New Furnace Rebates 2024 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

From Jan 1 2023 homeowners who make qualified energy efficient improvements including furnace upgrades may qualify for a tax credit of up to 3 200 The energy efficiency credit Learn more at the IRS website was initiative is designed to encourage the adoption of greener technologies in residential spaces Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

New Furnace Rebates 2024

New Furnace Rebates 2024

https://www.staycomfy.com/hubfs/AdobeStock_115000271.jpeg

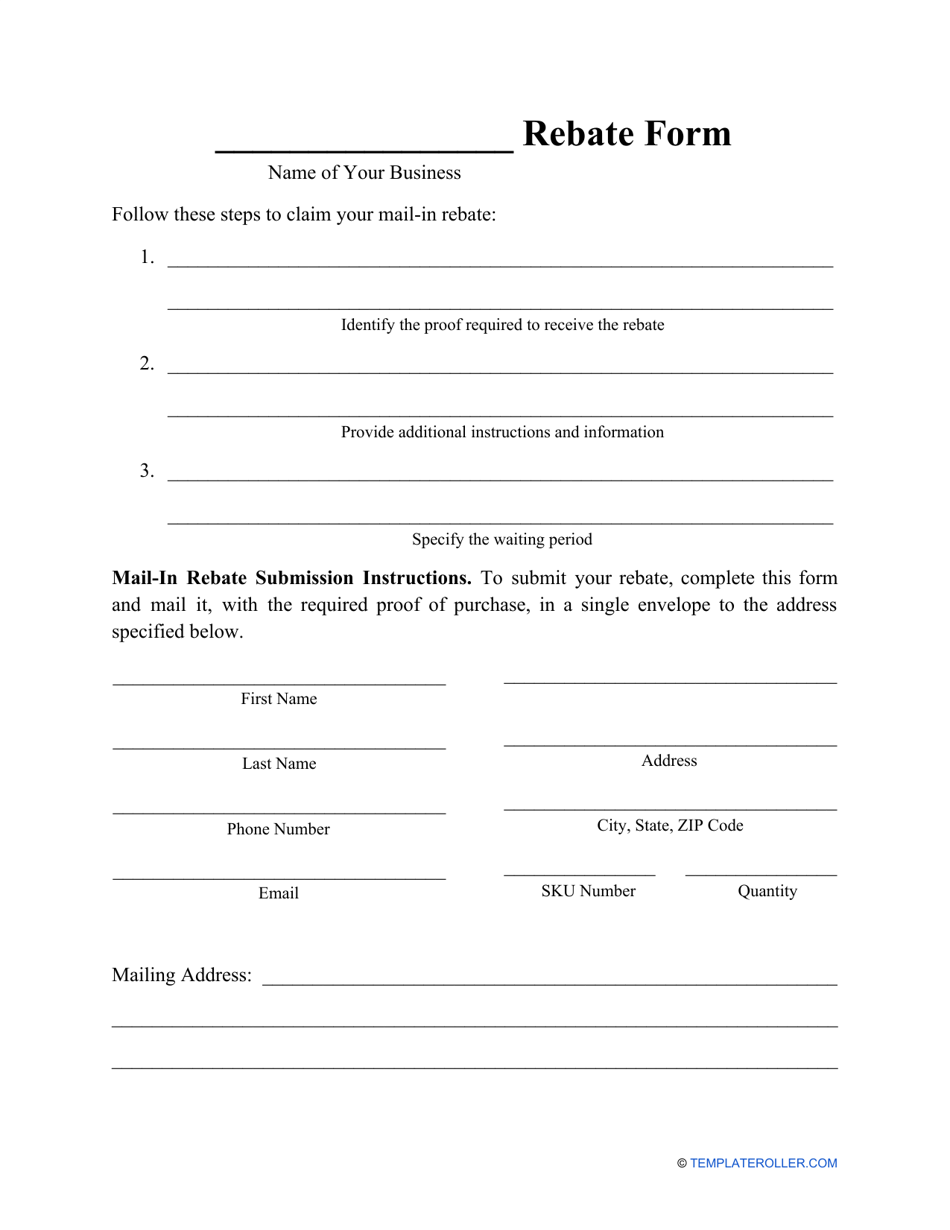

New Furnace Rebates Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/04/Government-Rebate-for-Furnaces-2022-1536x1153.png

What Is The Cost Of A New Furnace A Guide To Buying And Replacing A Furnace 2024 Bob Vila

https://empire-s3-production.bobvila.com/articles/wp-content/uploads/2021/03/Do-I-Need-a-New-Furnace.jpg

