Income Tax And Rebates Web 1 d 233 c 2022 nbsp 0183 32 In many cases your tax rebate check isn t directly related to deductions and credits you claim on a return What is a tax rebate Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer

Web Tax Relief is any program or incentive that helps reduce the tax in some way or another This tax relief can be in the form of a tax deduction or a tax credit A tax deduction is basically a deduction of tax It allows one to Web In simple terms income tax deduction is a reduction in tax obligation from your gross taxable income Standard deduction is the first brush with tax savings that every taxpayer benefits from Standard deduction of Rs

Income Tax And Rebates

Income Tax And Rebates

http://www.taxpolicycenter.org/sites/default/files/publication/137756/01_6.png

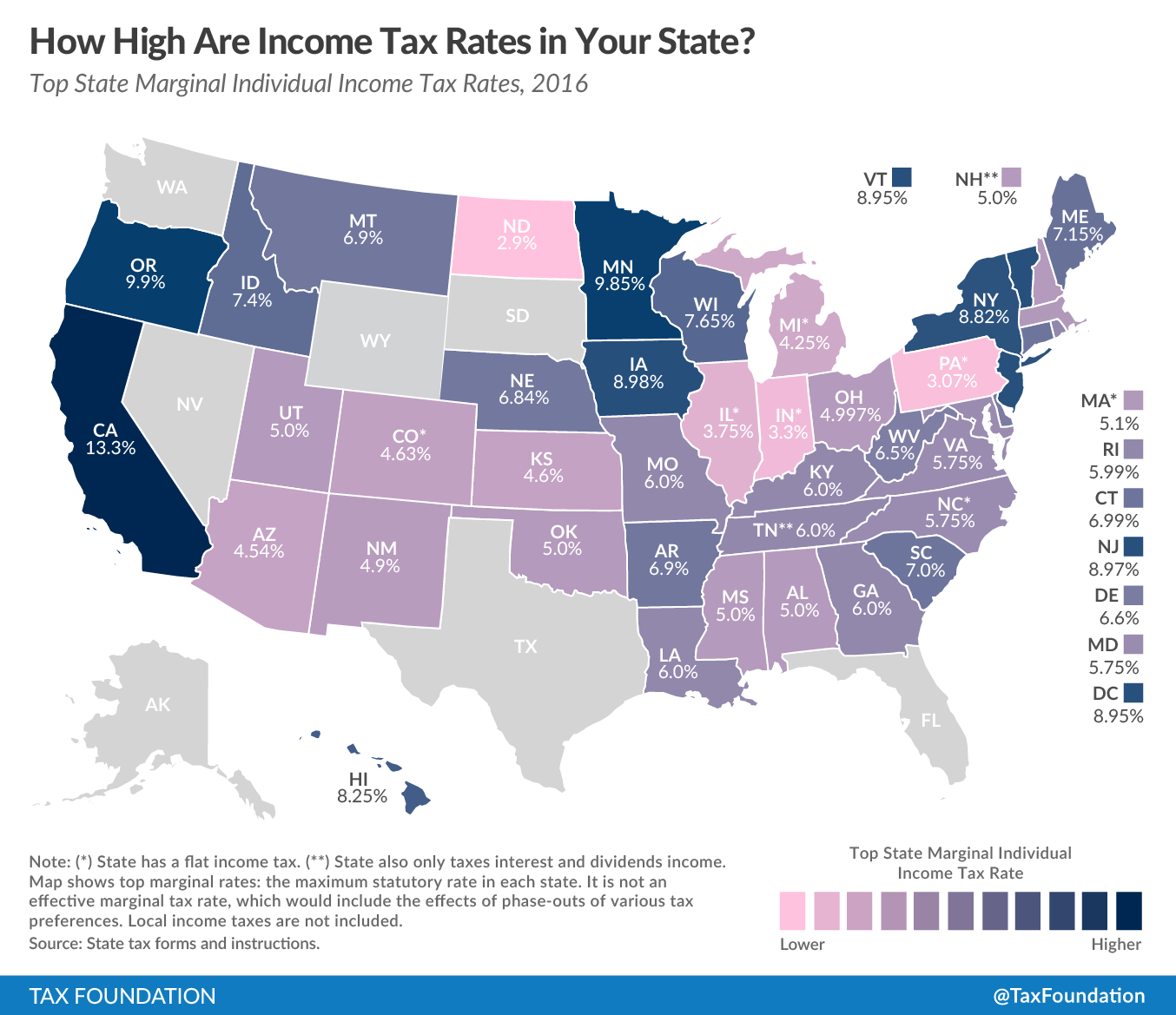

How High Are Income Tax Rates In Your State

https://www.richardcyoung.com/wp-content/uploads/2016/02/income-tax-rate-map.png

Taxes On The Rich Part 2 Wonder

https://files.taxfoundation.org/20191022154112/TEMTR-41Countries.png

Web 12 janv 2023 nbsp 0183 32 Tax Benefit A tax benefit is an allowable deduction on a tax return intended to reduce a taxpayer s burden while typically supporting certain types of commercial activity A tax benefit allows Web 6 avr 2023 nbsp 0183 32 April 6 2023 2 02 pm On occasion people are overcharged on their tax bill there is a system in place for you to receive money back from HMRC You may be

Web 1 f 233 vr 2023 nbsp 0183 32 Date 01 02 2023 Read 4 mins Learn the difference between an income tax rebate and tax exemption and compare it with a tax deduction Check how pensions and gratuity help in taxation Tax Web 9 sept 2023 nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have

Download Income Tax And Rebates

More picture related to Income Tax And Rebates

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

https://www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23-1024x719.png

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

https://akm-img-a-in.tosshub.com/indiatoday/images/bodyeditor/202002/new_income_tax_slabs-1200x1149.jpg?RA2r0ErOqnEHAPszFYqp_R3A8vlGK5kS

