Income Tax Benefit On Electric Scooter Tax Benefit MOST IMPORTANT THING You get a deduction of Rs 1 50 000 under section 80EEB on the interest paid on loan taken to buy Electric vehicles Low GST rate The government has reduced the rate of EVs from 12 to 5

EV buyers can claim up to 1 5 lakh income tax deduction on the interest paid for vehicle loans under section 80EEB of the IT Act As the current financial year is nearing its end Buying an electric vehicle with a vehicle loan can make you eligible for income tax benefits under the 80EEB Also an EV purchase will bring you tax benefits on GST with the government

Income Tax Benefit On Electric Scooter

Income Tax Benefit On Electric Scooter

https://s3.studylib.net/store/data/008517925_1-2e47209745cc9fd2c22f1dde169ae3eb-768x994.png

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

Lease Car Calculator Uk CALCULATORSA

https://i2.wp.com/exceltemplates.net/wp-content/uploads/2016/03/ET-Car-Lease-vs-Buy-Calculator.jpg

To be eligible under FAME 2 you must be an individual who meets the following conditions You must have a valid ID proof You must have never claimed a FAME 2 subsidy before for electric two wheelers The name provided during the registration must exactly match the name on the ID proof Do you know that you can avail tax deduction on loan taken for purchase of electric vehicle under section 80EEB on Income Tax Act Learn here the eligibilty criteria conditions to avail deduction

What is Section 80EEB of Income Tax Act Under Section 80EEB of Income Tax Act you can claim tax deduction benefits of up to 1 5 lakh on the interest paid towards a loan you have taken specifically to purchase an electric vehicle Section 80EEB is a new section added to the Income Tax Act of 1961 and introduced by the Indian government in the Union Budget 2019 Under this section an individual can claim a deduction of up to Rs 1 5 lakh on the interest paid on the loan taken for purchasing an electric vehicle

Download Income Tax Benefit On Electric Scooter

More picture related to Income Tax Benefit On Electric Scooter

Tax Benefit On Electric Vehicles Inside Narrative

https://insidenarrative.com/wp-content/uploads/2022/12/Tax-Benefits-On-Electric-Vehicles.jpg

