Income Limits For Solar Tax Credit Get details on the Residential Clean Energy Credit Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may

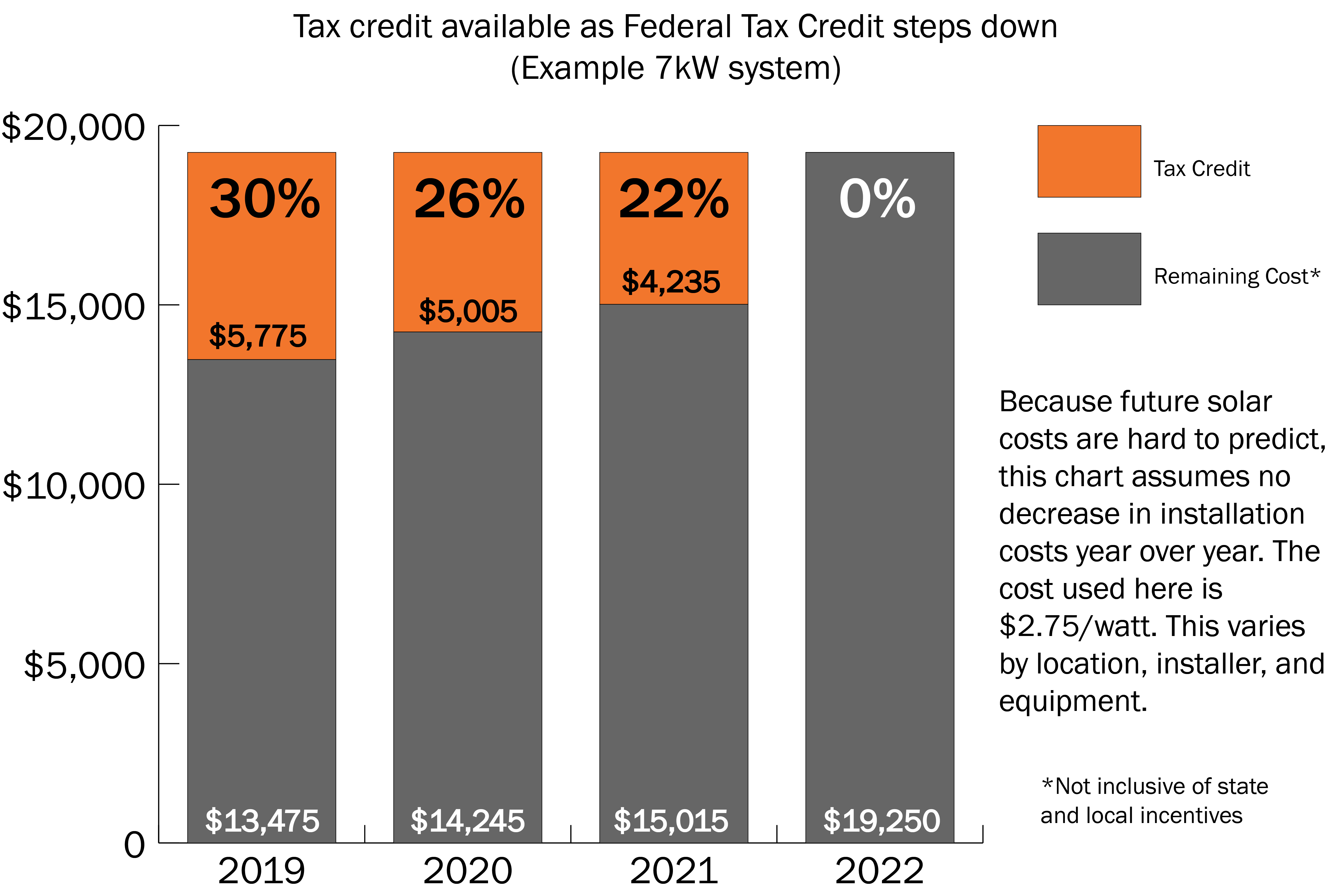

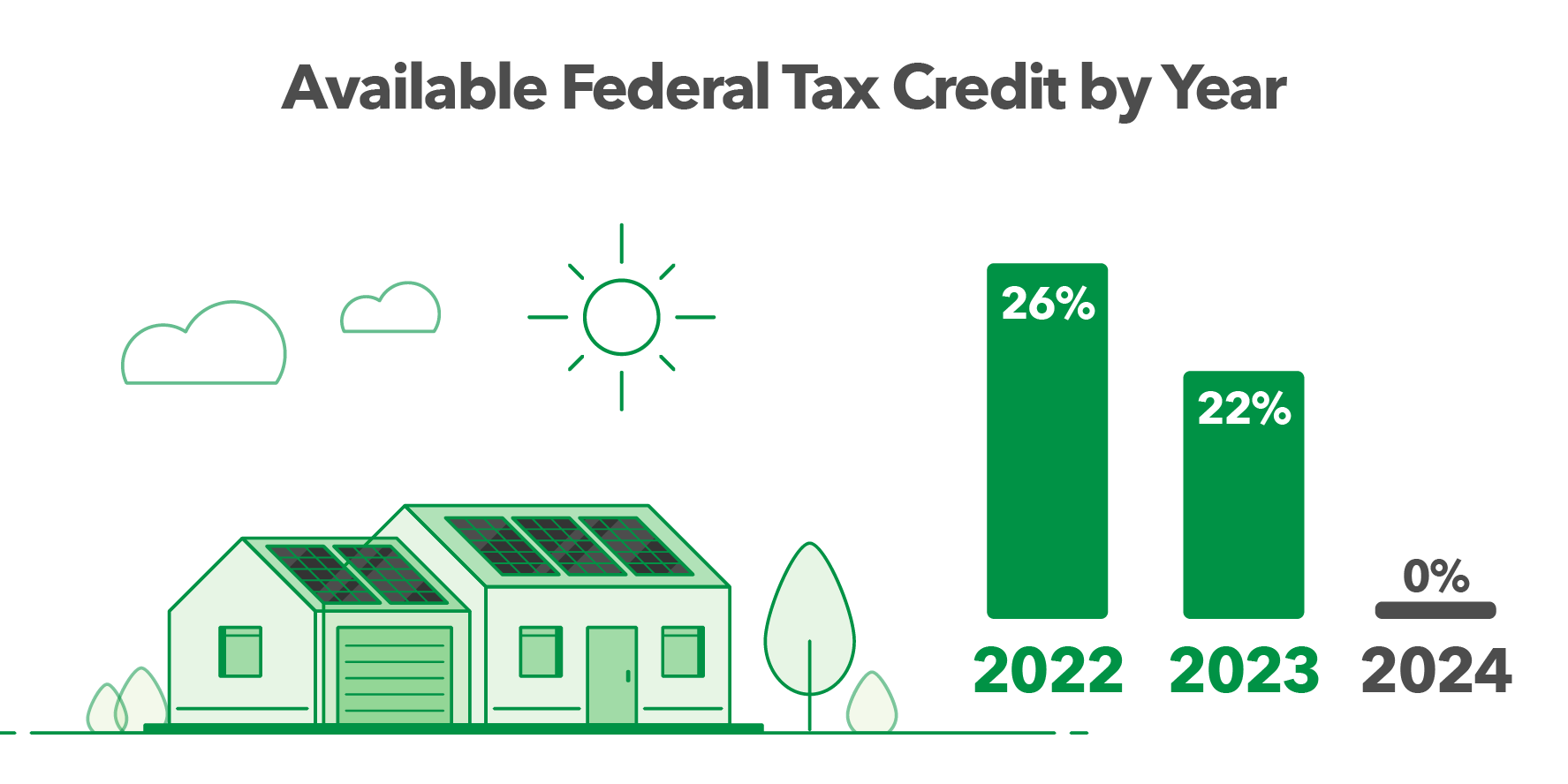

The federal solar tax credit residential energy credits Form 5965 is a tax credit not an itemized deduction So it won t be affected if you stop itemizing your deductions You Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was

Income Limits For Solar Tax Credit

Income Limits For Solar Tax Credit

https://iveeleaguesolar.com/wp-content/uploads/2020/12/Untitled-design-1-1536x1024.png

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

https://greenridgesolar.com/wp-content/uploads/2021/01/Solar-Tax-Credit-ITC-Step-Down-2.jpg

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Per the Inflation Reduction Act the ITC is 30 of the solar system cost until 2033 and will gradually reduce until it expires in 2035 Property tax exemptions SREC markets and utility rebates The federal solar tax credit has no income cap for claiming eligibility Taxable income must be sufficient to owe federal taxes to benefit from the credit The solar tax credit is

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery Is there a solar tax credit income limit No there is no income limit You can claim the solar tax credit regardless of your income level so long as the project expenses and residence are all qualified

Download Income Limits For Solar Tax Credit

More picture related to Income Limits For Solar Tax Credit

How Does The Solar Tax Credit Work Solar Pricing NJ Solar Power

https://njsolarpower.com/wp-content/uploads/2021/05/iStock-697170112.jpg

Solar Tax Credit Guide And Calculator

https://www.solar-estimate.org/build/images/pages/solar-tax-credit/residential-bar-e0482b8d.png

