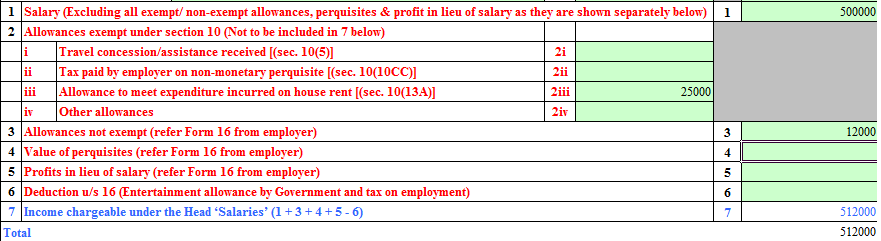

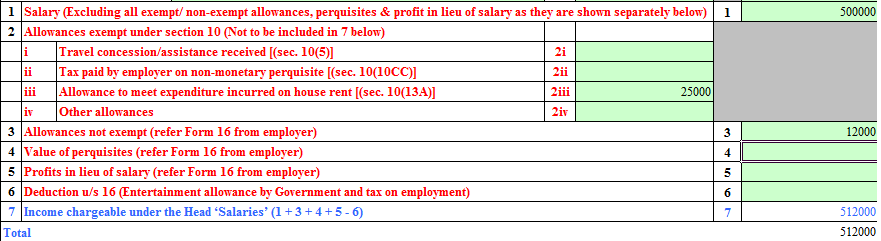

Income Tax Exemption Under Section 16 Section 16 provides a deduction from the income chargeable to tax under the head salaries It offers deductions for the standard deduction entertainment allowance and

Deductions from Salary Section 16 Income tax Act allows three deductions from the salary income i e Standard Deduction Deduction for Entertainment Allowance and Section 16 Income Benefits Section 16 of the Income Tax Act allows employees to claim the following benefits 1 Standard Reduction Rs 50 000 or the salary amount

