Medical Tax Rebate 2024 You can deduct 6 250 of medical expenses as part of your itemized deductions Standard versus itemized deductions Before we go into detail about medical and dental deductions let s take a step back and decide if standard or itemized deductions are right for you and your family

Achieving this milestone will enable up to 125 million paper documents to be submitted digitally per year An enhanced IRS Individual Online Account that includes chat the option to schedule and cancel future payments revise payment plans and validate and save bank accounts IRS Legislation Taxes The IRS on Aug 23 announced 2024 indexing adjustments for important percentages under the Affordable Care Act

Medical Tax Rebate 2024

Medical Tax Rebate 2024

https://www.mytaxrebate.ie/wp-content/uploads/2020/09/Medical-Expenses-Blog-Image-e1602500412593.png

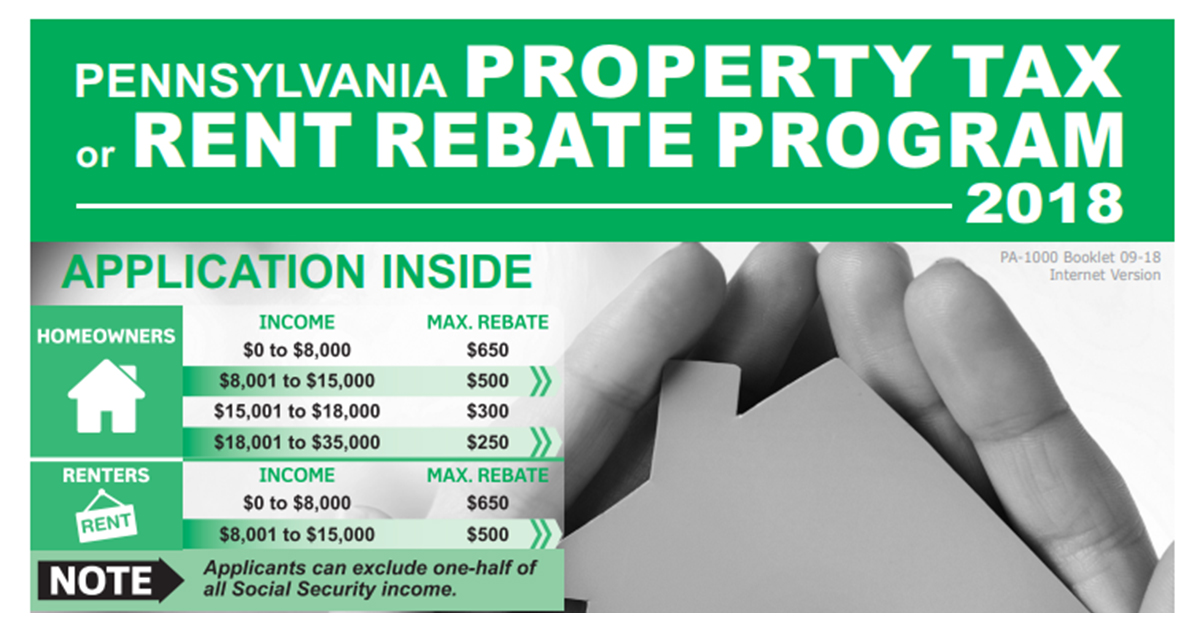

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

IRS Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they can claim and the records they need to show their eligibility Tax credits The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC 2021 and

On January 19 2024 the House Ways and Means Committee overwhelmingly approved the Tax Relief for American Families and Workers Act of 2024 by a 40 3 vote The bill provides for increases in the child tax credit delays the requirement to deduct research and experimentation expenditures over a five year period extends 100 percent bonus Abortion in the U S Medicaid Unwinding For the 2024 tax year you must repay the difference between the amount of premium tax credit you received and the amount you were eligible for There

