Income Tax Act Regulation 2101 Income Tax Act s 83 2 Reg 2101 Canadian controlled private corporations CCPCs keep track of certain non taxable income amounts and are able to pay these amounts to shareholders as a capital dividend

The technical requirements to have a distribution treated as a CDA Dividend are described in Regulation 2101 which requires a prescribed form T2054 to be filed with the Canada Revenue Agency CRA together with 14 The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e mail The Income Tax

Income Tax Act Regulation 2101

Income Tax Act Regulation 2101

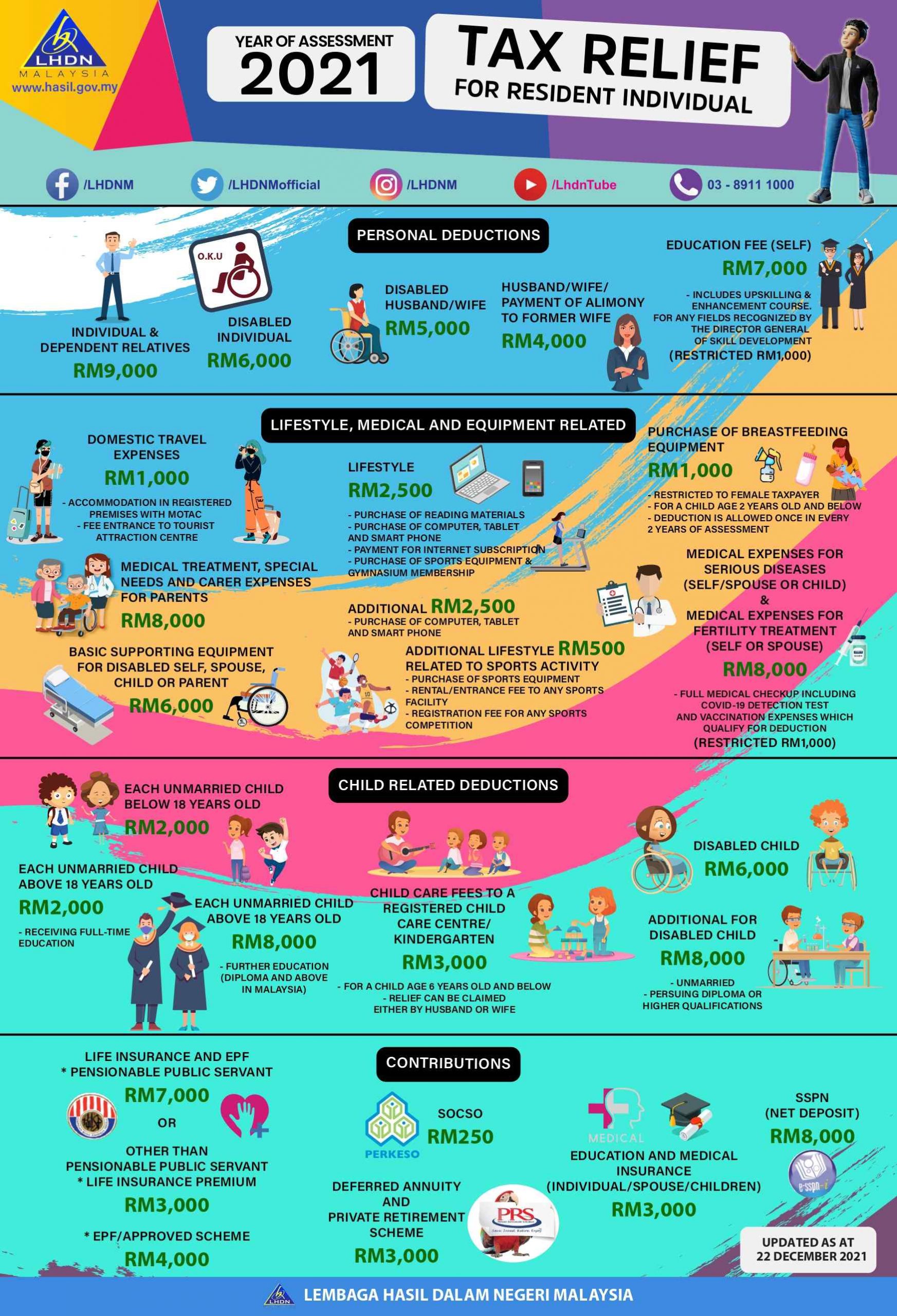

https://soyacincau.com/wp-content/uploads/2022/03/220324-efiling-tax-relief-scaled.jpeg

