Income Tax Exemption For Central Govt Employees Uncommuted pension or any periodical payment of pension is fully taxable as salary In the above case Rs 9 000 received by you is

Employees having LTA as a component specified in their salary structure can claim an exemption under Section 10 5 of the Income tax Act 1961 for the purpose of travel A Introduction EIS is employee information system deployed centrally for all central government employees It covers Pay bill Income tax and GPF modules For claiming

Income Tax Exemption For Central Govt Employees

Income Tax Exemption For Central Govt Employees

https://english.cdn.zeenews.com/sites/default/files/2021/05/22/938016-untitled-design-44.png

HOUSE RENT ALLOWANCE Page 4 CENTRAL GOVERNMENT EMPLOYEES NEWS

https://cgstaffportal.com/wp-content/uploads/2017/11/xHRA-Income-Tax-Exemption-Calculator-for-Govt-Employees.jpg.pagespeed.ic.3iEXOBv0Ny.jpg

Earned Leave Rules For Central Govt Employees Toposters

https://toposters.com/wp-content/uploads/2022/08/Earned-Leave-Important-Rules-for-Govt-Employees.png

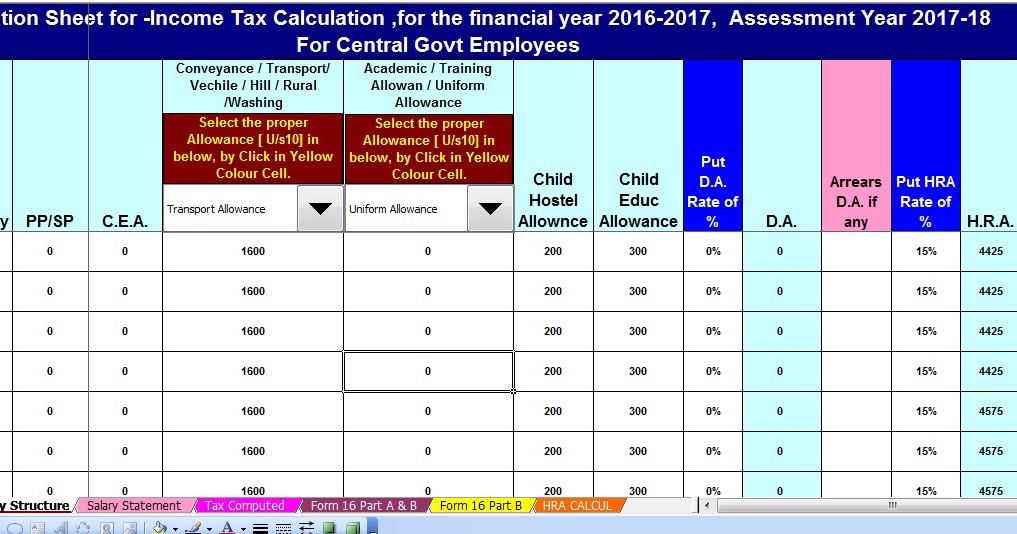

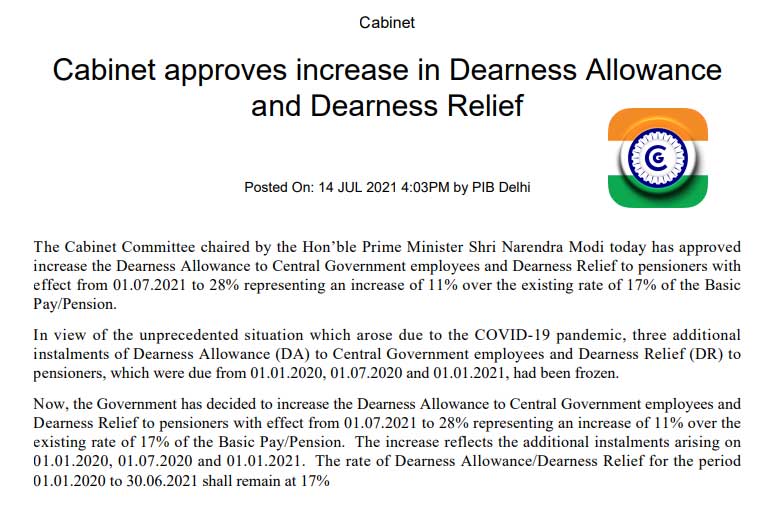

Dearness Allowance or DA Hike News Update Central government employees and pensioners are demanding the release of arrears for Dearness Allowance DA and The gratuity given to employees working in a government sector upon their termination retirement or superannuation are fully exempted from paying tax It is applicable to

