Income Tax Deduction For Central Government Employees Section 80CCD 2 allows a salaried individual to claim the following deduction Central Government or State Government Employer Up

As per section 15 of the Act the following incomes are chargeable to income tax under the head Salaries a any salary due from an employer or a former employer to an assessee in the previous year Intimated The present Circular contains the rates of deduction of Income tax from the payment of income chargeable under the head Salaries during the financial year 2022

Income Tax Deduction For Central Government Employees

Income Tax Deduction For Central Government Employees

https://newspaperads.ads2publish.com/wp-content/uploads/2018/10/income-tax-department-central-board-of-direct-taxes-ad-times-of-india-delhi-26-10-2018.png

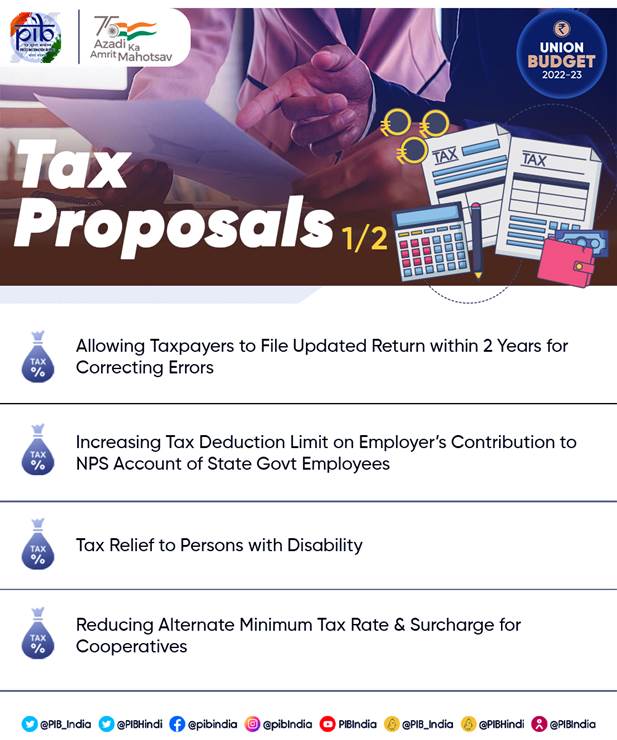

Tax Deduction Limit Increased To 14 On Employers Contribution To NPS

https://www.igecorner.com/wp-content/uploads/2022/02/2.png

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

If the Employer is a Central Government Entity A deduction of 14 of employee s salary Basic Dearness Allowance can be claimed as a deduction For all other Employers A maximum of 10 of salary Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such

Further the employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80CCD 2 of the Income Tax Act 14 of salary for government employees This rebate is over and When filing your income tax returns as a salaried or self employed individual you can claim up to 1 50 000 jointly under Section 80CCD 1 for contributions made to NPS or APY individually and

Download Income Tax Deduction For Central Government Employees

More picture related to Income Tax Deduction For Central Government Employees

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

How Does Tax Deduction Work In India Tax Walls

https://img.etimg.com/photo/msid-62914500/resident_gti_25l_salary-std-ded.jpg

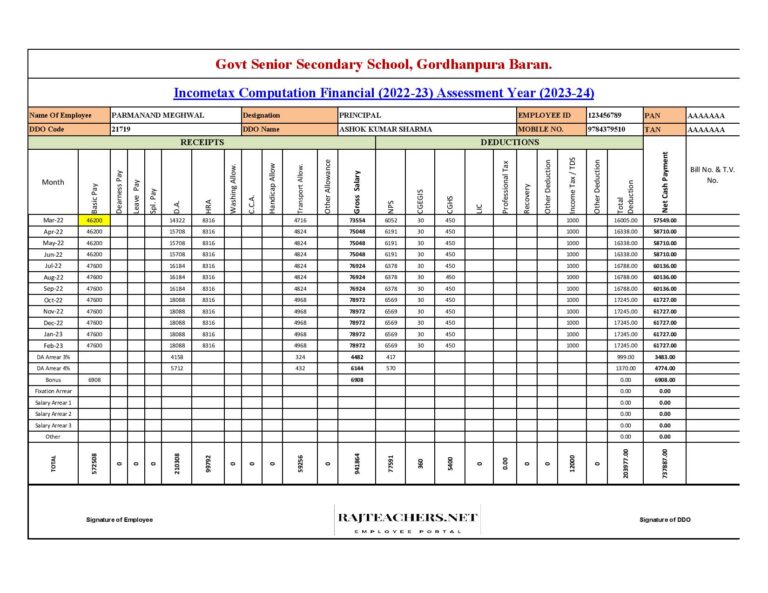

Income Tax Calculation For Central Government Employees

https://rajteachers.net/wp-content/uploads/2022/12/Income-Tax-Calculation-for-Central-Government-Employees-768x593.jpg

