Income Tax Benefits For Solar Power Generation The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before

Income Tax Benefits For Solar Power Generation

Income Tax Benefits For Solar Power Generation

https://uploads-ssl.webflow.com/63f3057cb222cb5f4d2ef33e/63f84f3998df86aa3f2b65a1_post05.webp

Tax Benefits Of Solar Energy

https://handymantips.org/wp-content/uploads/2021/03/Tax-Benefits-of-Solar-Energy-768x512.jpg

SUNCHEES Off Grid Solar Power Generation System Solar Energy System

https://www.sunchees.com/uploadfile/2022/03/02/202203021606491835.jpg

India encourages income tax exemption for solar power projects like Section 80 IA of the Income Tax Act 1961 Accelerated Depreciation AD and GST exemptions By Section 80IA of the Income Tax Act provides tax benefits to businesses that operate in infrastructure power telecommunication and other specified sectors This provision offers tax

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of The federal solar tax credit is a dollar for dollar income tax credit equal to 30 of solar installation costs Homeowners earn an average solar tax credit of 6 000 The 30 solar tax credit is available until 2032 before reducing to 26 in

Download Income Tax Benefits For Solar Power Generation

More picture related to Income Tax Benefits For Solar Power Generation

Aerial View Of Solar Power Plant On Green Field Solar Panels System

https://static.vecteezy.com/system/resources/thumbnails/011/393/393/original/aerial-view-of-solar-power-plant-on-green-field-solar-panels-system-for-solar-power-generation-green-energy-for-sustainable-development-to-prevent-climate-change-and-global-warming-to-protect-earth-free-video.jpg

Maximizing Tax Benefits For Parents TMT Insurance

https://www.tmtinsurance.com/wp-content/uploads/2023/03/Child-tax-credit-1.jpg

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

https://s3.amazonaws.com/solarassets/wp-content/uploads/2022/08/solar-tax-credit-before-and-after-inflation-reduction-act-1024x1013.jpg

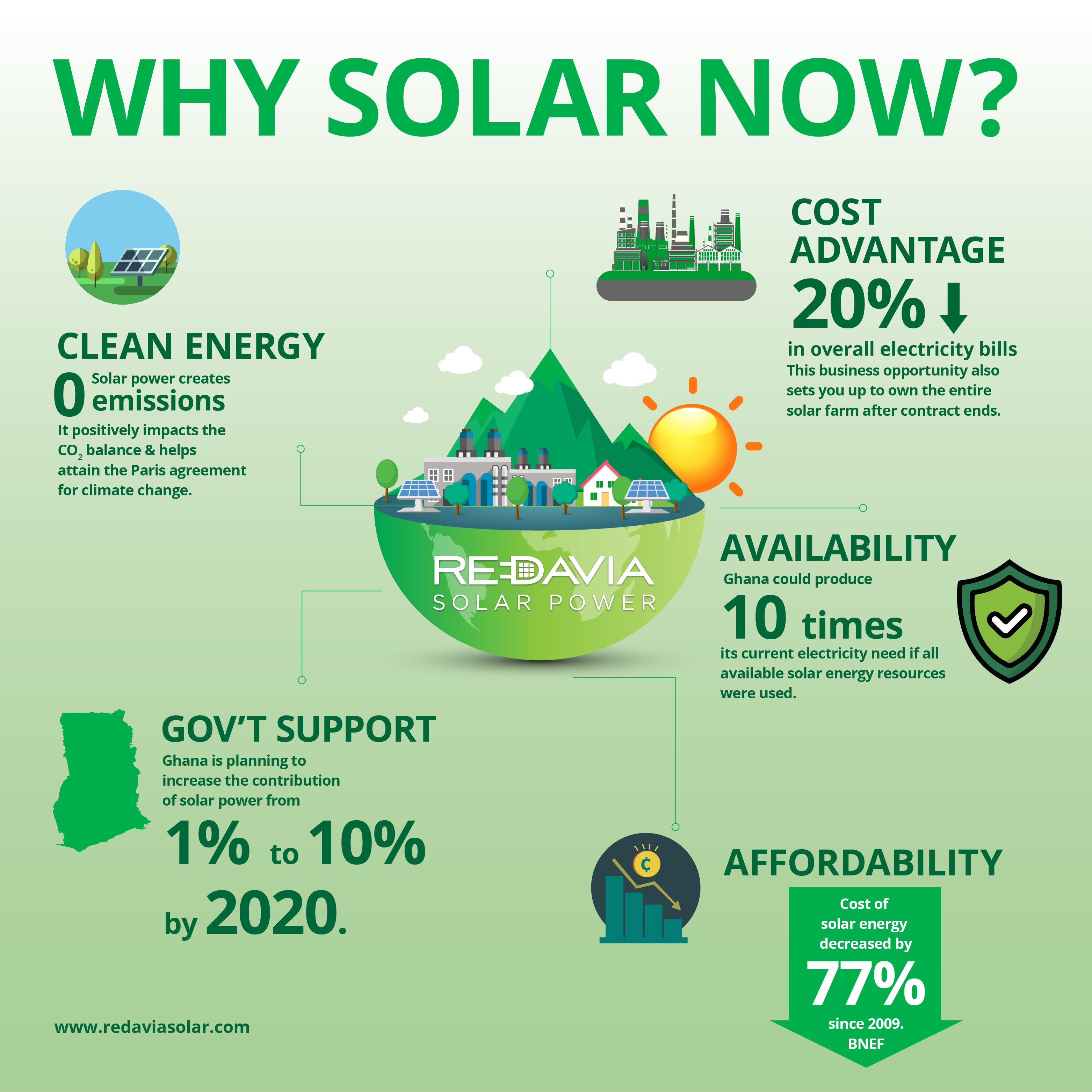

Assessee has the option to claim deduction for 10 consecutive assessment years out of 15 years beginning from the year in which the undertaking or the enterprise develops or Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make

