Income Tax Form For Central Government Employees Section 80CCD 2 provides that employees can claim a deduction on the NPS contribution of up to 10 of salary 14 of salary

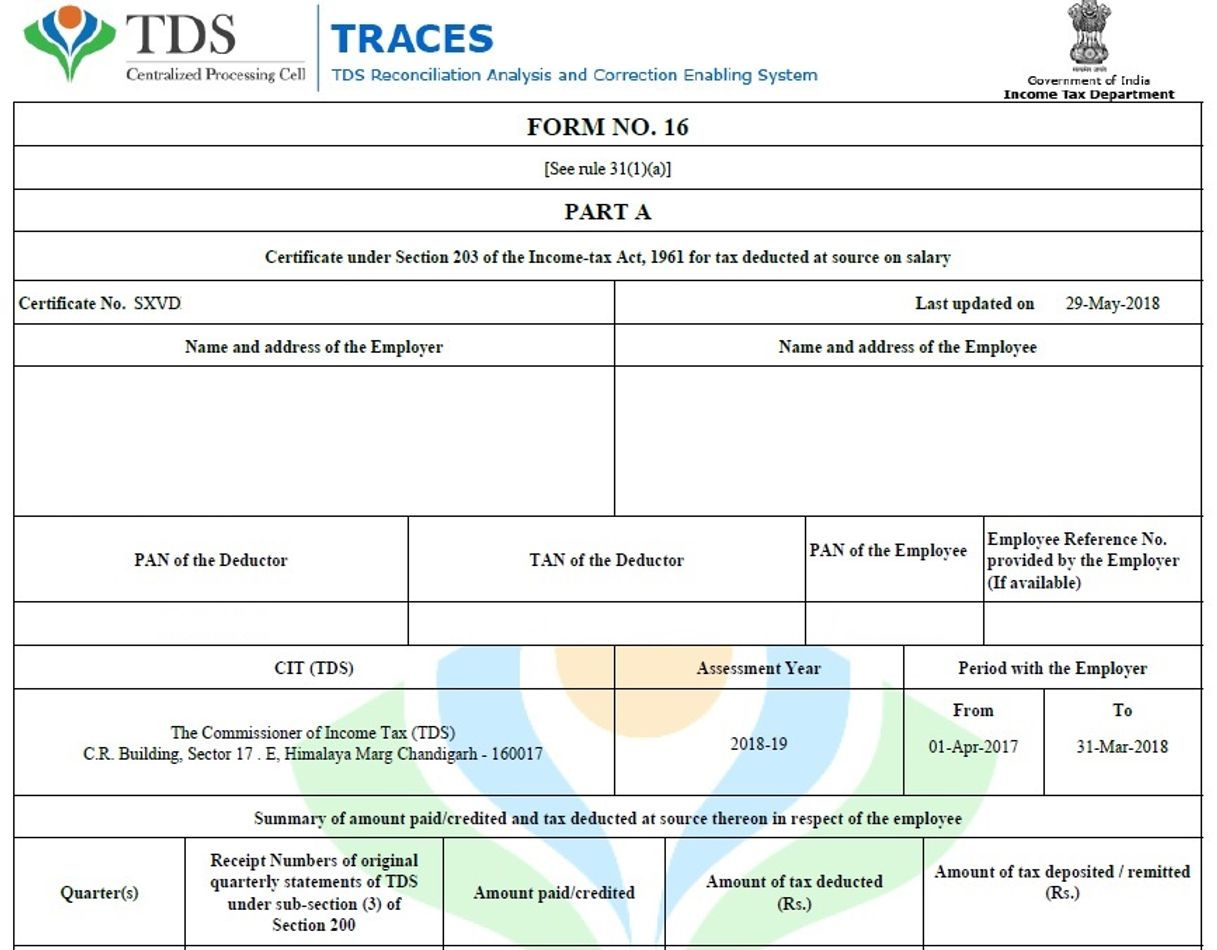

FORM NO 16 See rule 31 1 a PART A Certificate under Section 203 of the Income tax Act 1961 for tax deducted at source on salary paid to an employee EIS is employee information system deployed centrally for all central government employees It covers Pay bill Income tax and GPF modules For claiming income tax

