Income Tax Exemption On Top Up Home Loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home No limit in

Like home loan Top up home loan also helps in claiming tax benefits The tax benefits on Top up loan include a deduction of up to Rs 1 5 lakhs on the principal A typical home loan offers tax benefits such as a deduction of up to Rs 1 5 lakh on principal repayment under section 80C of the Income Tax Act and a deduction

Income Tax Exemption On Top Up Home Loan

Income Tax Exemption On Top Up Home Loan

https://www.signnow.com/preview/497/332/497332566/large.png

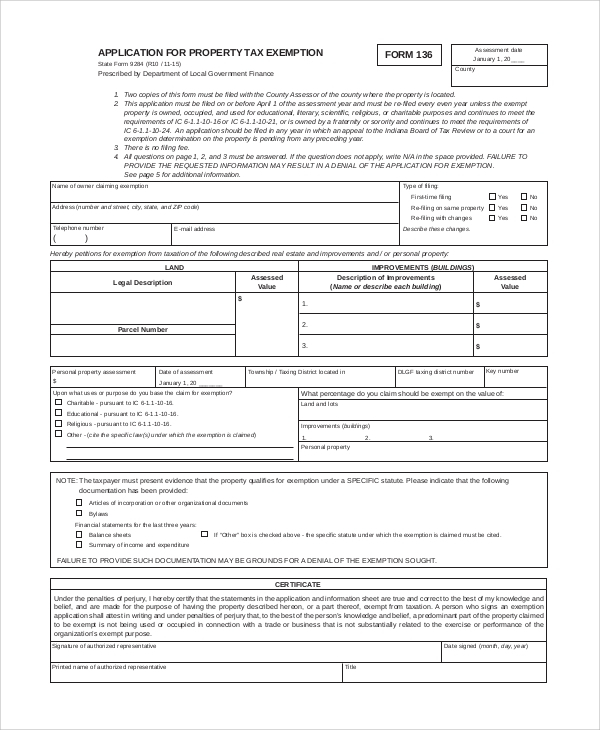

2022 Tax Brackets Lashell Ahern

https://www.kitces.com/wp-content/uploads/2021/09/01-Ordinary-Income-Tax-Rates-Under-The-Proposed-Legislation-1.png

Gratuity Under Income Tax Act All You Need To Know

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/Gratuity-under-Income-Tax-Act-All-You-Need-To-Know.png

However top up home loan interest eligible for tax exemption is subject to the limit specified under Section 80C and 24 b of the Income Tax Act Suppose one Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The

Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce If a borrower uses the Top up Loan to redecorate or refurbish their residential property the Income Tax Act allows them to claim a maximum of Rs 30 000

Download Income Tax Exemption On Top Up Home Loan

More picture related to Income Tax Exemption On Top Up Home Loan

IRS Tax Exemption Letter Peninsulas EMS Council

https://www.pemsc.org/images/Tax_Exempt_Page_2.jpg

State Lodging Tax Exempt Forms ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/ny-hotel-tax-exempt-fill-online-printable-fillable-blank-pdffiller-8.png

Budget 2023 Income Tax Cuts Stamp Duty Exemptions PTPTN Discounts

https://img.iproperty.com.my/angel/750x1000-fit/wp-content/uploads/sites/2/2023/03/image.png

This article explains the strategies for maximizing home loan deductions in Income Tax The Income Tax Act 1961 provides several deductions on home loans An additional deduction under Section 80EE is available to homebuyers up to Rs50 000 To claim this deduction the following conditions must be met The loan

Taxpayers can avail of various tax benefits in case of a regular home loan These include a deduction of Rs 2 lakh on interest payments and Rs 1 5 lakh on The tax breaks had lapsed as a cost containment measure under provisions of the 2017 tax bill that Republicans approved under the Trump administration The

Income Tax Exemption Cannot Be Granted Since Share Transactions Found

https://www.taxscan.in/wp-content/uploads/2022/12/Income-Tax-Exemption-income-Share-Transactions-Undisclosed-Income-Income-tax-ITAT-taxscan.jpg