How To Claim Tax Benefits On Home Loan Bleu Finance

https://bleu-finance.com/wp-content/uploads/2021/05/Home-Loan0428.jpg

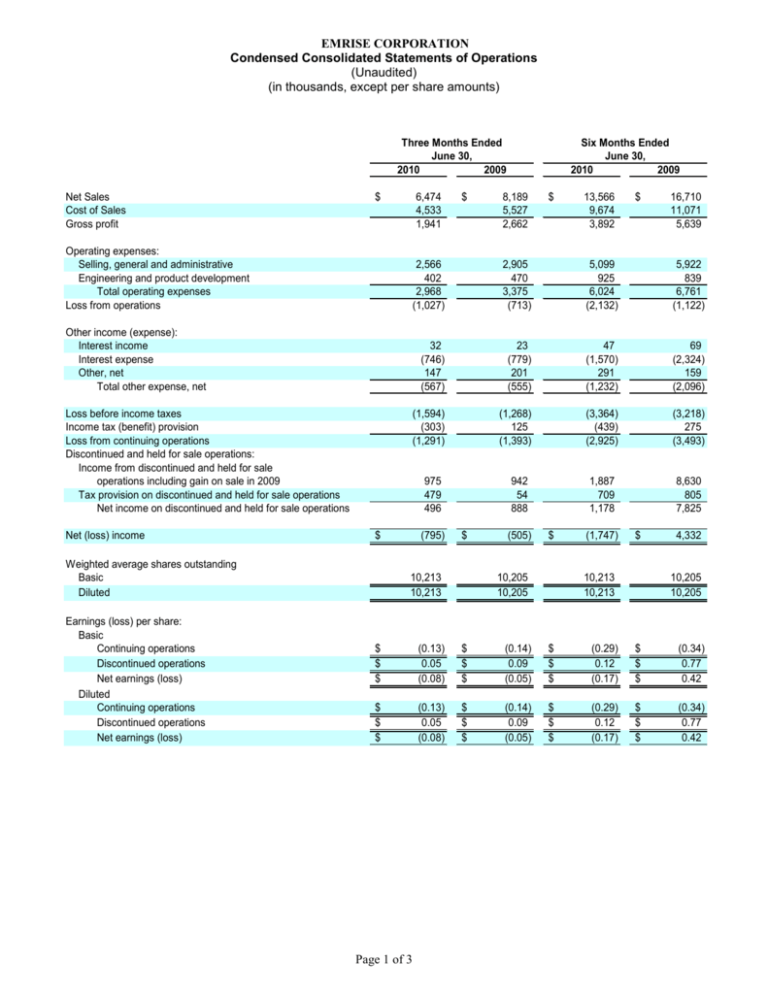

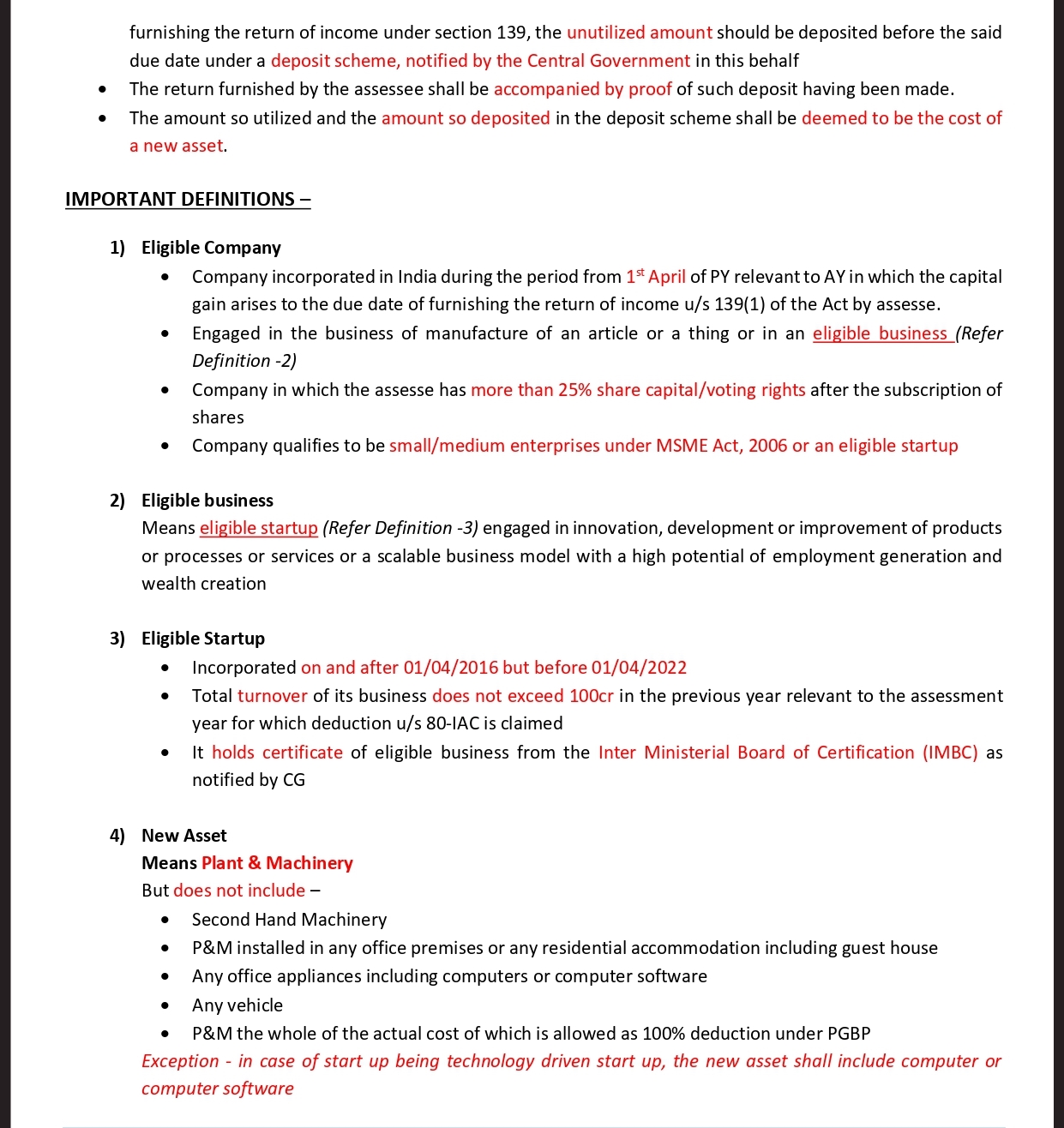

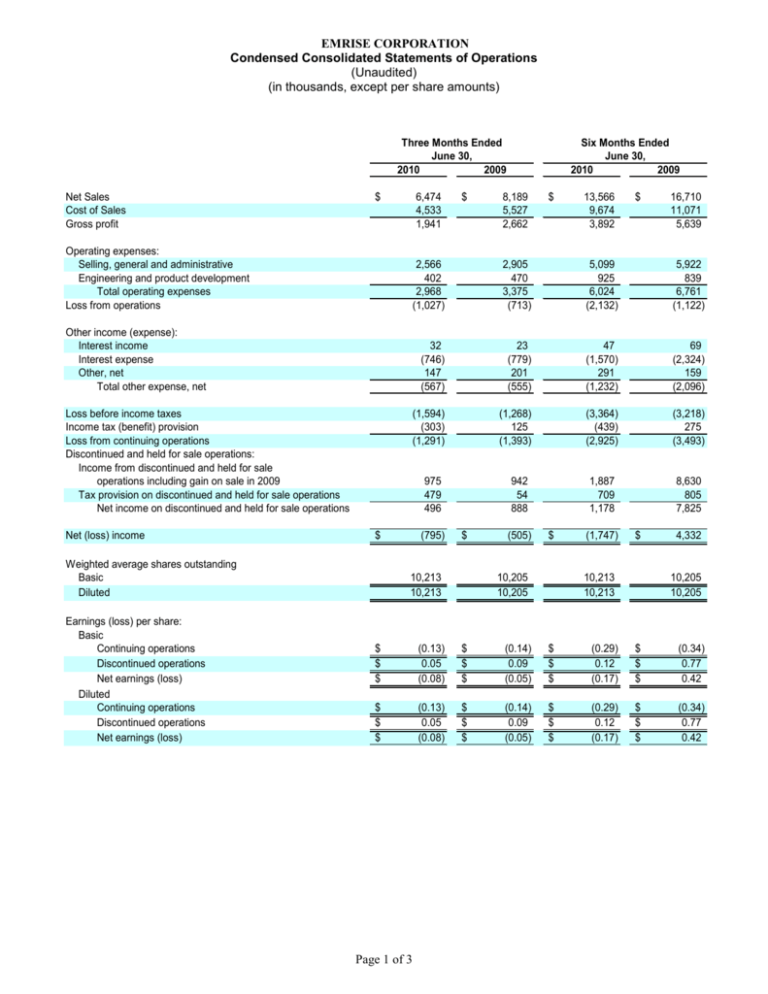

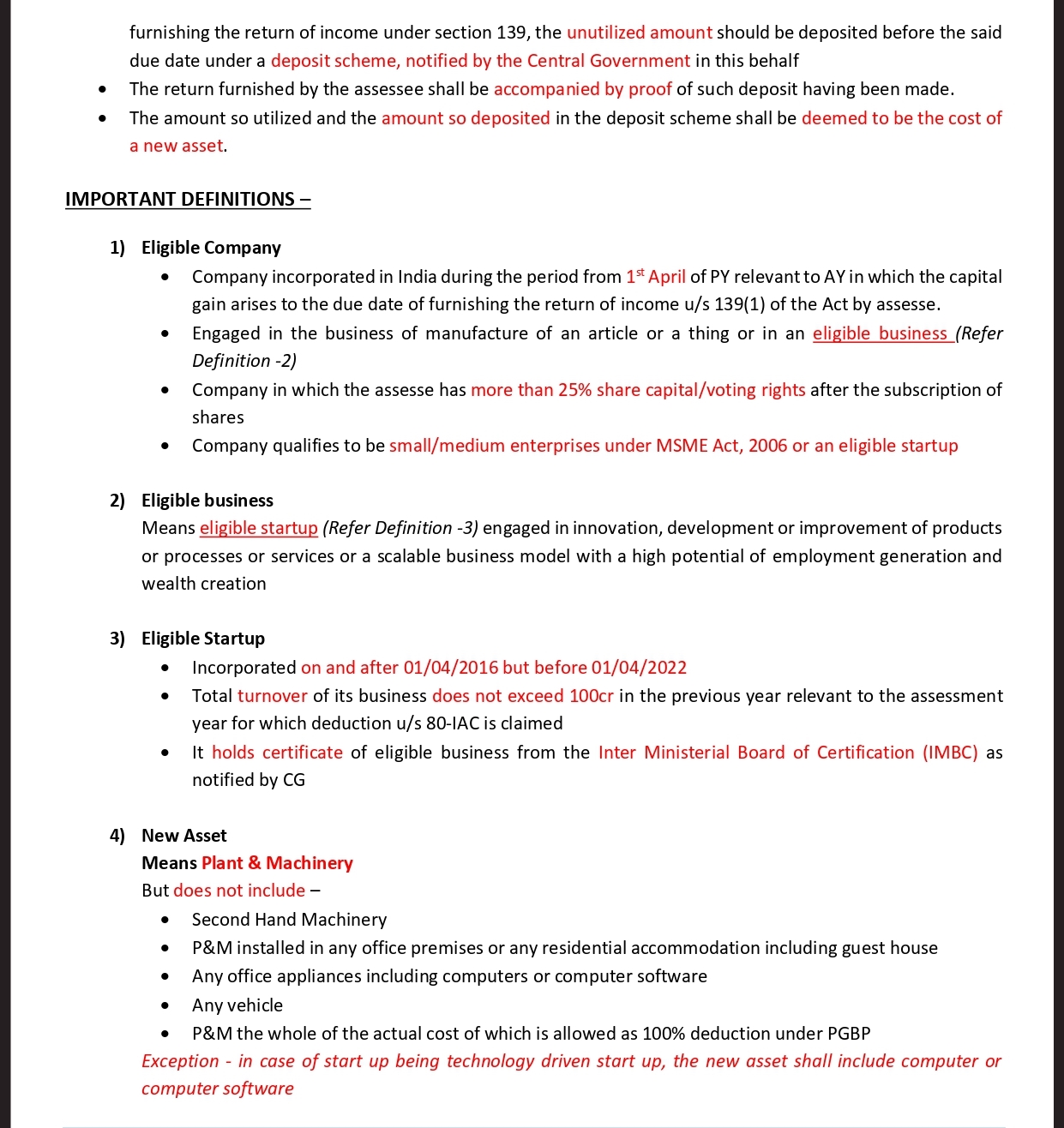

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

https://carajput.com/blog/wp-content/uploads/2022/04/INCOME-TAX-BENEFIT-ON-INVESTMENT-IN-STARTUPS-Section-54GB-1-885x1024.jpg

From April 1 2019 March 31 2022 a total of Rs 10 000 crore would be spent on FAME India Phase II Section 80EEB allows a deduction for the interest paid on the loan taken for the purchase of electric vehicles Know about its Even a new section was introduced to the