Income Tax Form For Central Government Employees

Income Tax Form For Central Government Employees

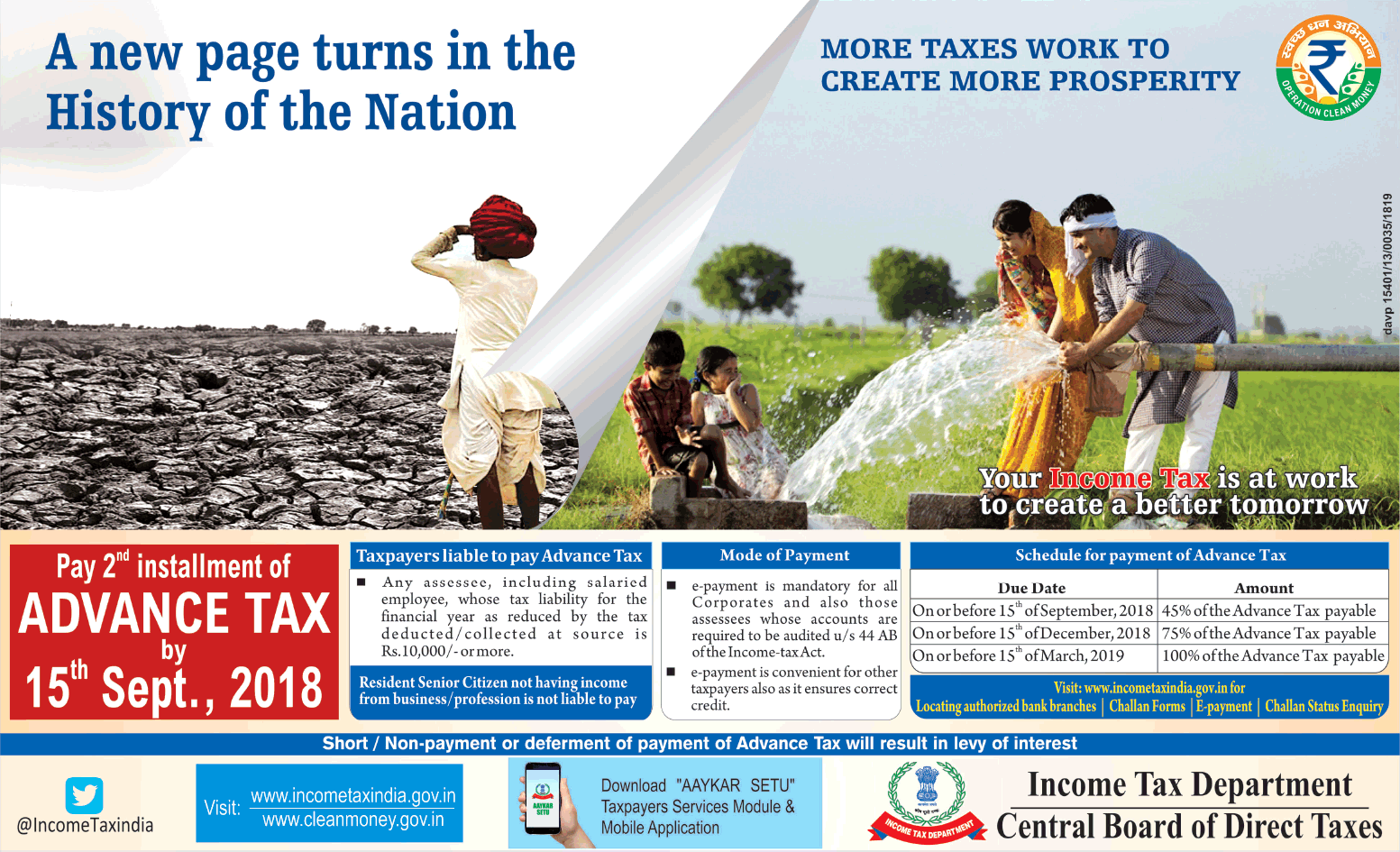

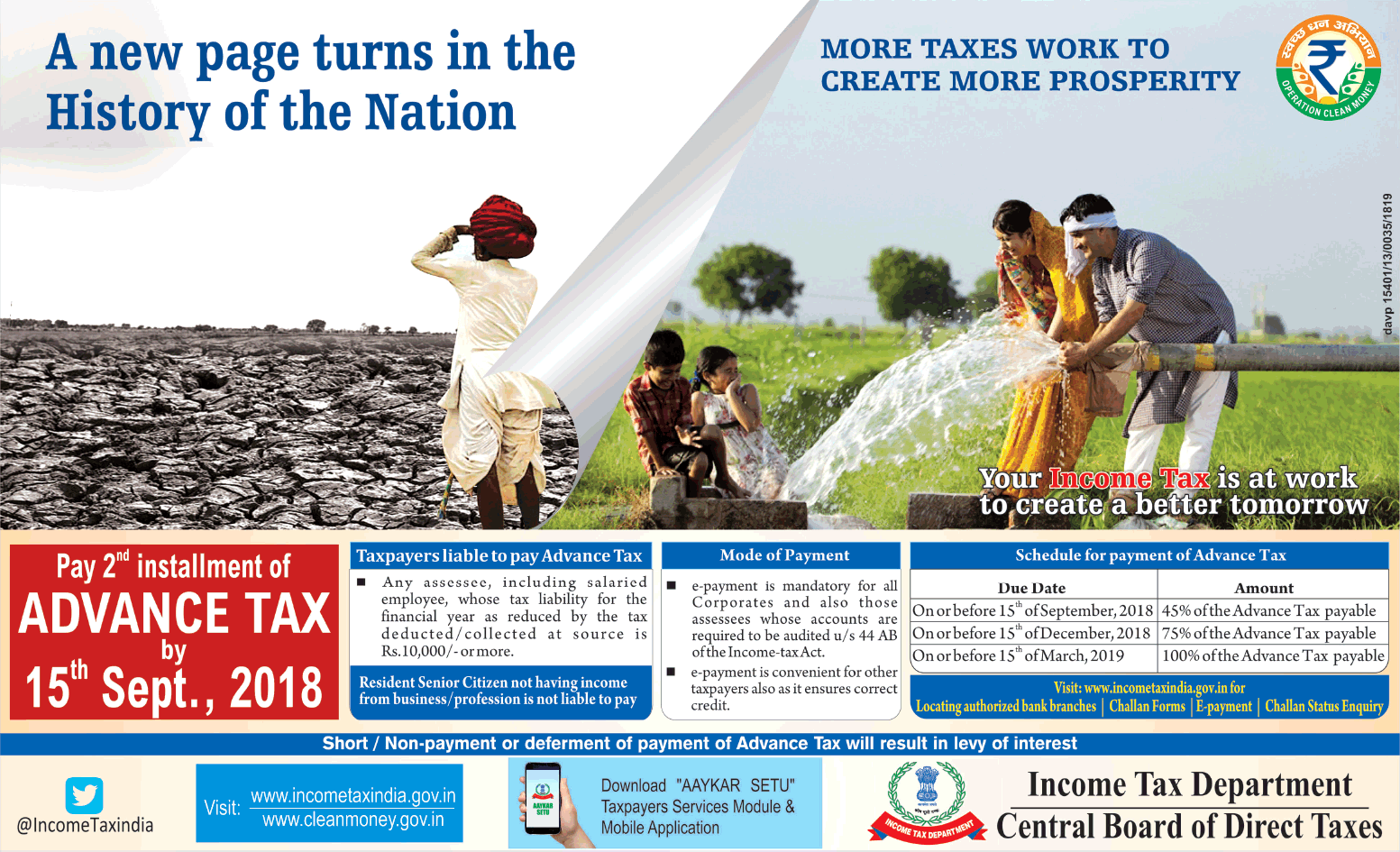

https://newspaperads.ads2publish.com/wp-content/uploads/2018/09/income-tax-department-central-board-of-direct-taxes-ad-times-of-india-delhi-06-09-2018.png