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates 2024 Rebates for Heating and Cooling Equipment These rates apply to equipment installed January 1 2024 through May 31 2024 Applications must be submitted within 60 days of installation and no later than June 30 2024 Rebates are subject to change Check focusonenergy for current rebate amounts Are You Eligible for Income Qualified Rebates

Efective January 1 2024 only customers who have removed or disabled their pre existing heating systems will be eligible for whole home heat pump rebates The following approved disablement methods will be listed on the 2024 Whole Home Heat Pump Verification Form and verified during post installation inspections Boilers and Furnaces You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

Download New Furnace Rebates 2024

More picture related to New Furnace Rebates 2024

How To Get The Best Deal On A New Furnace Installation Around The Clock

https://aroundclock.com/blog/wp-content/uploads/2021/12/How-to-Get-the-Best-Deal-on-a-New-Furnace-Installation.jpg

What Is The Cost Of A New Furnace A Guide To Buying And Replacing A Furnace 2024 Bob Vila

https://empire-s3-production.bobvila.com/articles/wp-content/uploads/2021/03/Cost-of-a-New-Furnace-DIY-vs.-Hiring-a-Professional.jpg

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

New Construction Not Eligible Existing Single Family Home 1 3 units Existing Multifamily 4 units 2024 HEATING AND COOLING REBATE APPLICATION FOR SINGLE FAMILY MULTIFAMILY AND CONDOS 1 of 2 Step 3 Complete Your Natural Gas Furnace Rebates may be automatically adjusted based on actual equipment efficiencies and Program Save Up to 1 200 on Energy Efficiency Home Improvements Claim 30 up to 1 200 for these qualifying energy property costs and certain energy efficient home improvements Windows Skylights Water Heaters Natural Gas Oil Propane Central Air Conditioners Doors Furnaces Electric Panel Upgrade Insulation Boilers Home Energy Audit

Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and Download the Rebate Application PDF Email completed PDF to NIPSCO SaveEnergy TRCcompanies Fax to 1 877 511 5032 Mail to Residential Rebate Program c o TRC P O Box 14237 Merrillville IN 46411 All faxed and emailed applications will receive an email confirmation If you do NOT receive confirmation within 3 business days or you do not