Income Tax Act Section 80EEB to accommodate EVs The new section aims at providing tax benefits to taxpayers who invest in EVs Here is all that you need to know about the new section Who are eligible for Section 80EEB The section is exclusively available for individuals and not companies

Explore the benefits of Section 80EEB providing a deduction for interest paid on loans for Electric Vehicles EVs Understand the eligibility criteria quantum of deduction and conditions for availing this tax benefit To achieve this the government launched the Electric Mobility Promotion Scheme EMPS 2024 to promote electric mobility in India and boost the EV manufacturing eco system This article provides detailed insights about the Electric Mobility Promotion Scheme its aim purpose and more

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

https://carajput.com/blog/wp-content/uploads/2022/04/INCOME-TAX-BENEFIT-ON-INVESTMENT-IN-STARTUPS-Section-54GB-2.jpg

Know Income Tax Benefit On Buying Two Wheeler And Four Wheeler Electric

https://i0.wp.com/facelesscompliance.com/wp-content/uploads/2022/11/electric-bike-ge0bcda581_1280.jpg?fit=1200%2C675&ssl=1

https://taxguru.in/income-tax/purchase-electric...

Tax Benefit MOST IMPORTANT THING You get a deduction of Rs 1 50 000 under section 80EEB on the interest paid on loan taken to buy Electric vehicles Low GST rate The government has reduced the rate of EVs from 12 to 5

https://auto.hindustantimes.com/auto/electric...

