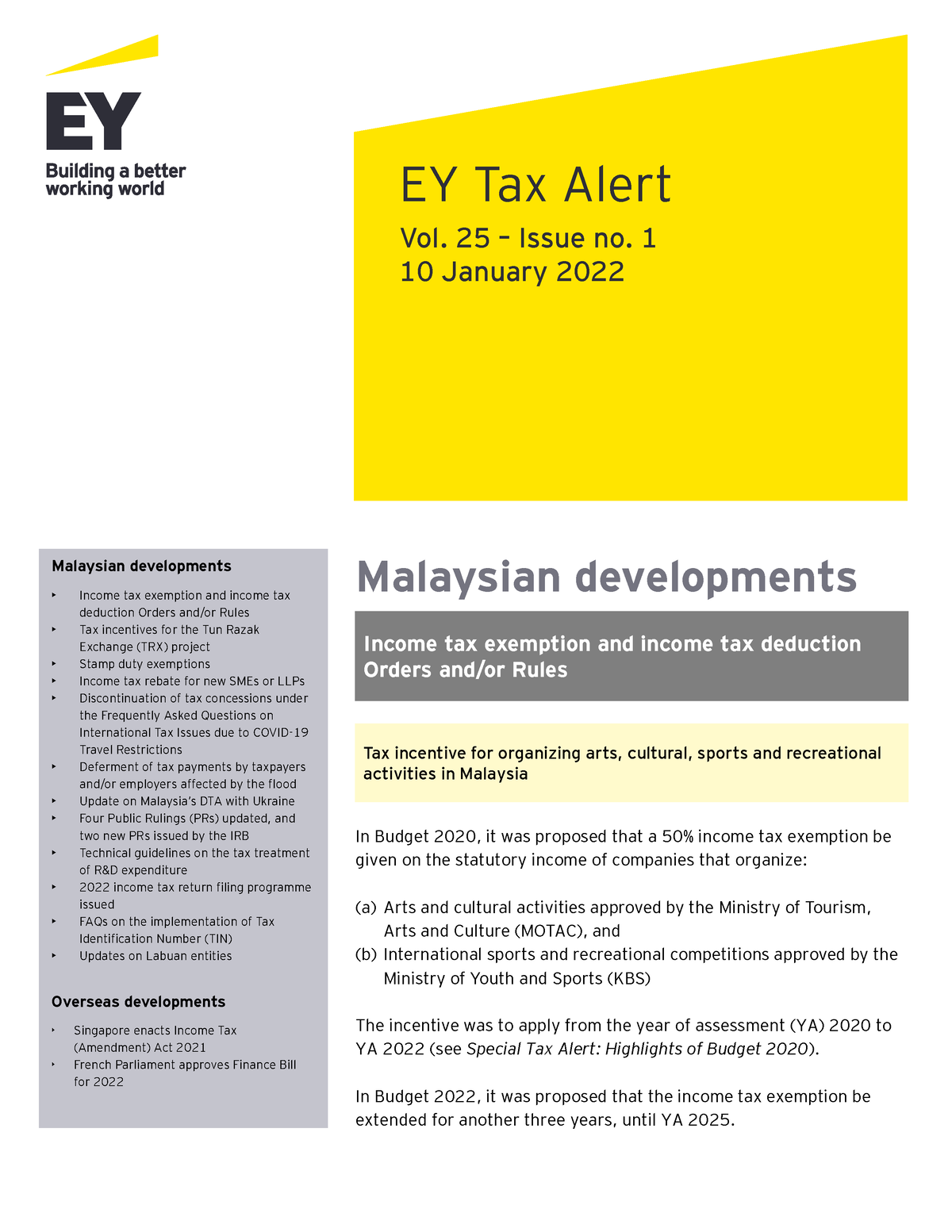

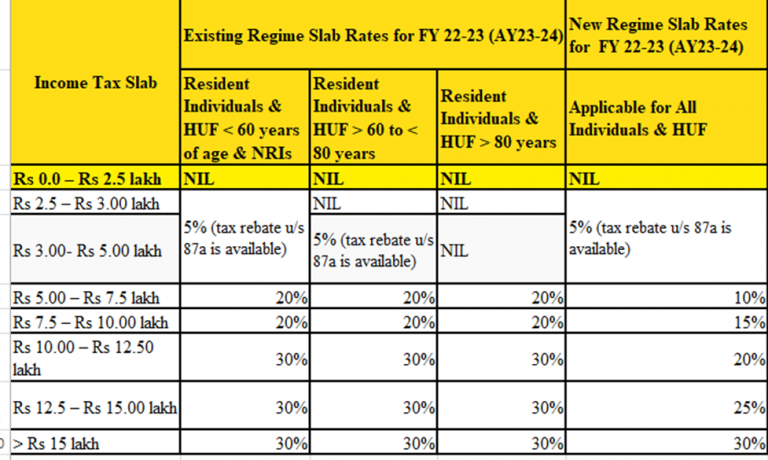

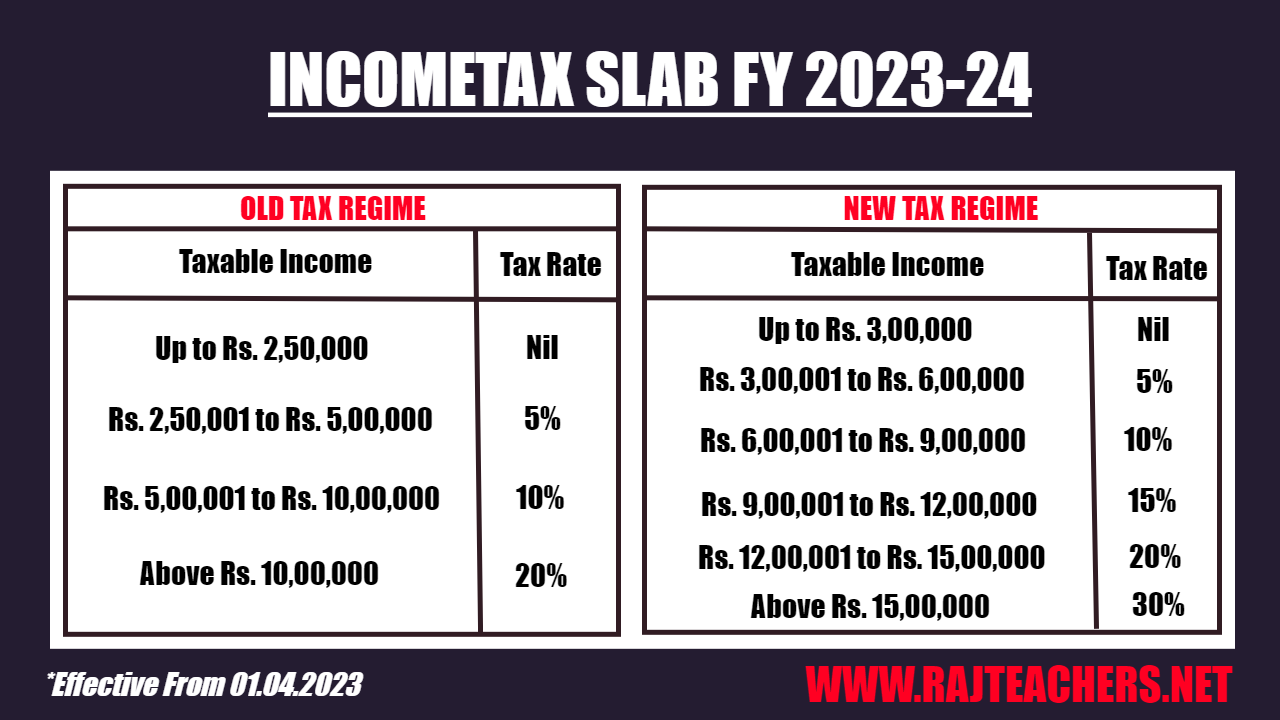

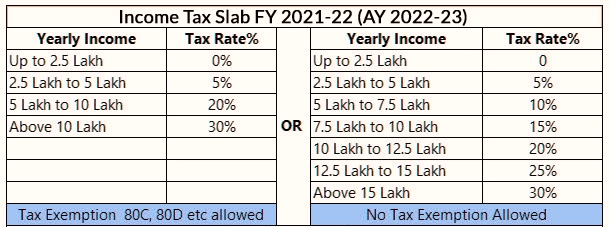

Income Tax Exemption For Fy 2022 23 Verkko 13 kes 228 k 2022 nbsp 0183 32 Assessment Year 2022 23 Up to Rs 5 00 000 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Hindu Undivided Family

Verkko The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Verkko 28 jouluk 2023 nbsp 0183 32 Explore the comprehensive list of Income Tax Deductions for FY 2022 23 AY 2023 24 under Sections 80C 80CCC 80CCD and 80D Maximize your tax

Income Tax Exemption For Fy 2022 23

Income Tax Exemption For Fy 2022 23

https://www.basunivesh.com/wp-content/uploads/2021/02/Latest-Income-Tax-Slab-Rates-for-FY-2021-22-AY-2022-23.jpg