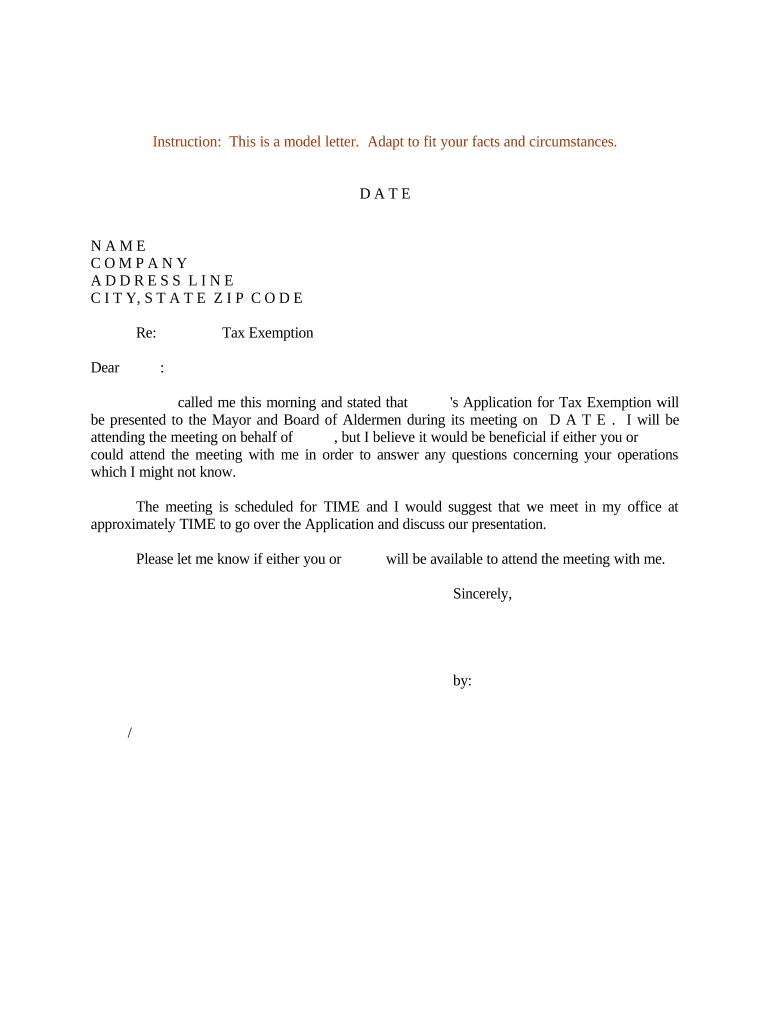

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/free-10-sample-tax-exemption-forms-in-pdf-22.jpg

https://cleartax.in/s/home-loan-tax-benefit

The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home No limit in

https://www.paisabazaar.com/home-loan/avail-tax...

Like home loan Top up home loan also helps in claiming tax benefits The tax benefits on Top up loan include a deduction of up to Rs 1 5 lakhs on the principal