For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and We explain how businesses can leverage this tax benefit to reduce costs and promote sustainable energy solutions Understand the impact of Solar Depreciation on your

What Are The Income Tax Benefits For Women

https://life.futuregenerali.in/media/u3edpcwp/tax-saving-for-women.jpg

Go Solar Now REDAVIA Solar Power Ghana

https://www.redaviasolar.com/wp-content/uploads/REDAVIA-infographic-design-Ghana-181207-v2.png

https://www.nerdwallet.com/article/tax…

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

https://www.energy.gov/sites/default/files/2021/02...

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of

Income Tax Benefits In Budget And Comparison With Old Regime By KK

What Are The Income Tax Benefits For Women

Agrivoltaics Is The Combination Of Farming And Solar Power Generation

Why Have Prices For Solar Increased Best Solar Power Services Australia

Single Phase Solar Power Inverter 20KW Buy Product On Foshan SNAT

How To Claim Income Tax Benefits On Home Loans In FY23 Mint

How To Claim Income Tax Benefits On Home Loans In FY23 Mint

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

Power Generation solar Power Generation And Pollution free Power

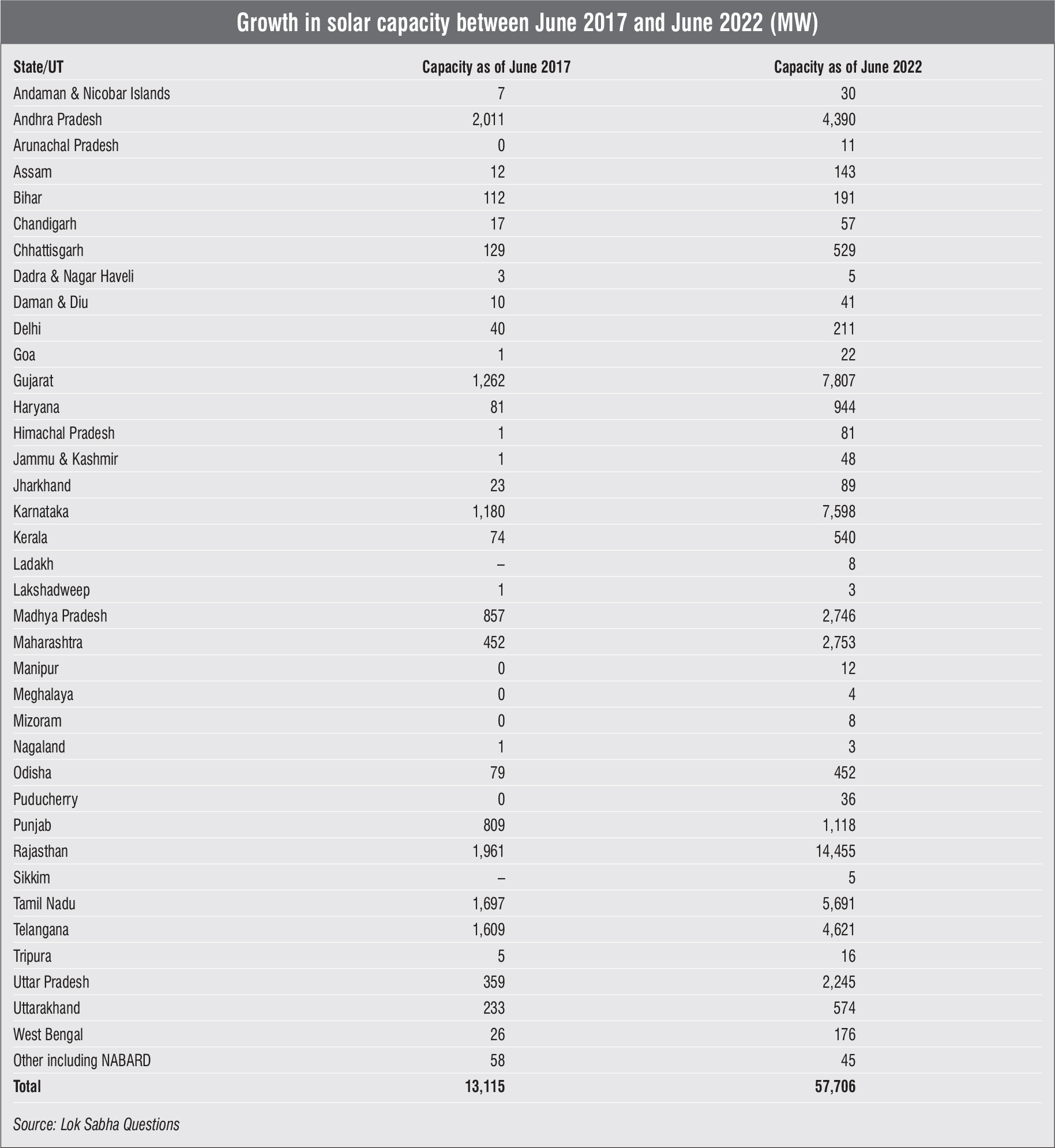

Solar Power Statistics Progress Over Five Years Renewable Watch

Income Tax Benefits For Solar Power Generation - India encourages income tax exemption for solar power projects like Section 80 IA of the Income Tax Act 1961 Accelerated Depreciation AD and GST exemptions By