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiuBLR2sr4zdq6frnOvYmY4TMuEbMynEFSiCiVO9-h9YlyZVcz20Rnk1V34S46-X5dWuSxwpF5eEVHb9f_Y-PWQSvT6D5tOGCeOjc5Ffmu9hxfpK9DcrJcDq3faqy3aR4w7eexxY8DMrm13bqa9-CohjejrV7vWzHLgplcUb6NtDbK0V_2k8wdyiQ9e/s1600/Income Tax FY 2022-23 AY 2023-24 Income Tax Act - IT Slab Rates Income Tax Official Circular.png

Income Tax Calculation 2022 23 How To Calculate Income Tax FY 2022 23

https://i.ytimg.com/vi/aTDYGbVWpas/maxresdefault.jpg

Verkko 12 toukok 2023 nbsp 0183 32 Rs 1 00 000 30 of income over Rs 10 00 000 Alternatively women including senior and super senior citizens can opt for the new tax regime Verkko It is available under both old and new income tax regimes The aggregate income tax deduction limit under sections 80C 80CCC and 80CCD 1 is Rs 1 50 Lakh and an

Verkko 26 kes 228 k 2023 nbsp 0183 32 NRI income tax slab rates FY 2022 23 Note Income tax exemption limit for NRI taxpayers is up to Rs 2 50 000 NRIs opting for the new tax regime with lower rates will not be eligible for certain Verkko 18 jouluk 2023 nbsp 0183 32 Know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan

Download Income Tax Exemption For Fy 2022 23

More picture related to Income Tax Exemption For Fy 2022 23

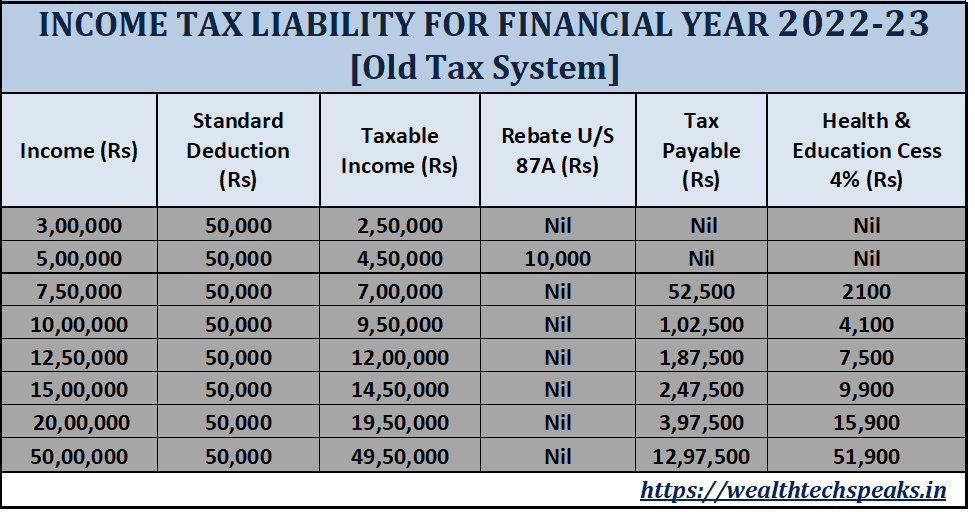

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

https://wealthtechspeaks.in/wp-content/uploads/2022/03/Income-Tax-Liability-Old-Tax-System.png

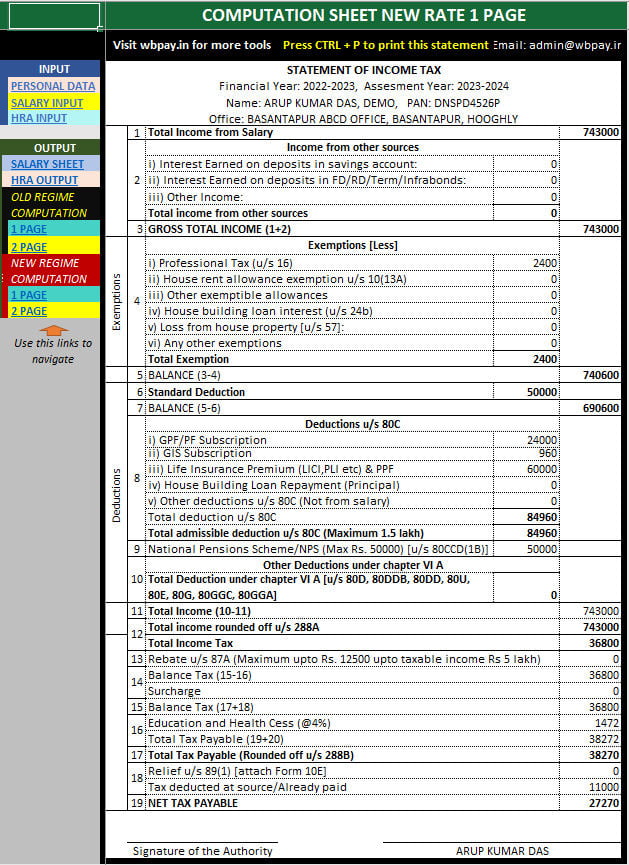

All In One Income Tax Calculator For The FY 2022 23

https://wbpay.in/wp-content/uploads/2023/01/All-in-one-income-tax-calculator-2022-23.jpg

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

https://academy.tax4wealth.com/storage/uploads/1681121464-last-date-to-file-income-tax-return-itr-for-fy-2022-23-ay-2023-24.jpg

Verkko 31 jouluk 2023 nbsp 0183 32 Income Tax Return Filing Last Date The deadline for filing Income Tax Returns for the FY 2022 23 expires today Taxpayers who missed the July 31 deadline Verkko 26 jouluk 2023 nbsp 0183 32 The last few days are left to file your Income Tax Return ITR for income earned during the previous year 2022 23 between 01 04 2022 and 31 03 2023

Verkko 14 jouluk 2023 nbsp 0183 32 Please note that Rohit is an individual taxpayer assessee having an income tax exemption of Rs 2 50 000 For other taxpayers assessee i e senior Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Income Tax Return Filing Last Date Last day for filing Income Tax Returns for FY 2022 23 ends on December 31 what happens if you miss it 1 min

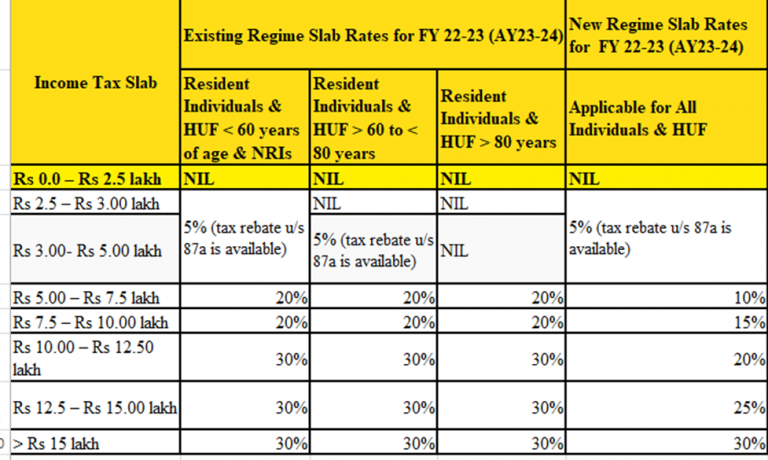

Income Tax Slabs New Old Tax Rates FY 2022 23 AY 2023 24 Janani

https://jananiservices.com/blog/wp-content/uploads/2022/08/image-2-768x460.png

Income Tax Calculation Example 2 For Salary Employees 2023 24

https://govtempdiary.com/wp-content/uploads/2022/12/example-2.jpg

https://taxguru.in/income-tax/income-tax-rates-financial-year-2021-22...

Verkko 13 kes 228 k 2022 nbsp 0183 32 Assessment Year 2022 23 Up to Rs 5 00 000 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Hindu Undivided Family

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Verkko The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old