Download Medical Tax Rebate 2024

More picture related to Medical Tax Rebate 2024

Claiming A Tax Rebate On Your Medical Expenses Rebates

https://www.rebates.ie/wp-content/uploads/2021/04/FRONTLINE-WORKERS_-1.png

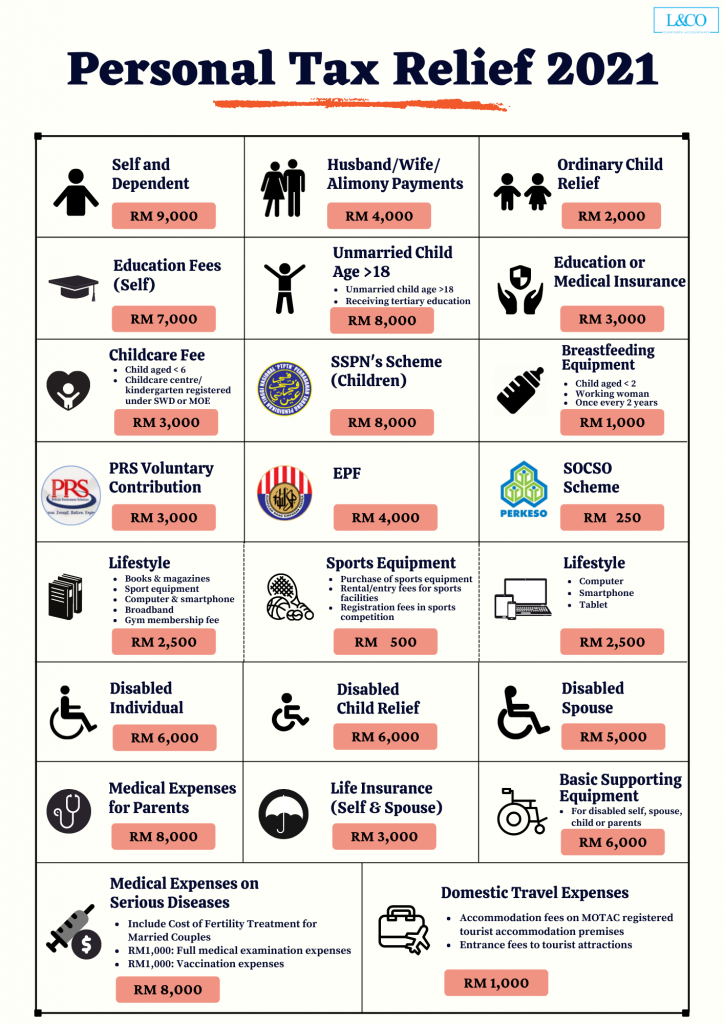

Personal Tax Relief 2021 L Co Accountants

https://landco.my/wp-content/uploads/2021/11/Personal-Tax-Relief-2021-724x1024.png

Medical Aid Tax Credits For 2022 And 2023 Medical Aid Quotes

https://www.medicalaid-quotes.co.za/sites/default/files/user3/medical-aid-tax-credits_0.jpg

a In general Paragraph 6 of section 24 h of the Internal Revenue Code of 1986 is amended 1 by striking credit Subsection and inserting credit A I N GENERAL Subsection and 2 by adding at the end the following new subparagraphs B R ULE FOR DETERMINATION OF EARNED INCOME i I N GENERAL In the case of a taxable year beginning after 2023 The Premium Tax Credit PTC makes health insurance more affordable by helping eligible individuals and their families pay premiums for coverage purchased through the Health Insurance Marketplace also referred to as the Marketplace or Exchange There are two ways to get the credit If you qualify for advance payments of the premium tax credit

The costs of healthcare prescriptions medical equipment and insurance premiums add up swiftly Luckily a portion of these expenditures may qualify for deductions if you meet the set guidelines The limit for tax deductions in 2024 is 7 5 off adjusted gross income and it is very crucial to examine all the medical expenditures and evaluate Top tax credits and deductions for 2024 There are numerous tax credits and deductions though many are only available to qualifying filers Some of the most common deductions include Child Tax Credit CTC For filers who are also caregivers for children the CTC provides up to 2 000 for each child or dependent under the age of 17