Income Tax Exemption Under Section 16

Income Tax Exemption Under Section 16

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

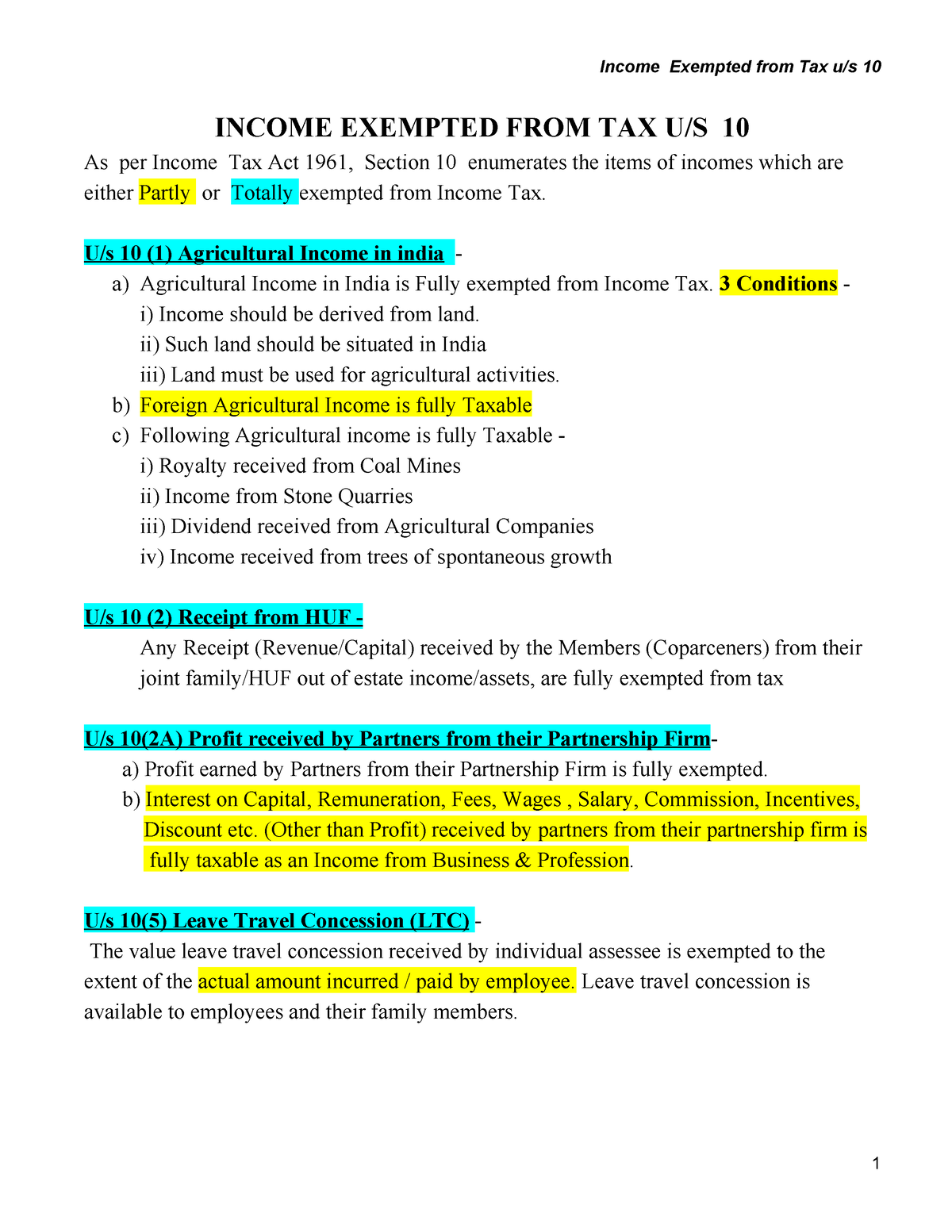

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1e6ed41ab1579da043d5061a9e55bffc/thumb_1200_1553.png

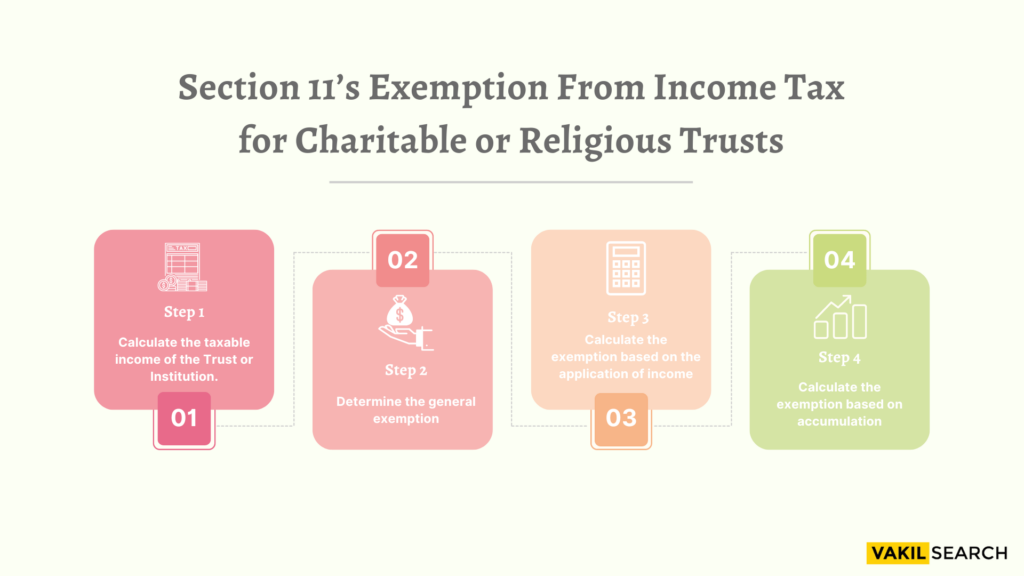

Section 11 Income Tax Act Exemptions For Charitable Trusts

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/08/SECTION-11S-INCOME-TAX-EXEMPTION-1024x576.png

Evidence or particulars of HRA LTC Deduction of Interest on home loan Tax Saving Claims Deductions on eligible payments or investments for the purpose of calculating Pocket WhatsApp Salary exemption under Section 16 of the Income tax Act 1961 Section 16 of the Income Tax Act 1961 deals with allowances and deductions on taxable

What is Section 16 of the Income Tax Act Section 16 of the Income Tax Act provides three different types of tax deductions from your salary income These deductions lower your What Is Income Tax Section 16 Section 16 of the Income Tax Act details three different types of tax deductions allowable in your salary income These deductions help revise

Download Income Tax Exemption Under Section 16

More picture related to Income Tax Exemption Under Section 16

Income Exempted Business Tax Deductions Income Tax Return Tax

https://i.pinimg.com/originals/da/a4/11/daa41151f5a8a0c1fcf98686bc23747b.jpg

Income Tax Under New Regime Understand Everything

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/New-Regime-under-Income-Tax-819x1024.jpeg

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

The standard deduction under Section 16 i a allows salaried individuals and pensioners to claim a flat deduction from their salary or pension income up to a limit specified by Exemption U s 16 standard deduction of the Income tax Act 1961 Therefore Section 16 of the Income tax Act 1961 provides for deduction from taxable income under the heading