Income Tax Exemption Good News Income Tax Exemption On Home Loan May

Income Tax Exemption Cannot Be Granted Since Share Transactions Found

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

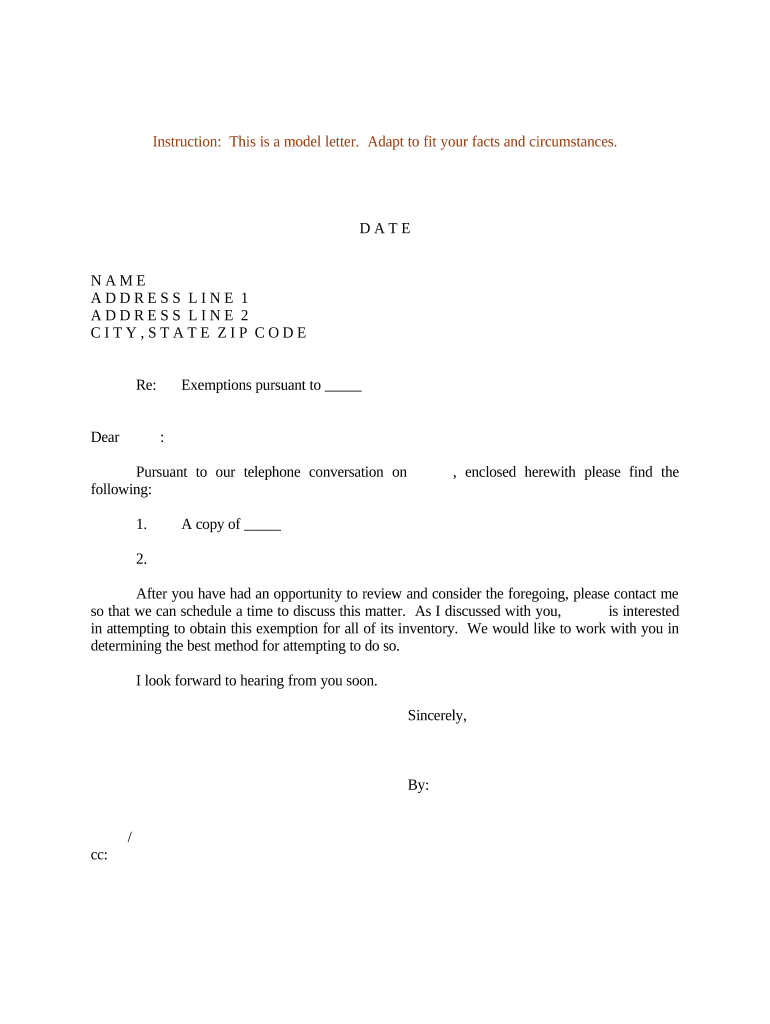

Letter Of Exemption Sample

Budget 2023 Check The Difference Between Income Tax Exemption

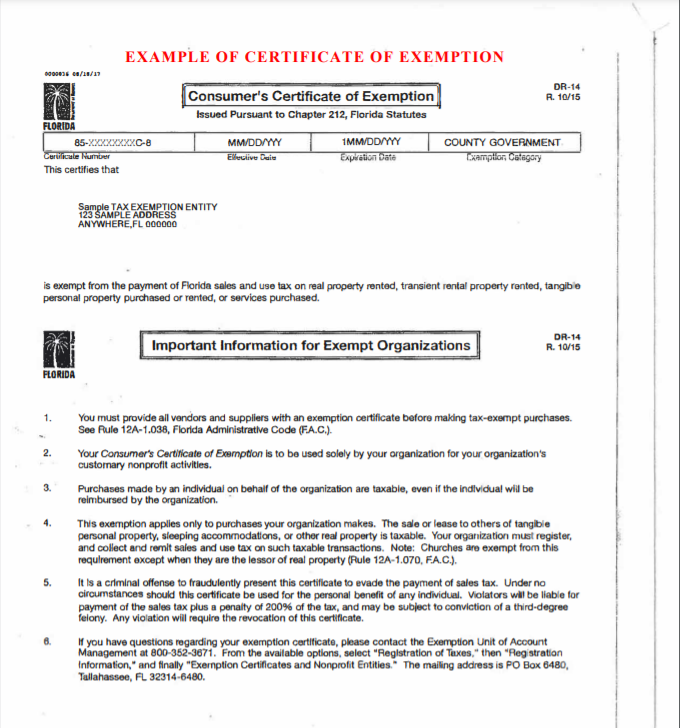

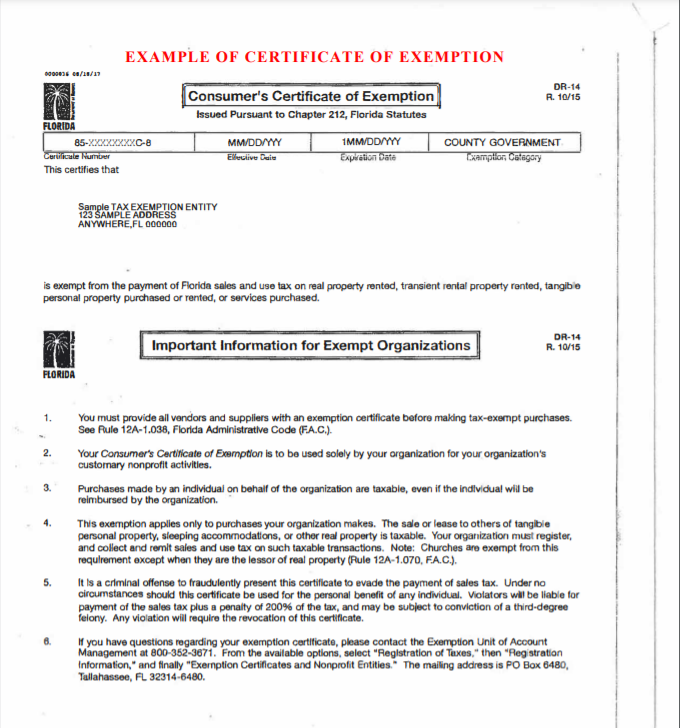

What Is An Example Of A Tax exemption Certificate

What Is An Example Of A Tax exemption Certificate

Religious Exemption Samples

Income Tax Exemption Allowable On Voluntary Payment Made By Employer To

Tax Exemption Certificate SACHET Pakistan

Income Tax Exemption On Top Up Home Loan - A usual home loan provides tax benefits such as deduction of up to Rs 1 5 lakh on principal repayment as per section 80C of the Income Tax Act and up to Rs 2