Income Tax Department Central Board Of Direct Taxes Ad Advert Gallery

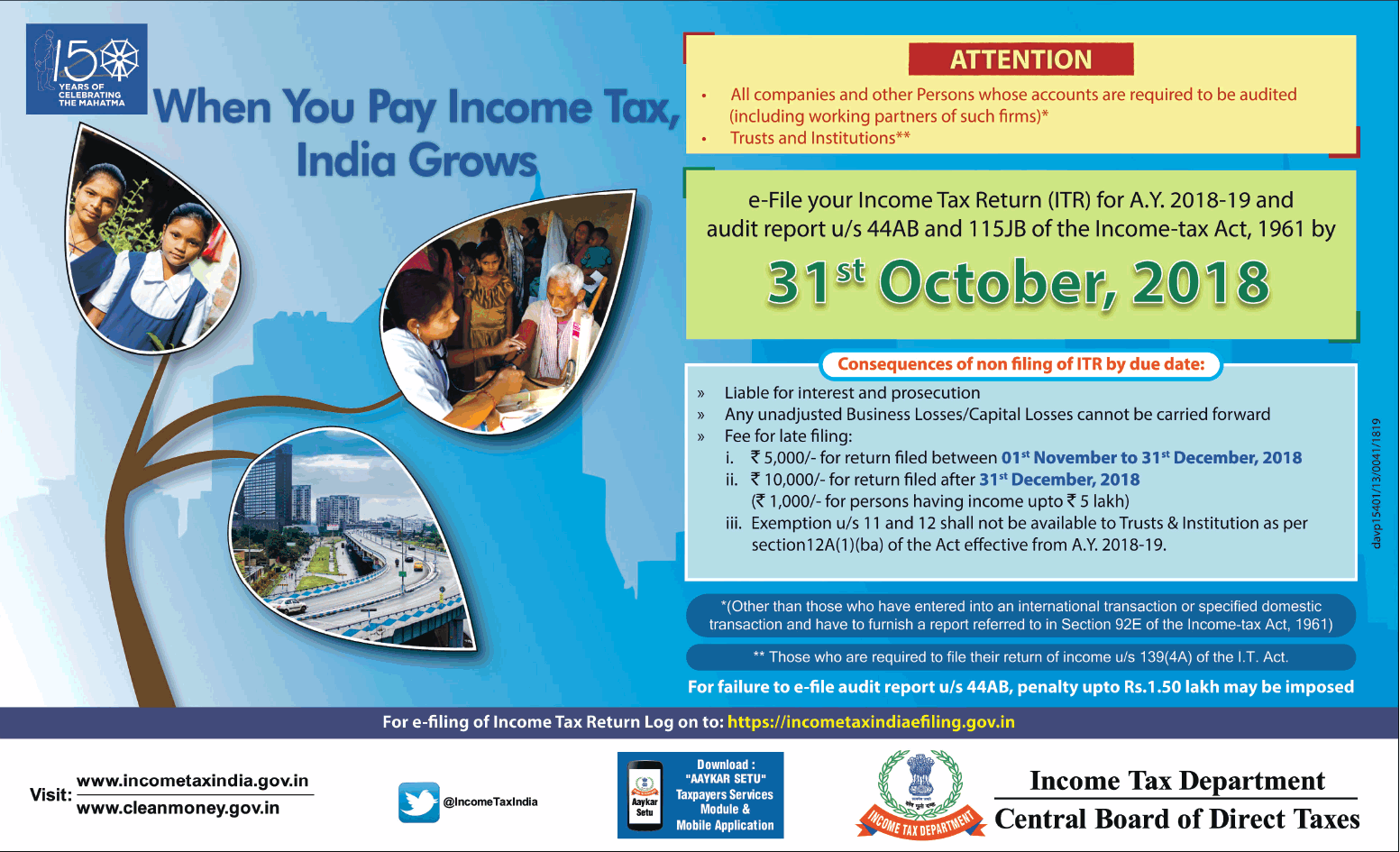

https://newspaperads.ads2publish.com/wp-content/uploads/2018/10/income-tax-department-central-board-of-direct-taxes-ad-times-of-india-delhi-26-10-2018.png

