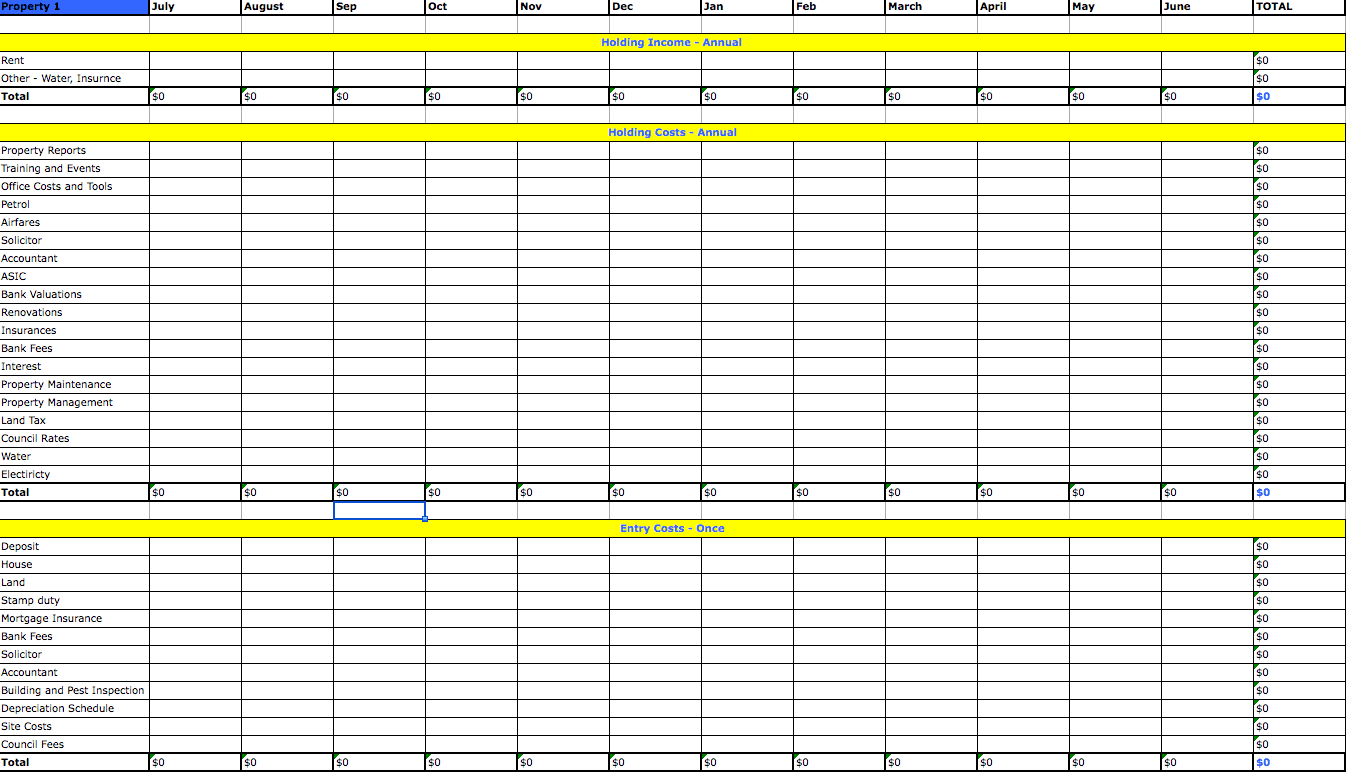

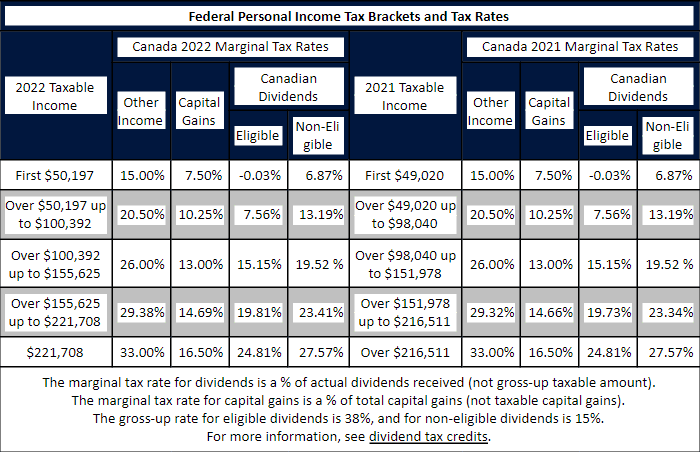

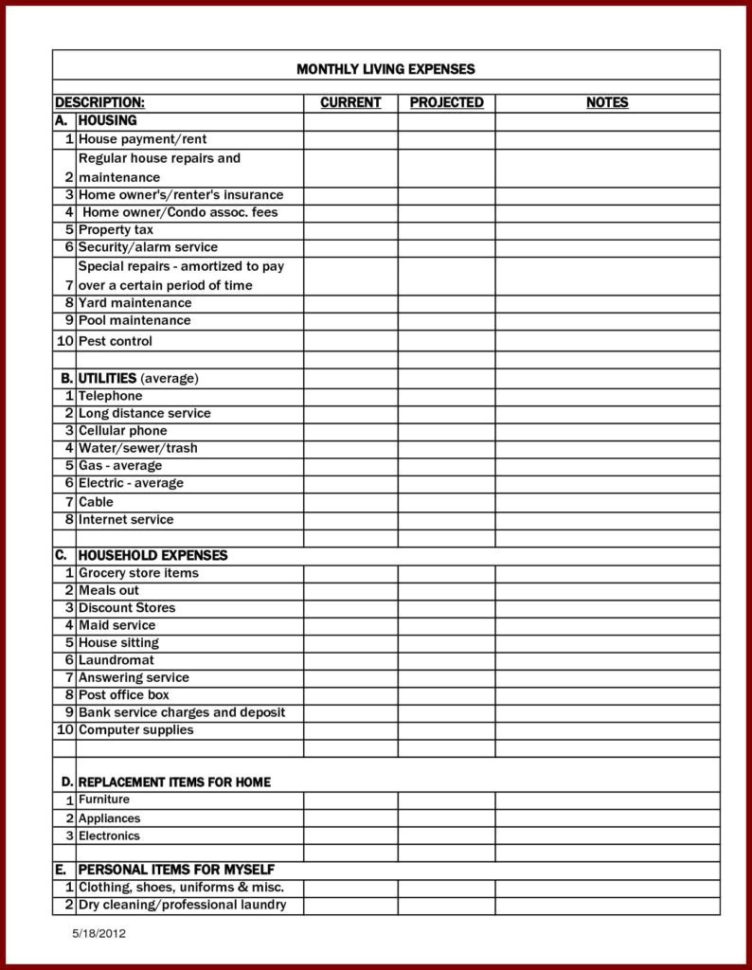

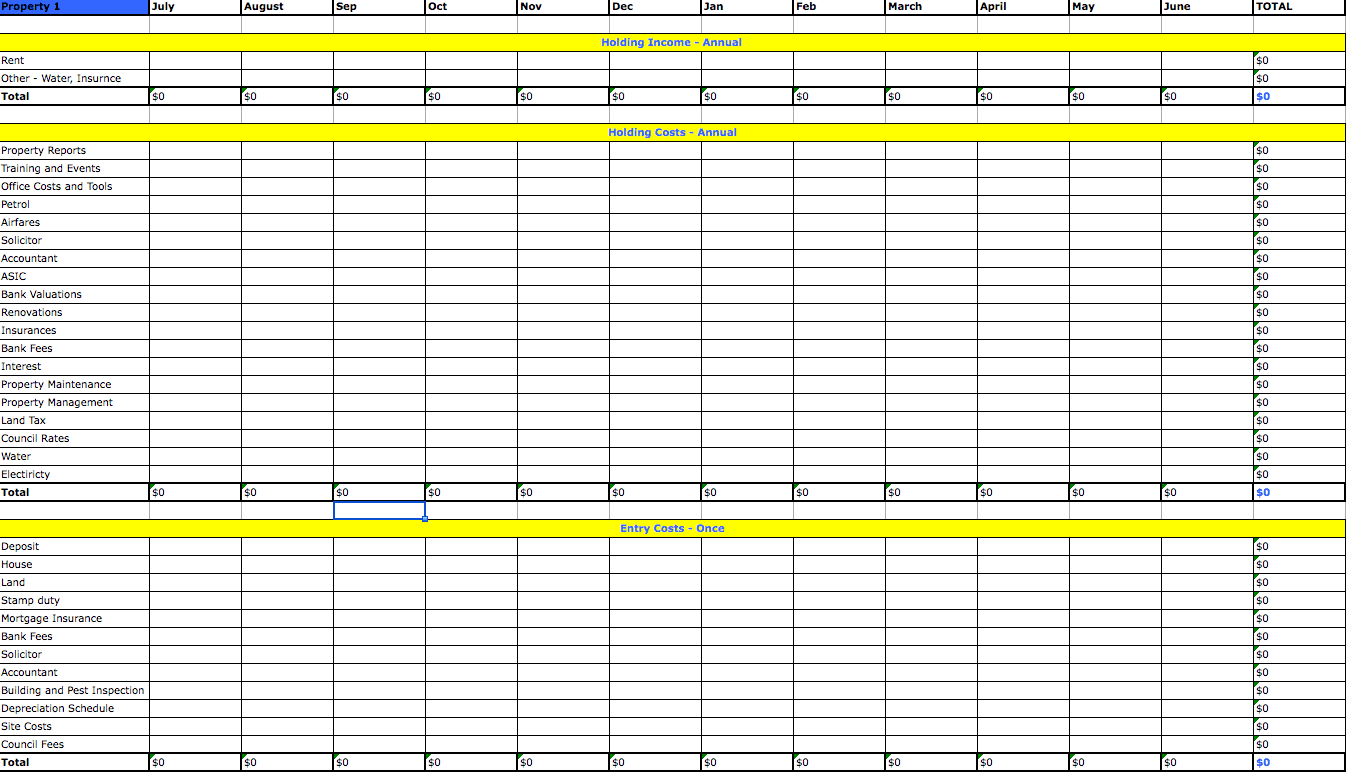

Income Tax Deductions Canada Bc B C personal income tax rates apply to specific tax brackets A tax bracket is a range of annual taxable income Income past a certain point is taxed at a higher rate The tax brackets are

Estimate your provincial taxes with our free British Columbia income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and TurboTax s free BC income tax calculator Estimate your 2024 25 tax refund or taxes owed and check provincial tax rates in BC

Income Tax Deductions Canada Bc

Income Tax Deductions Canada Bc

https://filingtaxes.ca/wp-content/uploads/2021/12/Screenshot_2.png

Neat infographic ABCs Of Tax Deductions And Credits For Canadians

https://i.pinimg.com/736x/6b/c8/9b/6bc89b7e7dd187afdfcb8e1d665e7fb7--tax-deductions-tax-refund.jpg

Standard Deduction For Salaried Employees Impact Of Standard

https://i.pinimg.com/originals/05/8c/32/058c32cbbbd99e3ad8dfee9a313112a1.jpg

