Income Tax Rebate On Housing Loan In India Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From Web 20 mars 2023 nbsp 0183 32 A home loan provides a number of benefits upon repayment through tax deductions under the Income Tax Act of 1961 A home loan repayment consists of two parts the principal amount and the interest

Income Tax Rebate On Housing Loan In India

Income Tax Rebate On Housing Loan In India

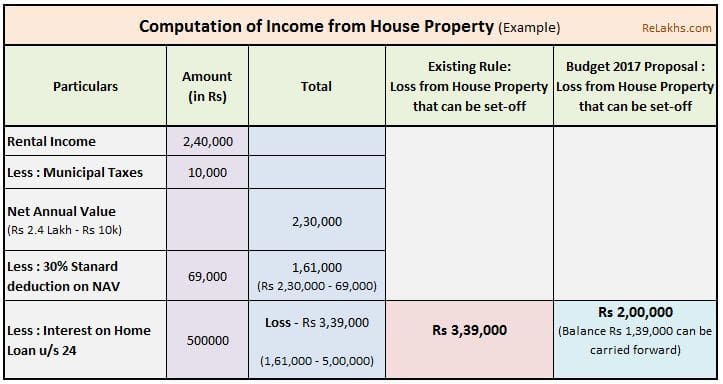

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri

Web 27 avr 2023 nbsp 0183 32 For a joint home loan both borrowers can claim deductions on the home loan interest and principal payments They can each claim deductions up to 2 lakh on Web 1 Deduction for interest on housing loan can be claimed u s 24 b under the head Income from house property 2 Deduction for principal amount of repayment can be claimed

Download Income Tax Rebate On Housing Loan In India

More picture related to Income Tax Rebate On Housing Loan In India

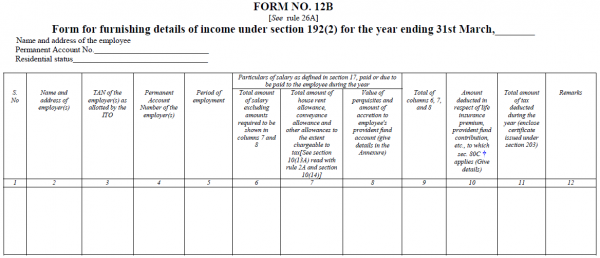

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Web 31 mars 2019 nbsp 0183 32 The Indian Income Tax Act extends home loan tax benefits on the amount that you repay every month through your EMIs for your first home EMIs or equated monthly instalments are made up of two Web Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability of your

Web 1 f 233 vr 2021 nbsp 0183 32 Getty Images Finance minister Nirmala Sitharaman in her Budget 2021 speech has proposed to extend the timeline for availing home loan by another year for Web Joint Home Loan Borrowers can claim a rebate of up to Rs 2 Lakh each provided they contribute to the EMI payments and are the co owners of the property A certificate

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

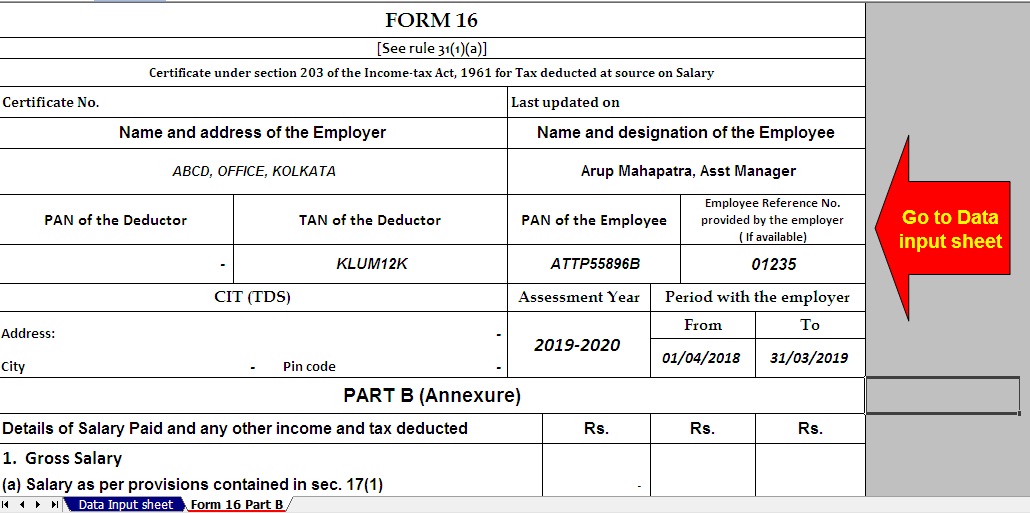

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

https://1.bp.blogspot.com/-iMxeS2BunP0/XqBA6tBeFDI/AAAAAAAAMqY/z1n5gJ66fQovpJMvwhx1NLTrJ58TLiUZACNcBGAsYHQ/s1600/Picture%2B4%2Bof%2BNew%2BForm%2B16%2BPart%2BB.jpg

https://www.livemint.com/money/personal-finance/new-income-tax-rules...

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Home Loan Tax Benefits In India Important Facts

Home Loan Tax Benefits In India Important Facts

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Rebate On Housing Loan In India - Web 1 Deduction for interest on housing loan can be claimed u s 24 b under the head Income from house property 2 Deduction for principal amount of repayment can be claimed