Income Tax Deduction From Salary Every Month TDS is deducted from your salary every month as per your income tax slab Employers estimate the annual tax liability based on your projected annual income and deduct the corresponding amount in

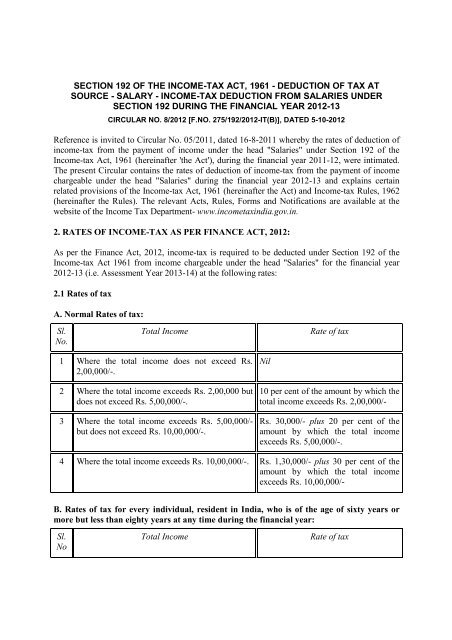

Is TDS Deducted from Your Salary Every Month How to Claim Revised TDS Return How to Check if You are Eligible for a TDS Refund What Happens If TDS Is Not As per Section 192 of the Income Tax Act 1961 TDS is deductible on salary income Depending on your net taxable salary the TDS is deducted by the employer on your behalf and deposited to the income tax department The

Income Tax Deduction From Salary Every Month

Income Tax Deduction From Salary Every Month

https://i1.wp.com/justpayroll.ph/wp-content/uploads/2017/09/Tax-Reform-2017-Salary-Tier.png?resize=597%2C318&is-pending-load=1#038;ssl=1

Pay Deduction Calculator 2021 Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/standard-deduction-for-salary-ay-2021-22-standard.jpg