RC4157 Deducting Income Tax on Pension and Other Income and Filing the T4A Slip and Summary These guides are available on our website at canada ca taxes Note Refer to the 16 rowsThe BC tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1 028 2 8 increase The Federal tax brackets and personal tax credit

We have built the tax credits and tax deductions for CPP contributions and EI premiums into the federal and provincial tax deductions tables in this guide However certain Tax Deductions A deduction reduces your taxable income lowering the amount that income tax will be based on The CRA provides detailed information on both federal and province territory specific deductions Below

Download Income Tax Deductions Canada Bc

More picture related to Income Tax Deductions Canada Bc

Income Tax Deductions For Canadian Small Businesses You May Miss

https://i.pinimg.com/originals/e1/d9/99/e1d99929fb9ff8a591a621f16afb6f2e.png

Gross Income Calculator Manitoba Trito Salary

https://www.birchwoodcredit.com/wp-content/uploads/2021/01/BCI022-Internal-TaxBracketsInManitoba.png

What Is Line 15000 Tax Return formerly Line 150 In Canada

https://thefinancekey.com/wp-content/uploads/2022/02/what-is-line-10100-on-tax-return-canada.jpg

You can reduce the amount of B C personal income tax you owe with basic tax credits However if the total of these credits is more than the amount you owe you won t get a Discover Talent s income tax calculator tool and find out what your payroll tax deductions will be in British Columbia for the 2025 tax year

The Income tax rates and personal allowances in British Columbia are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances In this guide we provide a structured breakdown of the most common tax deductions available in BC for 2024 including eligibility criteria how to apply and practical

Itemized Deductions Spreadsheet Excelxo

https://excelxo.com/wp-content/uploads/2018/02/itemized-deductions-spreadsheet.png

Federal Taxation Of Individuals In 2023 LBMC

https://www.lbmc.com/wp-content/uploads/2023/01/2023-federal-income-tax-brackets-for-individuals-and-trusts.png

https://www2.gov.bc.ca › gov › content › taxes › income...

B C personal income tax rates apply to specific tax brackets A tax bracket is a range of annual taxable income Income past a certain point is taxed at a higher rate The tax brackets are

https://www.wealthsimple.com › en-ca › tool › tax...