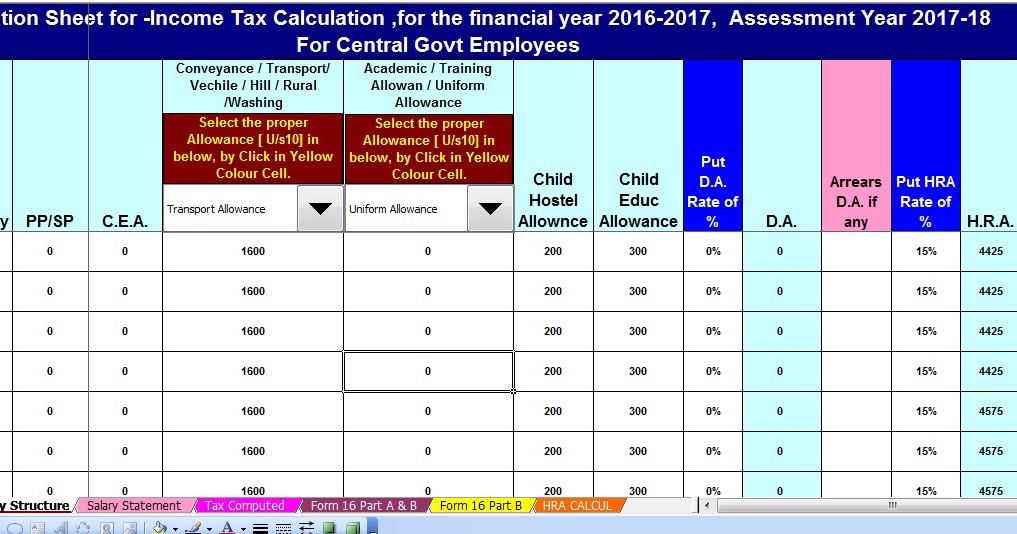

Conveyance allowance is exempt up to a maximum of Rs 1600 per month Dearness Allowance is paid to Central Government and Public Sector Employees to meet the cost The income tax exemption to receipt of deemed LTC fare by a non Central Government employee the employee shall be allowed subject to fulfilment of the following

Download Income Tax Exemption For Central Govt Employees

More picture related to Income Tax Exemption For Central Govt Employees

50 Income Tax Exemption For High Earners In Cyprus

https://shandaconsult.com/wp-content/uploads/2022/05/Cyprus-50-percent-income-tax-break-850px-ds.jpg

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

https://i.ytimg.com/vi/8JxQiLmrGvc/maxresdefault.jpg

Home Rent Allowance For Central Govt Employees Hindimaterials

https://hindimaterials.com/wp-content/uploads/2022/08/Home-Rent-Allowance-for-Central-Govt.-Employees.png

Individuals who are self employed and contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 20 of gross income under Synopsis Income tax regime for TDS on salary for FY 2024 25 Many employees have already informed their companies about their choice of tax regime for deducting taxes

Under Section 89 1 of the Act an assessee can claim tax relief for receiving salary in arrears or in advance or receipt of family pension in arrears To claim relief government The Budget 2024 has increased the tax deduction limit on employer NPS contributions from 10 to 14 aligning private sector employees with government counterparts

6 Income Tax Exemption For Salaried Persons As Per Budget 2016 With

https://1.bp.blogspot.com/--WbBP3U2j-o/Vue0bGPxGQI/AAAAAAAAA7Y/6kdBp49fZhkcJGeGtNaZhD6_QK1ngqz_w/w1200-h630-p-k-no-nu/Cental%2B1.jpg

Quarter Allotment Rules For Central Govt Employees PDF Download Toposters

https://toposters.com/wp-content/uploads/2022/06/Government-Quarters.png

https://cleartax.in/s/are-pensions-taxable

Uncommuted pension or any periodical payment of pension is fully taxable as salary In the above case Rs 9 000 received by you is

https://economictimes.indiatimes.com/wealth/save/...