Income Tax Act POCKET Edition Finance Act 2023 By Taxmann s

https://ttpl.imgix.net/9789356226982L.jpg?w=1200

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4f4b2caa6eb2579afccf97f0ae69d7d2/thumb_1200_1854.png

Established by the Income Tax Act the CDA allows Canadian private corporations to distribute tax free capital dividends to their shareholders This ensures that certain types of income particularly non taxable capital Position No Reg 2101 states that among others the prescribed form T2054 and a certified copy of the resolution of the administrators authorizing the election shall be filed to

Directive EU 2021 2101 signed by the co legislators on 24 November 2021 introducing amendments to Directive 2013 34 EU relating to the relating to the disclosure of income tax The purpose of changes in the Accounting Act or why to disclose taxes from other countries The purpose of the amendment to the Accounting Act is to implement Directive

Download Income Tax Act Regulation 2101

More picture related to Income Tax Act Regulation 2101

Section 27 Of The Income Tax Act Sorting Tax

https://sortingtax.com/wp-content/uploads/2023/03/Screenshot-2023-03-21-at-4.50.42-PM.png

The Income Tax Act 1961 Bare Act Pocket For AIBE Exams

http://mandjservice.com/cdn/shop/files/9789356035508.jpg?v=1693288122

Know About Section 43B In Income Tax Act 1961

https://khatabook-assets.s3.amazonaws.com/media/post/2021-10-27_124828.1686040000.jpg

The amendment transposes European Directive 2021 2101 of November 24 2021 which concerns the disclosure by multinational corporations of information on income tax paid in various countries Income tax assessment 1997 act regulations 2021 made under the Income Tax Assessment Act 1997 and the Income Tax Transitional Provisions Act 1997 TABLE OF PROVISIONS

1 Notwithstanding anything contained elsewhere in this Act for the purpose of computing the income earned by any person from any business employment or investment in any income The tax shall be 1 at the rate of one half of one per centum of the net consideration with respect to conveyances made before July first nineteen hundred seventy one or made in

Income TAX ACT 1961 INCOME TAX ACT 1961 BASIC INTRODUCTION

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4f4a5f4f29e334284480cf9bd8b7ae33/thumb_1200_1697.png

Master Income Tax ACT 2023 Inklogy

https://www.inklogy.com/wp-content/uploads/2020/06/Picture3.png

https://www.taxtips.ca › glossary › capital-…

Income Tax Act s 83 2 Reg 2101 Canadian controlled private corporations CCPCs keep track of certain non taxable income amounts and are able to pay these amounts to shareholders as a capital dividend

https://canadian-accountant.com › content …

The technical requirements to have a distribution treated as a CDA Dividend are described in Regulation 2101 which requires a prescribed form T2054 to be filed with the Canada Revenue Agency CRA together with 14

