Income Tax House Rent Exemption Rules Section 10 13A of the Income Tax Act allows salaried individuals to claim exemptions for House Rent Allowance HRA As this allowance is a significant part of an individual s salary it is important to follow the company s policies regarding the

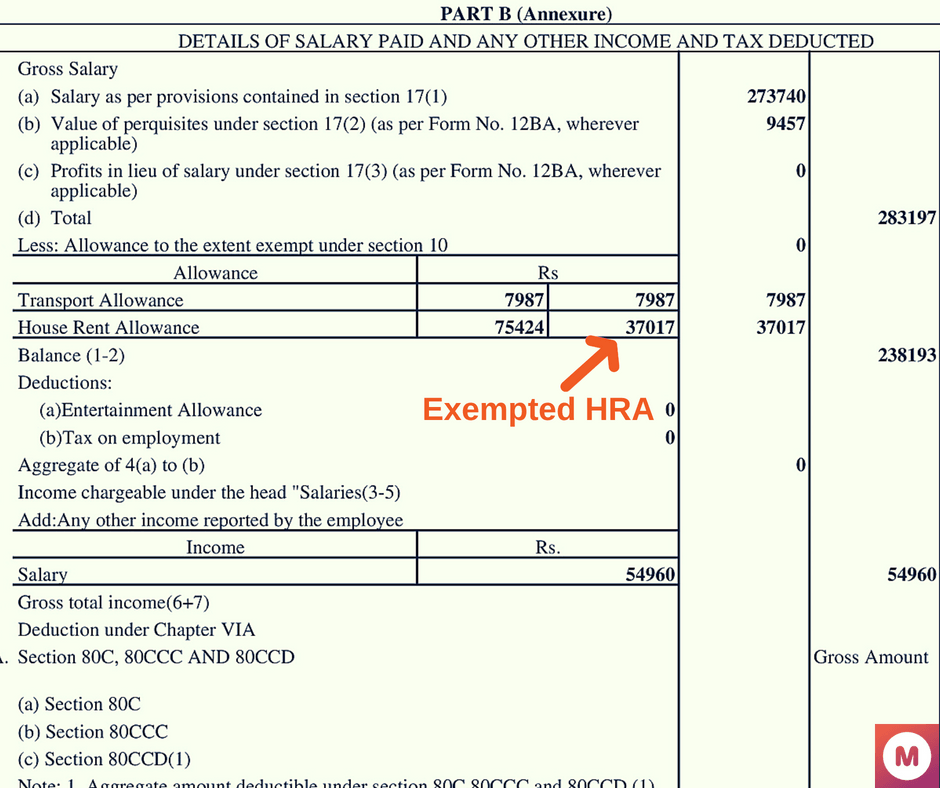

HRA tax exemption rules The HRA tax exemption reduces the total salary before calculating taxable income helping employees save on taxes It s important to note that if an employee lives in their own house or does not pay any rent the HRA received from the employer is fully taxable An employee can claim exemption on his House Rent Allowance HRA under the Income Tax Act if he stays in a rented house and is in receipt of HRA from his employer In order to claim the deduction an employee must actually pay rent for the house which he occupies