Estimate your provincial taxes with our free British Columbia income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and

Self Employment Tax Deductions Worksheet

Itemized Deductions Spreadsheet Excelxo

Income Tax Deductions For The FY 2019 20 ComparePolicy

Standard Deduction For 2021 22 Standard Deduction 2021

How To Calculate Income Tax Canada TAX

Doing Your Taxes Myths Reality Checks And How Soon To Send Them

Doing Your Taxes Myths Reality Checks And How Soon To Send Them

Allowable Deductions From Income While Filing Return Of Income

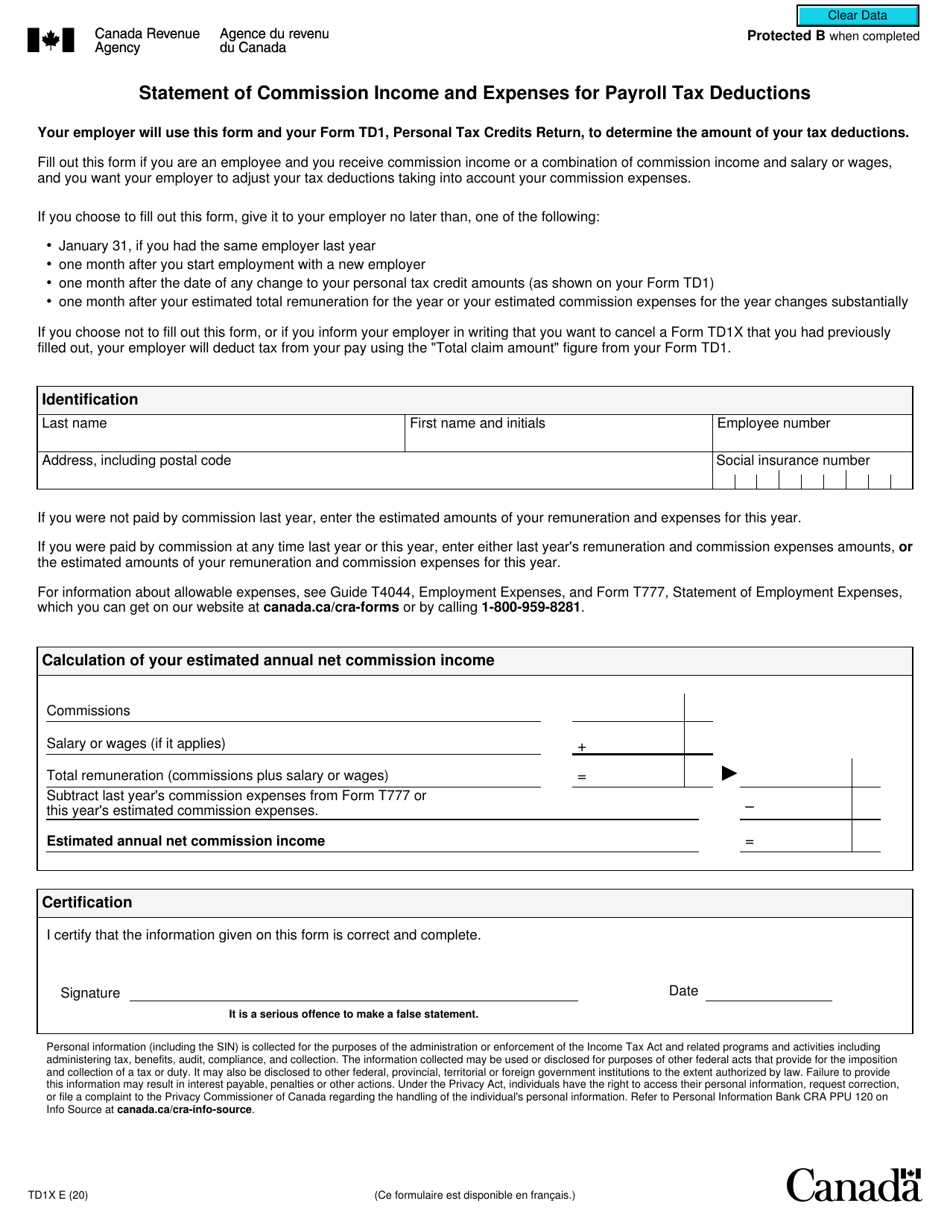

Form TD1X Download Fillable PDF Or Fill Online Statement Of Commission

Marginal Tax Rates For Each Canadian Province Kalfa Law Firm

Income Tax Deductions Canada Bc - In the British Columbia tax deductions table the provincial tax deduction for 1 815 weekly under claim code 1 is 98 20 Sara s total tax deduction is 348 10 249 90 98 20