Employees having LTA as a component specified in their salary structure can claim an exemption under Section 10 5 of the Income tax Act 1961 for the purpose of travel

Dearness Allowance For Central Govt Employees Frozen Till July 2021

6 Income Tax Exemption For Salaried Persons As Per Budget 2016 With

DA Hike For Central Govt Employees Pensioners Benefited Too

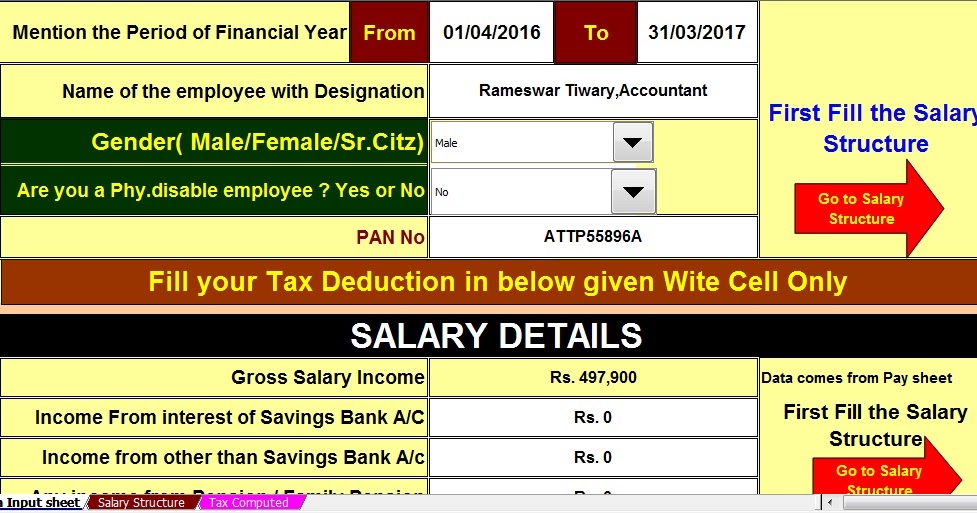

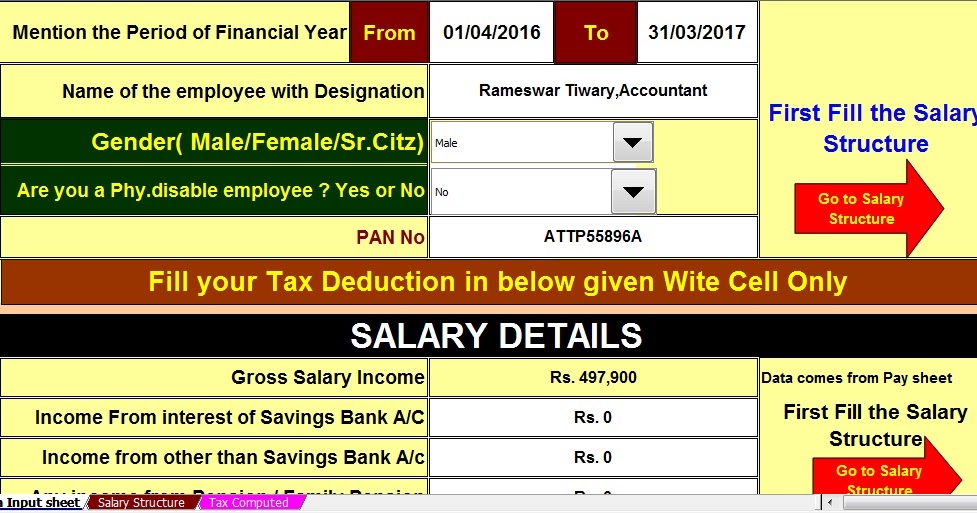

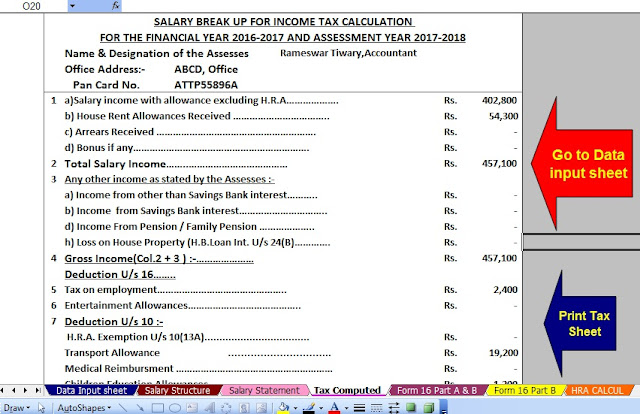

Automatic Income Tax Preparation Excel Based Software All In One For

Income Tax Exemption For Payment Of Deemed LTC Fare For Non Central

Automatic Income Tax Preparation Excel Based Software All In One For

Automatic Income Tax Preparation Excel Based Software All In One For

09 12 21 CENTRAL GOVERNMENT STAFF NEWS

Income Tax Exemption Loksabha Govtempdiary

Automatic Income Tax Preparation Excel Based Software All In One For

Income Tax Exemption For Central Govt Employees - Dearness Allowance or DA Hike News Update Central government employees and pensioners are demanding the release of arrears for Dearness Allowance DA and