EV buyers can claim up to 1 5 lakh income tax deduction on the interest paid for vehicle loans under section 80EEB of the IT Act As the current financial year is nearing its end

Electric Scooter Tax Benefit In Lichfield Segway GT1 Best Electric

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Section 80EEB Income Tax Benefit On Purchase Of Electric Vehicle

Electric Scooter Health Benefits In Lichfield Okai Neon Pro

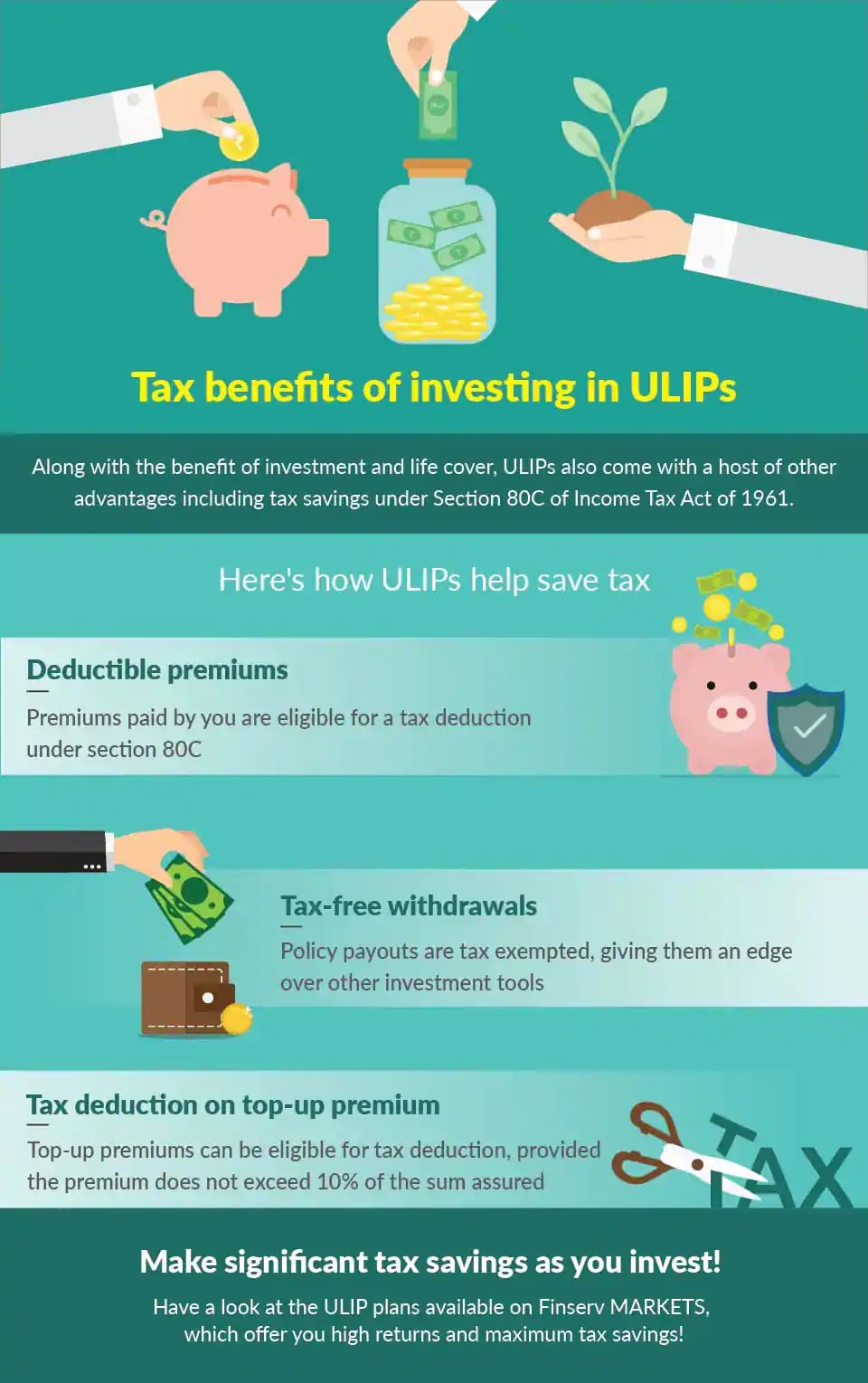

Know Everything About The Tax Benefits Of ULIPs

You Can Claim Income Tax Benefit On Interest For Home Loan Taken From

You Can Claim Income Tax Benefit On Interest For Home Loan Taken From

Section 80EEB Of Income Tax Act Deduction Tax Benefits

Electric Scooter Health Benefits In Exeter Swagtron Electric Scooter

Income Tax Of Lakhs Of Rupees Can Be Saved By Buying An Electric Vehicle

Income Tax Benefit On Electric Scooter - Only Electric Vehicles EVs defined under Section 80EEB are eligible for deduction The deduction is available only in respect of loans obtained from Banks or Non Banking Financial Companies NBFCs The loan should be sanctioned between the period from April 1 2019 to March 31 2023