Calculate Salary Allowances And Tax Deduction In Excel By Learning

https://i.pinimg.com/736x/44/ae/9c/44ae9ce35dc58909cb61b8d410ca02dd.jpg

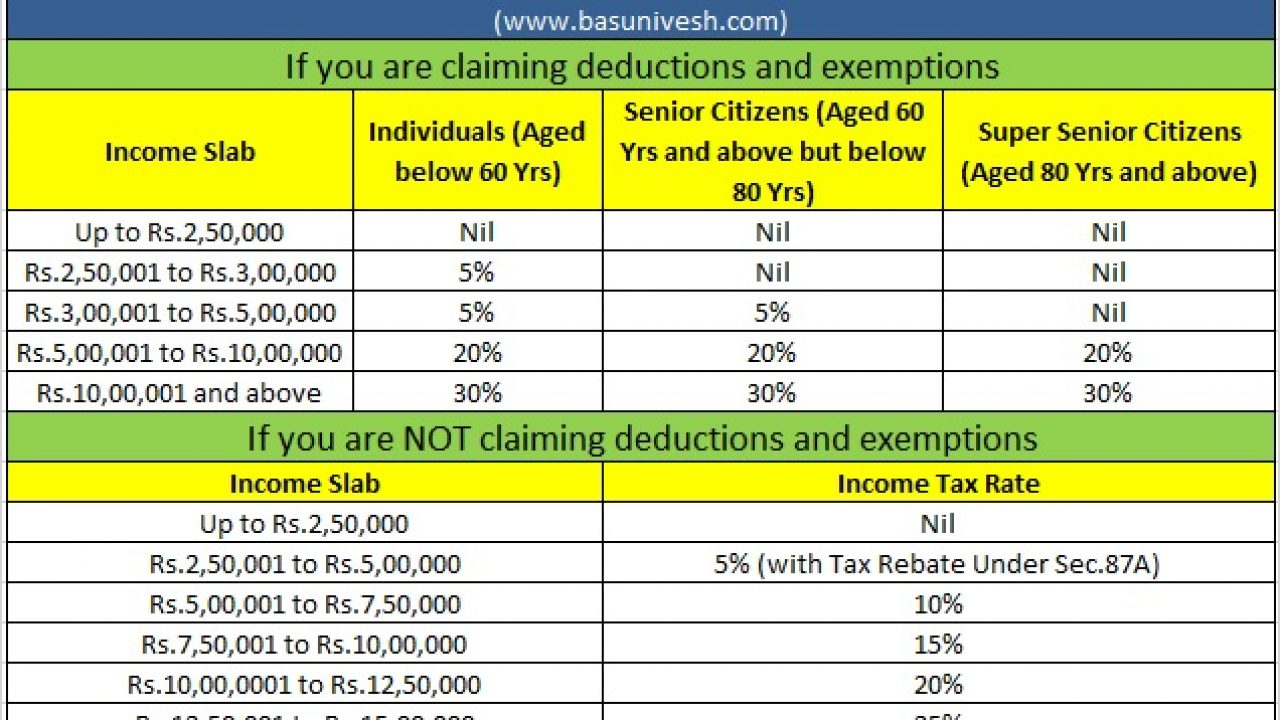

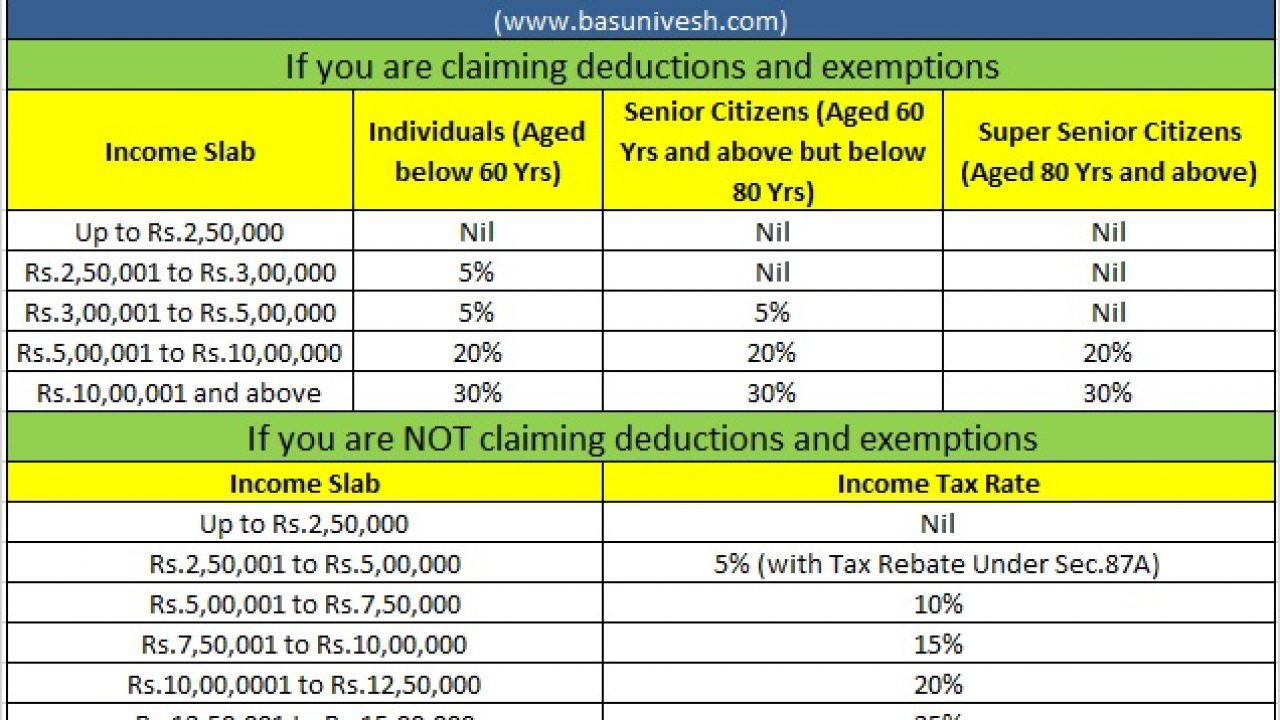

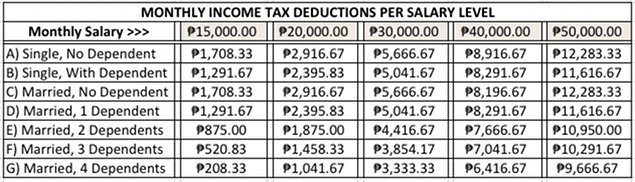

Why is income tax deducted from salary every month The income tax is deducted from your salary every month by your employer to deposit to the credit of the central government The intent is to pay tax to the income tax The following formula is used to calculate income taxes Gross Salary Deductions Taxable Income Income Tax Taxable Income x Applicable Tax Rate Tax Rebate What is the maximum non taxable income

