Income Tax Act Uk Income Tax Act 2007 CHAPTER 3 Explanatory Notes have been produced to assist in the understanding of this Act and are available separately 61 50

Income Tax is a tax you pay on your earnings find out about what it is how you pay and how to check you re paying the right amount using HMRC s tax calculator An Act to restate with minor changes certain enactments relating to income tax on employment income pension income and social security income and for connected purposes

Income Tax Act Uk

Income Tax Act Uk

https://sortingtax.com/wp-content/uploads/2022/06/Section-91-of-Income-Tax-Act-with-Example.png

Power Conferred By Section 254 2 Of Income Tax Act Does Not Extend

https://legiteye.com/media/uploads/legiteyeindian/Income-Tax-Act.jpg

Income Tax Act 1961 Establishing Taxation Rules In The Country

https://getlegalindia.com/wp-content/uploads/2021/09/income-tax-act-1.jpg

The Income Tax Act 2007 is an Act of the Parliament of the United Kingdom It is the primary Act of Parliament concerning income tax paid by individual earners subject to the law of United Kingdom and mostly replaced the Income and Corporation Taxes Act 1988 Check your Income Tax for the current year Check how much Income Tax you paid last year Check your Simple Assessment tax bill Check if you need to tell HMRC about additional income

Current rates and allowances How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your income falls within each View on Westlaw or start a FREE TRIAL today Income Tax Act 2007 PrimarySources

Download Income Tax Act Uk

More picture related to Income Tax Act Uk

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

44ae Of Income Tax Act Everything You Need To Know

https://housing.com/news/wp-content/uploads/2023/01/Provisions-under-Section-44AE-of-the-Income-Tax-Act-that-you-must-know.jpg

Malaysia Income Tax Act 1967 LAWS OF MALAYSIA ONLINE VERSION OF

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/fb38da961814d2d70f0f34d95585bdb5/thumb_1200_1694.png

Personal income tax rates Income tax is charged at graduated rates with higher rates of income tax applying to higher bands of income Tax is charged on total income from all earned and investment sources less certain deductions and allowances The income tax was reintroduced by Sir Robert Peel in the Income Tax Act 1842 Peel as a Conservative had opposed income tax in the 1841 general election but a growing budget deficit required a new source of funds

[desc-10] [desc-11]

Section 194M Of Income Tax Act 1961 Sorting Tax

https://sortingtax.com/wp-content/uploads/2022/08/blogimg1.png

Know About Section 43B In Income Tax Act 1961

https://khatabook-assets.s3.amazonaws.com/media/post/2021-10-27_124828.1686040000.jpg

https://www.legislation.gov.uk/ukpga/2007/3/pdfs/...

Income Tax Act 2007 CHAPTER 3 Explanatory Notes have been produced to assist in the understanding of this Act and are available separately 61 50

https://www.gov.uk/income-tax

Income Tax is a tax you pay on your earnings find out about what it is how you pay and how to check you re paying the right amount using HMRC s tax calculator

Income TAX ACT 1961 INCOME TAX ACT 1961 BASIC INTRODUCTION

Section 194M Of Income Tax Act 1961 Sorting Tax

Section 194A Of Income Tax Act Sorting Tax

Section 115BAC Of Income Tax Act IndiaFilings

Bonus Stripping And Tax On Bonus Shares Under Income Tax Act

Master Income Tax ACT 2023 Inklogy

Master Income Tax ACT 2023 Inklogy

No Limitation Under Income Tax Act For Filing Application For

Five Most Serious Offences Under The Income Tax Act

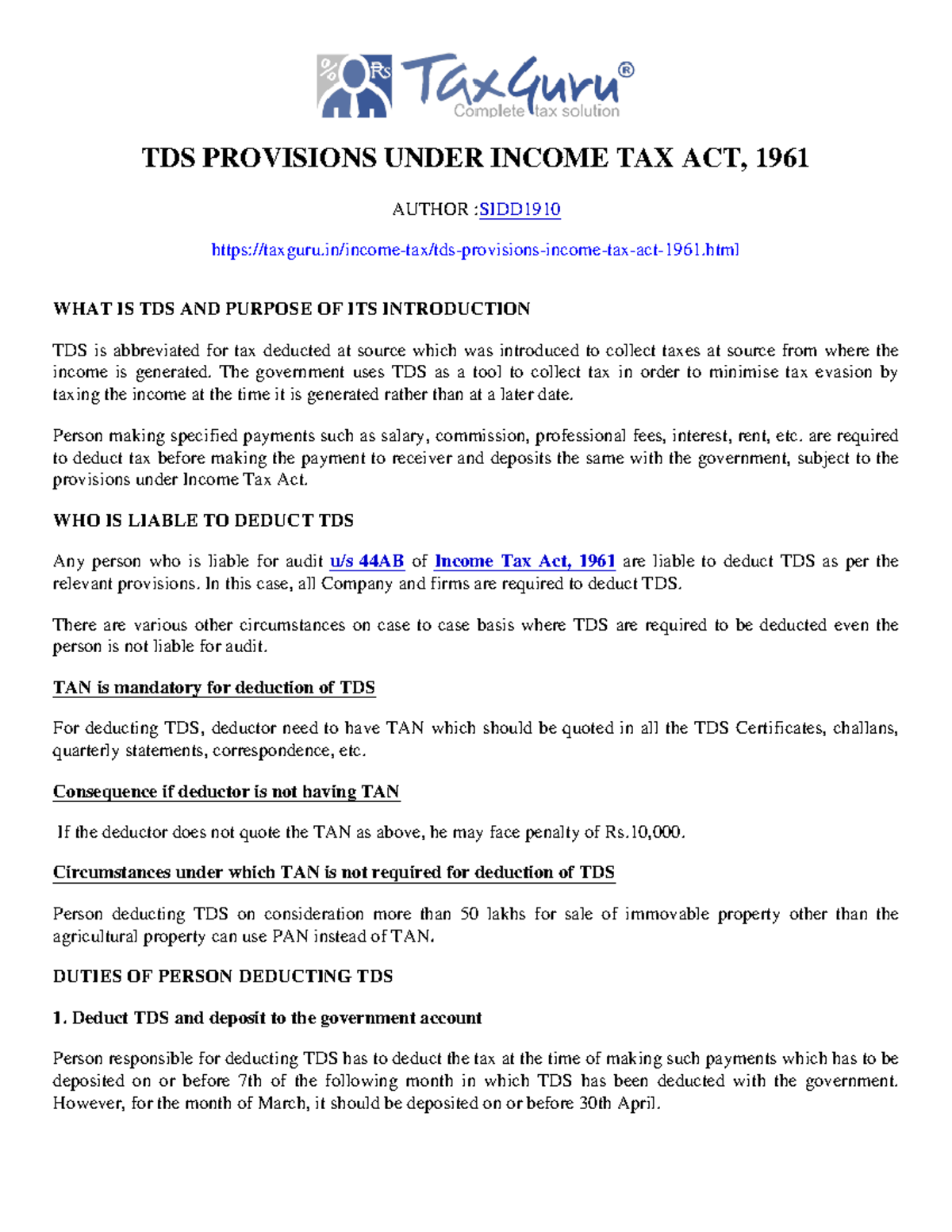

TDS Provisions Under Income Tax Act 1961 Taxguru in TDS PROVISIONS

Income Tax Act Uk - [desc-12]