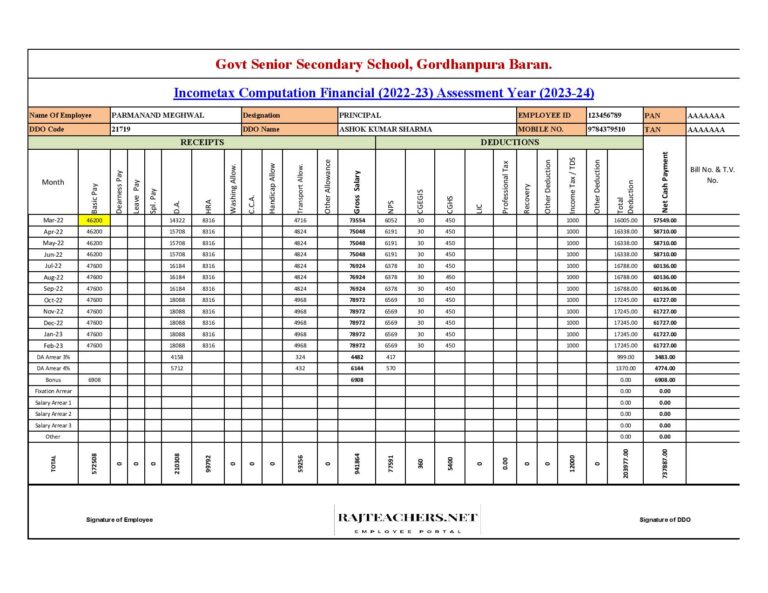

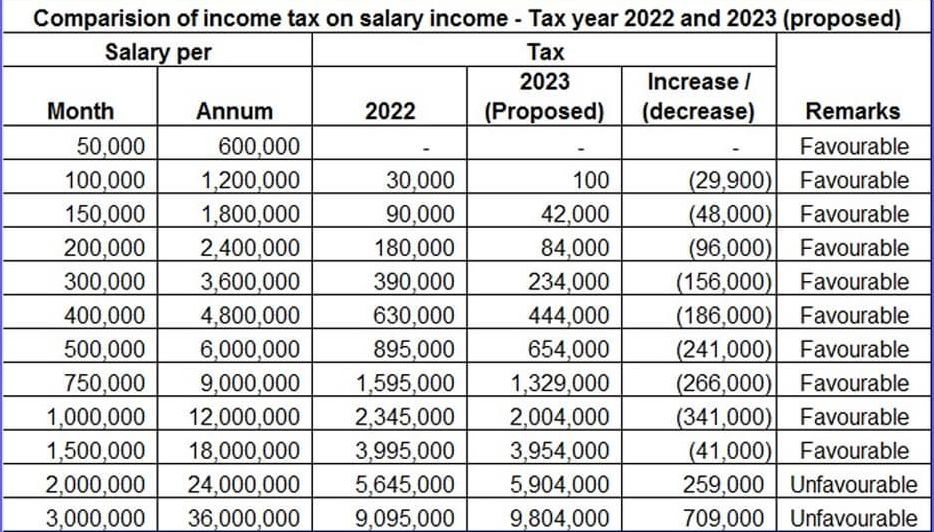

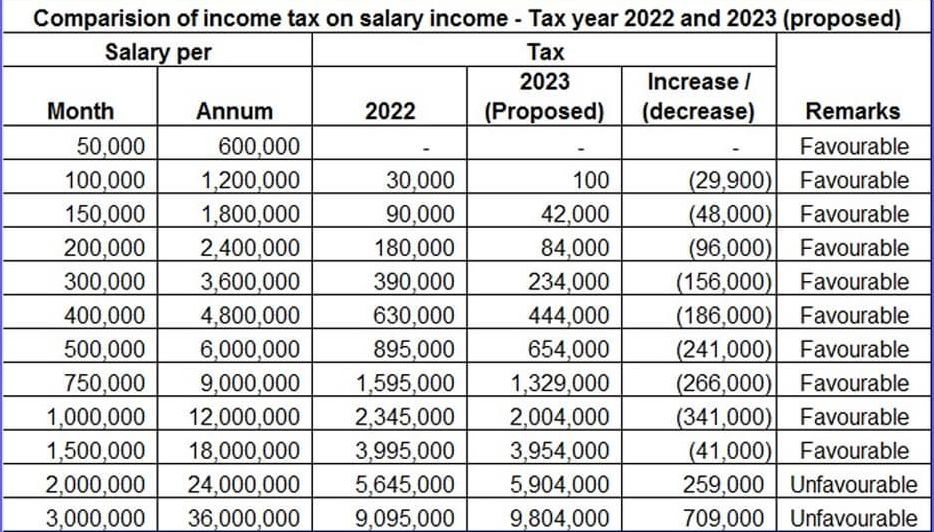

Income Tax Calculation For Central Government Employees

https://rajteachers.net/wp-content/uploads/2022/12/Income-Tax-Calculation-for-Central-Government-Employees-768x593.jpg

Dearness Allowance DA has recently been hiked by 4 to 50 for central government employees Dearness relief DR has also been increased by 4 to 50 This user manual describes Form 10E and the steps to view and submit the form online

Employees having LTA as a component specified in their salary structure can claim an exemption under Section 10 5 of the Income tax Act 1961 for the Employee s own Contribution towards NPS Tier I account is eligible for tax deduction under section 80 CCD 1 of the Income Tax Act within the overall ceiling of Rs 1 50 lakh under Section 80 C of the