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

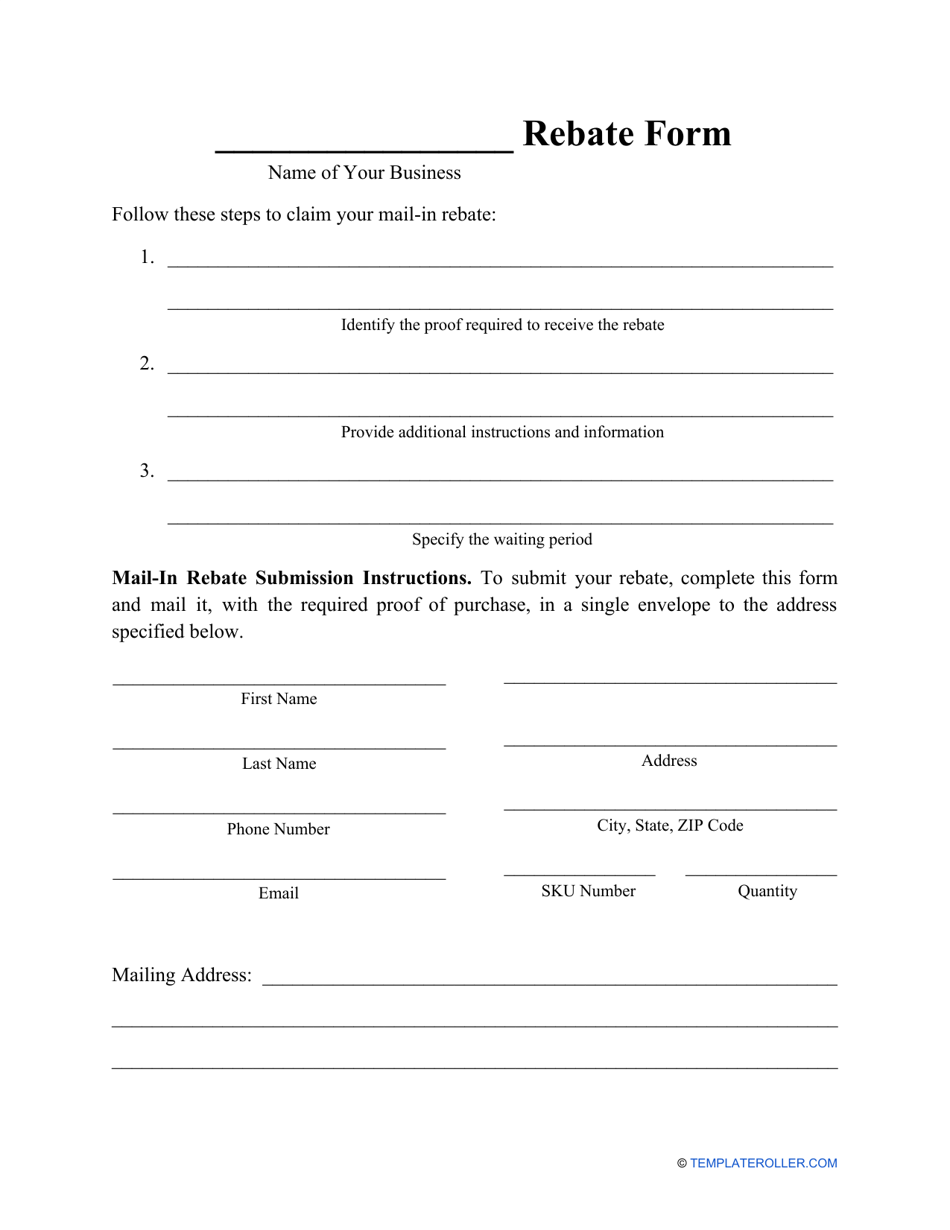

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

https://www.jacksonhewitt.com/tax-help/tax-tips-topics/personal-finance-savings/deducting-medical-and-dental-expesnse-on-your-2024-taxes/

You can deduct 6 250 of medical expenses as part of your itemized deductions Standard versus itemized deductions Before we go into detail about medical and dental deductions let s take a step back and decide if standard or itemized deductions are right for you and your family

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

Achieving this milestone will enable up to 125 million paper documents to be submitted digitally per year An enhanced IRS Individual Online Account that includes chat the option to schedule and cancel future payments revise payment plans and validate and save bank accounts