EIS is employee information system deployed centrally for all central government employees It covers Pay bill Income tax and GPF modules For claiming income tax This deduction basically availed by the individuals being as a salaried employee or as self employed against the contribution made towards Pension Funds notified by Central Government such as

Employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80CCD 2 of the Income Tax Act 14 of salary for central government employees and 10 for Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn

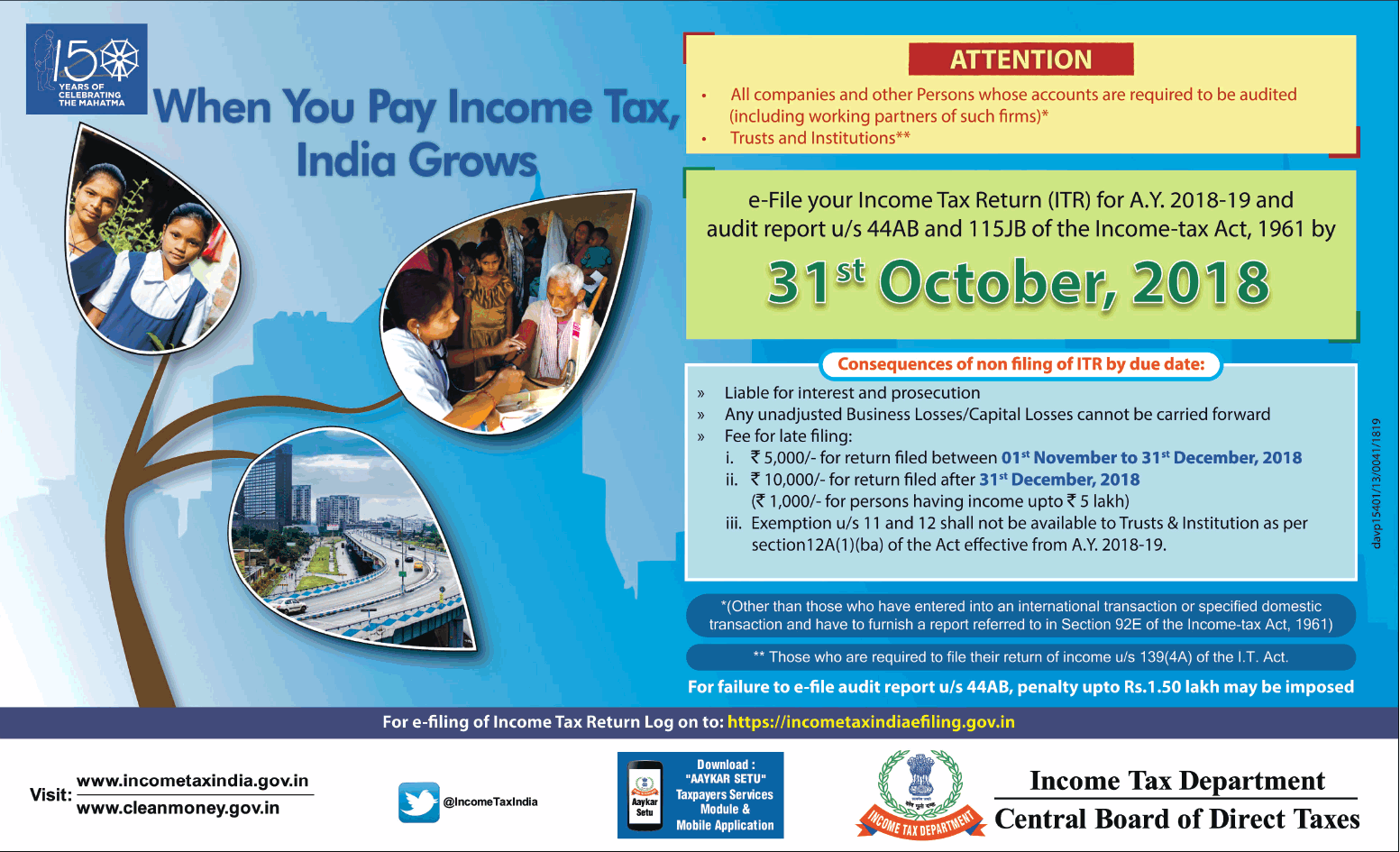

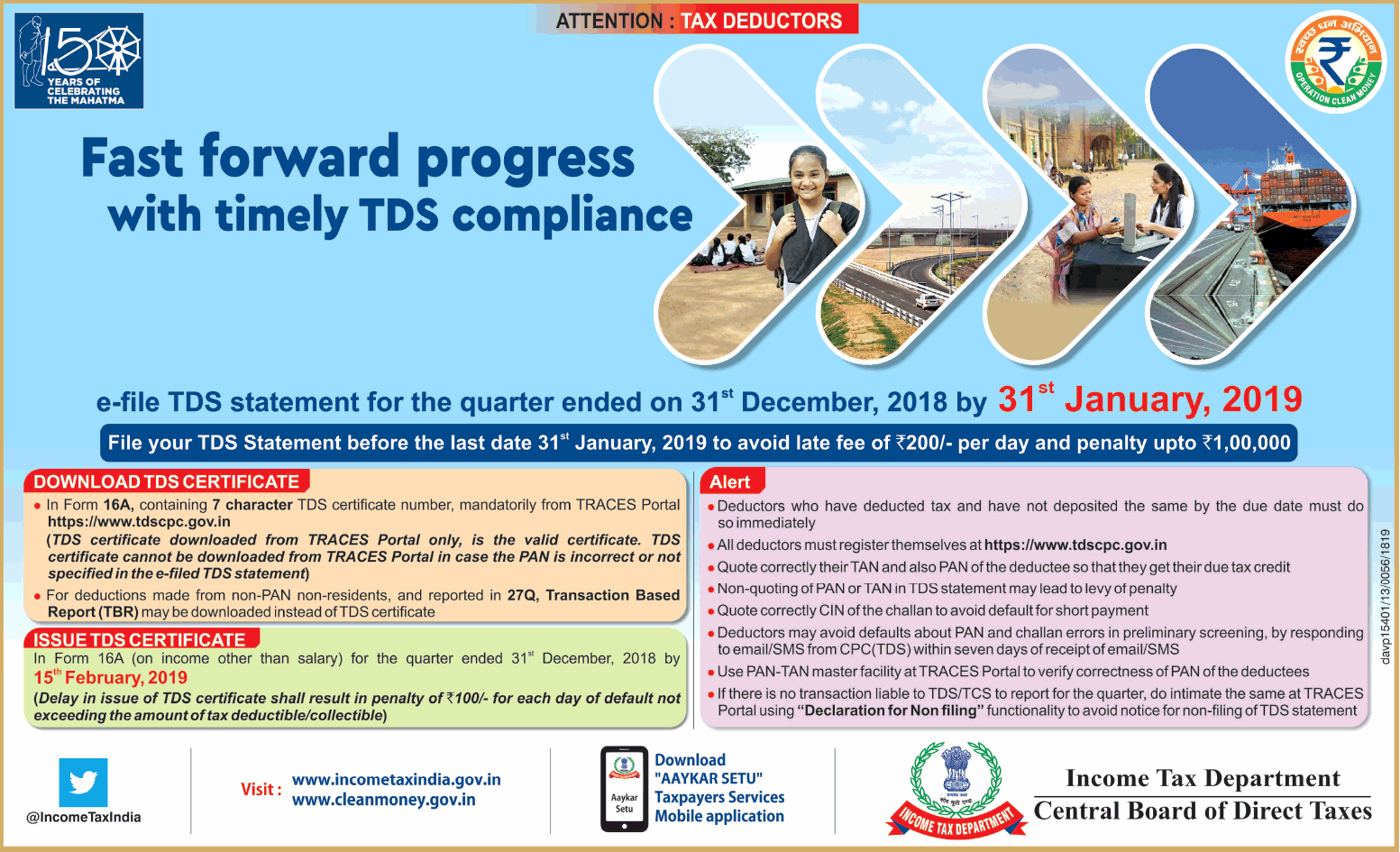

Income Tax Department Central Board Of Direct Taxes Ad Advert Gallery

https://newspaperads.ads2publish.com/wp-content/uploads/2018/01/income-tax-department-central-board-of-direct-taxes-ad-times-of-india-delhi-25-01-2018.png

Advance Income Tax Deduction For Salaried Persons West Bengal

https://i.ytimg.com/vi/g_mWWu14OxU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgSyhAMA8=&rs=AOn4CLA8-TBaOdHu2iLtozHwHyJNEfKAAA

https://cleartax.in/s/section-80ccd

Section 80CCD 2 allows a salaried individual to claim the following deduction Central Government or State Government Employer Up

https://igecorner.com/income-tax

As per section 15 of the Act the following incomes are chargeable to income tax under the head Salaries a any salary due from an employer or a former employer to an assessee in the previous year

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Income Tax Department Central Board Of Direct Taxes Ad Advert Gallery

Income Tax Department Central Board Of Direct Taxes Ad Advert Gallery

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

The 6 Best Tax Deductions For 2020 The Motley Fool

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

Govt Announced Seven Slabs For Salaried Class In Budget 2022 23

Tax Deduction Limit Increased To 14 On Employers Contribution To NPS

How To Calculate Income Tax On Salary With Example

Income Tax Deduction For Central Government Employees - Income tax Act allows three deductions from the salary income i e Standard Deduction Deduction for Entertainment Allowance and Deduction for