Section 194M Of Income Tax Act 1961 Sorting Tax

Income TAX ACT 1961 INCOME TAX ACT 1961 BASIC INTRODUCTION

How To File Withholding Tax Return As Per New Income Tax Act 2023 FM

44ae Of Income Tax Act Everything You Need To Know

About Income Tax In Hindi Seekhoaccounting

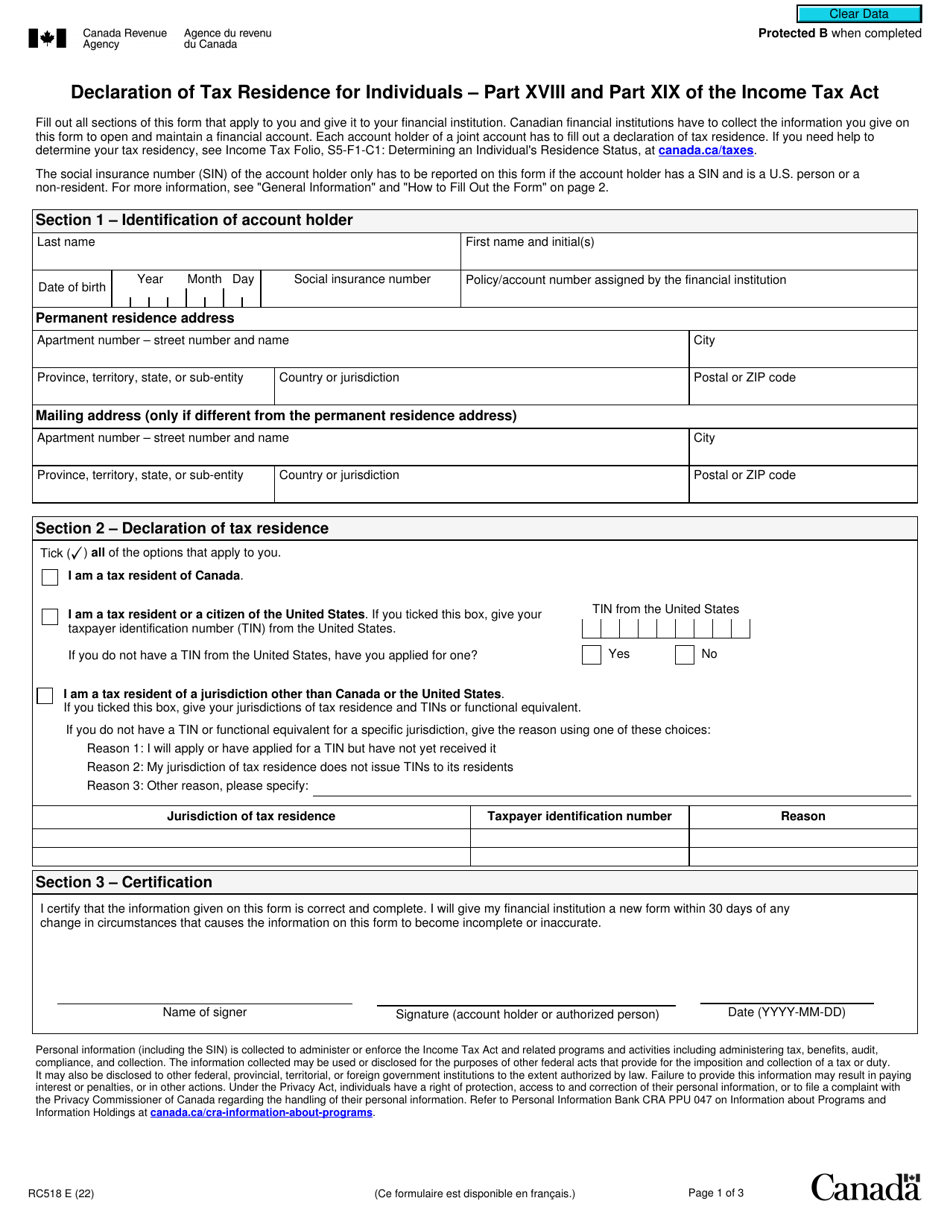

Form RC518 Download Fillable PDF Or Fill Online Declaration Of Tax

Form RC518 Download Fillable PDF Or Fill Online Declaration Of Tax

All You Need To Know On How To Save Income Tax Ebizfiling

NRIs How To File Your Income Tax Return On Rental Income From Indian

Section 115A Of Income Tax Act A Comprehensive Guide Thetaxmaster in

Income Tax Act Regulation 2101 - Under Section 269ST of the Income Tax Act cash transactions of 2 lakh or more in a single day for a single transaction or multiple related transactions are prohibited Violations