Income Tax Exemption For Senior Citizens Women Women over 60 years of age but less than 80 years are required to pay taxes based on the following income tax slabs if they have opted for the old income tax regime The female tax

Taxpayers 65 and older qualify for an additional standard deduction reducing their taxable income The extra deduction amount differs based on filing status and whether the taxpayer or Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above Conditions for exemption are Senior

Income Tax Exemption For Senior Citizens Women

Income Tax Exemption For Senior Citizens Women

https://resize.indiatvnews.com/en/resize/newbucket/1200_-/2021/02/eth6sfpu0auony6-1612164111.jpg

Senior Citizens Income Tax And Other Benefits

https://taxconcept.net/wp-content/uploads/2022/03/union-budget-tax-exemption-for-senior-citizens.jpg

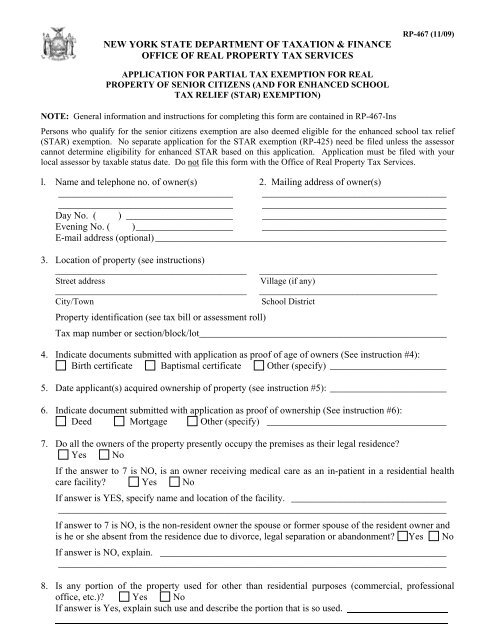

Sample Letter Exemption Doc Template PdfFiller

https://www.pdffiller.com/preview/497/332/497332566/large.png

The income tax exemption limit is up to Rs 3 lakh for senior citizens aged above 60 years but less than 80 years Surcharge and cess will be applicable Income tax slab for Individuals aged more than 80 years In the case of senior citizens if taxable income is up to Rs 5 00 000 then they can claim rebate from tax under the old tax regime i e they are not required to pay any tax Whereas under the

Income Tax Exemption for Women Under Old Tax Regime FY 2022 23 FY 2023 24 Under the old tax regime females can avail of certain deductions and allowances for Are my wages exempt from federal income tax withholding Use the Interactive Tax Assistant to get retirement income information including pensions IRAs and Social

Download Income Tax Exemption For Senior Citizens Women

More picture related to Income Tax Exemption For Senior Citizens Women

Income Tax Rules For Senior Citizens Income Tax Exemption For Senior

https://i.ytimg.com/vi/dBjjL3-Qu4E/maxresdefault.jpg

Income TAX Exemption Para Sa Mga Senior Citizens Aprubado Na Sa Komite

https://i1.wp.com/rmn.ph/wp-content/uploads/2021/09/INCOME-TAX.jpg?fit=1280%2C720&ssl=1

County Legislature Increases Senior Citizen Tax Exemption Rodney J

https://www.rodneyjstrange.com/wp-content/uploads/2019/05/Elderly-Tax-Exemption-1.jpg

This webpage presents an overview of Malta s 2025 tax policy updates emphasizing income tax reductions and incentives aimed at supporting various taxpayer groups and promoting Income tax slab for senior citizen women over 60 years of age In accordance with the Union Budget 2023 the following tax slabs will be applicable for women above 60 years but below 80 years of age who opt for

For 2025 married couples over 65 filing jointly will also see a modest benefit The extra deduction per qualifying spouse will increase from 1 550 in 2024 to 1 600 in 2025 a For 2023 the standard deduction amount has been increased for all filers The amounts are Single or Married filing separately 13 850 Married filing jointly or Qualifying surviving

Property Tax Exemption For Senior Citizens 2022 pdf Google Drive

https://lh5.googleusercontent.com/AWLT3OtyhUaNuc0LfHrZL_ZIHGxlabDL8YyyfkFHTAMWyDMhtTiwMqcyeGSDYfzi_mw=w1200-h630-p