Download Income Tax Form For Central Government Employees

More picture related to Income Tax Form For Central Government Employees

Income Tax Department Central Board Of Direct Taxes Ad Advert Gallery

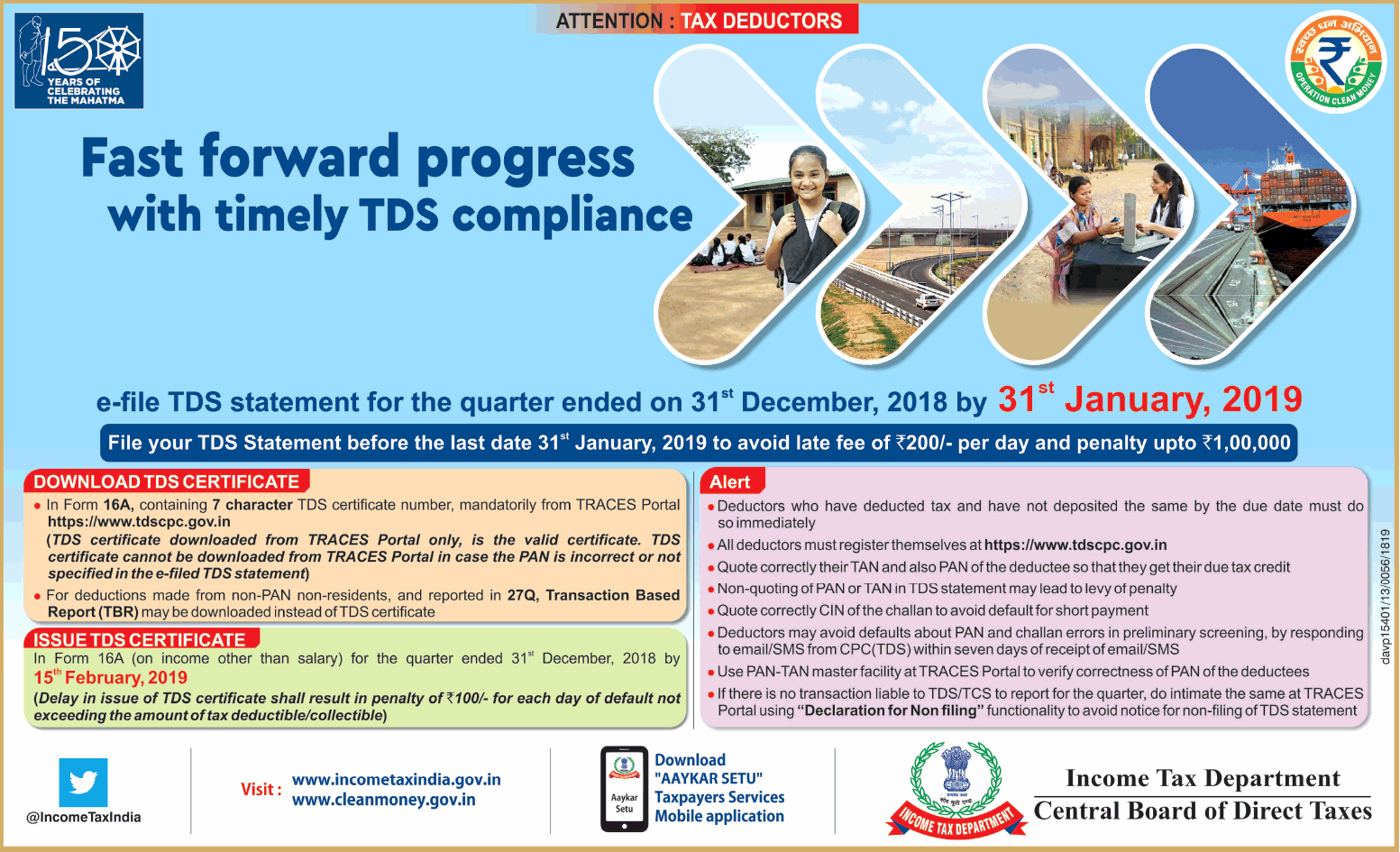

https://newspaperads.ads2publish.com/wp-content/uploads/2019/01/income-tax-department-central-board-of-direct-taxes-ad-times-of-india-delhi-22-01-2019.png

Income Tax Department Central Board Of Direct Taxes Ad Advert Gallery

https://newspaperads.ads2publish.com/wp-content/uploads/2018/01/income-tax-department-central-board-of-direct-taxes-ad-times-of-india-delhi-25-01-2018.png

