Income Tax Exemption For Donation To Temple Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The

As per Section 115 BBC 2 a of the Income Tax 1961 if all receipts are Temple Box collection such anonymous donations shall not be taxable under section 115BBC You can claim 50 deduction on your taxable income for donations made for renovation repair of the temple under Section 80G of the Income Tax Act provided

Income Tax Exemption For Donation To Temple

Income Tax Exemption For Donation To Temple

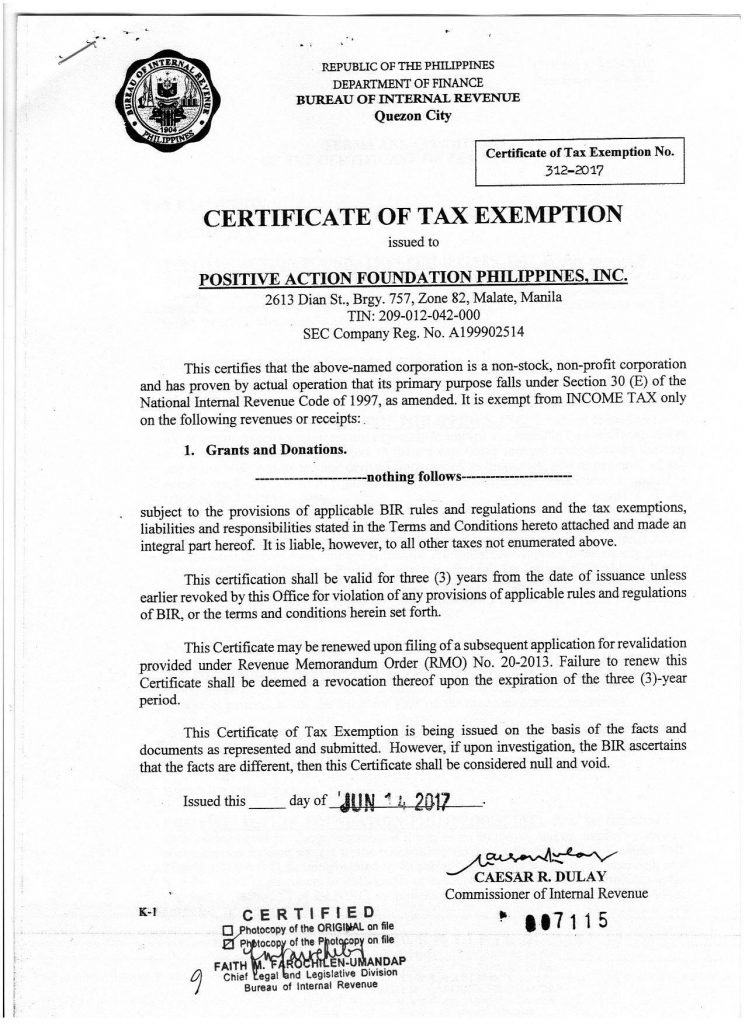

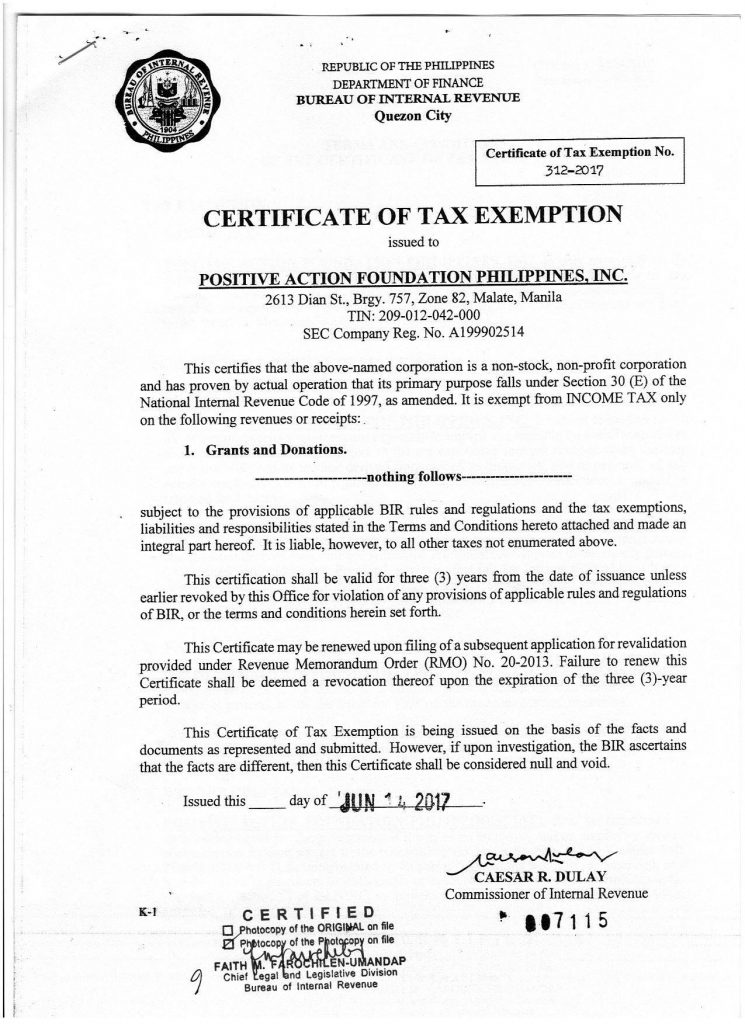

https://pafpi.org/wp-content/uploads/2017/07/2017-PAFPI-Certificate-of-TAX-Exemption-745x1024.jpg

