Income Tax Exemption Form For Disabled Persons As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may be found in the IRS publications referred to below

Section 80U offers tax benefits if an individual suffers a disability while Section 80DD offers tax benefits if an individual taxpayer s dependent family member s suffers from a disability This article is centered around discussing the tax benefits available under Section 80U This exemption provides a reduction of up to 50 in the assessed value of the residence of the eligible disabled person s Those municipalities that opt to offer the exemption also set an income limit The income limit may be as low as 3 000 and as high as 50 000

Income Tax Exemption Form For Disabled Persons

Income Tax Exemption Form For Disabled Persons

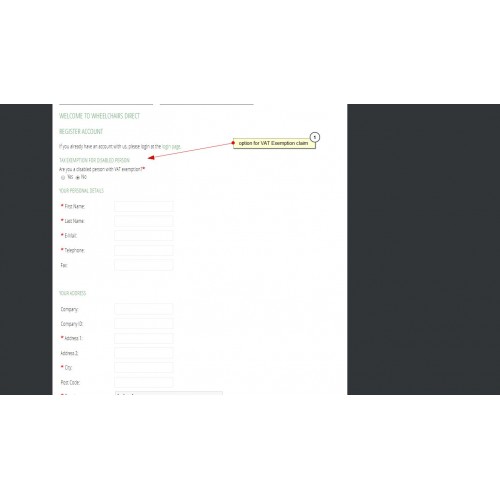

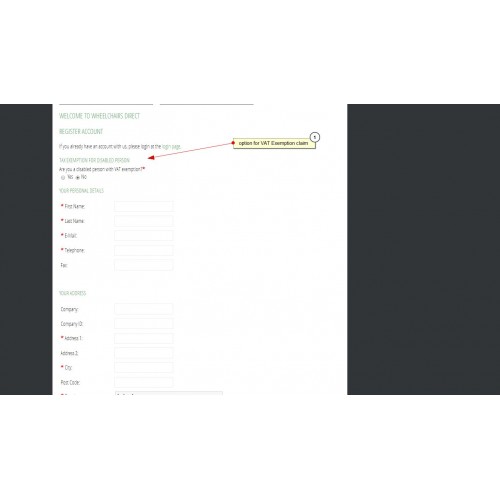

https://image.opencart.com/cache/561ccb7a9aec9-resize-500x500.jpg

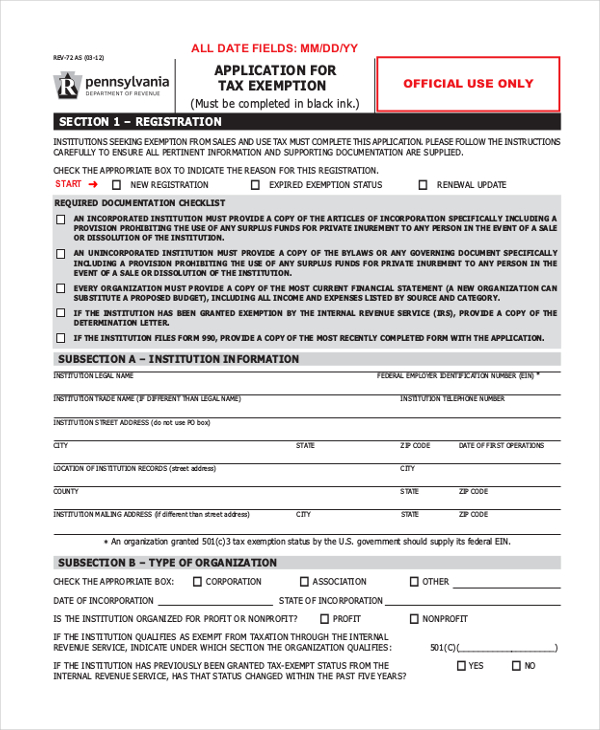

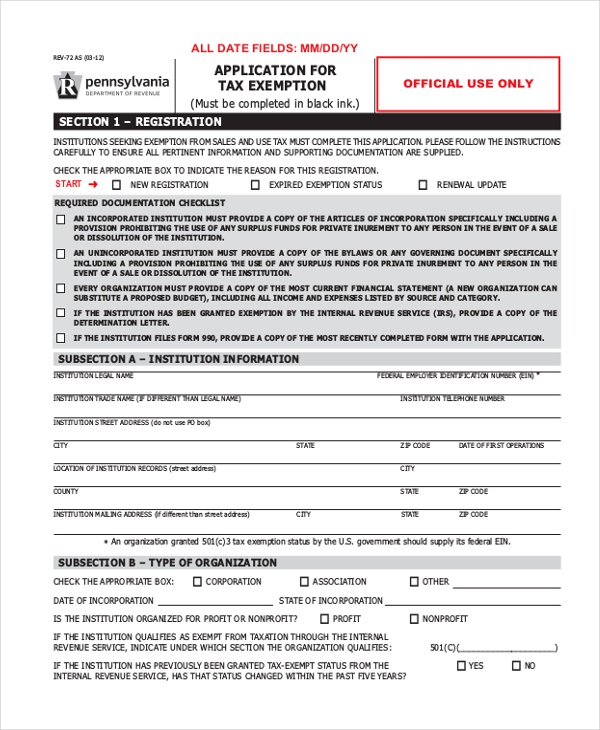

FREE 10 Sample Tax Exemption Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2016/11/Application-For-Tax-Exemption-Form.jpg

18 States With Full Property Tax Exemption For 100 Disabled Veterans

https://vaclaimsinsider.com/wp-content/uploads/2021/05/11-States-With-Full-Property-Tax-Exemption-for-100-Disabled-Veterans-scaled.jpg

This publication presents basic information about existing tax credits and benefits that may be available to qualifying taxpayers with disabilities parents of children with disabilities and businesses or other entities wishing to accommodate persons with disabilities The Volunteer Income Tax Assistance VITA program offers free tax help to people with low to moderate incomes persons with disabilities and limited English speaking taxpayers who need help preparing their own tax returns

Section 80U of the Income Tax Act of 1961 states the provisions for tax deductions or tax benefits for individual taxpayers who are suffering from a disability As per the law Indian residents who have more than 40 Child disability benefit Registered disability savings plan Find out how you can benefit Meet the people who may be eligible for the disability tax credit or other government programs for persons with disabilities See Scenarios What can persons with disabilities claim as a deduction or credit

Download Income Tax Exemption Form For Disabled Persons

More picture related to Income Tax Exemption Form For Disabled Persons

Student Tax Exemption Form 2 Free Templates In PDF Word Excel Download

https://www.formsbirds.com/formimg/student-tax-exemption-form/1020/student-tax-exemption-form-new-jersey-d1.png

Exemption Certificate Form TUTORE ORG Master Of Documents

https://images.sampletemplates.com/wp-content/uploads/2016/12/19155445/Agriculture-Tax-Exemption-Certificate-Form.jpg

Tax Exempt Sales Use And Lodging Certification Standardized As Of Jan

https://alabamaretail.org/wp-content/uploads/Proof-of-Exemption-GFX.png

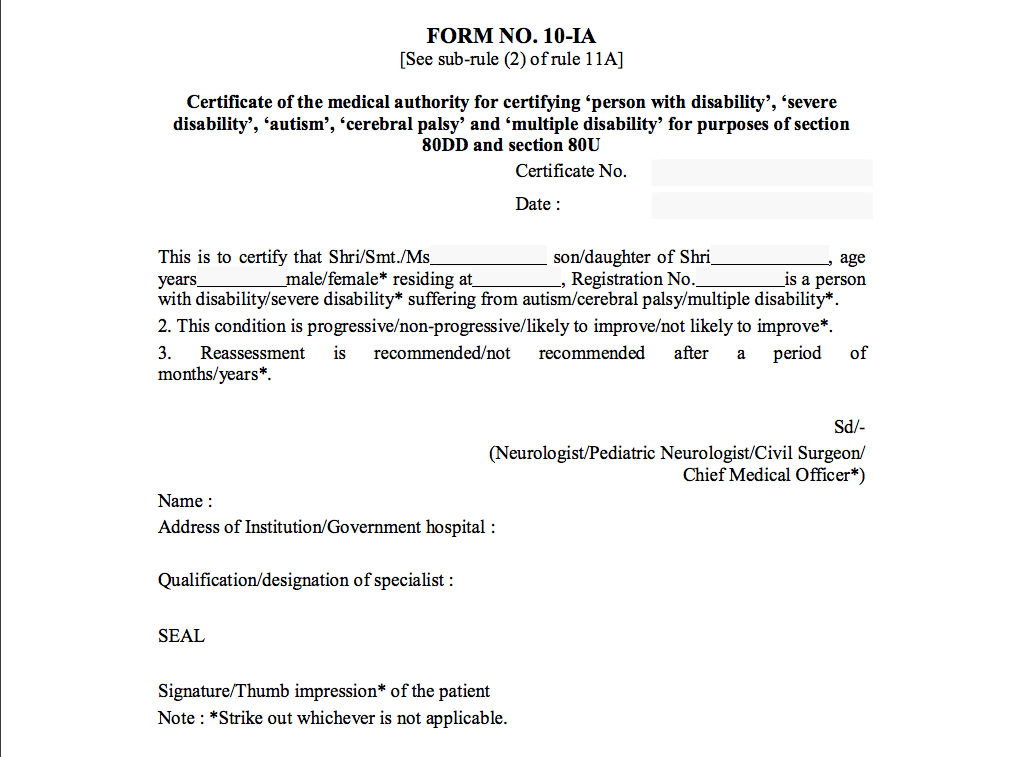

Rs 75 000 exemption is allowed for people with disabilities and Rs 1 25 000 exemption for people with severe disabilities Obligation to Apply for Exemption Under Section 80U Form 10 IA does not require any documents other than a certificate of disability attested by a recognized medical authority Persons with Disabilities in the Philippines are entitled to significant tax exemptions and benefits aimed at alleviating their financial burdens and fostering an environment of inclusivity and support

To claim deduction under Section 80DD you will need to submit a certificate in Form 10IA attested by medical authority This certificate is for certifying the person with disability severe disability cerebral palsy autism and multiple disability for purposes of section 80DD What is Section 80DD of income tax Section 80DD is the deduction available to the resident individual or HUF for the medical treatment of a disabled dependent The conditions to claim this deduction include

Income Tax Department Puts House Rental Allowance HRA Exemption Rules

https://i.pinimg.com/originals/4b/35/2c/4b352c55ac0959e4b980ff968f94f4f0.jpg

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/form-rev-1220-pennsylvania-exemption-certificate-printable-pdf-download-1.png?w=950&ssl=1

https://www.irs.gov/individuals/more-information...

As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may be found in the IRS publications referred to below

https://cleartax.in/s/section-80u-deduction

Section 80U offers tax benefits if an individual suffers a disability while Section 80DD offers tax benefits if an individual taxpayer s dependent family member s suffers from a disability This article is centered around discussing the tax benefits available under Section 80U

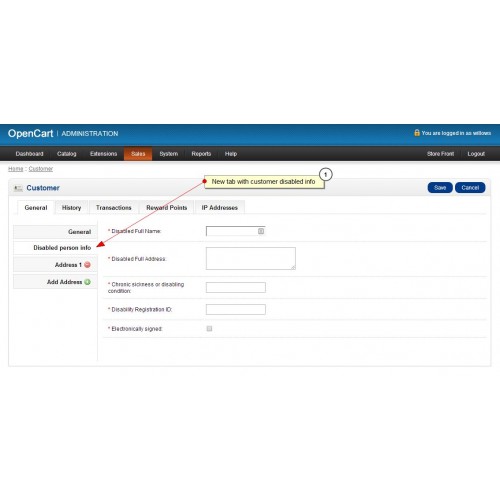

OpenCart VAT Exemption Declaration Form For The Disabled handicapped

Income Tax Department Puts House Rental Allowance HRA Exemption Rules

6 Important Income Tax Exemptions For Salaried Individuals

Texas Sales And Use Tax Exemption Blank Form

Michigan Tax Exempt Form 2023 Fill Out Sign Online DocHub

Form 10IA Section 80DD Deduction

Form 10IA Section 80DD Deduction

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Income Tax Exemption U s 10 23C iiiac Allowable When 50 Of Total

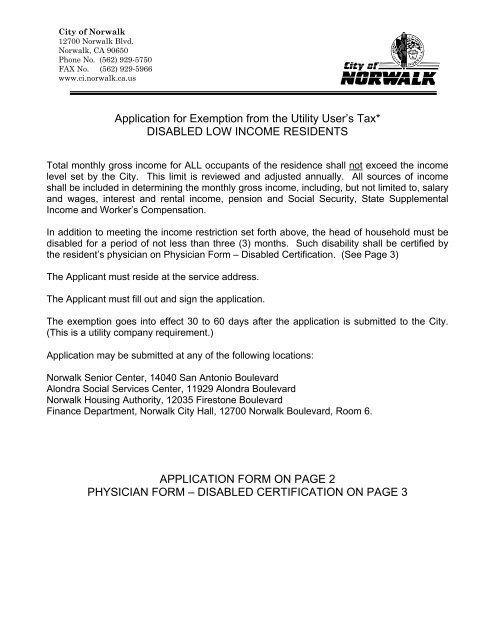

Disabled Low Income Utility Tax Exemption Form City Of Norwalk

Income Tax Exemption Form For Disabled Persons - A number of tax deductions and exclusions benefit people who are on SSDI or SSI and they can also gain from a few special rules for tax advantaged savings and retirement accounts These deductions and rules are in addition to several tax credits that help recipients of disability benefits