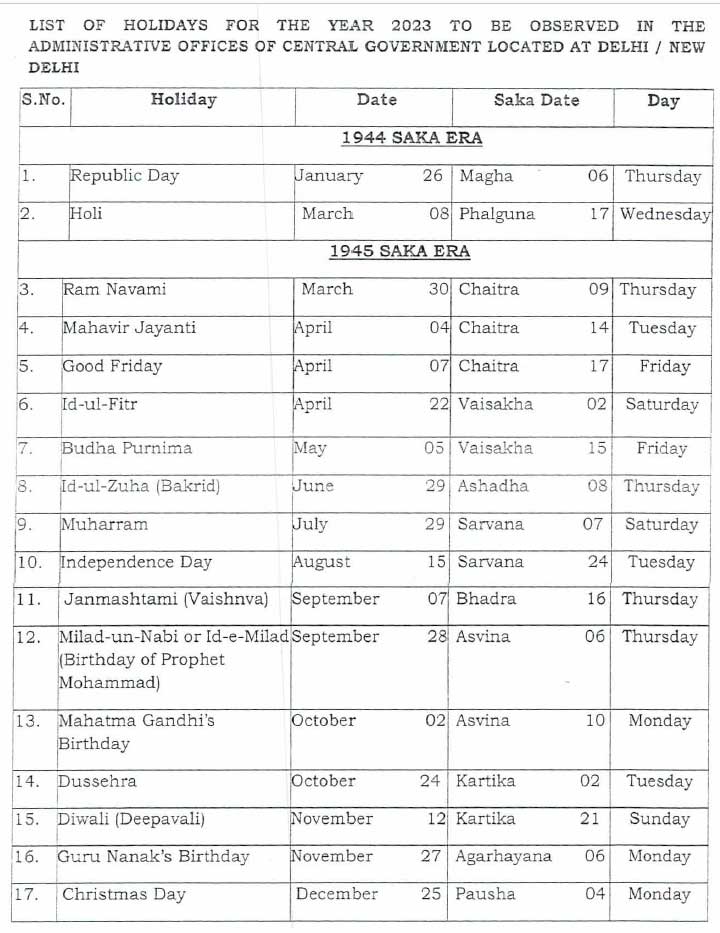

Central Government Offices Gazetted Holidays 2023 Central Government

https://www.centralgovernmentnews.com/wp-content/uploads/2022/06/CENTRAL-GOVERNMENT-EMPLOYEES-GAZETTED-HOLIDAYS-2023-DOPT-HOLIDAYS-2023.jpg

Many taxpayers are wondering whether they are allowed to switch their preferred income tax regime and avail new benefits announced by the central Updated Jul 28 2024 10 06 AM IST The Black Money Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 was introduced to crack down on black money

As a presidential candidate Harris also advocated for raising the corporate income tax rate to 35 where it was before the 2017 Tax Cuts and Jobs Act that During his 2022 re election campaign he denounced his Republican opponent for saying that accepting immigrants without enough resources threatened Minnesota s

Earned Leave Application Form For Central Government Employees In Hindi

https://i0.wp.com/www.employementform.com/wp-content/uploads/2022/10/earned-leave-application-form-for-central-government-employees-in-hindi.jpg

Features Of Confederal System Of Government

https://assets.coursehero.com/study-guides/lumen/images/americangovernment/introduction-3/GOVT-2305-Government-Structures-of-Government-by-Country-Chart-July-2017-update-e15003233557493.png

https://cleartax.in/s/section-80-ccd-1b

Section 80CCD 2 provides that employees can claim a deduction on the NPS contribution of up to 10 of salary 14 of salary

https://assets1.cleartax-cdn.com/cleartax/images/...

FORM NO 16 See rule 31 1 a PART A Certificate under Section 203 of the Income tax Act 1961 for tax deducted at source on salary paid to an employee

Code On Wages Central Advisory Board Rules 2021

Earned Leave Application Form For Central Government Employees In Hindi

Providing Form 16 To All Pensioners And Family Pensioners CPAO

LTC Claim Proforma For Central Government Employees PDF Transport

Budget 2017 18 No Income Tax Upto Rs 3 Lakh And 5 Percent Upto Rs 5

New Income Tax Slabs Introduced For Salaried Class In Budget 2022 23

New Income Tax Slabs Introduced For Salaried Class In Budget 2022 23

7th Pay Commission January Salary Of Central Govt Employees Set To

Increase In Salary Allowance For Central Government Employees Naadu

GPF Withdrawals Amendment Orders Issued On 7 3 2017 Central

Income Tax Form For Central Government Employees - To claim relief government employees must file form 10E online on the Income Tax e filing portal Taxpayers claiming relief under Section 89 without