Budget 2021 Income Tax Slabs And Rates Highlights Senior Citizens

https://images.indianexpress.com/2020/08/documents-for-income-tax-return-1200.jpg

https://www.godigit.com › income-tax › income-tax-slab-for-women

Women over 60 years of age but less than 80 years are required to pay taxes based on the following income tax slabs if they have opted for the old income tax regime The female tax

https://www.kiplinger.com › taxes

Taxpayers 65 and older qualify for an additional standard deduction reducing their taxable income The extra deduction amount differs based on filing status and whether the taxpayer or

Top 77 Imagen How To Apply For Senior Citizen Property Tax Exemption

Property Tax Exemption For Senior Citizens 2022 pdf Google Drive

Technologieser

Religious Exemption Samples

New Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

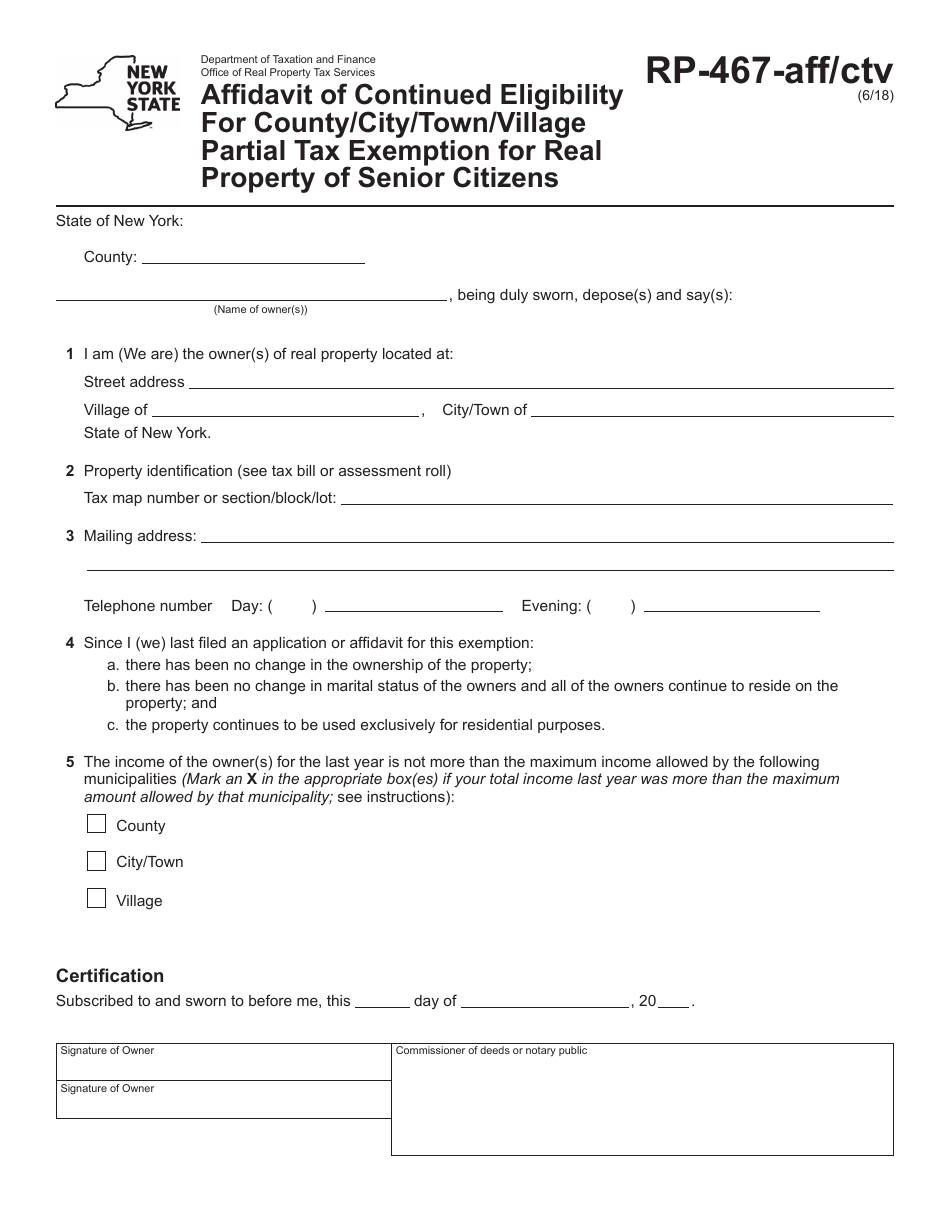

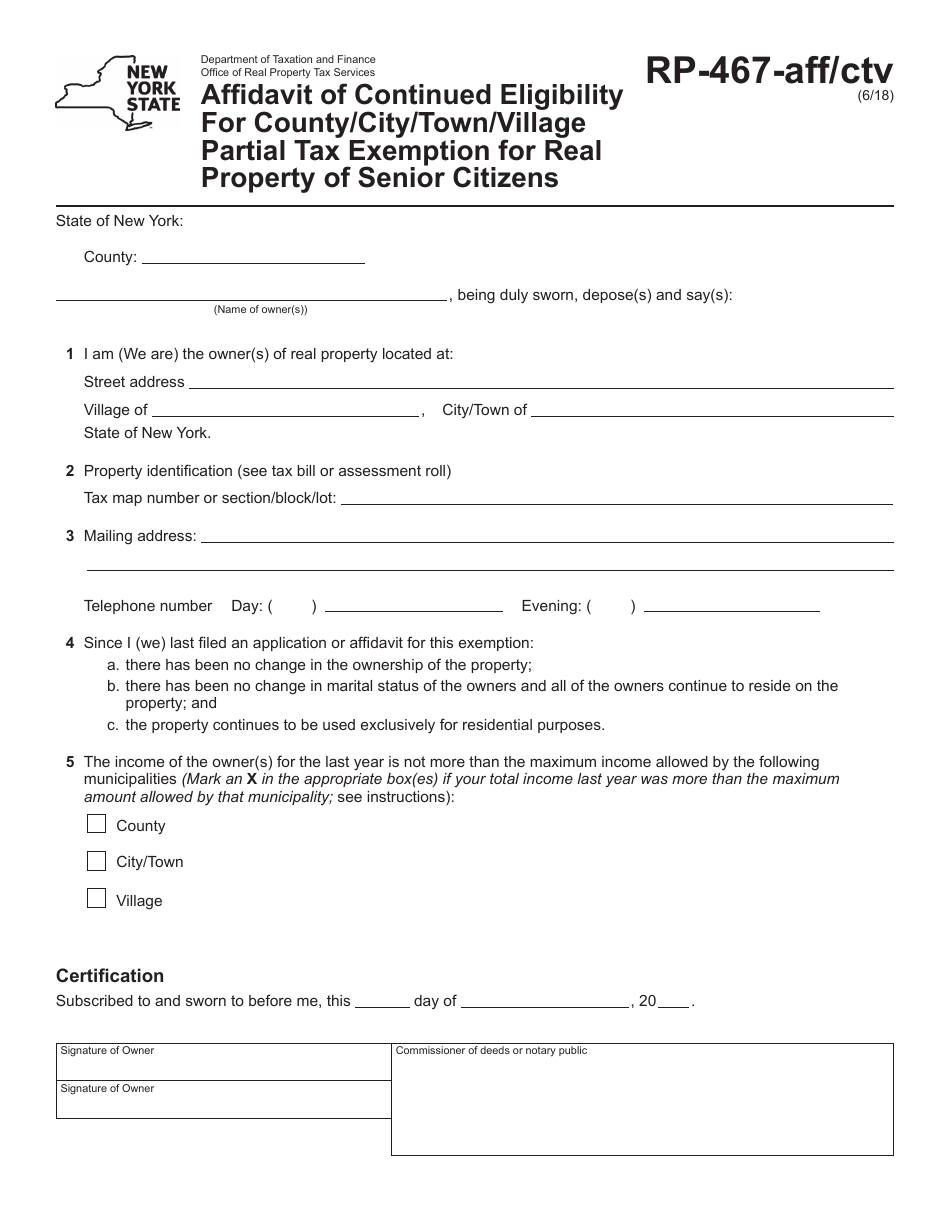

Form RP 467 AFF CTV Fill Out Sign Online And Download Fillable PDF

Form RP 467 AFF CTV Fill Out Sign Online And Download Fillable PDF

Arriba 30 Imagen Senior Citizen Tax Breaks Ecover mx

What Is A Senior Citizen Tax Exemption PROFRTY

Tax Benefits For Senior Citizen What Did Senior Citizens Gain India

Income Tax Exemption For Senior Citizens Women - Senior citizen women can get an exemption up to INR 50 000 per year on the interest they earn on deposits both saving and time deposits Section 80D Women can enjoy