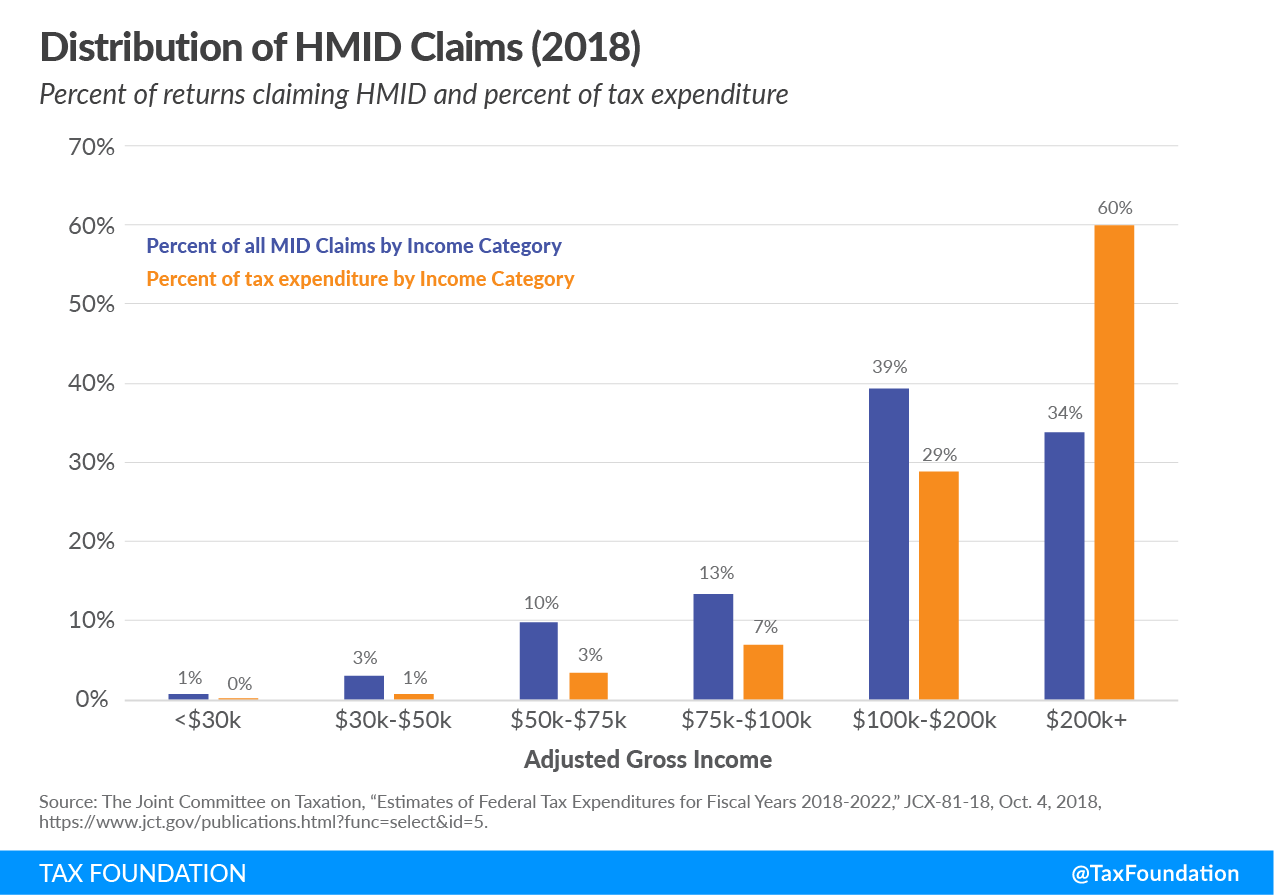

Mortgage Interest Deduction TaxEDU Glossary

https://taxfoundation.org/wp-content/uploads/2019/10/TF_ff671_figure1.png

https://www.investopedia.com/articles/…

If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary home up to 750 000 if you are single or married

https://www.rocketmortgage.com/learn/…

The short answer is yes Fortunately for taxpayers you can still deduct second mortgage interest but only under certain terms Factors affecting your ability to qualify can include the type and current amount of mortgage

Rental Property Tax Deductions A Comprehensive Guide Credible Tax

Understanding The Mortgage Interest Deduction The Official Blog Of

Can I Claim The Mortgage Interest Deduction Mortgage Interest Tax

Tax Deductions You Can Deduct What Napkin Finance

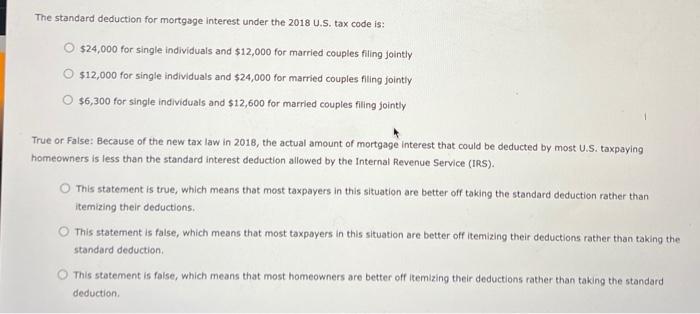

Solved The Standard Deduction For Mortgage Interest Under Chegg

Mortgage Interest Tax Deduction YouTube

Mortgage Interest Tax Deduction YouTube

Could This Be The End For The Mortgage Interest Deduction

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

GOP Tax Plan Where The Loss Of The Second Home Mortgage Deduction

Tax Deduction Mortgage Interest Second Home - Is the mortgage interest and real property tax I pay on a second residence deductible Answer Yes and maybe Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the