Income Tax Exemption For Housing Loan Principal And Interest A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property section 24 allows a deduction on the

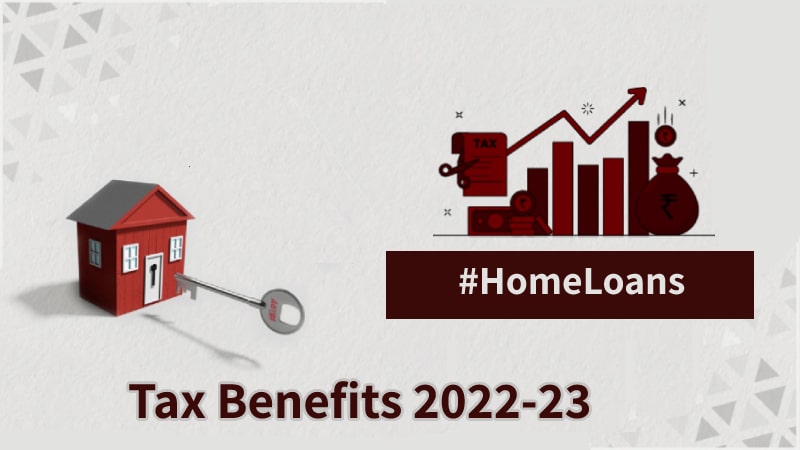

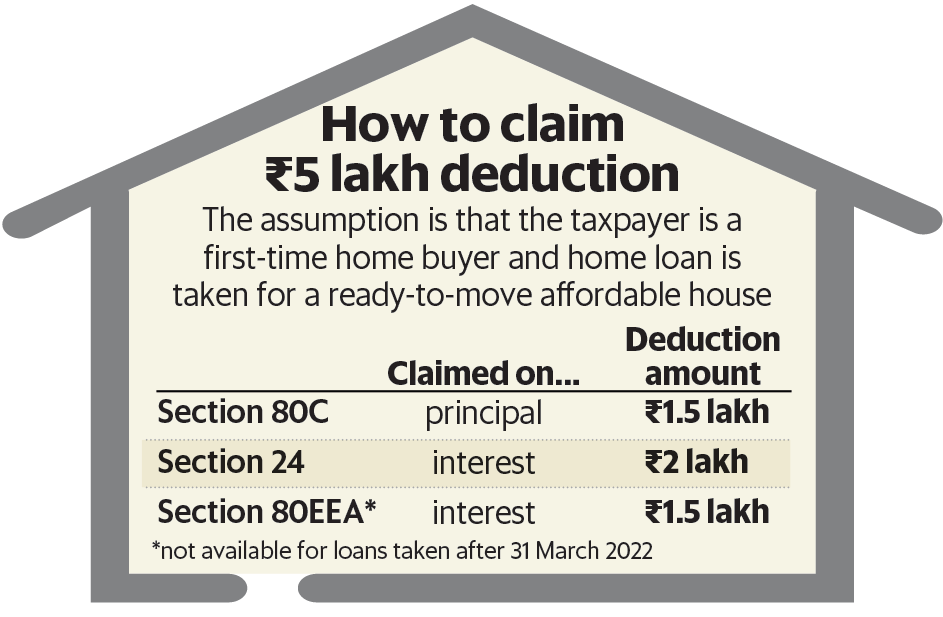

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Note that home loan borrowers opting for new tax regime cannot claim deductions under Sections 80C or 24 b A Home Loan consist of two components principal and interest As per income tax laws one can claim tax exemptions on both components Here is the list of tax benefits you can claim under various sections when borrowing a Home Loan if you are a taxpayer under the old tax regime 1 Section 24 b of the Income Tax Act This allows a deduction

Income Tax Exemption For Housing Loan Principal And Interest

Income Tax Exemption For Housing Loan Principal And Interest

https://www.aavas.in/uploads/images/blog/tax-benifits-2022-2023-aavasin-min-195380998.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

There is no threshold limit for claiming principal repayment of home loans hence any principal payment amount up to Rs 1 5 lakh irrespective of whether it is pre paid or not can be claimed as a deduction under Section 80C Can I claim tax benefits on the principal repaid on a housing loan Yes you can avail of tax benefits on the principal amount repaid on the home loan from total income under Section 80C What is the maximum amount I can avail of

Q 1 What are Income tax benefits of taking and repaying a housing loan under EMI Plan You will be eligible to claim both the interest and principal components of your repayment during the year Interest can be claimed as a deduction under Section 24 You can claim up to Rs 200 000 Rs 150000 up to A Y 2014 15 or the actual interest In this case Home Loan borrowers can claim tax rebates up to a maximum of Rs 1 5 Lakh on payments made towards principal repayment under Section 80C of the Income Tax Act However when it comes to payments made towards interest repayment one cannot claim a Home Loan tax exemption during the pre construction phase

Download Income Tax Exemption For Housing Loan Principal And Interest

More picture related to Income Tax Exemption For Housing Loan Principal And Interest

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan

https://life.futuregenerali.in/media/vyedfzjg/home-vs-tax.jpg

Tax Benefits Of Taking A Home Loan YouTube

https://i.ytimg.com/vi/XLgokrLkcQs/maxresdefault.jpg

Thus the total deduction available to an individual taxpayer on the interest payment on a housing loan taken to buy an affordable house is Rs 3 5 lakh in a financial year This article is for information only and written as per the provision given under income tax law and finance act 2021 You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross income annually provided the construction acquisition of the house is completed within 5 years

A home loan provides a number of benefits upon repayment through tax deductions under the Income Tax Act of 1961 A home loan repayment consists of two parts the principal amount and the interest One can claim tax exemption on the principal repayment for up to Rs 1 5 lakh Home loan interest deduction can be claimed in five equal instalments after the property is fully constructed For the full tax deduction of Rs 2 lakh on interest amount the property must be fully constructed within five years of taking the loan

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

https:// economictimes.indiatimes.com…

A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property section 24 allows a deduction on the

https://www. paisabazaar.com /home-loan/home-loan-tax-benefits

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Note that home loan borrowers opting for new tax regime cannot claim deductions under Sections 80C or 24 b

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

What Are The Tax Benefits On Top Up Loan HomeFirst

Joint Home Loan Declaration Form For Income Tax Savings And Non

Joint Home Loan Declaration Form For Income Tax Savings And Non

How To Fill Housing Loan Interest And Principal In Income Tax Return

How To Calculate Interest On Housing Loan For Income Tax Haiper

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Income Tax Exemption For Housing Loan Principal And Interest - There is no threshold limit for claiming principal repayment of home loans hence any principal payment amount up to Rs 1 5 lakh irrespective of whether it is pre paid or not can be claimed as a deduction under Section 80C