Deduction is a way to give relief to tax payer It is the amount a taxpayer reduces from his her total income in computing the tax liability Often some confuse the deductions Standard Deduction under Section 16 With effect from the financial year 2019 20 taxpayers can claim a standard deduction of Rs 50000 from the salary income or the actual

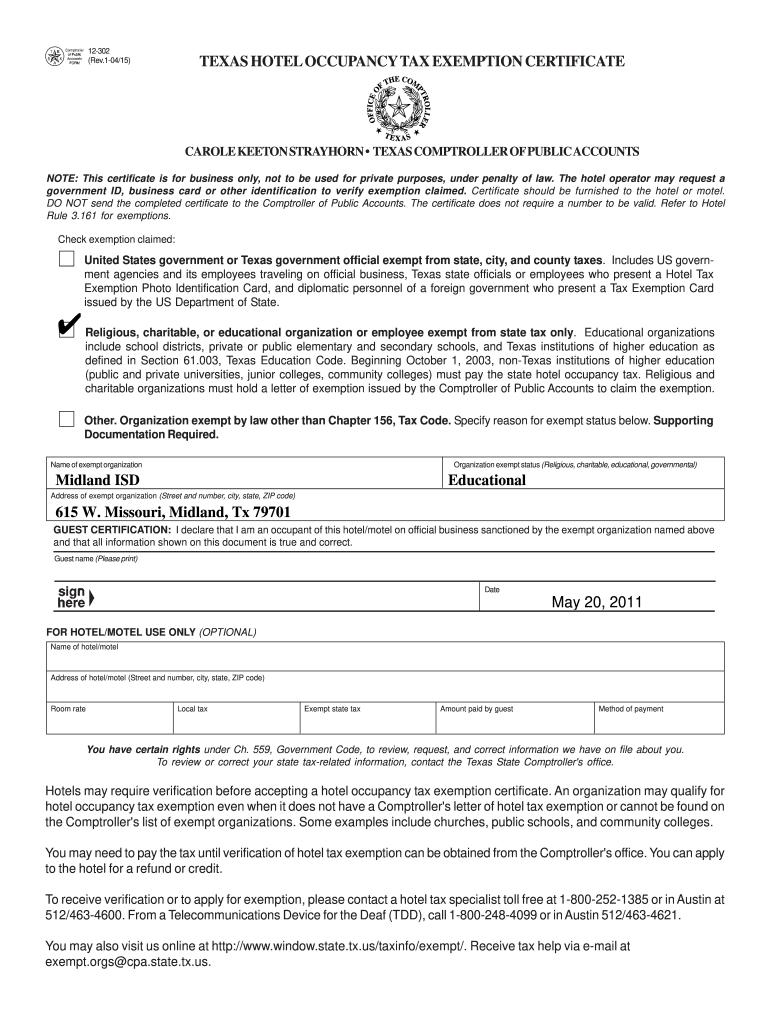

State Lodging Tax Exempt Forms ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/ny-hotel-tax-exempt-fill-online-printable-fillable-blank-pdffiller-8.png

InkPoint Media Breaking Down The New Income Tax Structure

https://cdn.siasat.com/wp-content/uploads/2020/02/Income-Tax-Department.jpg

https://groww.in/p/tax/section-16-of-income-tax-act

Section 16 provides a deduction from the income chargeable to tax under the head salaries It offers deductions for the standard deduction entertainment allowance and

https://incometaxindia.gov.in/Tutorials/80...

Deductions from Salary Section 16 Income tax Act allows three deductions from the salary income i e Standard Deduction Deduction for Entertainment Allowance and

Section 24 Of Income Tax Act Deduction For Home Loan Interest

State Lodging Tax Exempt Forms ExemptForm

Income Tax Exemption U s 10 23C iiiac Allowable When 50 Of Total

Section 10 Of Income Tax Act Exemptions Deductions How To Claim

Income Tax Calculation Example 2 For Salary Employees 2023 24

Best Guide On HRA Exemption Section 10 13A TaxAdda

Best Guide On HRA Exemption Section 10 13A TaxAdda

Tax Exemption Certificate SACHET Pakistan

Capital Gains Exemption Under Section 54 Of The Income Tax Act

Texas Tax Exempt Certificate Fill Online Printable Fillable Blank

Income Tax Exemption Under Section 16 - What is Section 16 of the Income Tax Act Section 16 of the Income Tax Act provides three different types of tax deductions from your salary income These deductions lower your