Income Tax Deduction For Cancer Patients Taxpayers who have dependents with specified diseases write to us inquiring about how to get a certificate for claiming deduction under section 80DDB on their income tax return This has been discussed below Details of deduction allowed under section 80DDB

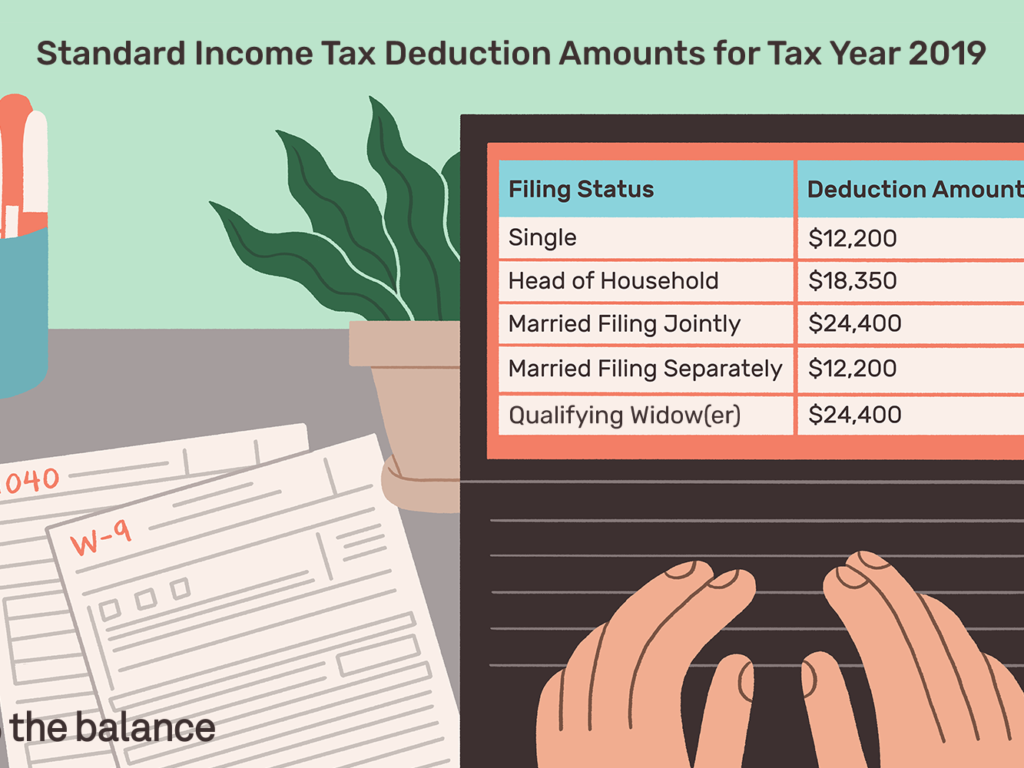

Deduction under section 80DDB can be claimed by an individual or a HUF who is resident in India Deduction is available in respect of amount actually paid by the taxpayer on medical treatment of specified disease or ailment prescribed by the Board see rule 11DD for prescribed disease or ailment If you are able to itemize your tax deductions your medical costs must exceed 7 5 of Adjusted Gross Income AGI and in 2019 the threshold goes back to 10 AGI In 2018 someone whose AGI is 50 000 would be able to deduct out of pocket medical expenses if they exceed 3 750 50 000 x 7 5

