Medical Rebate In Income Tax Web 14 juin 2018 nbsp 0183 32 Deduction of Medical Expenses for Senior Citizens Section 80D For the welfare of senior citizens Resident aged 60 or above who don t have health

Web 20 avr 2017 nbsp 0183 32 Deduction under section 80DDB is allowed for medical treatment of a dependant who is suffering from a specified disease listed in the table below Can be Web 6 mars 2019 nbsp 0183 32 While Medical Reimbursement on any disease was tax free up to Rs 15 000 u s 17 2 of the Income Tax Act till last year Medical Allowance was fully taxable

Medical Rebate In Income Tax

Medical Rebate In Income Tax

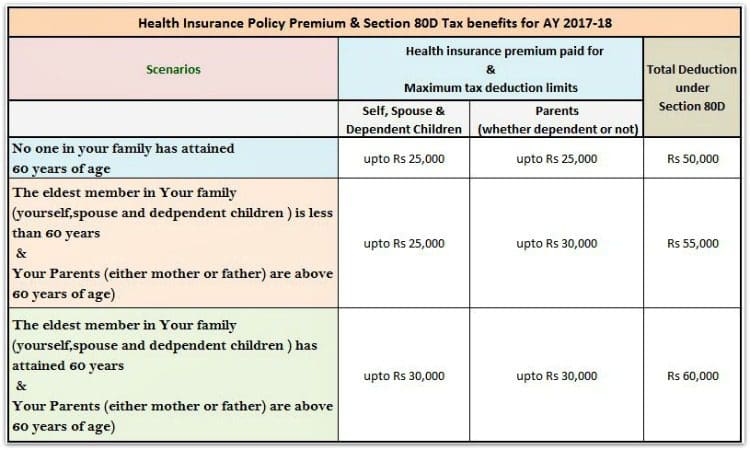

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

