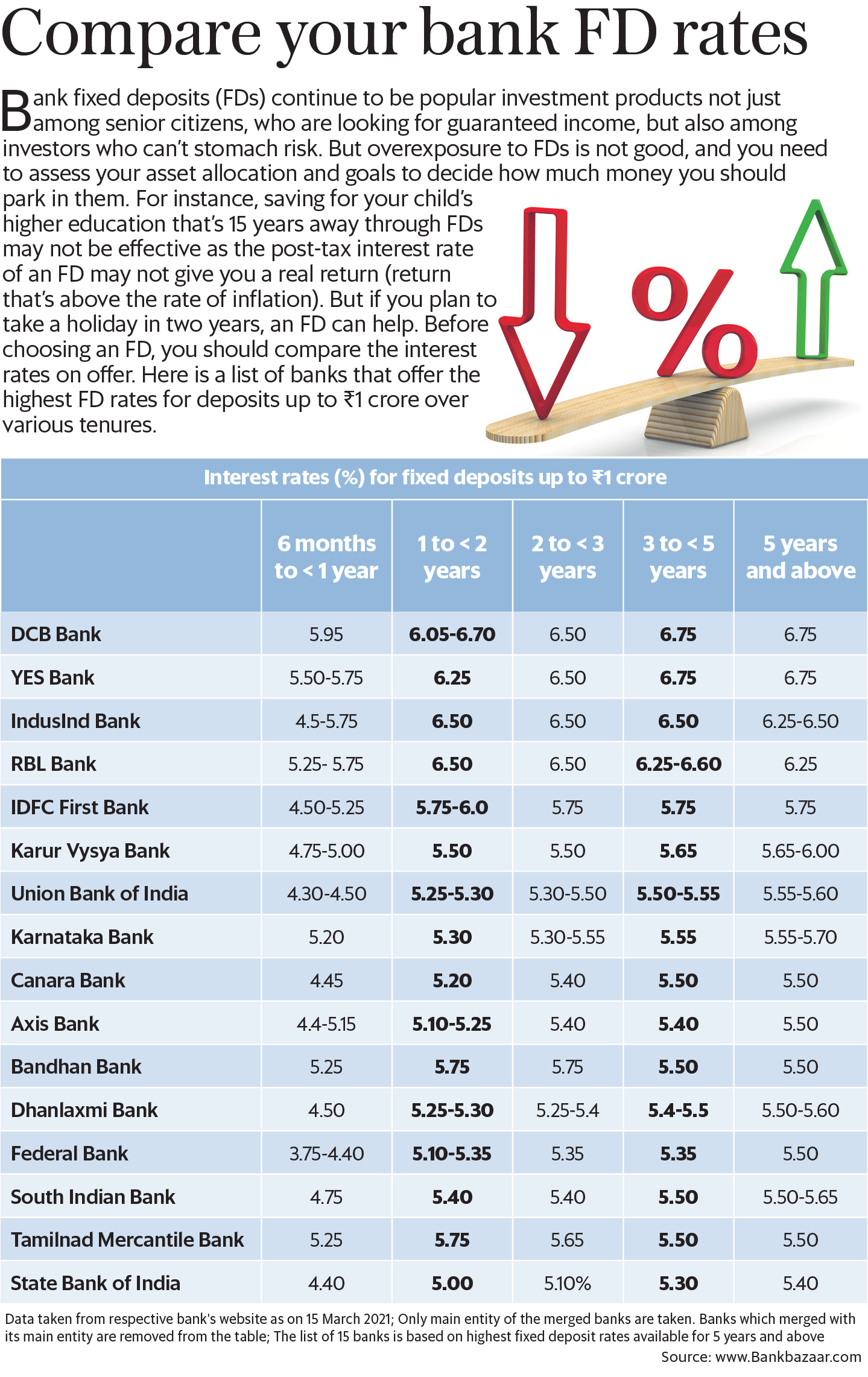

Income Tax Deduction For Fd Interest The interest earned on a Fixed Deposit FD is subject to tax based on the income tax slab you fall into There is TDS Tax Deducted at Source on FD interest along with any applicable surcharge or cess For example if your total annual income is above Rs 10 lakh you fall into a 30 tax slab

Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post office There is no deduction for interest earned from fixed deposits an recurring deposits Fixed deposit accounts offer a variety of options including tax saving FDs with specific benefits like income tax deduction under Section 80C Tax saving FDs have an interest rate ranging from 5 5 to 7 75 and a lock in period of 5 years

Income Tax Deduction For Fd Interest

Income Tax Deduction For Fd Interest

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

IDR 2020 Interest Rates Standard Deductions And Income Tax Brackets

https://www.northscottpress.com/uploads/original/20191106-134728-tax rate chart.jpg

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

Tax is deducted in the form of Tax Deduction at Source TDS by the bank for interest income from fixed deposits The rate of tax deduction at source is 10 if the income from interest for each year exceeds Rs 40 000 Section 80TTA of Income Tax Act offers deduction on interest income earned from savings bank deposit of up to Rs 10 000 for FY 2023 24 AY 2024 25

If you are an Indian resident and your interest income from FD exceeds Rs 10 000 in a financial year you can claim a deduction for the TDS paid while filing your Income Tax Return You can do this by filing Form 15G or Form 15H with your bank or financial institution This guide explores how interest in Fixed Deposits is taxed in India Learn the 40 000 limit TDS deduction ways to potentially avoid tax on FD interest income

Download Income Tax Deduction For Fd Interest

More picture related to Income Tax Deduction For Fd Interest

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

https://wealthtechspeaks.in/wp-content/uploads/2022/02/Income-Tax-Deductions.png

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

https://cdn1.npcdn.net/image/16461036862a2b9367f2ff16eb9b748ff28b5b7ef8.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

How Does Tax Deduction Work In India Tax Walls

https://img.etimg.com/photo/msid-62914500/resident_gti_25l_salary-std-ded.jpg

The interest income earned on a fixed deposit is taxable and you have to pay taxes as per the applicable tax rates under the IT Act for the said financial year Moreover banks deducts tax at source TDS on interest paid on fixed deposits when interest income exceeds Rs 40 000 Rs 50 000 for senior citizens in any given financial year for Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving fixed deposit scheme offered by different banks

Interest income from FDs is taxable and banks follow Tax Deduction at Source TDS for this purpose Pay attention to the deadline for tax payments and consider Advance Tax if the total tax liabilities exceed Rs 10 000 This article provides an overview of how to pay income tax on FD interest income earned from fixed deposits It outlines the process of calculating the taxable amount filing the income tax return and paying due taxes It also provides information on how to claim tax deductions and exemptions on fixed deposit interest income tax on FD interest

How To Avoid TDS On Interest On Fixed Deposits Bank FD Wealth18

https://wealth18.com/wp-content/uploads/2014/04/avoid-taxes.jpg

Interest Income From FD Is Eligible For Deduction U s 10AA ITAT

https://www.taxscan.in/wp-content/uploads/2023/05/Interest-Income-from-FD-is-Eligible-for-Deduction-Interest-Income-from-FD-Interest-Income-Interest-Income-FD-Deduction-ITAT-Taxscan.jpg

https://www.icicibank.com/blogs/fixed-deposits/tax...

The interest earned on a Fixed Deposit FD is subject to tax based on the income tax slab you fall into There is TDS Tax Deducted at Source on FD interest along with any applicable surcharge or cess For example if your total annual income is above Rs 10 lakh you fall into a 30 tax slab

https://cleartax.in/s/claiming-deduction-on...

Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post office There is no deduction for interest earned from fixed deposits an recurring deposits