Income Tax House Rent Exemption Rules

Income Tax House Rent Exemption Rules

https://i.pinimg.com/originals/cd/bf/52/cdbf5266dd5ee6d50226e5e607a73e23.png

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

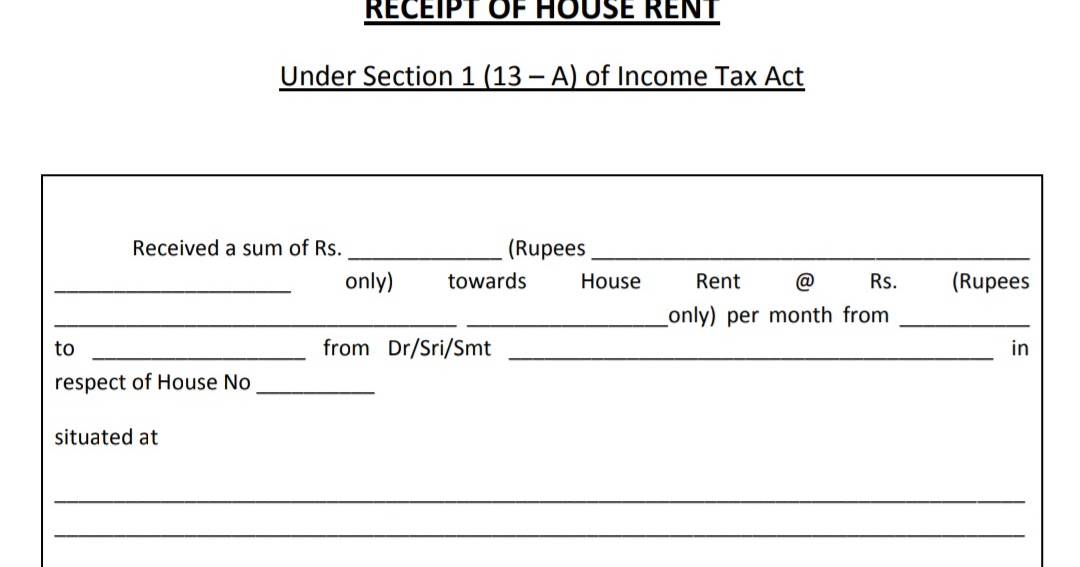

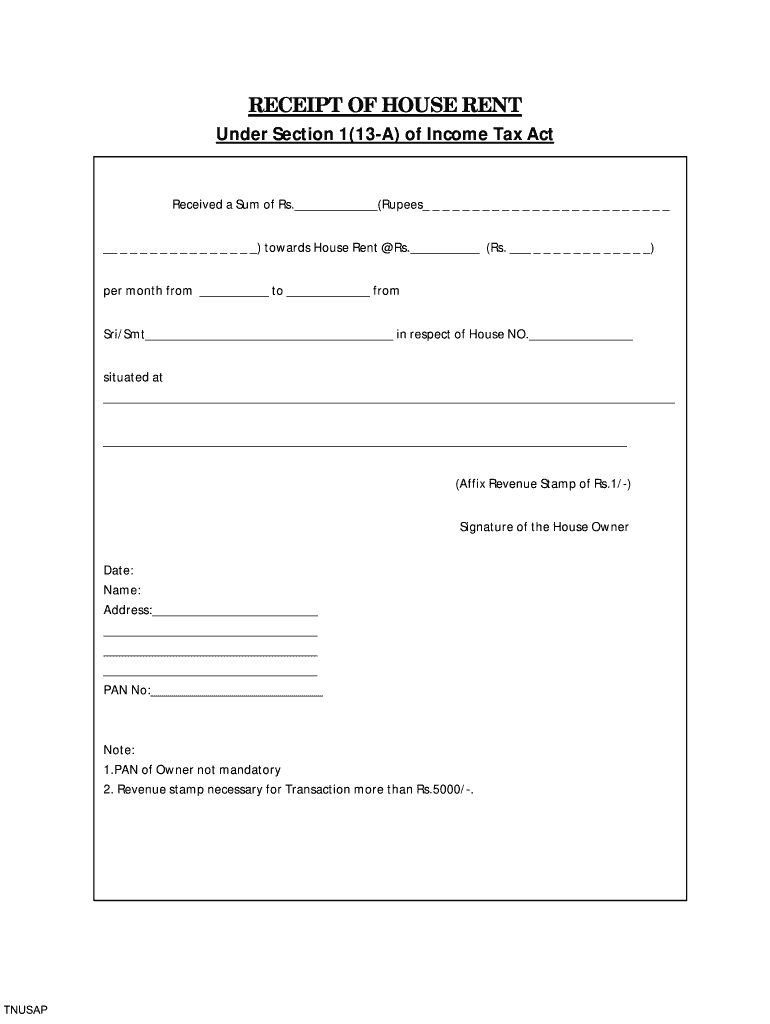

House Rent Receipt Format PDF Download

https://captainsclerk.com/18790bfb/https/34a049/geod.in/wp-content/uploads/2021/07/Receipt-of-House-Rent.jpg

