Income Tax Exemption House Rent If your rental expenses exceed rental income the loss can be deducted against your other income from investments and capital The Tax Administration will

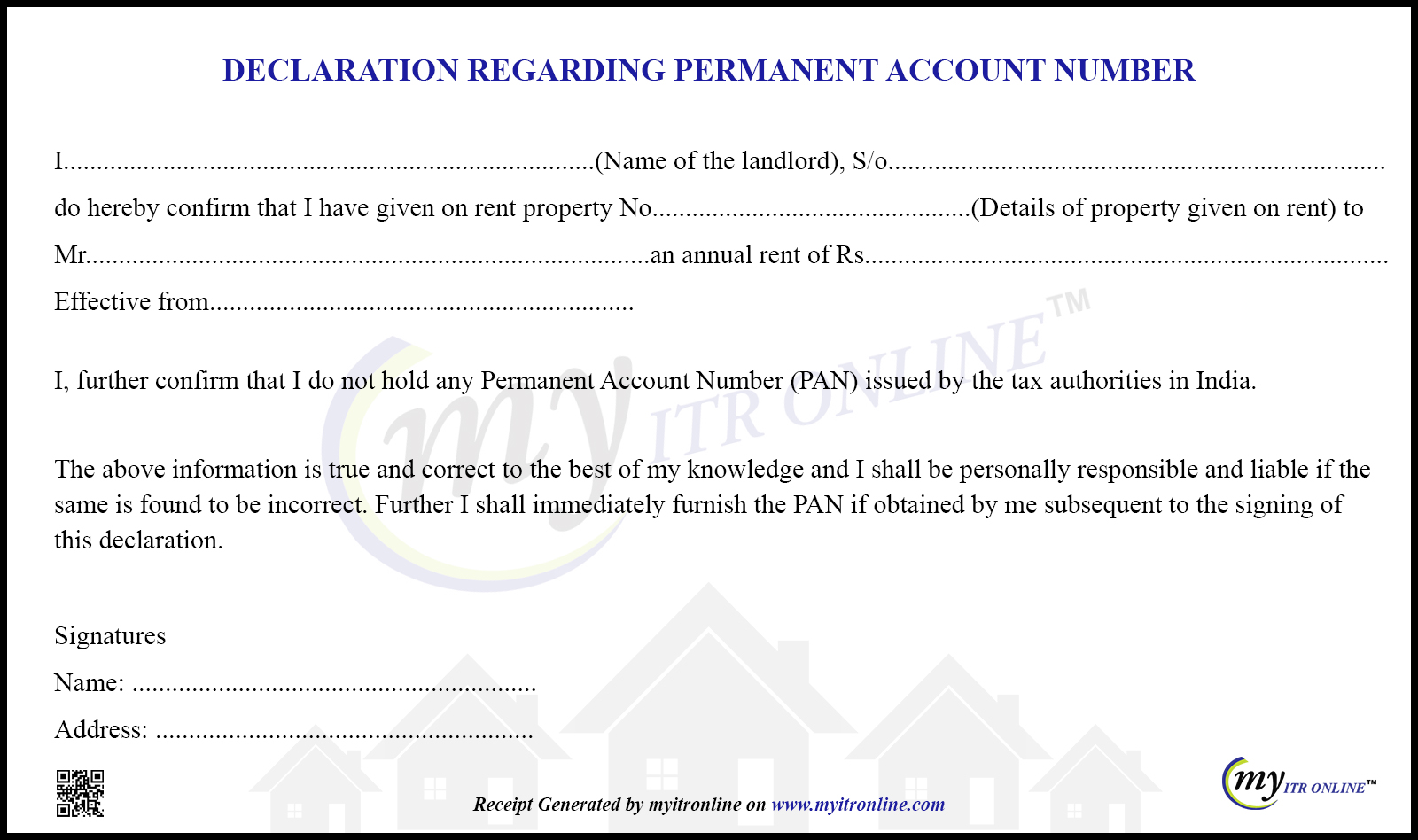

What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to

Income Tax Exemption House Rent

Income Tax Exemption House Rent

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

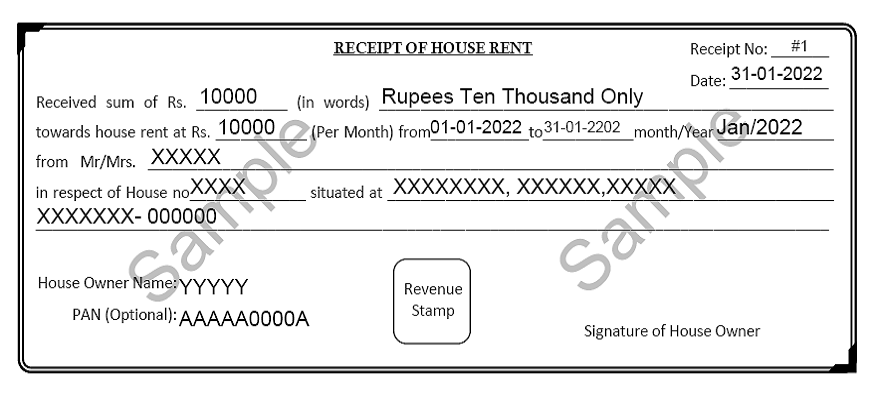

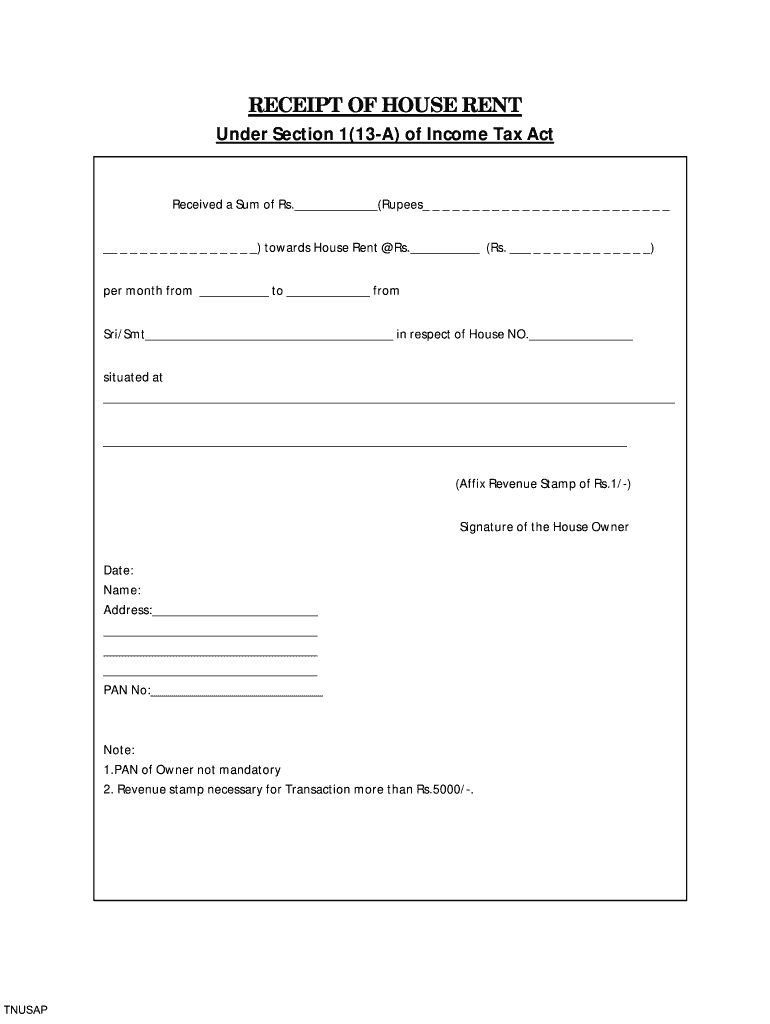

Rent Receipt Format Download Printable PDF With Revenue Stamp

https://static-lib.s3.amazonaws.com/cms/Image_353_cc2daf7222.png

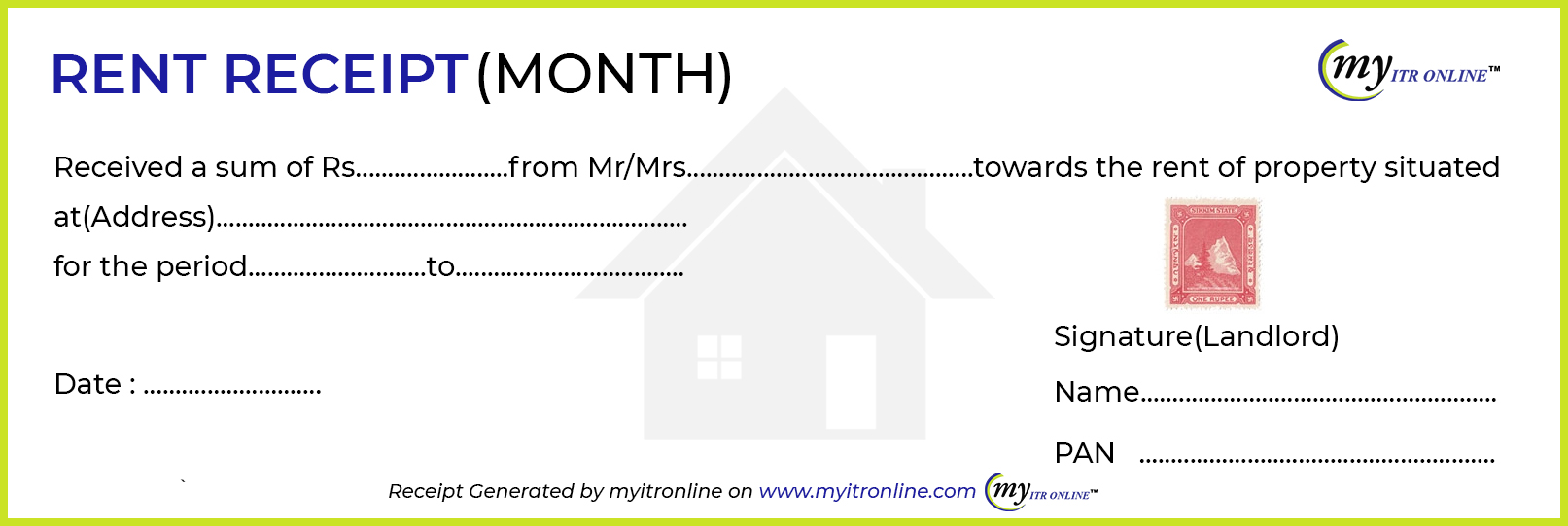

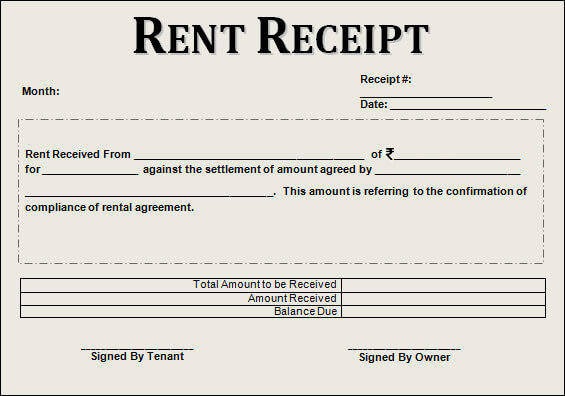

Rent Receipt Generator Online Download Rent Receipt For HRA

https://localitydetails.com/images/rental-receipt-fromat-2.png