Tax Deductions You Can Deduct What Napkin Finance

How To Avoid TDS On Interest On Fixed Deposits Bank FD Wealth18

How To Donate Real estate And Get A Tax Deduction By I Believe World

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

Recurring Deposit Interest Rates Of Major Banks May 2020 Yadnya

PDF Form 16A Tax Deduction Certificate PDF Download InstaPDF

PDF Form 16A Tax Deduction Certificate PDF Download InstaPDF

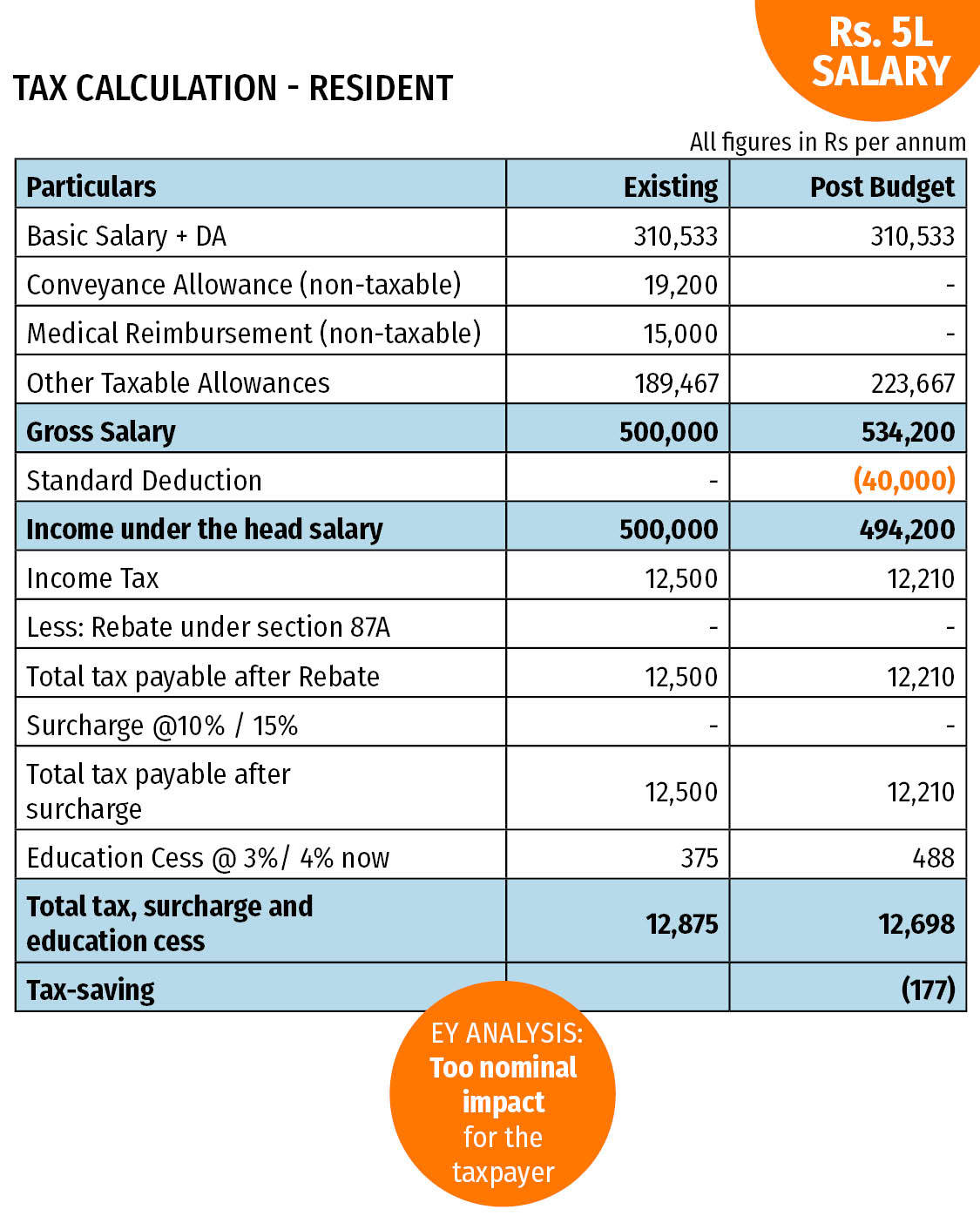

Compare Your Bank FD Rates Mint

How Does Tax Deduction Work In India Tax Walls

IRS Announces 2022 Tax Rates Standard Deduction

Income Tax Deduction For Fd Interest - Senior citizens can avail of a deduction of up to Rs 50 000 on interest income from FDs RDs and savings accounts under Section 80TTB If their total FD interest income is below Rs 50 000 no TDS will be deducted