Income Tax Exemption Limit For Home Loan Interest Deductions can be claimed under Section 80C of the Income Tax Act on stamp duty and registration charge paid on home purchase under the overall limit of Rs 1 50 lakhs per annum This claim can

What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Income Tax Exemption Limit For Home Loan Interest

Income Tax Exemption Limit For Home Loan Interest

https://life.futuregenerali.in/media/suwdjtal/tax-saving-on-interest-paid-on-house-loan.jpg

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

Good News For Non govt Salaried Employees Income Tax Exemption Limit

https://cdn.zeebiz.com/sites/default/files/2023/05/25/244235-income-tax-4916261920.jpg

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto As mentioned under the newly inserted section 80EEA of the Income Tax Act the government has extended the limit of deduction up to Rs 1 50 000 applicable to the interest paid by any individual on the

Check out the Home Loan tax benefits under Sections 24 b 80EE and 80C to save tax on your Home Loan Learn how much tax exemption you can claim on a housing loan Presently under Section 24 a home loan borrower who pays interest on the loan may deduct that interest from his or her gross annual income up to a maximum of Rs 2 lakh The deduction of Rs

Download Income Tax Exemption Limit For Home Loan Interest

More picture related to Income Tax Exemption Limit For Home Loan Interest

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202302/new_tax_slab_amounts-sixteen_nine.jpg?VersionId=fwHXK2_vWXcpm_arzu9kYnCvtYzgEmii&size=690:388

Income Tax Exemption On Interest Of Education Loan YouTube

https://i.ytimg.com/vi/6NRHslwXCcM/maxresdefault.jpg

Income Tax Exemption Limit May Get Doubled To Rs 2 Lacs

https://blog.getdistributors.com/wp-content/uploads/2014/07/Tax-cut.jpg

Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You can claim this deduction if you complete A home loan can help you claim an 80C deduction of up to 1 5 lakh a 80EE deduction of 50 000 and a 24 b deduction of 2 lakh making a total taxable value deduction of up to 4 lakh

Currently under Section 24 a house loan borrower who pays interest on the loan can deduct that interest from his or her gross yearly income up to a limit of Rs 2 In India taxpayers can claim tax deductions on home loan interest under Section 24 b of the Income Tax Act This deduction is available for self occupied properties that are

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiuBLR2sr4zdq6frnOvYmY4TMuEbMynEFSiCiVO9-h9YlyZVcz20Rnk1V34S46-X5dWuSxwpF5eEVHb9f_Y-PWQSvT6D5tOGCeOjc5Ffmu9hxfpK9DcrJcDq3faqy3aR4w7eexxY8DMrm13bqa9-CohjejrV7vWzHLgplcUb6NtDbK0V_2k8wdyiQ9e/s1600/Income Tax FY 2022-23 AY 2023-24 Income Tax Act - IT Slab Rates Income Tax Official Circular.png

Share

https://investinkenya.co.ke/wp-content/uploads/2024/03/c783e14b-0e27-4b10-a784-40bd925acdda-768x464.png

https://housing.com/news/home-loans-guid…

Deductions can be claimed under Section 80C of the Income Tax Act on stamp duty and registration charge paid on home purchase under the overall limit of Rs 1 50 lakhs per annum This claim can

https://www.hdfc.com/.../home-loan-tax-be…

What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

Income Tax Clarification Opting For The New Income Tax Regime U s

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

New Income Tax Slab 2019 20 Income Tax Income Tax Exemption

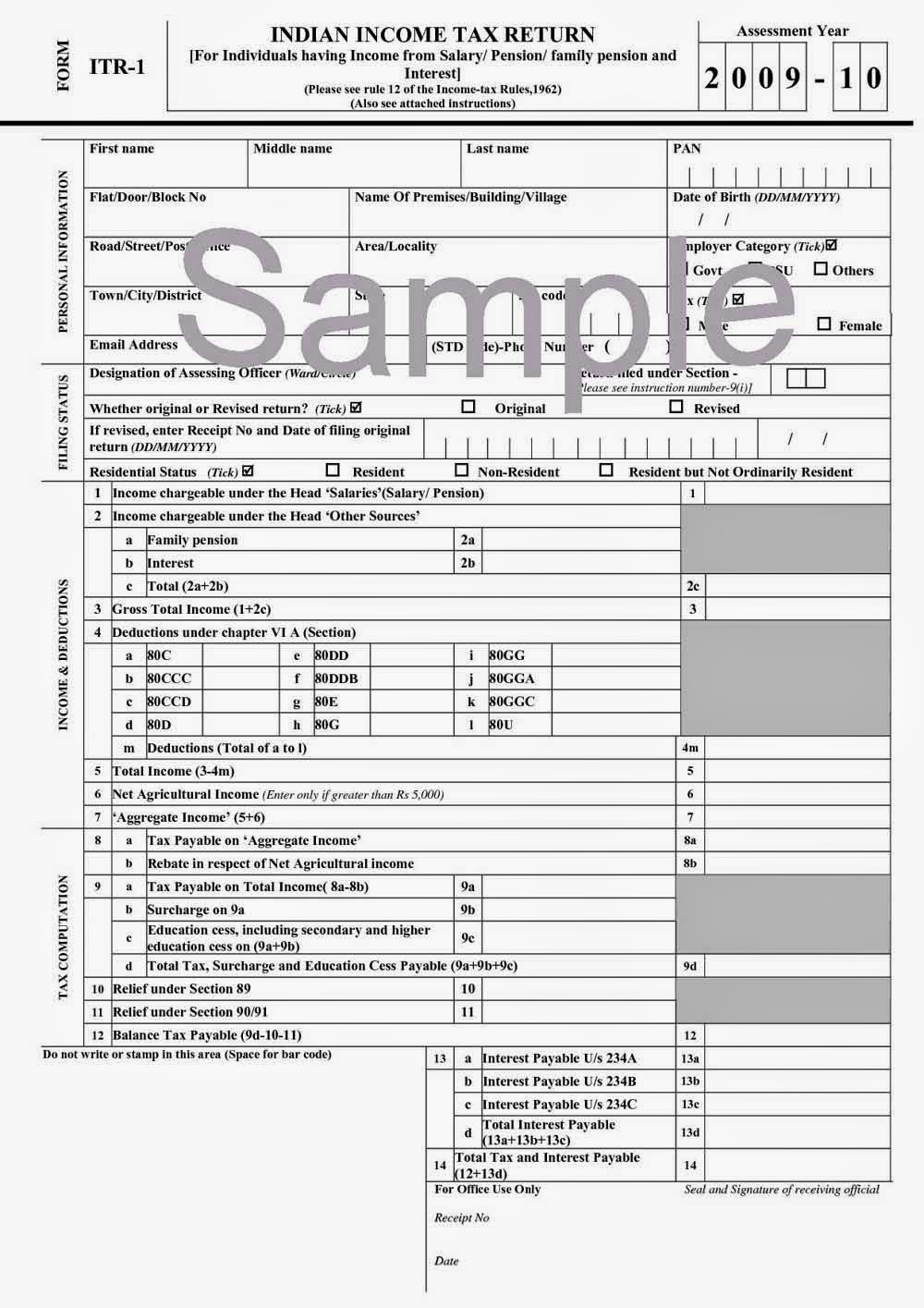

File Income Tax Return How To E File Your Income Tax Vrogue co

Old Vs New Tax Regime Make Sure Which One To Opt For With These 4 Tips

Income Tax Exemption Limit For Home Loan Interest - Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto