Income Tax In Spain 2024 Our guide to Spanish income tax in 2024 including allowable expenditure and tax rates

In general non resident taxpayers are taxed at a rate of 24 on income received or derived from Spanish sources in Spanish territory and at a rate of 19 on capital gains and financial investment income Individual Taxes on personal income Last reviewed 30 June 2024 The Spanish system for direct taxation of individuals is mainly comprised of two personal

Income Tax In Spain 2024

Income Tax In Spain 2024

https://es.icalculator.com/img/og/ES/253.png

1007 11k Salary After Tax In Spain ES Tax 2024

https://es.icalculator.com/img/og/ES/108.png

1015 45k Salary After Tax In Spain ES Tax 2024

https://es.icalculator.com/img/og/ES/172.png

Discover how to file your income tax return in Spain including the latest rates allowable deductions and 2024 deadlines Tax Year 2024 2025 If you live in Spain and earn a gross annual salary salario bruto of 21 876 or 1 823 per month your monthly net income salario neto will be 1 486

Calculate your income tax return in Spain for 2024 25with our free online income tax calculator Includes detailed information of capital gains tax income tax social security Filing your annual tax return in Spain can seem daunting but don t worry This guide will walk you through everything you need to know about the 2023 2024 tax

Download Income Tax In Spain 2024

More picture related to Income Tax In Spain 2024

1112 25k Salary After Tax In Spain ES Tax 2024

https://es.icalculator.com/img/og/ES/72.png

Expat Taxes In Spain 2024 Non Resident Tax Rates Spain

https://www.myspanishresidency.com/wp-content/uploads/2022/01/Screenshot-2022-01-05-at-18.58.37-1024x497.png

Severance And Income Tax In Canada Dutton Employment Law

https://duttonlaw.ca/wp-content/uploads/2020/09/income-tax-and-severance-scaled.jpeg

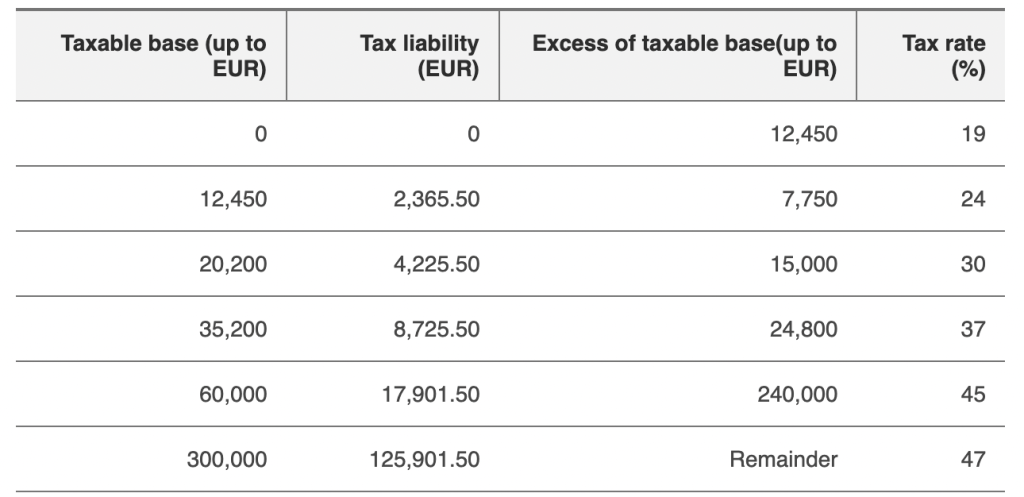

TAX TABLES FOR SPAIN 2024 Tax rates for investment income This table combines the State and ACs tax rates as no regional variations currently exist Main income Our Spanish tax introduction service will be available from 1st September 2024 Taxes in Spain explained with this detailed overview specifically tailored for

Calculate you Annual salary after tax using the online Spain Tax Calculator updated with the 2024 income tax rates in Spain Calculate your income tax social security and The tax rates in 2023 for income are as follows up to 12 450 at 19 and income between 12 451 and 20 200 at 24 Higher income brackets face progressively higher rates

To Foreigners Paying The Tax In Spain Can Be Confusing This Guide

https://i.pinimg.com/originals/a1/d2/8b/a1d28b093ee63891ad562a26b9653818.jpg

Income Tax Archives Business News Philippines

https://www.businessnews.com.ph/wp-content/uploads/2018/01/Tax-1-1200x600.jpg

https://www.europeaccountants.com/spain/income-tax

Our guide to Spanish income tax in 2024 including allowable expenditure and tax rates

https://www.myspanishresidency.com/taxes-…

In general non resident taxpayers are taxed at a rate of 24 on income received or derived from Spanish sources in Spanish territory and at a rate of 19 on capital gains and financial investment income

How To File Income Tax In Malaysia 2023 Complete Guide To File Tax

To Foreigners Paying The Tax In Spain Can Be Confusing This Guide

Things You Didn t Know About Income Tax Vazoria

20 Easy Ways To Save Income Tax In 2023

Personal Income Tax Guide In Malaysia 2016 Tech ARP

Tax Return 2018 Holiday Rentals Income Tax In Spain

Tax Return 2018 Holiday Rentals Income Tax In Spain

Tax Payment Which States Have No Income Tax Marca

Corporate Income Tax In Spain Koperus BLS

Different Ways To Save Income Tax In India Under Section 80C

Income Tax In Spain 2024 - Discover how to file your income tax return in Spain including the latest rates allowable deductions and 2024 deadlines