Income Tax Deduction For Donation To Political Parties Key Takeaways Donations made to political organizations or political candidates aren t tax deductible Non deductible contributions include donations to a political party a campaign committee a

Section 80GGC of the Income Tax Act provides tax deductions for contributions made to political parties The amount of deduction that can be claimed depends on the mode of payment If the Taxpayers can claim 100 deduction for donations to a registered electoral trust or political party This is subject to total deduction not exceeding the individual s

Income Tax Deduction For Donation To Political Parties

Income Tax Deduction For Donation To Political Parties

https://financepost.in/wp-content/uploads/2022/05/donation-to-political-party.jpg

Donation To Political Parties Claim Tax Deduction Under Section 80GGC

https://ebizfiling.com/wp-content/uploads/2023/05/Section-80GGC-Donation-of-Political-Parties.png

How To Maximize Your Charity Tax Deductible Donation WealthFit

https://wealthfit-staging.cdn.prismic.io/wealthfit-staging/412c54c56299372c10093120ad811293a9e703bd_02-maximize-charitable-deductions.jpg

What is Section 80GGC Section 80GGC provides for tax deductions with respect to donations made by taxpayers towards political parties or any electoral trusts Unlike charitable donations political donations are used to influence legislation or support the election of a political candidate This is why political donations aren t tax deductible The IRS has strict tax

Section 80GGC of the Income Tax Act 1961 provides a tax deduction to individuals for donations made to registered political parties or electoral trusts registered under the Representation of the People Act Section 80GGC of income tax act allows an Individual tax payer to claim deduction against donation paid to political party or electoral trust in India This donation can help the Individuals to save income tax

Download Income Tax Deduction For Donation To Political Parties

More picture related to Income Tax Deduction For Donation To Political Parties

80GGC Deduction On Donation To Political Parties YouTube

https://i.ytimg.com/vi/gs9CIXanPb8/maxresdefault.jpg

Section 80G Deduction For Donations To Charitable Institutions Tax2win

https://blog.tax2win.in/wp-content/uploads/2019/03/80G-deduction-in-respect-of-donation-to-funds-charitable-institutions-1024x954.jpg