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both

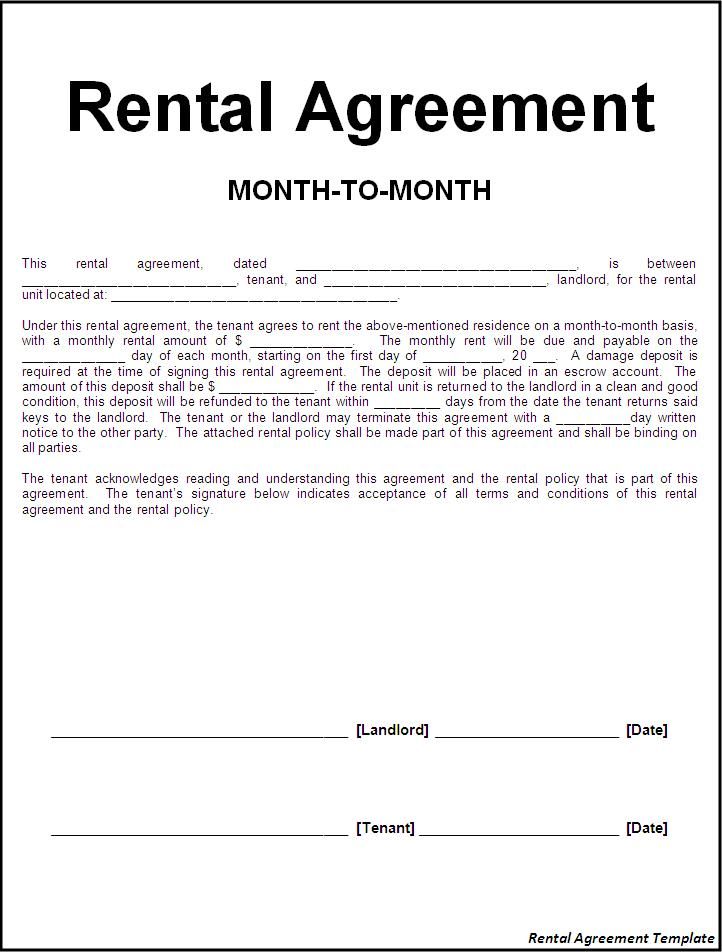

By providing the rental agreement or rent receipts to your employer you can claim income tax HRA exemption without excess tax deduction at source In case the annual rent The house rent allowance exemption calculator will help determine how much tax you need to pay in a financial year HRA slabs also depend on the city you stay in For example if

Download Income Tax Exemption House Rent

More picture related to Income Tax Exemption House Rent

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

Rent Agreement A Complete Guide

https://bikayi.com/b/wp-content/uploads/2022/07/rent-agreement-for-blog.jpg

House Rent Allowance HRA Calculator is to help calculate HRA exemption rebate for the salaried individual from the HRA received from your Employer