For most employees House Rent Allowance HRA is a part of their salary structure Although it is a part of your salary HRA unlike basic salary is not fully taxable Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable

Understanding the rules and guidelines for claiming House Rent Allowance Exemption can significantly reduce the tax burden for salaried individuals In this article we will walk you through the process of claiming HRA exemption in income tax From FY 2020 21 onwards House Rent Allowance Exemption is only available if an employee opts for the Old Tax Regime Exemption Rules and Calculation The amount of Exempt HRA will be the least of the following amounts Actual House Rent Allowance received Actual rent paid less 10 of salary

Download Income Tax House Rent Exemption Rules

More picture related to Income Tax House Rent Exemption Rules

HRA House Rent Allowance Exemption Rules Tax Deductions

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/01/HRA-–-House-Rent-Allowance-–-Exemption-Rules-Tax-Deductions.jpg

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

https://www.meteorio.com/wp-content/uploads/2018/05/Exempted-HRA-.png

What Is House Rent Allowance HRA Exemption And Calculation Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

What is HRA for Salaried Individuals HRA or House Rent Allowance is an exemption provided to salaried individuals under Section 10 13A rule 2A of the Income Tax Act It allows individuals to claim tax benefits for the rent they pay House Rent Allowance HRA is a crucial tax benefit for salaried individuals who rent their accommodations focusing on exemptions under section 10 13A of the Income Tax Act 1961 The financial year 2023 24 introduced significant changes aligned with the Budget 2023 effective from April 1 2023 which streamlines exemptions under

Under the old tax regime House Rent Allowance HRA is exempted under section 10 13A for salaried individuals However this exemption is not available in the new tax regime What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section 80GG towards rent that you pay Learn more

Pin Auf NEWS You Can USE

https://i.pinimg.com/originals/4b/35/2c/4b352c55ac0959e4b980ff968f94f4f0.jpg

Sample House Rent Receipt For Income Tax

https://3.bp.blogspot.com/-9CD_BsqOb4o/XGU1vFzLz0I/AAAAAAAAKo8/HHN4B9O6MMc-bhGts-bVFLxtWnuNUSKkwCLcBGAs/w1200-h630-p-k-no-nu/Screenshot_2019-02-14-15-01-22-527_com.google.android.apps.docs.png

https://cleartax.in/s/hra-house-rent-allowance

Section 10 13A of the Income Tax Act allows salaried individuals to claim exemptions for House Rent Allowance HRA As this allowance is a significant part of an individual s salary it is important to follow the company s policies regarding the

https://economictimes.indiatimes.com/wealth/tax/...

HRA tax exemption rules The HRA tax exemption reduces the total salary before calculating taxable income helping employees save on taxes It s important to note that if an employee lives in their own house or does not pay any rent the HRA received from the employer is fully taxable