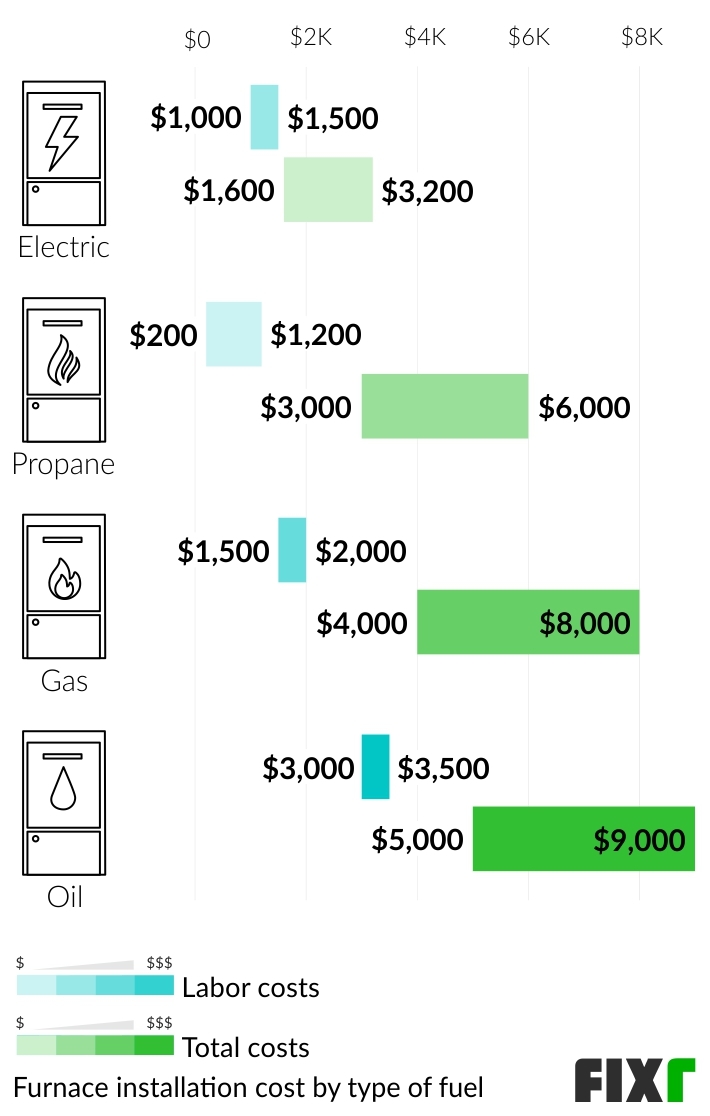

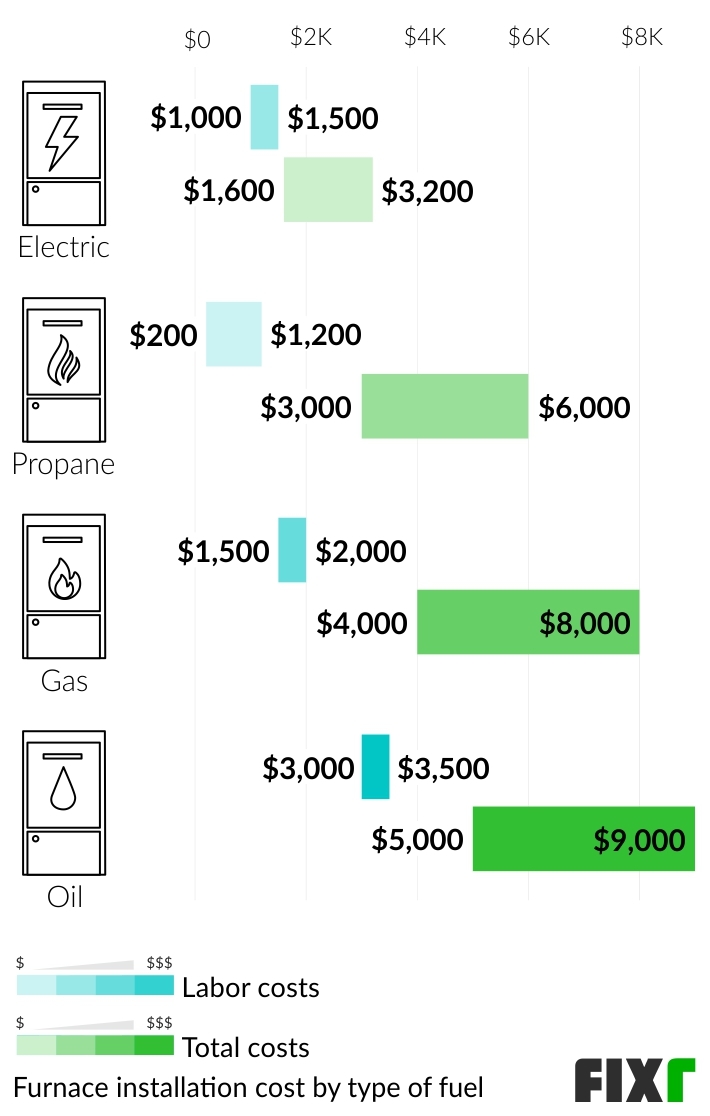

Cost Of Replacing Furnace In Mobile Home Www cintronbeveragegroup

https://cdn.fixr.com/cost_guide_pictures/furnace-613b1ed6f380d.png

Billabong Wetsuits The New Furnace Carbon YouTube

https://i.ytimg.com/vi/lsjbJ6XZnwI/maxresdefault.jpg

https://todayshomeowner.com/hvac/guides/hvac-tax-credit/

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

https://www.furnacepriceguides.com/rebates-and-incentives/

From Jan 1 2023 homeowners who make qualified energy efficient improvements including furnace upgrades may qualify for a tax credit of up to 3 200 The energy efficiency credit Learn more at the IRS website was initiative is designed to encourage the adoption of greener technologies in residential spaces

2023 Ford Expedition Rebates And Incentives Autoblog

Cost Of Replacing Furnace In Mobile Home Www cintronbeveragegroup

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

Furnace Rebates 2019 Coastal Energy

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

How To Claim FortisBC s Furnace Rebates Murray s Solutions

How To Claim FortisBC s Furnace Rebates Murray s Solutions

5 Reasons To Get A New Furnace

Furnace Air Conditioner Rebates Ontario AirRebate

Getting A New Propane Furnace What To Expect Dans Le Lakehouse

New Furnace Rebates 2024 - Trane is a reliable option for those who want a secure investment The company offers a 20 year heat exchanger warranty and a 10 year parts and labor warranty which is more comprehensive than