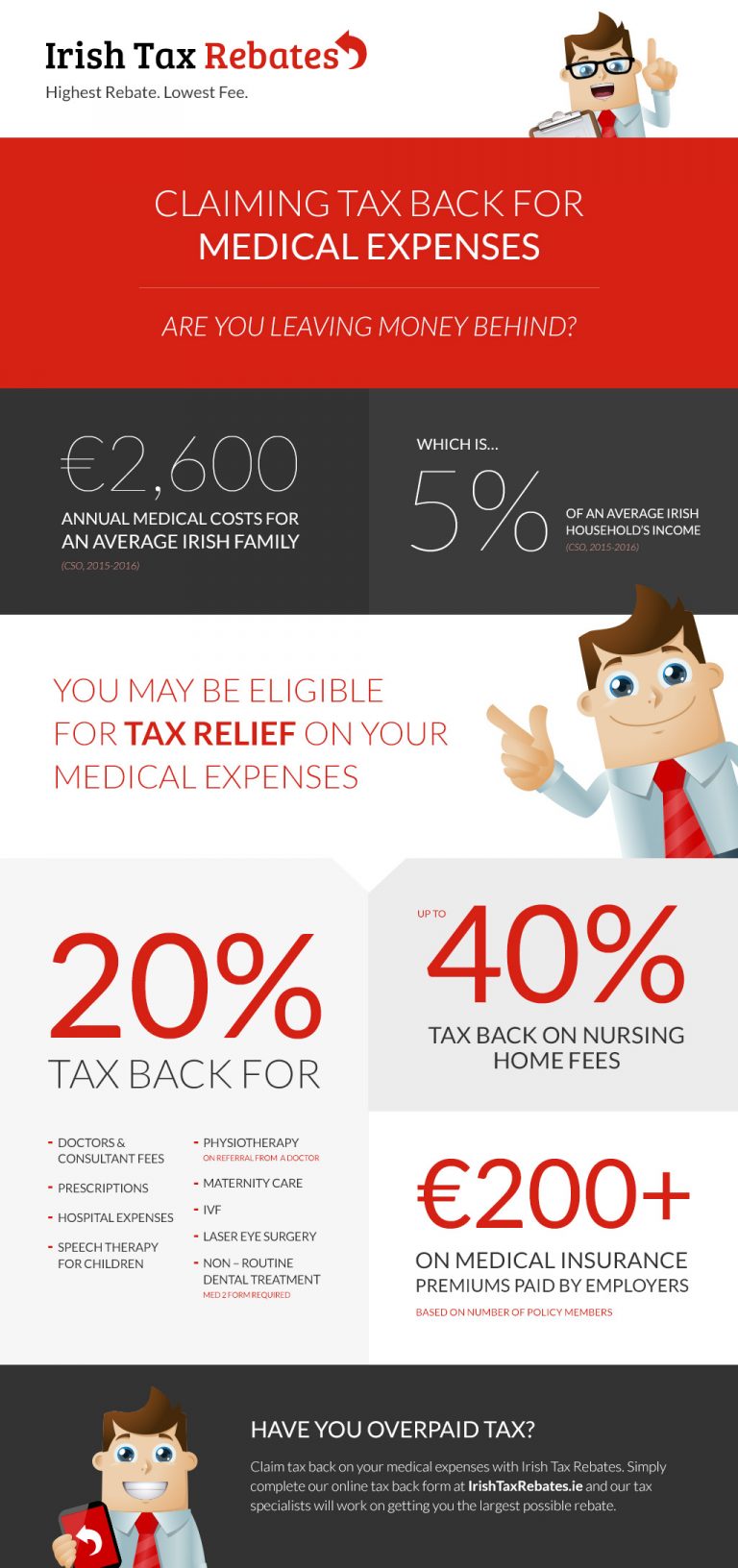

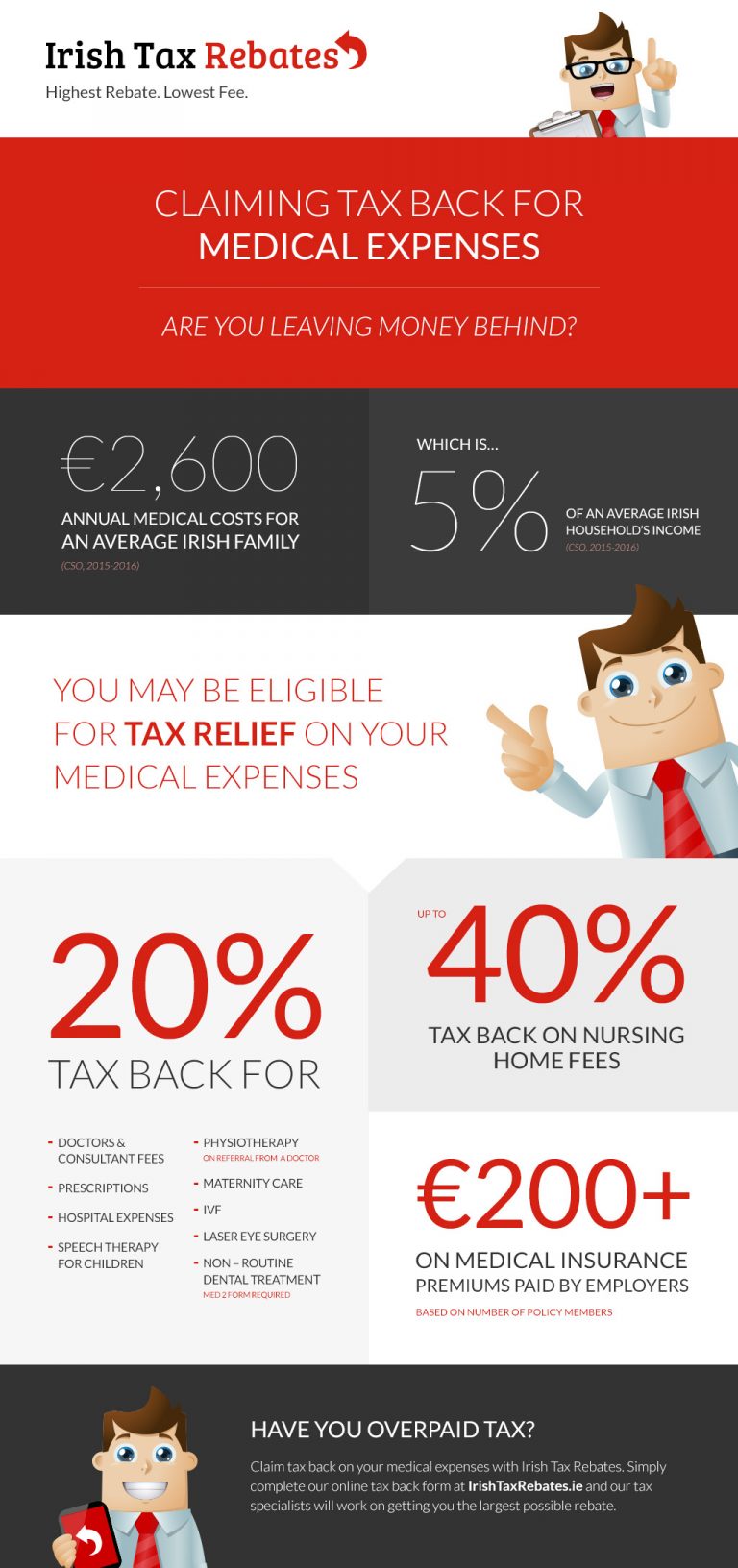

Tax Back On Medical Expenses Infographic Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2018/04/itr-infographic-1-768x1632.jpg

Why Is Medicare

https://www.iselect.com.au/content/uploads/2018/05/ISEL0021-Medicare_Health_Tiles-900pix-v3.png

Web 13 mai 2017 nbsp 0183 32 The Income Tax Act allows tax exemption of up to Rs 15 000 on medical reimbursements paid by the employer What is the Eligibility to Claim Medical Web 13 f 233 vr 2020 nbsp 0183 32 Income Tax Deduction for Medical Expenses Last updated February 13th 2020 05 46 pm This article provides a list of all income tax deductions and other