As per current income tax laws TDS from salary income is deducted at the income tax rate applicable to income tax slabs on net taxable income of an employee From FY 2020 Use our take home pay calculator to work out how much should be landing in your bank account every month and how much goes to the taxman Simply enter your annual

Download Income Tax Deduction From Salary Every Month

More picture related to Income Tax Deduction From Salary Every Month

Income From Salary Taxes Guide Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2022/08/Salary-Slip.jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

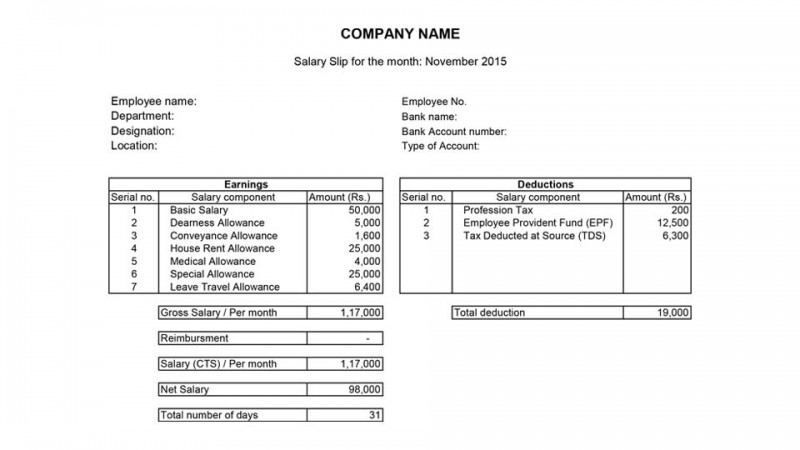

Every employer who is paying a salary to their employees must deduct tax tax deducted at source on the month s salary However unlike other incomes TDS rate on salary Is TDS deducted every month from salary Yes TDS gets deducted from your salary every month According to section 192 of the Income Tax Act 1961 TDS should be

Tax Deduction at Source is one of the primary obligations of the employer Therefore from the monthly salary of every employee who is expected to cross the required income exempted Use this interactive income tax tool with a visual breakdown to see how much of your monthly gross pay you end up with and how each deduction is allocated

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Inform Employees Of Salary Deduction Letter 4 Templates Writolay

https://writolay.com/wp-content/uploads/2021/08/46-letter-to-inform-about-salary-deduction-to-employee.png

https://www.moneycontrol.com › news › b…

TDS is deducted from your salary every month as per your income tax slab Employers estimate the annual tax liability based on your projected annual income and deduct the corresponding amount in

https://fi.money › guides › money-matters › how-to...

Is TDS Deducted from Your Salary Every Month How to Claim Revised TDS Return How to Check if You are Eligible for a TDS Refund What Happens If TDS Is Not

How Does Tax Deduction Work In India Tax Walls

Tax Deduction Letter Sign Templates Jotform

Salary Deduction Letter To Employee For Loan Dollar Keg

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

Income tax Deduction From Salaries Under Section

Decision To Increase Income Tax Deduction To Rs 5 Lakh Kalvi Kalanjiyam

Decision To Increase Income Tax Deduction To Rs 5 Lakh Kalvi Kalanjiyam

Tax Deductions On Salaries Of Employees EdZee s Net Logs

China s Income Tax Deduction Goes Digital CGTN

What Can Be In Hand Salary Also I Am Fresher So Fishbowl

Income Tax Deduction From Salary Every Month - Yes TDS on salary is deducted every month As per Section 192 the employer will deduct TDS on salary at the time of making the payment to the employee Since the employee gets a