Income Tax In Usa For Foreigners Taxable income from US trade or business entities can include some kinds of foreign source income as well as US source income US investment income is generally taxed at a flat 30 percent tax rate which may be

Overview of U S taxes on foreign income for individuals Thomson Reuters Tax Accounting October 12 2023 17 minute read Jump to What is foreign income What is FEIE How to report foreign If you paid or accrued foreign taxes to a foreign country on foreign source income and are subject to U S tax on the same income you may be able to take either

Income Tax In Usa For Foreigners

Income Tax In Usa For Foreigners

https://duttonlaw.ca/wp-content/uploads/2020/09/income-tax-and-severance-scaled.jpeg

Mainland China Individual Income Tax For Foreigners HKWJ Tax Law

https://www.hkwj-taxlaw.hk/wp-content/uploads/2018/11/Untitled-design-47.png

Income Tax Archives Business News Philippines

https://www.businessnews.com.ph/wp-content/uploads/2018/01/Tax-1-1200x600.jpg

The United States levies tax on its citizens and residents on their worldwide income Non resident aliens are taxed on their US source income and income If you earn foreign income not understanding your U S tax obligation can lead to some serious consequences To help you out we distilled the basics of U S taxes for expats down to 20 things you

Unlike resident aliens nonresident aliens must file taxes on any income generated within the United States Any foreign earned income doesn t qualify for In general the foreign tax credit permits a taxpayer to reduce US tax by the amount of income tax paid to a foreign government subject to certain limitations The foreign tax

Download Income Tax In Usa For Foreigners

More picture related to Income Tax In Usa For Foreigners

Things You Didn t Know About Income Tax Vazoria

https://vazoria.com/wp-content/uploads/2022/11/Income-tax-d-e1667869490562-1536x971.jpg

Imposition Of Income Tax For Foreigners Indoservice

https://indoservice.co.id/wp-content/uploads/2021/11/Income-Tax-for-Foreigners.jpg

How To Reduce Income Tax In USA 7 Legal Secrets

https://theinfonews.com/wp-content/uploads/2022/04/How-To-Reduce-Income-Tax-In-Usa.jpg

Income tax purposes are very specific with only limited exceptions once the objective criteria or mechanical tests are met Individuals classified as resident aliens are taxed on The US offers a couple of programs that ease the burden of US expat taxes like the Foreign Tax Credit FTC The FTC essentially allows expats to subtract what they ve paid in taxes to foreign

Interest income received by citizens and resident aliens is subject to US tax whether it is from US or foreign sources Non resident aliens US source interest is Living abroad doesn t exempt U S citizens from their tax obligations to the U S government Here s what you need to know about handling income earned abroad

Personal Income Tax Guide In Malaysia 2016 Tech ARP

https://www.techarp.com/wp-content/uploads/2016/03/lhdn.png

Different Ways To Save Income Tax In India Under Section 80C

https://i.pinimg.com/originals/2b/99/cb/2b99cb347a93577e2e11ab53512dc436.png

https://www2.deloitte.com/us/en/pages/tax/…

Taxable income from US trade or business entities can include some kinds of foreign source income as well as US source income US investment income is generally taxed at a flat 30 percent tax rate which may be

https://tax.thomsonreuters.com/blog/overvi…

Overview of U S taxes on foreign income for individuals Thomson Reuters Tax Accounting October 12 2023 17 minute read Jump to What is foreign income What is FEIE How to report foreign