Web 12 juin 2020 nbsp 0183 32 1 To pay medical expenses out of your own source It happens in case of non insured self employed persons or for non insured salaried people where employer does not provide any medical benefit Web 3 ao 251 t 2023 nbsp 0183 32 What is Section 80D of the Income Tax Act Who is eligible to claim Tax deductions under Section 80D What is the maximum deduction that can be claimed under Section 80D A Medical Insurance

Download Medical Rebate In Income Tax

More picture related to Medical Rebate In Income Tax

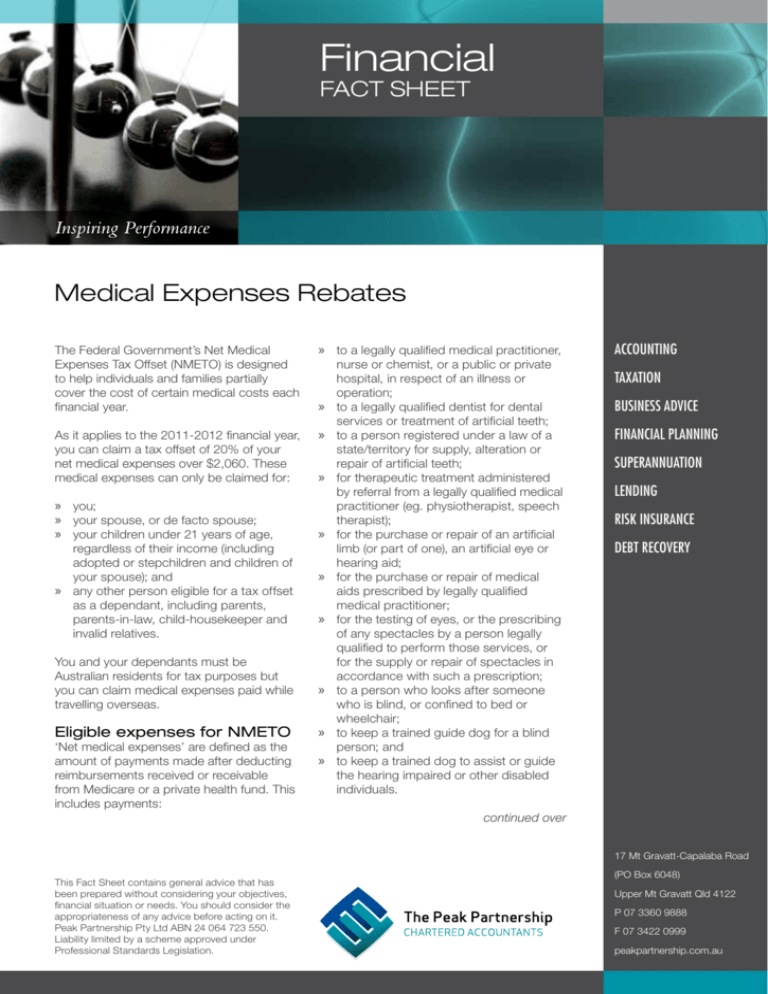

Medical Expenses Rebates

https://s3.studylib.net/store/data/008082010_1-c32f4bdb4afdf54db3e7d4bebd5ba95a-768x994.png