Ey Tax Alert Vol 25 No 1 10 January 2022 Malaysian Developments

Income Tax Slabs New Old Tax Rates FY 2022 23 AY 2023 24 Janani

2022 Capital Gains Tax Rate Brackets Latest News Update

Income Tax Calculator Fy 2021 22 Major Changes In Income Tax Rules FY

2022 23 Tax Rates TAX

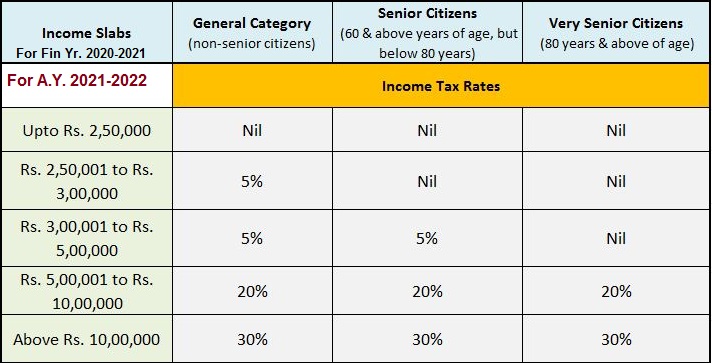

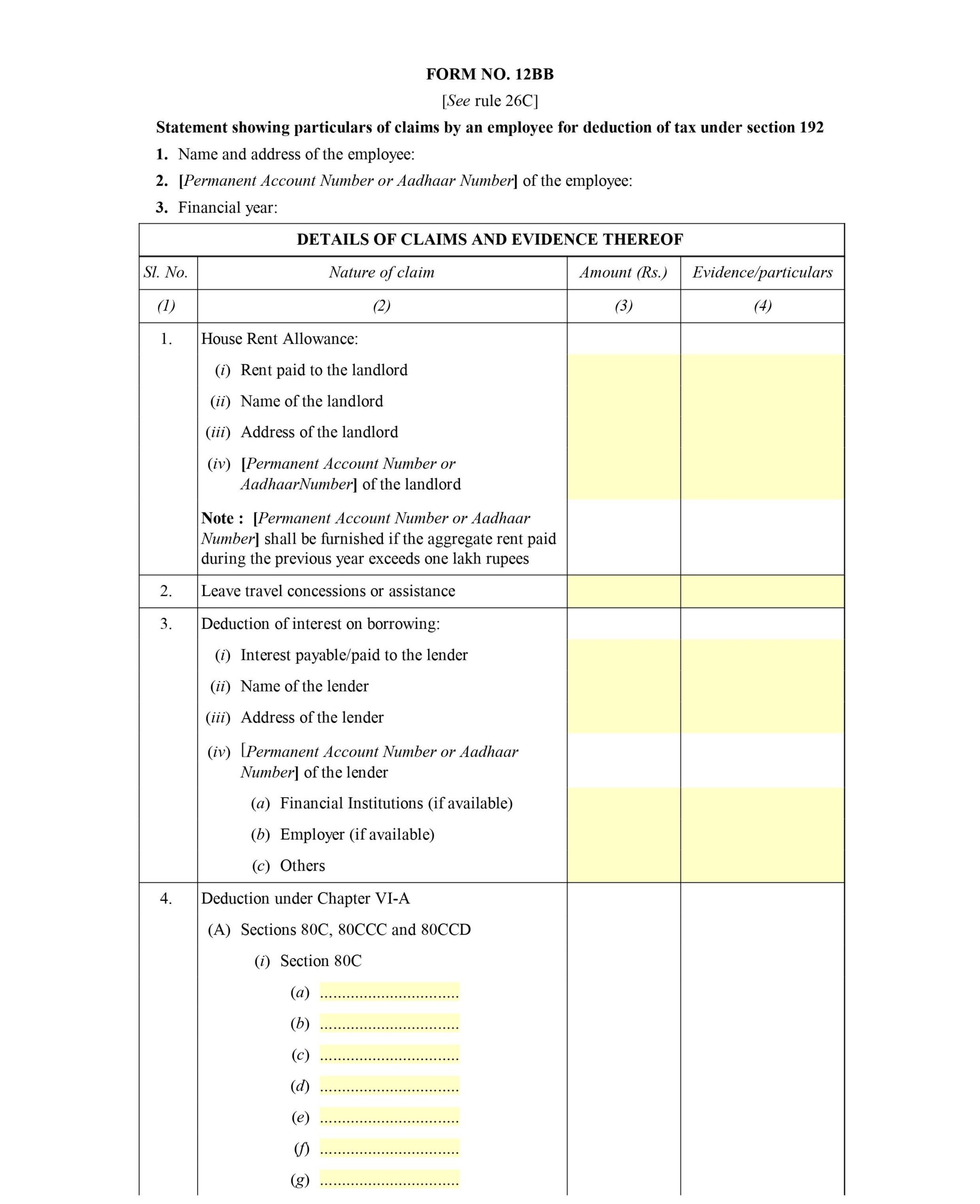

PDF Investment Declaration Form PDF Download

PDF Investment Declaration Form PDF Download

Income Tax Calculator For FY 2020 21 AY 2021 22 Excel Download

Itax Calculation Fy 2023 24

India Income Tax Slabs 2023 PELAJARAN

Income Tax Exemption For Fy 2022 23 - Verkko 26 kes 228 k 2023 nbsp 0183 32 NRI income tax slab rates FY 2022 23 Note Income tax exemption limit for NRI taxpayers is up to Rs 2 50 000 NRIs opting for the new tax regime with lower rates will not be eligible for certain