An employee can claim exemption on his House Rent Allowance HRA under the Income Tax Act if he stays in a rented house and is in receipt of HRA from his employer In order to claim the

Salaried individuals who live in rental premises can claim exemption of House Rent Allowance u s 10 13A Employees are required to submit the rent receipts Calculate your HRA Exemption with Tax2win s House Rent Allowance HRA Calculator easily and maximize your tax benefits

Amazing Inspiration House Format

https://www.bankbazaar.com/images/india/infographic/House_Rent_Receipt_Format.png

Free Rent Receipt Generator Online House Rent Receipt Generator With

https://admin.myitronline.com/assets/tax-tools/Rent-recept-format.jpg

https://www.vero.fi/en/individuals/property/rental_income/deductions

If your rental expenses exceed rental income the loss can be deducted against your other income from investments and capital The Tax Administration will

https://cleartax.in/s/claim-deduction-und…

What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim

House Rent Receipt India

Amazing Inspiration House Format

House Rent Receipt India

House Rent Receipt India

Rent Receipt With Revenue Stamp India 2011 23 Printable Receipt For

Get More Tax Exemptions For Income Tax In Malaysia IMoney

Get More Tax Exemptions For Income Tax In Malaysia IMoney

9 Rent Payment Receipts Sample Templates Sample Templates

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

Pin Auf NEWS You Can USE

Income Tax Exemption House Rent - By providing the rental agreement or rent receipts to your employer you can claim income tax HRA exemption without excess tax deduction at source In case the annual rent