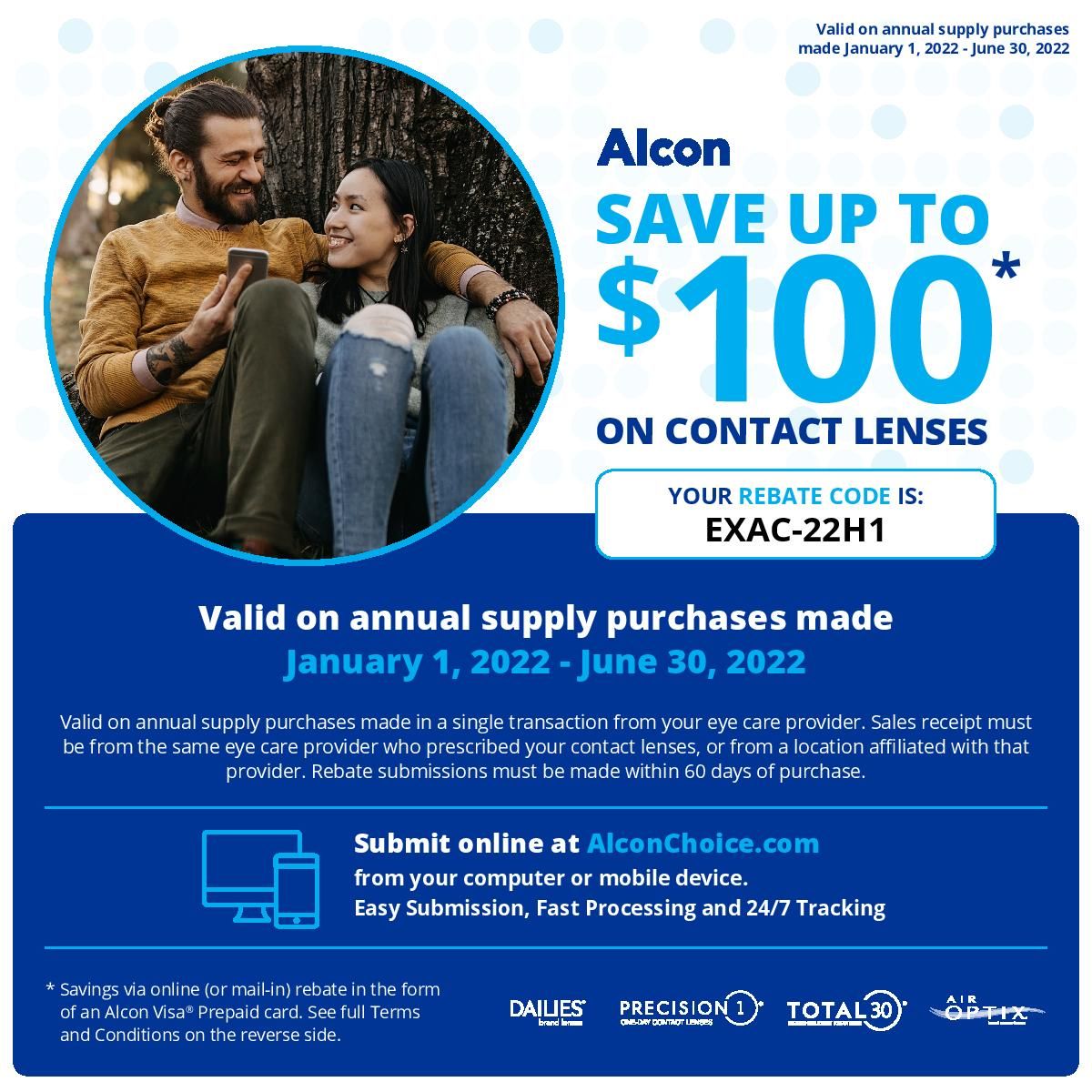

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Lensrebates Alcon Com

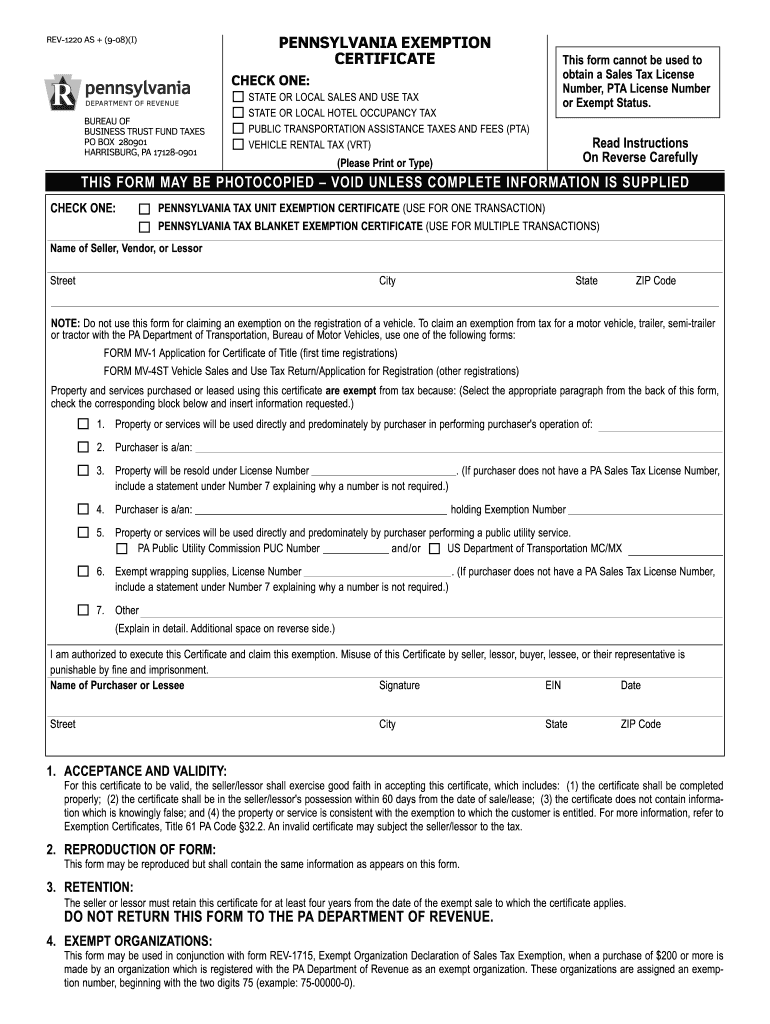

2023 Tax Exemption Form Pennsylvania ExemptForm

Property Tax Rebate Pennsylvania LatestRebate

Property Tax Rebate Pennsylvania LatestRebate

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Medical Tax Rebate 2024 - Abortion in the U S Medicaid Unwinding For the 2024 tax year you must repay the difference between the amount of premium tax credit you received and the amount you were eligible for There