Income Tax 87a Rebate Ay 2024 25 Pdf 9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed Rs

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under 3 For the FY 2023 24 AY 2024 25 the rebate limit has been increased to Rs 7 00 000 under the new tax regime This means a resident individual with taxable income up to Rs

Income Tax 87a Rebate Ay 2024 25 Pdf

Income Tax 87a Rebate Ay 2024 25 Pdf

https://i.ytimg.com/vi/QxMWUdQxeGk/maxresdefault.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Income Tax Rebate Under Section 87A

http://bemoneyaware.com/wp-content/uploads/2016/04/ITR-87a-rebate.png

From assessment year 2024 25 onwards an assessee being an individual resident in India whose income is chargeable to tax under the proposed sub section 1A of section 115BAC shall now be entitled to a The maximum rebate under section 87A for the AY 2024 25 is Rs 25 000 under the new tax regime and Rs 12 500 under the optional tax regime See the

The new tax regime allows tax rebate under Section 87A for taxable incomes up to Rs 7 lakh It s important to note that the tax rules may change from the Individuals with net taxable income less than or equal to Rs 7 lakh will be eligible for tax rebate u s 87A i e tax liability will be NIL under the new regime What is

Download Income Tax 87a Rebate Ay 2024 25 Pdf

More picture related to Income Tax 87a Rebate Ay 2024 25 Pdf

TDS Rate Chart AY 2023 2024 FY 2022 2023 Sensys Blog

http://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210.jpg

Income Tax Slab Rates For FY 2021 22 AY 2022 23 Bachat Mantra

https://bachatmantra.in/wp-content/uploads/2022/07/income-tax-gc475a97c6_1920-2-1024x683-1.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rebate-US-87A-for-AY-2024-25-FY-2023-24-1-1.png?w=1280&ssl=1

Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified by Finance Act 2023 A resident Claim tax rebate under Section 87A only when the income does not exceed 5 lakhs The maximum rebate under section 87A for AY 2024 25 FY 2023 24 is 25 000 under the

Income tax rebate under Section 87A is available to provide relief for individual resident taxpayers The new tax regime has increased the taxable income limit Section 87A rebate is an income tax provision that allows taxpayers to lower their tax liability It allows you to claim the refund if your yearly income does not

Section 87A Tax Rebate Under Section 87A Rebates Financial

https://i.pinimg.com/736x/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

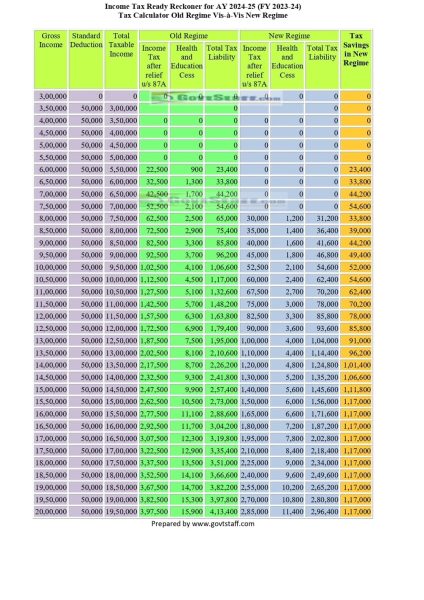

Income Tax Ready Reckoner For AY 2024 25 FY 2023 24 Tax Calculator

https://www.govtstaff.com/wp-content/uploads/2023/02/income-tax-ready-reckoner-for-ay-2024-25-fy-2023-24-tax-calculator-old-regime-vis-a-vis-new-regime-424x600.jpg

https://www.incometax.gov.in/iec/foportal/sites...

9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed Rs

https://www.incometax.gov.in/iec/foportal/help/...

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under 3

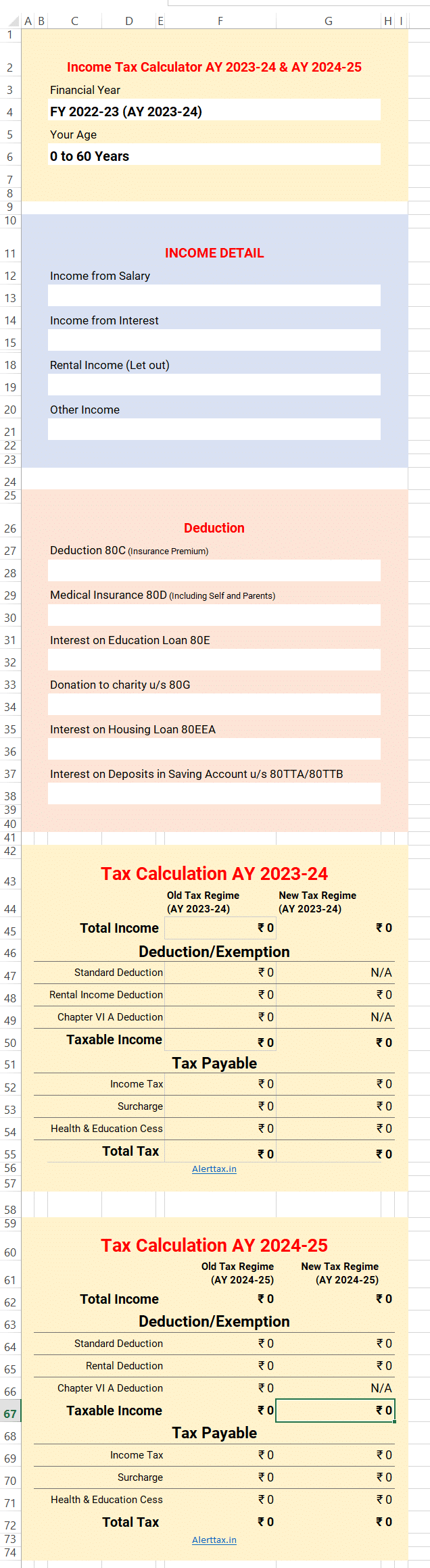

Income Tax Calculator Excel AY 2024 25 AY 2023 24

Section 87A Tax Rebate Under Section 87A Rebates Financial

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Income Tax Slab Rate For Fy 2019 20 Income Tax Slab Rate For FY 19 20

Income Tax Slab Rate For Fy 2019 20 Income Tax Slab Rate For FY 19 20

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club

Income Tax 87a Rebate Ay 2024 25 Pdf - Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for