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2014/11/Medical-allowance-form-16.jpg

SCE OFFERS REBATES TO CUSTOMERS WHO ARE MEDICAL BASELINE BASED ON LOWER

https://us1-photo.nextdoor.com/post_photos/14/87/148718885ba5f67f6cbd45ed001c07b7.png

Web 22 f 233 vr 2023 nbsp 0183 32 A Medical Scheme Fees Tax Credit also known as an MTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a person Web 2 mai 2023 nbsp 0183 32 A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers reduce their income tax liability You can claim the

Web 20 sept 2020 nbsp 0183 32 However in case of senior citizens parents you may claim tax deductions up to Rs 50 000 on health insurance premium preventive health checkup up to Rs Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can

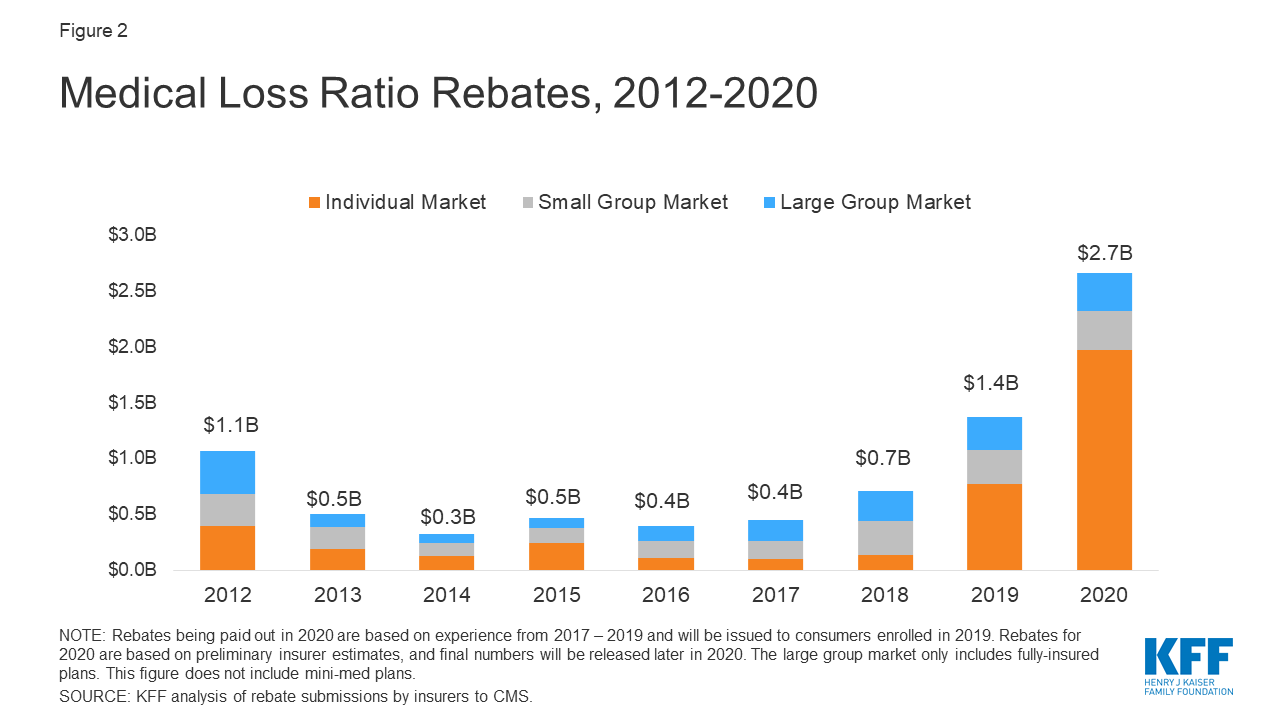

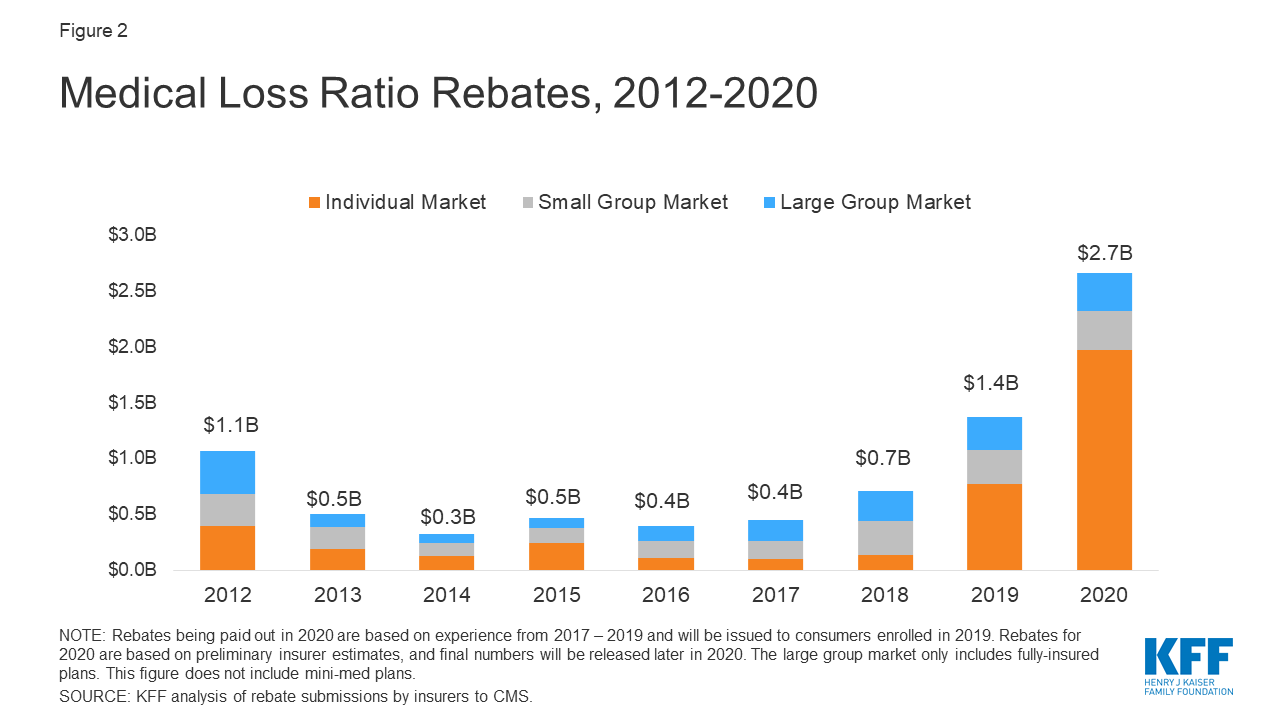

Data Note 2020 Medical Loss Ratio Rebates KFF

https://www.kff.org/wp-content/uploads/2020/04/9346-02-Figure-2.png?resize=300

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

https://i.pinimg.com/originals/04/6c/93/046c93de3420d11217b08ec3f970154b.png

https://cleartax.in/s/medical-insurance

Web 14 juin 2018 nbsp 0183 32 Deduction of Medical Expenses for Senior Citizens Section 80D For the welfare of senior citizens Resident aged 60 or above who don t have health

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Web 20 avr 2017 nbsp 0183 32 Deduction under section 80DDB is allowed for medical treatment of a dependant who is suffering from a specified disease listed in the table below Can be

Rebate In Income Tax Ultimate Guide

Data Note 2020 Medical Loss Ratio Rebates KFF

Travelling Expenses Tax Deductible Malaysia Paul Springer

Rebating Meaning In Insurance What Is Insurance Rebating The

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Medical Rebate In Income Tax - Web 3 ao 251 t 2023 nbsp 0183 32 What is Section 80D of the Income Tax Act Who is eligible to claim Tax deductions under Section 80D What is the maximum deduction that can be claimed under Section 80D A Medical Insurance