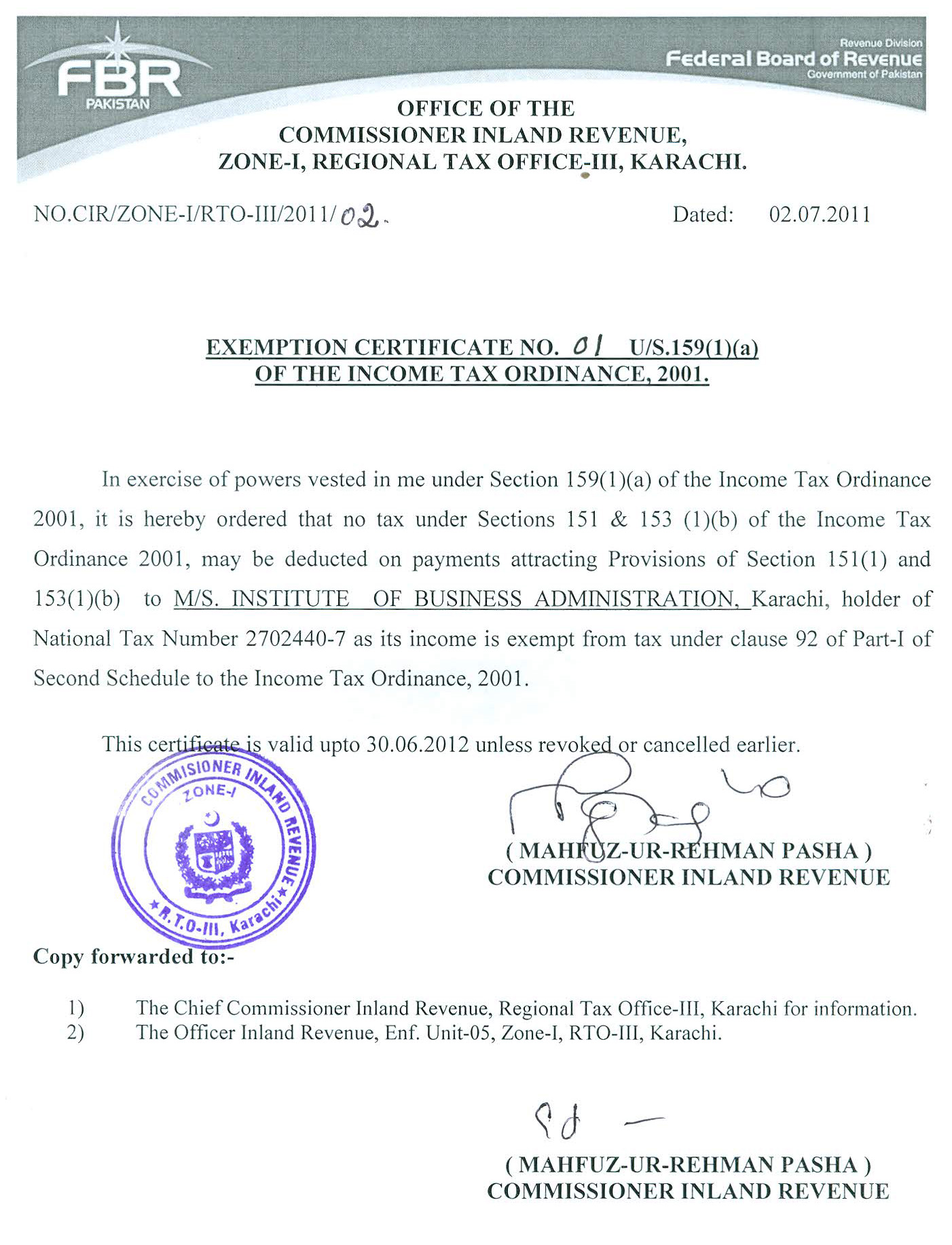

Sample Letter Exemption Doc Template PdfFiller

Pin Auf NEWS You Can USE

Tax Exemption Certificate SACHET Pakistan

House Rent Allowance HRA Exemption Rules Its Tax Benefits Chandan

Income Tax Exemption From Income On Salary For The F Y 2023 24

Right Step CommonFloor Groups

Right Step CommonFloor Groups

Rent Receipt At In India 2012 2024 Form Fill Out And Sign Printable

House Rent Allowance And Rent Free Accommodation Are They Really

Nysc Exemption Letter How To Apply And Collect Nysc Exemption Letter

Income Tax House Rent Exemption Rules - Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance the allowance will be fully taxable