Which States Have The Highest And Lowest Income Tax USAFacts

Personal Income Tax Guide In Malaysia 2016 Tech ARP

20 Easy Ways To Save Income Tax In 2023

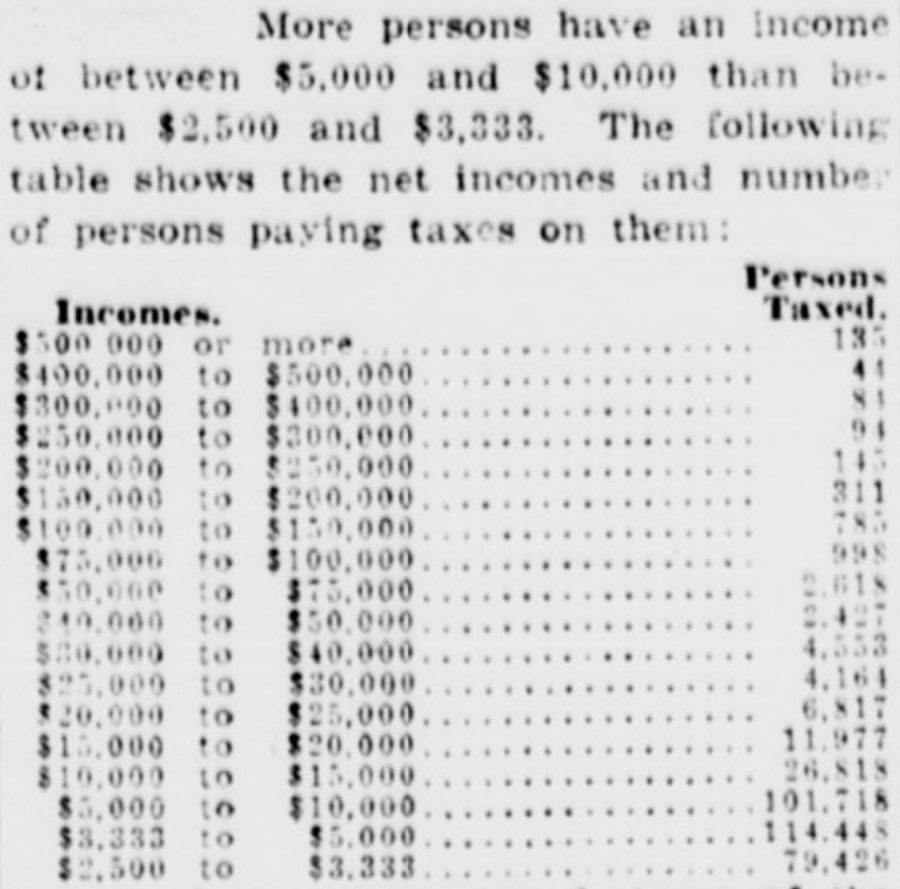

Only 357 598 Americans Paid Income Tax In 1914

Tax Payment Which States Have No Income Tax Marca

TAX HACKS The 9 States With No Income Tax and The Hidden Catch In Each

TAX HACKS The 9 States With No Income Tax and The Hidden Catch In Each

Tax Free In The USA For Foreigners And Tourists From Other Countries

Income Tax Explained ProjectionLab

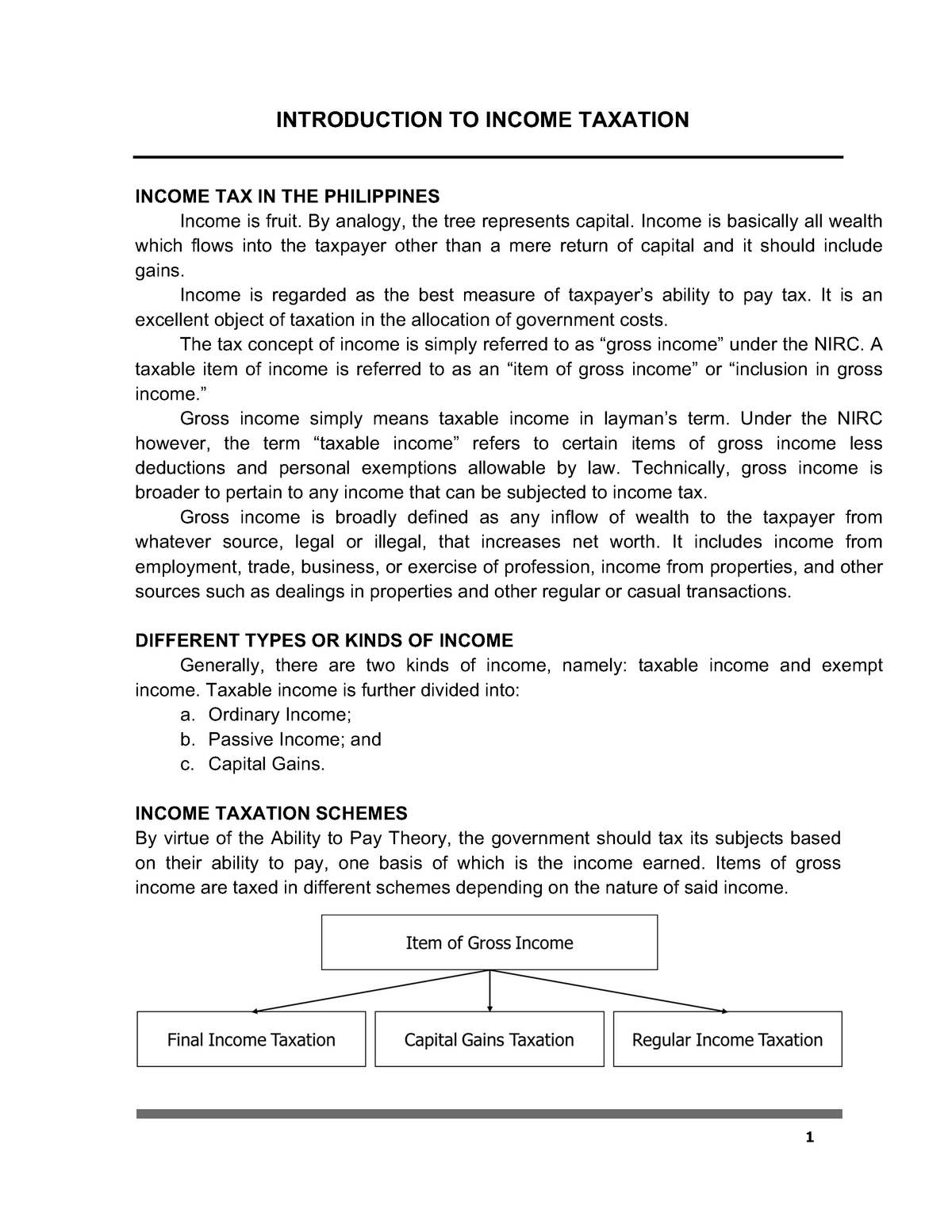

2 Introduction To Income Tax INTRODUCTION TO INCOME TAXATION INCOME

Income Tax In Usa For Foreigners - If you earn foreign income not understanding your U S tax obligation can lead to some serious consequences To help you out we distilled the basics of U S taxes for expats down to 20 things you