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re There are no income limits on the solar tax credit so all individual taxpayers are eligible to claim the credit on qualifying solar energy equipment investments made to their homes within the United States

There is no income limit for the federal solar tax credit However you need a large enough taxable income to claim the full credit The solar panel tax credit or Investment Tax Credit ITC allows homeowners to deduct 30 of the cost of a solar installation from their federal taxes It s a key incentive for

Federal Solar Tax Credit 2023 How Does It Work ADT Solar

https://www.goadtsolar.com/wp-content/uploads/2022/11/Tax-Credit-Percentage-Chart-1024x1019.png

Federal Investment Solar Tax Credit Guide Learn How To Claim The

https://static.wixstatic.com/media/bfb107_57532271fd4f41489474855e38c96a99~mv2.jpg/v1/fit/w_1000%2Ch_1000%2Cal_c%2Cq_80/file.jpg

https://www.irs.gov › credits-deductions › home-energy-tax-credits

Get details on the Residential Clean Energy Credit Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may

https://ttlc.intuit.com › community › state-taxes › ...

The federal solar tax credit residential energy credits Form 5965 is a tax credit not an itemized deduction So it won t be affected if you stop itemizing your deductions You

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Federal Solar Tax Credit 2023 How Does It Work ADT Solar

Solar Tax Credit Graph without Header Solar United Neighbors

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

Income Charts OregonHealthCare us

Income Charts OregonHealthCare us

Guidance For Solar Tax Credit Prevailing Wage And Apprenticeship

Federal Investment Solar Tax Credit Guide Learn How To Claim The

What Is The Solar Tax Credit

Income Limits For Solar Tax Credit - The federal solar tax credit has no income cap for claiming eligibility Taxable income must be sufficient to owe federal taxes to benefit from the credit The solar tax credit is