Top State Corporate Income Tax Rates In 2014 Tax Foundation

https://files.taxfoundation.org/legacy/docs/Corporate Income Tax Rates.png

Web 20 juil 2023 nbsp 0183 32 The High Efficiency Electric Home Rebate Act HEEHRA offers low to medium income families as much as 14 000 per year in point of sale discounts for electrification projects including up Web 13 avr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Web Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can receive a rebate for the entire cost of the Web 16 ao 251 t 2022 nbsp 0183 32 A tax rebate refers to a tax refund when the actual tax liability is lower than the taxes paid For example if your actual tax liability is Rs 40 000 but your employer

Income Tax And Rebate For Apartment Owners Association

https://image.slidesharecdn.com/incometaxandrebateforapartmentownersassociation-091116034252-phpapp01/95/income-tax-and-rebate-for-apartment-owners-association-6-728.jpg?cb=1258343000

Tax Rates By State Map Printable Map Gambaran

https://files.taxfoundation.org/20200127173134/linkedin-In-Stream_Wide___2020-State-Corporate-Income-Tax-Rates-01.png

https://turbotax.intuit.com/tax-tips/tax-relief/w…

Web 1 d 233 c 2022 nbsp 0183 32 In many cases your tax rebate check isn t directly related to deductions and credits you claim on a return What is a tax rebate Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer

http://www.differencebetween.info/difference …

Web Tax Relief is any program or incentive that helps reduce the tax in some way or another This tax relief can be in the form of a tax deduction or a tax credit A tax deduction is basically a deduction of tax It allows one to

Graph Of The Week World s Highest Tax Rates

Income Tax And Rebate For Apartment Owners Association

2007 Tax Rebate Tax Deduction Rebates

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Income Tax What s It All About

Income Tax Rates For Fy 2019 2020 Pdf Carfare me 2019 2020

Income Tax Rates For Fy 2019 2020 Pdf Carfare me 2019 2020

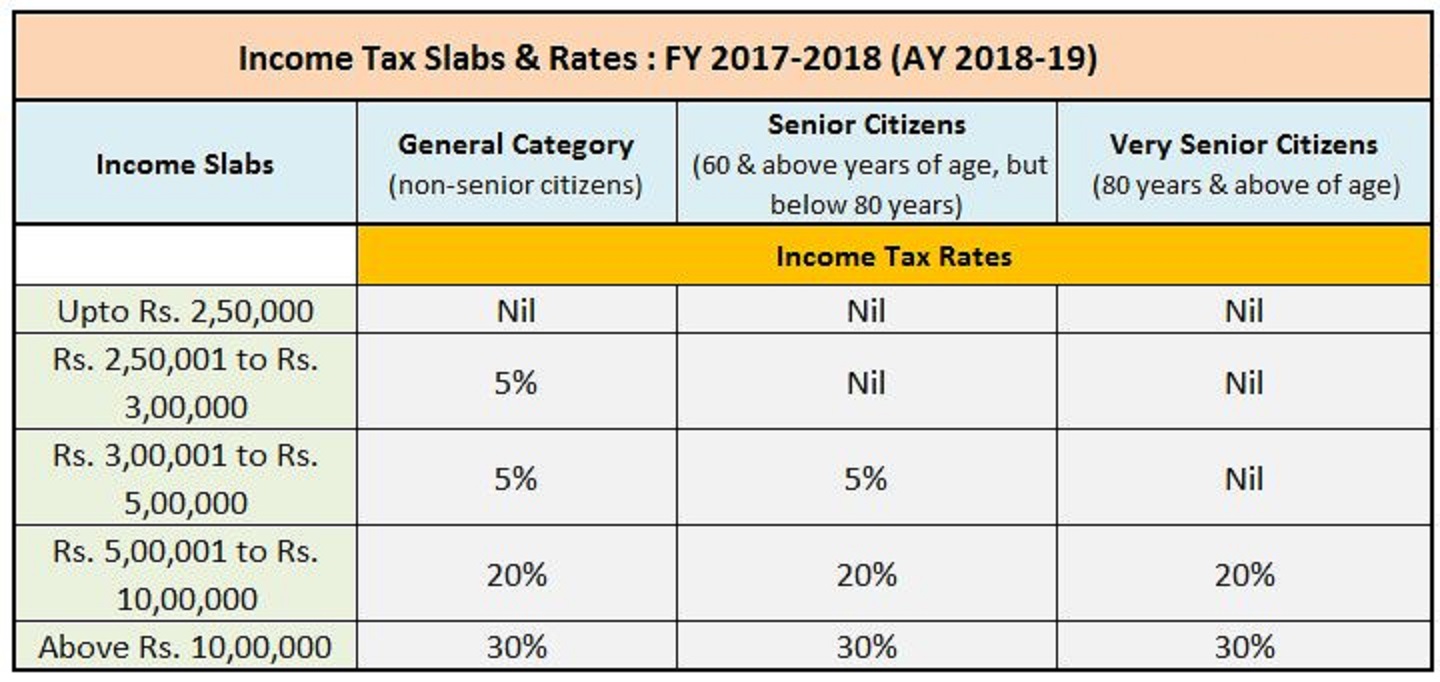

Top 5 Income Tax Changes And Slab Rates From Budget 2017 SavingsFunda

Section 87A Tax Rebate Under Section 87A

How State Taxes Are Paid Matters Stevens And Sweet Financial

Income Tax And Rebates - Web 6 avr 2023 nbsp 0183 32 April 6 2023 2 02 pm On occasion people are overcharged on their tax bill there is a system in place for you to receive money back from HMRC You may be