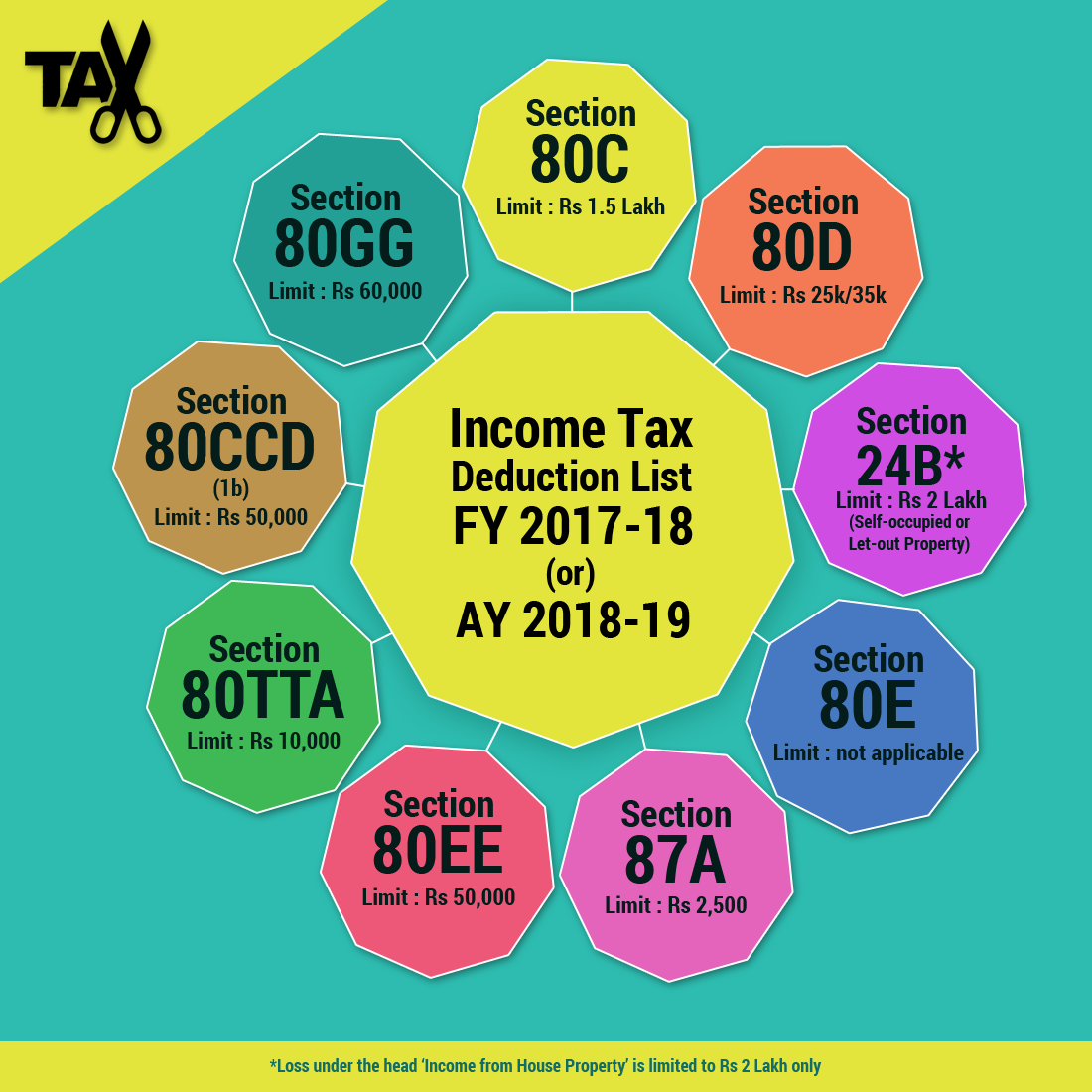

Income Tax Deductions For The FY 2019 20 ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2017/12/income-tax-deduction-list-2017-18.png

Political parties in India need to be registered under the Representation of the People Act 1951 to participate in elections Income tax provisions under Section Section 80GGB of the Income Tax Act 1961 deals in any Indian company or enterprise that donates to a political party or an electoral trust registered in India can

Deduction Under Section 80GGC Individuals who contribute to any political party or electoral trust may avail tax deduction up to 100 of their contribution to that Both individuals and companies can claim deduction on 100 of the amount donated by them to a political party under Section 80GGC and 80GGB respectively The

Section 80GGC Donation To Political Parties By Individuals

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2022/06/section-80ggc-image.jpg

Contribution Or Donation To Political Parties Make My Filing

https://www.makemyfiling.com/Learning-Center/wp-content/uploads/2019/10/images-2-730x410.jpg

https://turbotax.intuit.com/tax-tips/char…

Key Takeaways Donations made to political organizations or political candidates aren t tax deductible Non deductible contributions include donations to a political party a campaign committee a

https://taxguru.in/income-tax/contributio…

Section 80GGC of the Income Tax Act provides tax deductions for contributions made to political parties The amount of deduction that can be claimed depends on the mode of payment If the

80G

Section 80GGC Donation To Political Parties By Individuals

Chapter VI A 80G Deduction For Donation To Charitable Institution

Chapter VI A 80G Deduction For Donation To Charitable Institution

Capping Cash Donation To Political Parties At Rs 2000 An Appreciative

Donation To Political Parties YouTube

Donation To Political Parties YouTube

Free Images Writing Receipt Giving Charity Label Brand Document

FREE 9 Donation Receipt Templates In Google Docs Google Sheets

Tax Deductible Donation Letter Templates At Allbusinesstemplates

Income Tax Deduction For Donation To Political Parties - Section 80GGB Contribution done by an Indian Company Political Contribution In computing the total income of an assessee being an Indian company