Tax Exemption Donation FAQs Support Our Heroes

https://supportourheroes.in/wp-content/uploads/2018/01/80g-1400x1397-768x766.png

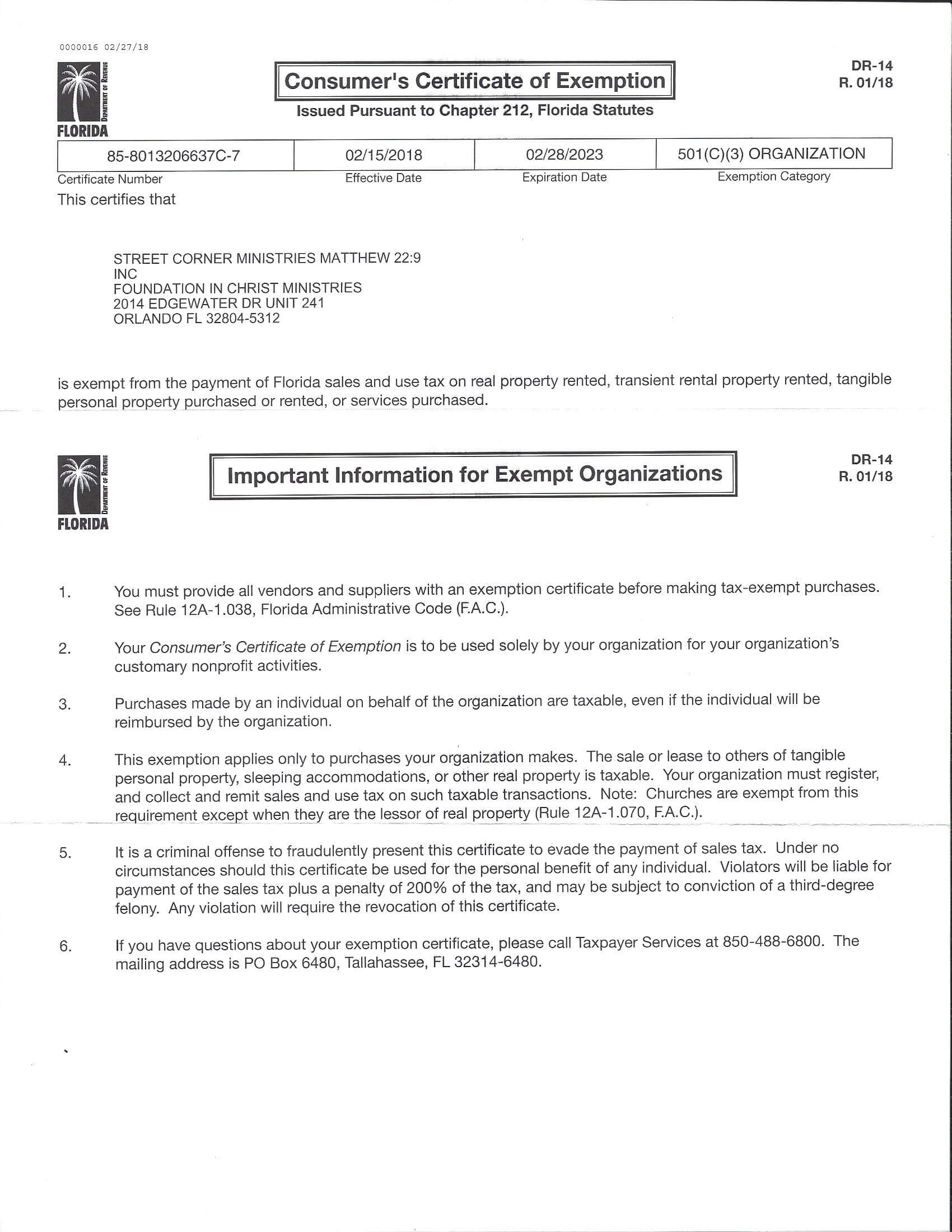

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

https://eoqsmt5wite.exactdn.com/wp-content/uploads/FL-Sales-Tax-Exemption-Certificate.jpg?strip=all&lossy=1&w=2560&ssl=1

Individuals who have contributed to the Ayodhya Ram Mandir Trust officially known as the Shri Ram Janmabhoomi Teerth Kshetra Trust or those intending to Donations to religious institutions are taxed under Section 80G of the Income Tax Act where upto 50 of the amount donated is deductible

Acknowledgement Income Tax Exemption Certificate under 80 G 50 Donor pass books will be issued to the eligible donors Prior to June 2008 Tokens are being issued to the pilgrims in side Sri Vari Tirumala The donor can claim exemption U s 35 1 ii to the extent of 100 on Business income or U s 80GGA to the extent of 100 on all incomes other than Business income