Income Tax Deduction For Cancer Patients

Income Tax Deduction For Cancer Patients

https://www.copewithcancer.org/wp-content/uploads/2018/05/Capture2.gif

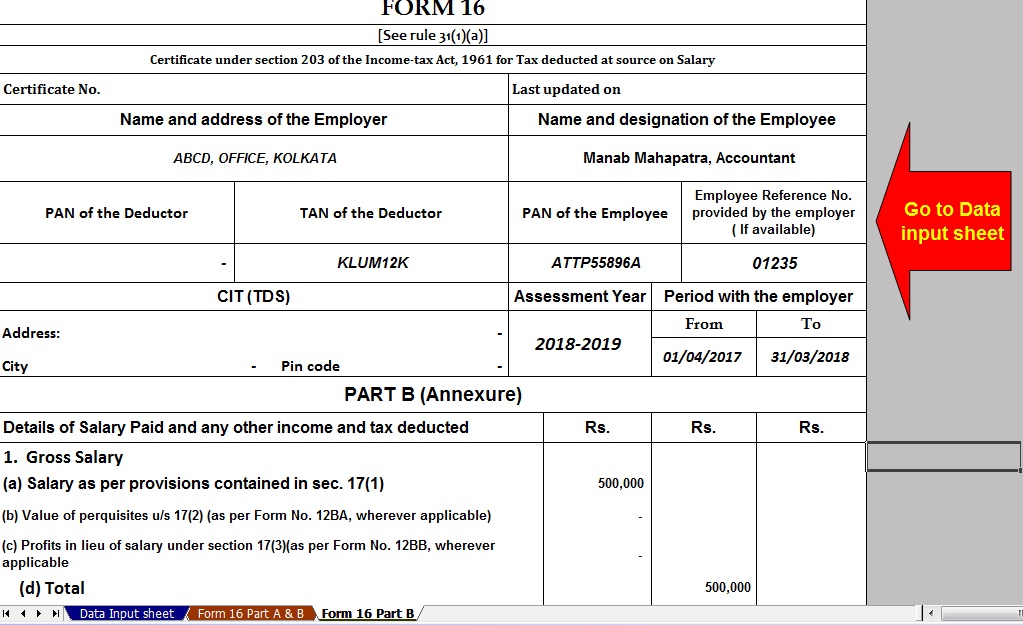

Income Tax Deduction For Medical Treatment With Automated TDS On

https://tdstax.files.wordpress.com/2018/01/1a1d4-form2b162bpart2bb.jpg

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-7.jpg

You may be eligible for tax breaks if diagnosed with cancer Find out these benefits and how they could help you pay fewer taxes as you manage cancer treatment In this article we discuss various U S based resources and regulations Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure

The cost involved in the travel during cancer treatment medical procedures might be tax deductible There is a comprehensive list of costs which would qualify for a tax deduction and this list would include health insurance premiums which are not paid in Under Section 80DDB of the Income Tax Act 1961 an individual can claim tax deduction for medical treatment of certain specified ailments availed for self or a dependent The dependent can be spouse parent or sibling

Download Income Tax Deduction For Cancer Patients

More picture related to Income Tax Deduction For Cancer Patients

Health Insurance Deduction U S 80D Income Tax Deductions Exemptions

https://www.careinsurance.com/kitextproxy/cms-careinsurance-com/upload_master/cmscatpages/upload/36a9da0fb58fbe170af301b399b62e73.png

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

https://image.isu.pub/191218132338-c9941d8aadc7169747a4f0bb5ba413a5/jpg/page_1.jpg

The deduction under section 80DDB can be claimed irrespective of whether you have paid a premium for a health insurance policy or not The deduction is available on the medical expenses incurred on specified diseases Section 80DDB of the Income Tax Act of 1961 allows tax deductions to taxpayers on the treatment of certain specified diseases According to Section 80DDB these taxpayers are individuals and Hindu Undivided Families HUFs

Section 80DDB of the Income Tax Act Section 80DDB provides a deduction for medical treatment of specified diseases This deduction can only be claimed if an individual or HUF has incurred expenses towards the maintenance and care of self or dependent family members Any critical illness such as Cancer comes with a high treatment cost Find out how you can claim tax deductions for such expenses under section 80DDB of the Income Tax Act

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

https://wealthtechspeaks.in/wp-content/uploads/2022/02/Income-Tax-Deductions.png

https://www.roojai.com/wp-content/uploads/2022/01/cancer-insurance-tax-deduction-cover.jpg

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Taxpayers who have dependents with specified diseases write to us inquiring about how to get a certificate for claiming deduction under section 80DDB on their income tax return This has been discussed below Details of deduction allowed under section 80DDB

https://taxguru.in/income-tax/deduction-section-80...

Deduction under section 80DDB can be claimed by an individual or a HUF who is resident in India Deduction is available in respect of amount actually paid by the taxpayer on medical treatment of specified disease or ailment prescribed by the Board see rule 11DD for prescribed disease or ailment

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

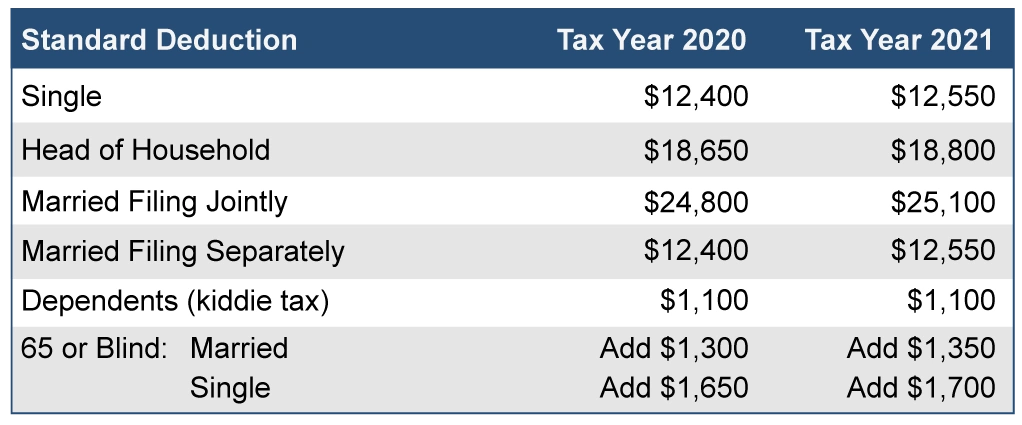

What Is The Standard Deduction For 2021

Standard Income Tax Deduction For 2020 Standard Deduction 2021

The Tax Deductions For Dementia Patients In The United States Excel

Tax Deductions For Cancer Patients

Tax Deductions For Cancer Patients

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Deduction For Expenses In Relation To The Cost Of Personal Protective

2565

Income Tax Deduction For Cancer Patients - You may be eligible for tax breaks if diagnosed with cancer Find out these benefits and how they could help you pay fewer taxes as you manage cancer treatment In this article we discuss various U S based resources and regulations