Download Income Tax Exemption For Donation To Temple

More picture related to Income Tax Exemption For Donation To Temple

Exemption U s 80G Can t Be Granted If Expenditure Of Religious Nature

https://www.taxscan.in/wp-content/uploads/2018/04/Exemption-80G-Donation.jpg

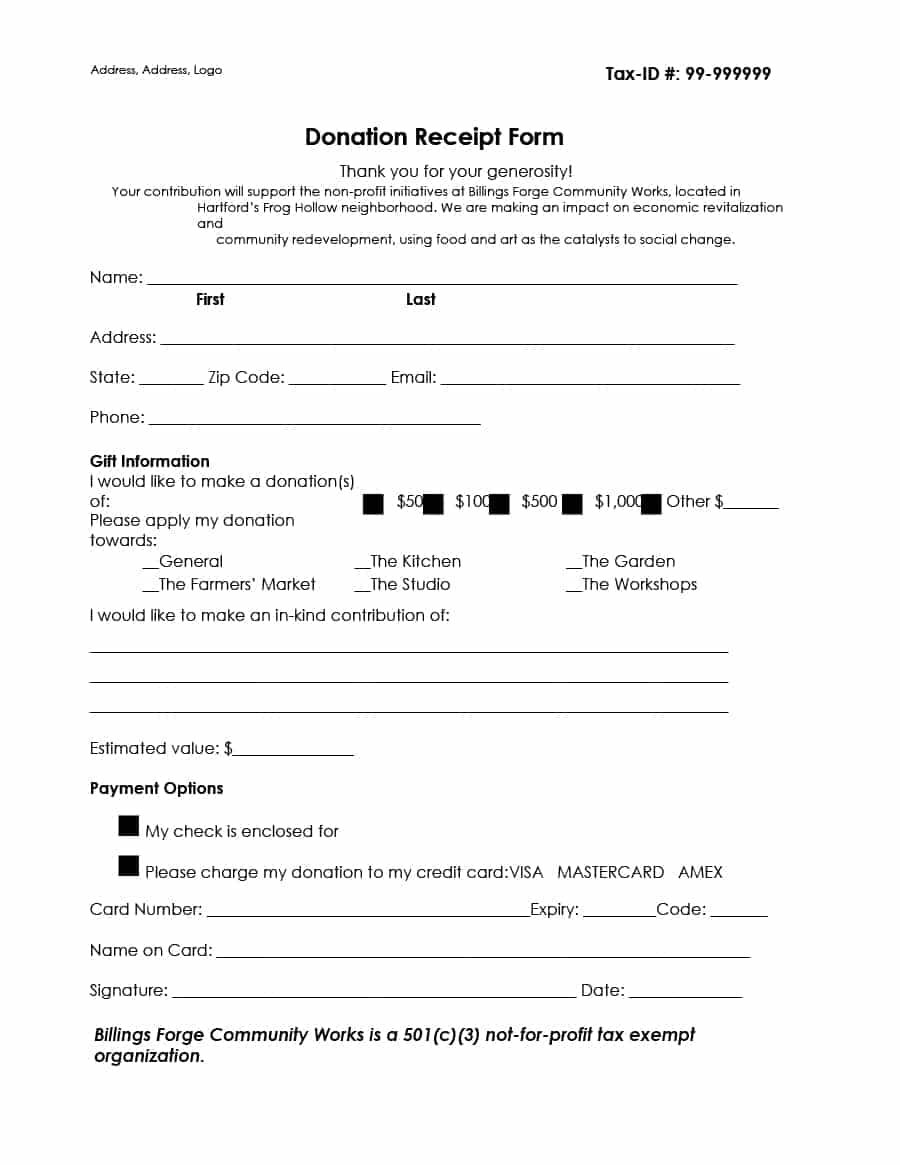

Donation Receipt Letter Template Word Examples Letter Template Collection

https://simpleartifact.com/wp-content/uploads/2018/08/donation-receipt-for-tax-purposes-acurnamedia-of-donation-receipt-letter-template-word.jpg

Tax Exemption Certificate SACHET Pakistan

https://sachet.org.pk/wp-content/uploads/2016/01/Exemption-236-698x1024.jpg

The article outlines the eligibility conditions and procedures for claiming tax deductions under Section 80G for donations made to Shri Ram Trust including details Section 80G of I T Act permits donations made to specified charitable institutions like temple mosque or church and relief funds as a deduction from your gross total income before reaching at taxable income

Individuals firms companies etc can make donations and they are eligible for Income Tax exemption under Section 80 G of the Indian Income Tax Act 1961 This means donation to the temple will get tax exemption The Central Board of Direct Taxes CBDT has issued a notification under section 80G of the Income Tax Act

Affidavit Of Tax Exemption

https://imgv2-1-f.scribdassets.com/img/document/239250719/original/68e111ba5b/1627336409?v=1

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

https://tax2win.in/guide/80g-deduction-d…

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The

https://taxguru.in/income-tax/provision…

As per Section 115 BBC 2 a of the Income Tax 1961 if all receipts are Temple Box collection such anonymous donations shall not be taxable under section 115BBC

What Is Donation Tax Exemption ISKCON Dwarka

Affidavit Of Tax Exemption

Tax Exempt Letter

Statement Of Donation In Form No 10BD Certificate Of Donation In

How To Get A Certificate Of Tax Exemption In The Philippines FilipiKnow

Tax Exempt Forms San Patricio Electric Cooperative

Tax Exempt Forms San Patricio Electric Cooperative

Exemption Certificate Format TUTORE ORG Master Of Documents

Company Income Tax Malaysia Jacob Berry

Free Goodwill Donation Receipt Template PDF EForms

Income Tax Exemption For Donation To Temple - Individuals who have contributed to the Ayodhya Ram Mandir Trust officially known as the Shri Ram Janmabhoomi Teerth Kshetra Trust or those intending to